Press release

Private Equity Market Size, Share, Growth And Forecast Report | 2034

Private Equity Market Overview:The global Private Equity Market was valued at USD 855.4 Billion in 2025 and is forecast to reach USD 1,751.6 Billion by 2034, growing at a CAGR of 8.29% during 2026-2034. This growth is driven by rising demand for alternative investments offering higher returns, increased institutional investor activity, technological advancements in investment analysis, and expanding focus on high-growth sectors including technology, healthcare, and renewable energy.

The private equity market size is expanding rapidly driven by rising investor appetite for alternative assets, pursuit of superior risk-adjusted returns, and strategic acquisitions across diverse sectors. Growing adoption in buyout transactions, venture capital funding, real estate investments, and infrastructure development is accelerating market growth. Advancements in artificial intelligence, data analytics, financial technologies, ESG integration, and sophisticated due diligence processes are driving operational efficiencies and investment decision-making. The growth of specialized funds targeting emerging sectors, favorable regulatory frameworks, tax incentives, and secondary market development is boosting capital deployment. Increasing participation from pension funds, sovereign wealth funds, endowments, and high-net-worth individuals further supports future global market expansion.

Study Assumption Years

• Base Year: 2025

• Historical Years: 2020-2025

• Forecast Years: 2026-2034

Private Equity Market Key Takeaways

• Current Market Size (2025): USD 855.4 Billion

• CAGR (2026-2034): 8.29%

• Forecast Period: 2026-2034

• The market is propelled by increasing institutional investor allocation to alternative investments.

• Growing demand for higher returns amidst market volatility is driving capital inflows.

• Technological advancements in AI and data analytics are enhancing investment decision-making.

• Expansion into high-growth sectors including technology, healthcare, and renewable energy.

• Favorable regulatory frameworks and tax incentives are fostering investment opportunities.

Access Detailed Sample Report: https://www.imarcgroup.com/private-equity-market/requestsample

Market Growth Factors

The private equity market is significantly driven by the increasing shift in investor preference toward alternative investments over traditional asset classes. Growing dissatisfaction with stocks and bonds due to their volatility, lower returns, and market saturation is contributing to market growth. Geopolitical uncertainties, fluctuating interest rates, and economic instability have further accelerated this transition. As a result, institutional investors such as pension funds, endowments, sovereign wealth funds, and high-net-worth individuals are substantially increasing their capital allocation to alternative assets, particularly private equity. These investors seek portfolio diversification, enhanced risk-adjusted returns, and opportunities to meet long-term investment objectives. The ability of private equity to generate alpha through active management, operational improvements, and strategic value creation makes it an increasingly attractive investment vehicle for sophisticated investors worldwide.

The pursuit of higher returns amidst ongoing market volatility represents another major growth factor for the private equity market. Unpredictable economic conditions, including inflation pressures, interest rate fluctuations, and global economic uncertainties, are driving investors to seek alternative avenues for generating superior returns. Private equity investments offer the potential for significant capital appreciation through strategic acquisitions, operational enhancements, and value creation initiatives. The long-term investment horizon of private equity allows fund managers to pursue contrarian opportunities and capitalize on market inefficiencies without the pressure of short-term market volatility. This alignment of investor interests with long-term value creation, combined with the ability to implement decisive management changes and strategic transformations, enables private equity to deliver returns that often exceed those of public market investments.

Favorable regulatory environments and evolving market dynamics are creating conducive conditions for private equity investment growth across global markets. Regulatory reforms including the relaxation of fundraising restrictions, easing of investment barriers, and implementation of favorable tax policies are facilitating industry expansion and creating new opportunities across geographies and sectors. Regulatory authorities in various jurisdictions are establishing frameworks to monitor and govern private equity activities while promoting market development. Advancements in technology and communication enable private equity firms to access broader investment opportunities, conduct due diligence more efficiently, and monitor portfolio performance in real-time. The integration of artificial intelligence, machine learning, and advanced analytics into investment processes is enhancing decision-making capabilities, risk assessment accuracy, and operational execution efficiency, thereby contributing significantly to market growth and investor confidence.

Market Segmentation

Fund Type:

• Buyout: Represents the largest segment, accounting for the majority of market share, driven by its focus on acquiring controlling stakes in established companies to drive operational and financial improvements. Buyout funds attract investors seeking substantial returns through strategic transformations, management optimization, and long-term value creation. The popularity of buyout is supported by its ability to streamline business operations, enhance efficiencies, unlock growth potential, and implement decisive strategic changes in acquired companies.

• Venture Capital (VCs): Growing segment focusing on early-stage and high-growth companies, particularly in technology, healthcare, and innovation-driven sectors. Venture capital provides essential funding for startups and emerging businesses with significant growth potential.

