Press release

Mexico Courier, Express and Parcel (CEP) Market Outlook: Key Growth Drivers, Trends and Opportunities 2025-2033

IMARC Group has recently released a new research study titled "Mexico Courier, Express and Parcel (CEP) Market Size, Share, Trends and Forecast by Service Type, Destination, Type, End-Use Sector, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.Market Overview

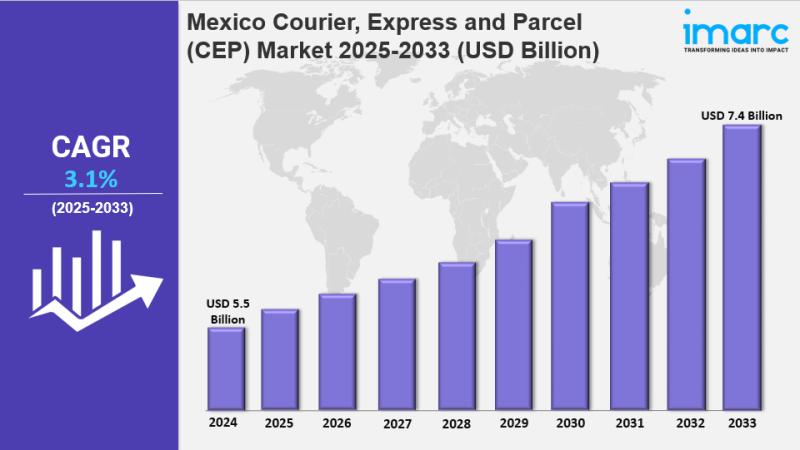

The Mexico courier, express and parcel (CEP) market size reached USD 5.5 Billion in 2024. The market is expected to grow to USD 7.4 Billion by 2033, with a CAGR of 3.1% during the forecast period 2025-2033. This growth is fueled by expanding e-commerce, rapid urbanization, increasing cross-border trade, technological advancements, and innovations in last-mile delivery solutions. The market also benefits from rising small enterprise participation and escalating consumer demand for faster, reliable shipment options and competitive logistics improvements.

Study Assumption Years

• Base Year: 2024

• Historical Years: 2019-2024

• Forecast Period: 2025-2033

Mexico Courier, Express and Parcel (CEP) Market Key Takeaways

• Current Market Size: USD 5.5 Billion in 2024

• CAGR: 3.1% for 2025-2033

• Forecast Period: 2025-2033

• The market's growth is driven by rapid expansion in e-commerce and evolving consumer expectations for expedited deliveries.

• Technological advancements such as warehouse automation, route optimization software, drone deliveries, and AI-based logistics are enhancing service efficiency.

• Cross-border trade and nearshoring strategies leverage Mexico's position as North America's manufacturing hub, promoting logistics and shipment growth.

• Increasing social commerce activities on platforms like Facebook and WhatsApp are contributing to rising parcel volumes for small businesses.

• Initiatives like Schneider's intermodal service and USMCA customs improvements are facilitating efficient cross-border shipments.

Sample Request Link: https://www.imarcgroup.com/mexico-courier-express-parcel-market/requestsample

Mexico Courier, Express and Parcel (CEP) Market Growth Factors

The Mexico CEP market growth is primarily driven by the booming e-commerce sector. Rising online shopping has compelled logistics providers to improve infrastructure, implement technological upgrades, and enhance delivery speeds to meet growing customer demands. The new standard emphasizes rapid delivery, often same-day or next-day. Providers also automate warehouses and implement route optimization software while building partnerships with local delivery networks. For example, in 2025, Cainiao (Alibaba's logistics arm) expanded its delivery services across Mexico, integrating automation and smart technologies to increase efficiency and speed. Growing social commerce on platforms such as Facebook and WhatsApp has prompted small businesses to increase parcel volumes. Market competition has accelerated the adoption of drone deliveries, smart lockers, and AI-based logistics management.

