Press release

Bioequivalence Studies Market to Reach US$1.35 Billion by 2033, Growing at a 7.5% CAGR | Key Players: Simulations Plus, Certara & SGS

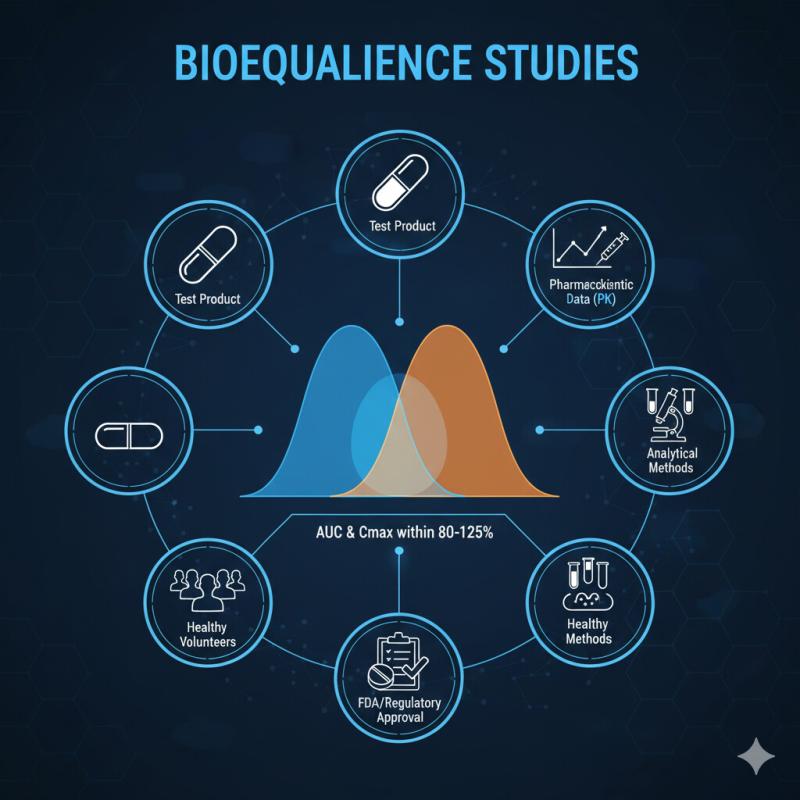

The global bioequivalence studies market size was US$ 701.70 Million in 2024 and is expected to reach US$ 1349.06 Million by 2033, growing at a CAGR of 7.5% from 2025 to 2033. , according to DataM Intelligence.United States: Recent Industry Developments

✅ In October 2024, Simulations Plus, Inc., in collaboration with the University of Strathclyde and InnoGI Technologies, received an FDA grant to enhance understanding of amorphous solid dispersions and predict food and pH-dependent drug-drug interactions using mechanistic modeling and simulation, advancing bioequivalence predictions.

✅ Ongoing regulatory support from the FDA for model-informed drug development (MIDD), including grants and qualifications promoting biosimulation tools for virtual bioequivalence assessments and reduced in vivo studies.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):

https://www.datamintelligence.com/download-sample/bioequivalence-studies-market?sindhuri

Japan: Recent Industry Developments

Japan-focused developments highlighted; however, the Asia-Pacific region, including Japan, benefits from growing adoption of AI-driven biosimulation and government support for digital health and pharmaceutical R&D in generic drug development.

Asia-Pacific: Recent Industry Developments

✅ Rapid expansion in biosimulation adoption and infrastructure improvements in countries like China, India, South Korea, and Japan, driven by government initiatives for cost-effective drug development, generic manufacturing hubs (e.g., India and China), and increasing clinical research facilities for bioequivalence testing.

Mergers & Acquisitions

recent M&A detailed in the report; growth primarily driven by strategic partnerships, collaborations, and technology integrations among biosimulation providers and CROs.

Technological Partnerships

✅ In March 2025, Certara, Inc. formed a strategic partnership with Biowaived to combine Certara's advanced simulation tools with Biowaived's experimental expertise, delivering integrated biopharmaceutics, formulation, and bioequivalence solutions to streamline drug development.

✅ Ongoing collaborations, such as Simulations Plus with academic institutions (e.g., University of Strathclyde, Polish Academy of Sciences), for advancing PBPK/PBBM modeling, AI-driven predictions, and regulatory-compliant biosimulation.

New Product/Service Launch

✅ In May 2024, Simulations Plus, Inc. launched GastroPlus X (GPX), the next-generation PBPK/PBBM modeling and simulation software with advanced algorithms, integrated machine learning, enhanced user interface, faster processing, and improved accuracy for bioequivalence studies.