• Real Estate: Significant segment involving investments in commercial, residential, and industrial properties, offering stable returns and portfolio diversification benefits for institutional investors.

• Infrastructure: Expanding segment focusing on essential services including transportation, utilities, energy, and telecommunications, providing long-term stable cash flows and inflation protection.

• Others: Including growth equity, distressed debt, mezzanine financing, and specialized investment strategies targeting niche opportunities across various sectors.

Application:

• Corporate Acquisitions: Largest application segment involving buyouts, mergers, and strategic acquisitions of established businesses across multiple industries.

• Growth Capital: Providing expansion funding to mature companies seeking to scale operations, enter new markets, or develop new products without surrendering control.

• Startup Funding: Early-stage investments in innovative companies with high growth potential, particularly in technology and disruptive sectors.

• Operational Restructuring: Investments focused on turning around underperforming companies through management changes, operational improvements, and strategic repositioning.

• Others: Including leveraged buyouts, management buyouts, carve-outs, and specialized investment strategies.

Deployment Strategy:

• Direct Investment: Private equity firms making direct investments in target companies, maintaining full control over deal sourcing, due diligence, and value creation.

• Fund of Funds: Investment vehicles pooling capital to invest across multiple private equity funds, offering diversification and professional fund selection.

• Co-Investment: Institutional investors partnering with private equity firms on specific deals, gaining direct exposure while reducing fee burdens.

Region:

• North America

• Europe

• Asia Pacific

• Latin America

• Middle East and Africa

Regional Insights

North America leads the global private equity market, holding the largest market share of over 33.8% in 2025. The region's dominance is driven by its well-established financial infrastructure, robust capital markets, and significant investor activity. The presence of leading private equity firms, sophisticated institutional investors, and a competitive investment environment promotes innovation and strategic deal-making. Strong capital markets, favorable regulatory frameworks, and access to diverse investment opportunities across sectors including technology, healthcare, consumer products, and financial services enhance North America's market leadership. High-net-worth individuals and institutional investors in the region demonstrate strong preference for alternative investments, particularly private equity, driving substantial capital deployment. Additionally, the developed economies in North America offer reliable growth prospects for buyouts, venture capital, and growth equity investments, supported by cutting-edge financial technologies and analytics-driven decision-making processes.

Recent Developments & News

In September 2024, Institutional investor Oister Global and Tribe Capital India partnered to establish a secondaries franchise in India, targeting USD 500 Million in investments over the next two years, capitalizing on India's growing secondaries market. In March 2024, Kimmeridge, a U.S.-based energy private equity firm, made a USD 2.1 Billion bid for Houston exploration company SilverBow Resources, offering USD 32.4 Million shares at USD 34 per share. Also in March 2024, the Federal Trade Commission held a virtual workshop titled "Private Capital, Public Impact: An FTC Workshop on Private Equity in Health Care," exploring private equity's impact on healthcare markets. In June 2024, Niobrara Capital Partners was established as a private equity firm focused on middle market strategic investments in technology and tech-enabled services in North America and Europe.

Key Players

• AHAM Asset Management Berhad

• Allens

• Apollo Global Management, Inc.

• Bain and Co. Inc.

• Bank of America Corp.

• BDO Australia

• Blackstone Inc.

• CVC Capital Partners

• Ernst and Young Global Ltd.

• HSBC Holdings Plc

• Morgan Stanley

• The Carlyle Group

• Warburg Pincus LLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Expert Insights Available - Connect With Our Analysts: https://www.imarcgroup.com/request?type=report&id=8078&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Private Equity Market Size, Share, Growth And Forecast Report | 2034 here

News-ID: 4363719 • Views: …

More Releases from IMARC Group

Waste Plastic Recycling Plant DPR 2026: Cost Structure, Business Plan, and Profi …

The global waste plastic recycling sector is gaining powerful momentum as governments, industries, and consumers intensify efforts to address plastic pollution, regulatory compliance, and circular economy mandates. With rising plastic consumption across packaging and consumer goods, increasing enforcement of Extended Producer Responsibility (EPR) frameworks and single-use plastic bans, and a growing industrial demand for high-quality recycled polymers, establishing a waste plastic recycling plant positions investors at the heart of one…

Green Cement Manufacturing Plant Setup 2026: Complete DPR with Process Flow, Mac …

The global green cement manufacturing industry is witnessing robust growth driven by the rapidly expanding construction sector and increasing demand for sustainable, low-carbon building materials. At the heart of this expansion lies a critical specialty construction material green cement. As the construction industry transitions toward eco-friendly and energy-efficient practices, establishing a green cement manufacturing plant presents a strategically compelling business opportunity for entrepreneurs and construction material investors seeking to capitalize…