Cross-border trade and nearshoring are reshaping logistics strategies significantly. Mexico's strategic position as North America's manufacturing hub has accelerated cross-border shipments and improved supply chain efficiencies. Global companies increasingly nearshore production to Mexico to serve the US market, which boosts parcel and freight transport. Schneider's November 2024 launch of an intermodal rail service connecting Mexico, Texas, and the Southeastern US streamlines cross-border logistics. The USMCA trade agreement further facilitates international shipping by simplifying customs processes. To address increased border traffic, logistics providers invest in digital customs clearance tools and custom infrastructure at borders. Additionally, growing Mexican retailer sales to US consumers increase the need for cost-effective international delivery solutions.

Technological advancement in delivery and logistics services is shaping the Mexico CEP market outlook. Companies differentiate themselves by offering fast, reliable, and affordable solutions driven by consumer demands for speed and efficiency. Automation of warehouse operations, deployment of AI-based logistics management, and new delivery innovations like drones and smart lockers enhance operational capabilities. Industry players also focus on last-mile delivery improvements to meet high consumer expectations. Partnerships, digital tool adoption for customs clearance, and multimodal transportation systems contribute to greater efficiency and competitiveness. These innovations ensure logistics companies can handle increased volumes and provide better service reliability and speed in Mexico's evolving CEP market.

Buy Report Now: https://www.imarcgroup.com/checkout?id=31977&method=3682

Mexico Courier, Express and Parcel (CEP) Market Segmentation

Breakup By Service Type:

• B2B (Business-to-Business): Includes parcel delivery services between businesses, supporting commercial transactions and supply chain logistics.

• B2C (Business-to-Consumer): Encompasses deliveries directly to individual consumers, primarily driven by e-commerce growth and retail distribution.

• C2C (Customer-to-Customer): Involves parcel shipments between individual customers, often via digital marketplaces and social commerce platforms.

Breakup By Destination:

• Domestic: Shipments occurring within Mexico, focusing on national logistics and last-mile delivery.

• International: Cross-border shipments, including exports and imports, facilitated by trade agreements and nearshoring practices.

Breakup By Type:

• Air: Air freight services for expedited and long-distance parcel delivery.

• Ship: Maritime transport handling bulk or heavy shipments, typically international cargo.

• Subway: Not explicitly detailed but considered part of urban or intra-city parcel transit.

• Road: Road transport including trucks and vans, crucial for last-mile and regional deliveries.

Breakup By End-Use Sector:

• Service (BFSI-Banking, Financial Services and Insurance): Parcels related to the financial and banking sector.

• Wholesale and Retail Trade (E-commerce): Dominated by online retail shipments, bulk and consumer parcel deliveries.

• Manufacturing, Construction, and Utilities: Parcel services supporting industrial and infrastructural operations.

• Others

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and Others compose the major regional markets analyzed. The report does not provide specific market share or CAGR figures for these regions. However, Mexico's strategic geographic positioning supports logistics and cross-border trade growth, especially through Northern Mexico, leveraging proximity to the US border. Efforts to improve customs infrastructure and transport connectivity strengthen the market presence across these regions.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=31977&flag=C

Recent Developments & News

In September 2024, Parcel Perform launched a partnership program to enhance e-commerce delivery experiences, empowering Mexican logistics providers with advanced data and technology solutions. In July 2024, UPS announced plans to acquire Estafeta, a leading Mexican express delivery company, aiming to strengthen its logistics network and benefit from Mexico's expanding role in global trade.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mexico Courier, Express and Parcel (CEP) Market Outlook: Key Growth Drivers, Trends and Opportunities 2025-2033 here

News-ID: 4363779 • Views: …

More Releases from IMARC Group

Methyl Cyclohexane Production Plant DPR 2026: CapEx/OpEx Analysis with Profitabi …

Setting up a methyl cyclohexane production plant positions investors within a strategically important segment of the global petrochemical and specialty chemicals industry, supported by rising demand across fuel blending, chemical intermediates, and hydrogen storage applications. Methyl cyclohexane is widely used as a solvent, a precursor in organic synthesis, and increasingly as a liquid organic hydrogen carrier in clean energy systems. Its role in supporting energy transport, advanced chemical processing, and…

Dacarbazine Production Plant DPR & Unit Setup 2026: Machinery Cost, Business Pla …