✅ In April 2025, Certara, Inc. released an enhanced version of its Simcyp Simulator, advancing capabilities in biopharmaceutics, drug-drug interaction prediction, and biologic modeling to support data-driven regulatory decisions.

Technological Advancements in the Market

✅ 2025 trends: Rapid integration of AI, machine learning, and advanced computing in PBPK (Physiologically Based Pharmacokinetic) and PBBM (Physiologically Based Biopharmaceutics Modeling) for virtual bioequivalence assessments; shift toward in vitro and in silico methods reducing in vivo trials; EMA qualification of tools like Simcyp Simulator (August 2025) as the first PBPK platform for regulatory submissions; validation of AI-driven ADMET Predictor models (July 2025 publication).

Funding Raised by Companies

✅ In October 2024, Simulations Plus, Inc. secured an FDA grant (in collaboration with partners) for mechanistic modeling research in amorphous solid dispersions and drug interactions, supporting bioequivalence innovation.

Market Dynamics & Key Insights

✅ Drivers: Technical advances in PBPK/PBBM and computing; strong regulatory support from FDA/EMA for MIDD; digital transformation with AI/ML in pharma R&D; biosimulation growth enabling virtual assessments and cost/time reductions in generic/biosimilar development.

✅ Key focus: Oncology dominates applications (48.3% share in 2024) due to complex formulations, narrow therapeutic indices, rising cancer incidence, and generic oncology demand. In vivo studies lead (70.3% share in 2024) as gold standard.

✅ Restraints: Stringent model validation, data quality needs, time-intensive/expensive processes, limited expertise in smaller firms, and regulatory hurdles for unvalidated models.

✅ North America dominates; Asia-Pacific fastest-growing with improving facilities and generic hubs.

Speak to Our Analyst and Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/bioequivalence-studies-market?sindhuri

Segmentation

☛ By Study Type

In Vivo dominates with 70.3% share in 2024 (gold standard for therapeutic equivalence and regulatory approvals); In Vitro (growing with simulation advancements).

☛ By Application

Oncology dominates with 48.3% share in 2024 (driven by complex generics, rising incidence, R&D investments); Cardiovascular Disease; Central Nervous System (CNS) Disorders; Infectious Diseases; Others.

☛ By End User

Pharmaceutical Companies; Contract Research Organizations (CROs); Research Institutes; Research Laboratories.

Regional Analysis

» North America leads the global bioequivalence studies market with the largest revenue share of 43.5% in 2024; driven by advanced infrastructure, R&D, early AI/biosimulation adoption, FDA support for MIDD, and strong pharmaceutical presence in the U.S.

» Asia-Pacific exhibits the fastest growth at a CAGR of 7.4% over the forecast period, supported by generic manufacturing hubs (India/China), government digital initiatives, improved research facilities, and cost-efficient simulation adoption in China, India, Japan, and South Korea.

» Europe holds a significant share of 34.5% in 2024, fueled by EMA qualifications (e.g., Simcyp in 2025), advanced computing, collaborations, and regulatory backing in Germany, UK, and France.

» The Middle East and Africa, along with South America, hold emerging potential with increasing access to biosimulation and generic development.

Buy now and enjoy a limited-time discount - limited-time offer!

https://www.datamintelligence.com/buy-now-page?report=bioequivalence-studies-market?sindhuri

(Purchase 2 or more Reports and get higher discounts)

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription

✅ Competitive Landscape

✅ Technology Innovation Tracker

✅ Export vs. Domestic Consumption Analysis

✅ Healthcare Expert Insights

✅ Digital Transformation & ROI Benchmarks

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us:

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us:

DataM Intelligence is a full-service market research and consulting firm, guiding organizations from initial insight to strategic implementation. We transform proprietary data, emerging trends, and market developments into agile, actionable solutions.

Our robust methodology powers a vast research database featuring 6,300+ syndicated and custom reports across 40+ industries. We have delivered strategic solutions to 200+ companies in 50+ countries, addressing the core research challenges that drive growth for our clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bioequivalence Studies Market to Reach US$1.35 Billion by 2033, Growing at a 7.5% CAGR | Key Players: Simulations Plus, Certara & SGS here