Europe Recycled Plastics Market to Hit 20.2 Million Tons by 2034 with a Robust C …

The Europe recycled plastics market size reached 13.89 Million Tons in 2025 and is forecast to reach 20.2 Million Tons by 2034, with a CAGR of 4.2% from 2026 to 2034. This growth is driven by sustainable packaging emphasis, stricter environmental regulations, and wide adoption of extended producer responsibility programs. The market is also propelled by government policies promoting recycling infrastructure across packaging, automotive, and construction industries. Consumer preference for…

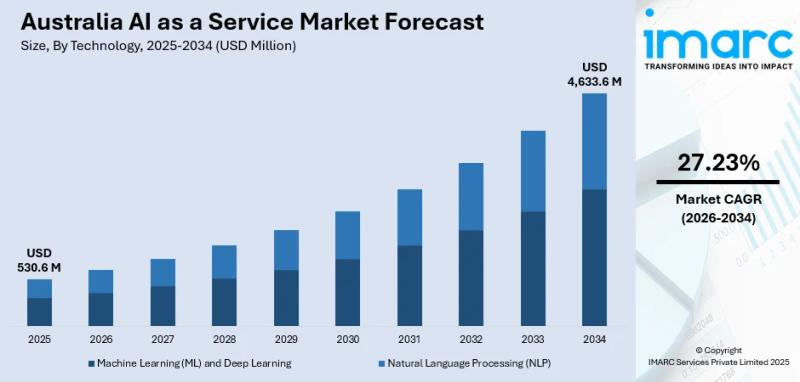

Australia AI as a Service Market Projected to Reach USD 4633.6 Million by 2034

Market Overview

The Australia AI as a Service market size reached USD 530.6 Million in 2025 and is projected to reach USD 4,633.6 Million by 2034. The market expansion is fueled by growing cloud adoption, government investments in AI research, and increased demand for AI-powered automation across multiple industries including healthcare and finance. The surge of AI startups and collaborations between tech firms and enterprises further propel the market's advancement. The…

More Releases for Private

real estate private equity firms,private equity manager,private equity financing …

Real estate private equity is the practice of investing in real estate properties or real estate-related assets using private capital. Private equity firms, high net worth individuals, and institutional investors are among the primary players in this market. These investors provide the capital for real estate transactions, such as the purchase of properties, and in return, they receive a share of the profits generated by the properties.

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The…

private asset management,private wealth management firms,middle market private e …

Private asset management is the management of assets on behalf of private individuals, families, or institutions. It involves the creation of a customized investment strategy to achieve specific financial goals, such as wealth preservation, growth, income generation, or a combination of these objectives. The assets managed can include cash and cash equivalents, stocks, bonds, real estate, private equity, and alternative investments.

https://tendawholesale.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private asset management is typically provided by…

private equity international,private equity investment, equity firm,private inve …

Private equity firms are investment companies that specialize in acquiring and managing private companies. These firms typically provide capital to mature companies that have a proven track record of revenue and earnings, but that may be underperforming or undervalued. Private equity firms typically hold their investments for several years and then exit through a sale or an initial public offering (IPO).

http://gdzaojiazixun.cn/

China private investment consulting

E-mail:nolan@pandacuads.com

The private equity process begins with the…

private investment,private equity,private equity firms,private equity fund,capit …

Private investment refers to the purchase or financing of a private company or a portion of it, typically by a private equity firm, venture capital firm, or angel investor. Private investments can take various forms, including equity investments, debt investments, or a combination of both.

http://pandacuads.com/

China private investment consulting

E-mail:nolan@pandacuads.com

Private equity firms typically invest in mature companies that have a proven track record of revenue and earnings, but that may be underperforming…

Asia Private Equity Firm, Asia Private Equity Management, Asia Private Equity Se …

The private equity market in China has been rapidly growing in recent years. Private equity (PE) refers to the purchase of shares in a company that are not publicly traded on a stock exchange. PE firms typically target companies that are undervalued or in need of capital for growth, and aim to improve the company's operations and financial performance before selling it at a higher value.

https://boomingfaucet.com/

Asia Private Equity Consulting

E-mail:nolan@pandacuads.com

In China,…

China Private Equity Financing Consulting, China Private Equity Investment Corpo …

Pandacu China is a venture capital firm that focuses on early-stage investments in technology companies based in China. The firm was founded in 2015 by a group of experienced venture capitalists and entrepreneurs who have a deep understanding of the Chinese market and a strong network of contacts in the tech industry.

http://pandacuads.com/

China Private Equity Financing Consulting

Email:nolan@pandacuads.com

Pandacu China's mission is to help innovative and ambitious entrepreneurs turn their ideas into successful…