Setting up a dacarbazine production plant positions investors within a strategically important segment of the global agrochemical and industrial chemicals industry, driven by increasing demand for high-efficiency fertilizers, water-soluble nutrient formulations, and specialty industrial applications. As modern farming practices advance, precision agriculture expands, and the need for balanced nitrogen and phosphorus fertilization grows, dacarbazine continues to gain traction across horticulture, fertigation systems, and drip irrigation networks worldwide. Rising food production…

Industrial Adhesive Manufacturing Plant DPR 2026: Investment Cost, Market Growth …

Setting up an industrial adhesive manufacturing plant positions investors within a vital and high-demand segment of the global specialty chemicals industry, supported by expanding applications across construction, automotive, packaging, electronics, woodworking, and aerospace sectors. Industrial adhesives play a critical role in modern manufacturing by enabling strong, durable bonding solutions that enhance structural integrity, reduce mechanical fastening requirements, and improve production efficiency.

As industries shift toward lightweight materials, advanced composites, and automated…

Denim Fabric Manufacturing Plant DPR & Unit Setup 2026: Machinery Cost, CapEx/Op …

Setting up a denim fabric manufacturing industry is witnessing robust growth driven by the increasing demand from the apparel and fashion industry, growing preference for durable and versatile textiles, and the rising popularity of casual and workwear clothing across global markets. At the heart of this expansion lies a critical textile material-denim fabric. As fashion and lifestyle markets continue to evolve, establishing a denim fabric manufacturing plant presents a strategically…

More Releases for Mexico

Egg Freezing in Mexico: Leading Mexico City Clinics Launch 2026 Programs

Enlistalo Fertilidad offers expanded egg freezing services for international patients, including Americans, seeking fertility preservation.

Mexico City, Mexico - January 22, 2026 - Egg freezing is becoming an increasingly popular option for patients worldwide, and Mexico City continues to emerge as a leading destination for those seeking high-quality, affordable fertility care.

In 2026, Enlistalo Fertilidad stands out for its personalized approach, advanced medical standards, and focus on supporting international patients through every…

Human Resources Mexico Releases Employer Guide To Mexico 2026 Minimum Wage Compl …

Mexico's National Minimum Wage Commission (CONASAMI) has confirmed the new minimum wage levels that will take effect on January 1, 2026. The general daily minimum wage will increase to MXN [315.04], while the Northern Border Free Zone rate will rise to MXN [440.87] for 2026.

Image: https://www.globalnewslines.com/uploads/2025/12/d53f76670eba46736b7e94c6a16fb975.jpg

The adjustment reflects an estimated 13 percent increase for the general zone and about 5 percent for the Northern Border Free Zone compared to 2025.…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico…

Mexico Rooftop Solar Market Research Report Segmented by Applications, Geography …

Mexico Rooftop Solar Market by Component, Application, Services, and Region- Forecast to 2025

The Global Mexico Rooftop Solar Market Research Report 2021-2025 published by MarketInsightsReports is a significant source of keen information for business specialists. It furnishes the Mexico Rooftop Solar business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction of the Mexico Rooftop Solar…

The Mexico Online On-demand Home Services Market , Major Keyplayers - Aliada Inc …

Mexico Online On-demand Home Services Market 2021

Mexico online on-demand home services market offer a range of services within the comfort of home as well as save time and money. Additionally, these services help in bridging the gap between the real-world services and instant online services with improved efficiency. Recently, the demand for Mexico online on-demand home services marekt has started witnessing huge growth due to convenience and accessibility. The growing…

Mexico Agriculture Market, Mexico Agriculture Industry, Mexico Agriculture Grain …

Mexico Agriculture has been crucial sector of the country’s economy traditionally and politically even if it currently accounts for a really little share of Mexico’s GDP. Mexico is one in all the cradles of agriculture with the Mesoamericans emerging domesticated plants like maize, beans, tomatoes, squash, cotton, vanilla, avocados, cacao, number sorts of spices, and more. Domestic turkeys and Muscovy ducks were the solely domesticated fowl within the pre-Hispanic amount and little dogs…