Press release

Pretiorates' Thoughts - Is the Japanese bond market now pulling the plug?

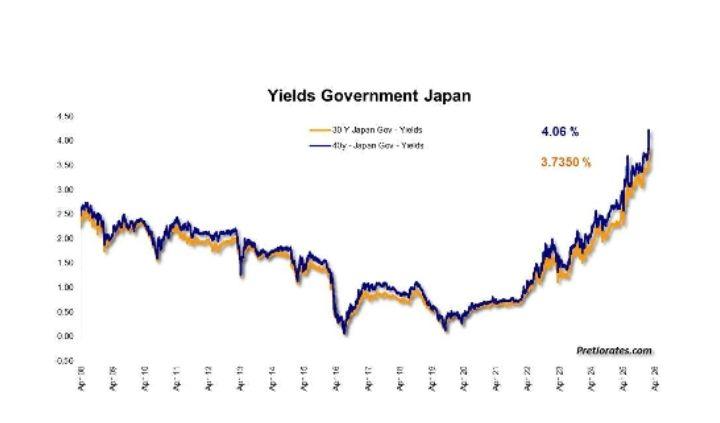

Over the last few days, we have seen a small selection of the best scenarios currently on the table. We have already summarized some of them in the issue "Welcome to 2026, expect the unexpected! [https://pretiorates.substack.com/p/welcome-to-2026-expect-the-unexpected]" However, the newly emerging nervousness is now being explained by a unusually large number of theories - apparently, everyone is allowed to have a go. So let's take a closer look at a few of them.The long-missed volatility in the bond markets has finally made itself felt - and not shyly. The rising yields in the Japanese bond market should now be flashing on the radar screens of every investor worldwide.

Image: https://www.abnewswire.com/upload/2026/01/76027493d2368ad9f3c8f20c673e1a69.jpg

Good news for gold investors: Japanese market yields also show a high correlation with the price of gold.

To many, Japan seems like a distant island somewhere in the Pacific. In global finance, however, the Land of the Rising Sun is a heavyweight. Over the past 30 years, yen carry trades have been used to take out enormous loans in yen at extremely favorable terms in order to park this capital in US Treasuries or stocks, among other things, with higher yields. And since we are not talking about a few billions, but trillions of US dollars, it is hardly surprising that US market yields and the Japanese yen have a very close relationship.

These yen carry trades led to market yields being depressed by massive purchases of US bonds, while US equities benefited from abundant cheap liquidity.

But the days of cheap yen are over. The trades are no longer being extended, which should logically have the opposite effect: rising US yields and selling pressure on US stocks. We saw the first taste of this yesterday, and not just on Wall Street. Sentiment has been fairly neutral recently - in other words, ripe for being pushed in either direction.

Image: https://www.abnewswire.com/upload/2026/01/b185ab91c759b00e831254ec3a2fa1d2.jpg

The media now believes that US President Donald Trump's desire to annex Greenland is responsible for the sell-off in stocks and bonds. Let's take a closer look, because the Greenland story is not as simple as it is portrayed in the media:

Geologists suspect that Greenland has significant deposits of rare earths. These are indispensable for modern electronics - and around 90% of them are currently refined in China.

As we have mentioned several times before, we are on the threshold of a new era in which artificial intelligence and the computing power of quantum computers will converge.

This is precisely why the big high-tech companies are investing so aggressively - they know exactly what lies ahead. Data centers are only the first step. The combination of AI and quantum computing will change our world so dramatically over the next five years that the winner of this race will effectively gain global power. It is therefore less a race between companies and more a race between governments. That is why the investment sums involved are almost irrelevant.

If the US is denied access to the necessary metals, it risks losing this race. This cannot be allowed to happen, because nothing can be expected from Europe, and the only alternative would be for China to set the economic and political pace for decades to come.

Not every investor may be aware of this, but the market seems to have understood it very well - just look at the movements of individual (sub-)sectors in recent months and years. The market apparently assumes that the US government will ultimately be satisfied with an increased military presence and mining rights in Greenland. In principle, the US has already controlled the large island since its invasion in 1940.

Image: https://www.abnewswire.com/upload/2026/01/5877a3c27aa9b0c37dbef3229f0b825c.jpg

Has the pulse of the financial markets now increased because of Greenland or because of new threatened import tariffs? In recent years, Europe has largely withdrawn from world politics. The national debt of many countries has exploded, economic flexibility has shrunk, while socialist regulations have increased significantly. Added to this is political disagreement. After Japan, Europe is therefore also one of the regions with an increased risk of turmoil in the bond markets. And import tariffs? These are no longer a real specter for the market. More on this later...

We recognize that cheap capital from Japan is drying up - and that sooner or later, capital from Europe will also be looking for a new home. Realistically, the US dollar is really the only option. The much-cited Armageddon scenario of a dying US dollar should therefore be treated with caution. Perhaps it is simply the last fiat currency to be laid to rest.

Also interesting is the assessment of a large independent research firm, which classifies Trump's Greenland initiative as a mere distraction. In the coming days and weeks, the US Supreme Court (SCOTUS) is expected to rule on import tariffs. Analysts believe that the ruling could potentially go against the US government. However, tariffs have not only become a political and economic weapon for the president, but also a pillar of support for the US stock market. After initial nervousness, they have even calmed the US bond market. They reduce the trade deficit - a welcome calming pill in terms of debt.

Image: https://www.abnewswire.com/upload/2026/01/2310cd2f0e756afeec12592f25ea2625.jpg

If the Supreme Court does indeed rule against import tariffs, it would not only be a political slap in the face for the president, but would also likely cause headaches for the US stock and bond markets. The reputation of US government bonds as a safe haven would suffer further - a circumstance from which gold is likely to benefit once again.

In the end, it is almost secondary whether the Japanese bond market, Greenland, or SCOTUS with its tariff decision is responsible for the increased nervousness. The market itself is already clearly signaling that it is no longer entirely satisfied. Whenever the volatility future is trading significantly above the spot price for six months, trouble is brewing. This situation arises when large investors use futures to hedge against rising volatility - i.e., nervousness.

We have also observed that US investors have recently been increasingly betting on defensive stocks. This is another clear indication that the very strong bullish sentiment is currently weakening.

Many investors still have the impression that the US stock market has performed excellently in recent months. In reality, however, it has been weakening since November. In relative terms, the S&P 500 has not been able to keep pace with the global world index for three months. We would therefore not be surprised if the bears slowly emerge from hibernation in the coming days and weeks.

We wish you successful investments!

If you enjoyed this issue, please click on the Like icon at the top or at the bottom of this email. This is very important in helping our Thoughts gain more followers. Thank you!

Yours sincerely,

Pretiorates

Find out more about Pretiorates.com [https://www.pretiorates.com/]

Subscribe for free to receive the next Pretiorates' Thoughts [https://pretiorates.substack.com/]!

Media Contact

Company Name: pretiorates

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=pretiorates-thoughts-is-the-japanese-bond-market-now-pulling-the-plug]

City: New York

Country: United States

Website: https://www.pretiorates.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Pretiorates' Thoughts - Is the Japanese bond market now pulling the plug? here

News-ID: 4362301 • Views: …

More Releases from ABNewswire

Class Action Settlements Made Simple: TheClassActionLawsuit.com Helps Consumers …

TheClassActionLawsuit.com tracks open and closed class action settlements with no-proof claim filters, plain-English guides, and direct links to official claim forms - all free, with no app or subscription required.

Class action settlements [https://www.theclassactionlawsuit.com/settlements/] go unclaimed by millions of Americans every year, often because consumers don't know they qualify or can't find clear information about open cases. TheClassActionLawsuit.com [https://www.theclassactionlawsuit.com/] is a free consumer resource designed to change that - making it…

New AI App Helps Families Navigate $350 Billion Resale Economy During Estate Tra …

Item Value launches as the resale economy reaches $350 billion, offering families an AI-powered solution to instantly determine realistic resale values for household items. The app addresses a critical need as unprecedented numbers of Baby Boomers downsize and adult children face the overwhelming task of valuing decades of accumulated possessions during estate transitions.

As the resale economy surges past $350 billion and an estimated 10,000 Baby Boomers reach retirement age daily,…

Sustainable Coffee Company Tamana Coffee Transforms Personal Loss Into Mission f …

Following the tragic loss of three family members to medication reactions and chronic disease, Tamana Coffee founder channels grief into action by establishing a rainforest wellness center. The online retailer's entire business model supports this healing sanctuary through sales of sustainably sourced coffee.

In an era where consumers increasingly seek purpose-driven brands, Tamana Coffee stands out with a powerful mission born from heartbreak. The online coffee retailer has committed 100 percent…

Premium Organic Coffee Service Get Coffee'd Brings Roastery-Fresh Beans Directly …

Get Coffee'd eliminates the freshness gap in coffee consumption with a new service that roasts premium organic beans to order and ships directly to consumers. The company serves coffee enthusiasts who demand exceptional quality and are willing to move beyond mass-market options. This direct model ensures customers experience coffee as roasters intend, at peak flavor and aroma.

Get Coffee'd has entered the specialty coffee market with a compelling value proposition for…

More Releases for Japan

Vision Guided Robotic Systems Market Size 2022 - FANUC(Japan), KUKA(Germany), AB …

The Vision Guided Robotic Systems Market research report also provides an in-depth analysis of key players in the market, including their company profiles, business offerings, recent development, market strategies, and critical observation related to the product. The research study provides extensive coverage of the Vision Guided Robotic Systems Market size across all industries and businesses. In addition, it offers detailed insights into market size and growth depending upon various segments…

Japan Agriculture Market, Japan Agriculture Industry, Japan Agriculture Livestoc …

The agriculture sector is a very significant sector in Japan. Agriculture sector exists in every part of country, but is especially essential on the northern island of Hokkaido that accounts for approximately 10% of national production. Modern methods such as commercial fertilizers, hybrid seeds, insecticides, and machinery, have been used so efficiently in farming. Japan is the second major agricultural product importer in the world (after the U.S.). Almost all…

Car Navigation ECU Market 2019: Top Key Players are AW Software (Japan), Contine …

Car Navigation ECU Market 2019 Report analyses the industry status, size, share, trends, growth opportunity, competition landscape and forecast to 2025. This report also provides data on patterns, improvements, target business sectors, limits and advancements. Furthermore, this research report categorizes the market by companies, region, type and end-use industry.

Get Sample Copy of this Report@ https://www.researchreportsworld.com/enquiry/request-sample/13844912

Global Car Navigation ECU market 2019 research provides a basic overview of the industry…

Global Car Navigation ECU Market Outlook to 2023 – AW Software (Japan), Contin …

An automotive navigation system is part of the automobile controls or a third party add-on used to find direction in an automobile and the ECU is the core part control it.

Car Navigation typically uses a satellite navigation device to get its position data which is then correlated to a position on a road. According to this study, over the next five years the Car Navigation ECU market will register a…

Global Car Navigation Parts Market Research Report 2019-2025 | Global Key Play …

This research report titled “Global Car Navigation Parts Market” Insights, Forecast to 2025 has been added to the wide online database managed by Market Research Hub (MRH). The study discusses the prime market growth factors along with future projections expected to impact the Car Navigation Parts Market during the period between 2018 and 2025. The concerned sector is analyzed based on different market factors including drivers, restraints and opportunities in…

Global Automotive 3D Scanning Laser Radar (3D-LiDAR) Market 2019-2025 | Velodyne …

Researchmoz added Most up-to-date research on "Global Automotive 3D Scanning Laser Radar (3D-LiDAR) Market Insights,Forecast to 2025" to its huge collection of research reports.

3D LiDAR uses a pulsed laser to detect distance, velocity and angle with high precision. LiDAR can classify objects, detect lane markings, and may also be used to accurately position an autonomous vehicle relative to a high definition map.

3D LiDAR is prominent, as it is a key…