News-ID: 4361536 • Views: …

More Releases from DataM Intelligence 4Market Research LLP

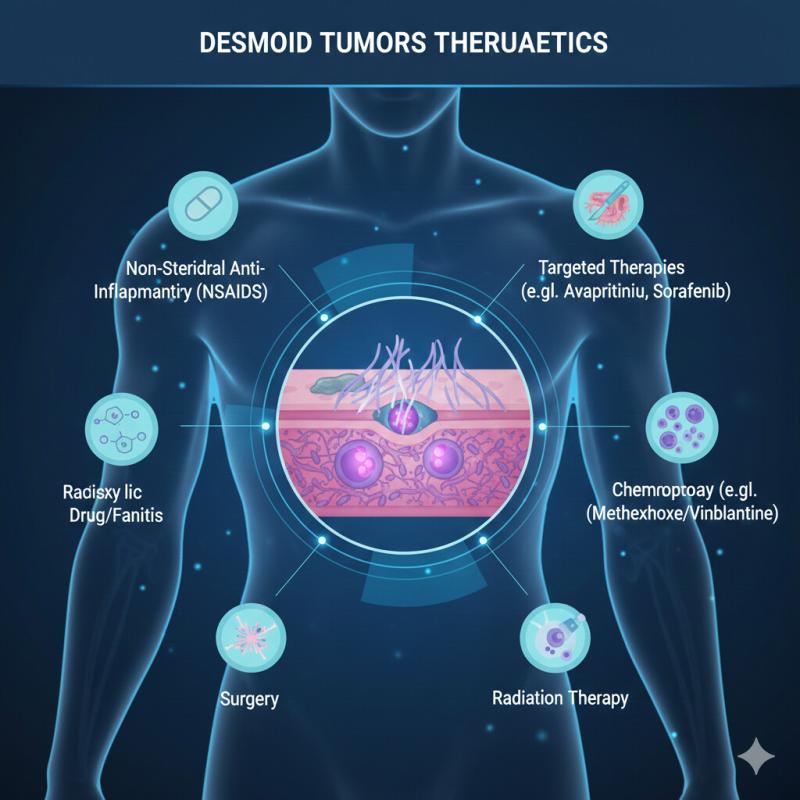

Desmoid Tumors Market to Reach US$3.05 Billion by 2033, Growing at a 5.6% CAGR | …

The global desmoid tumors market size reached US$1.88Billion in 2024 from US$1.79Billion in 2023 and is expected to reach US$ 3.05Billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033., according to DataM Intelligence.

United States: Recent Industry Developments

✅ In October 2025, SpringWorks Therapeutics (a Merck unit) announced publication of long-term efficacy and safety data from the Phase 3 DeFi trial of OGSIVEO® (nirogacestat) in the Journal of…

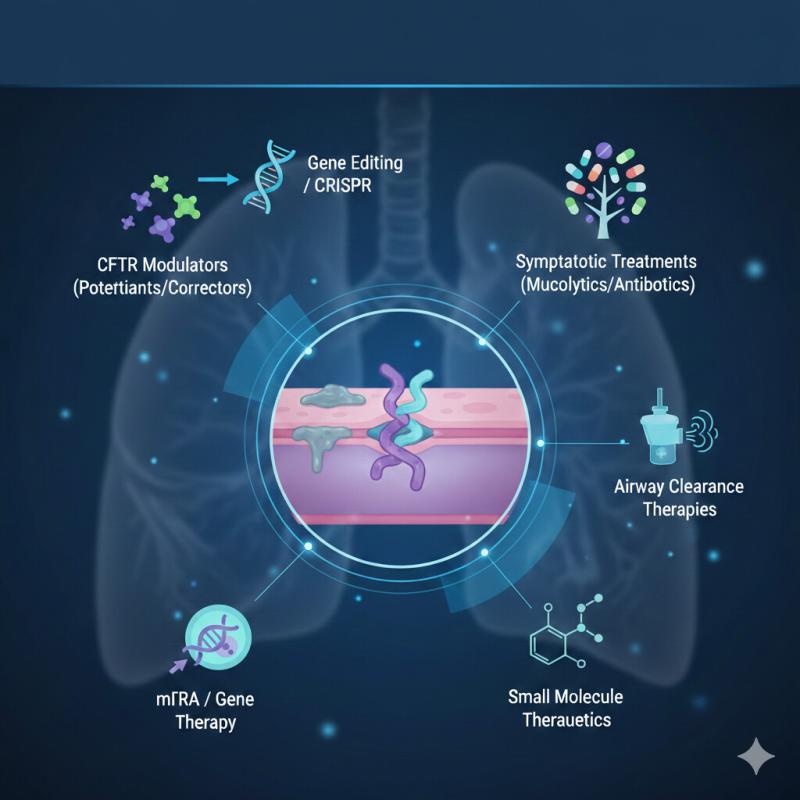

Cystic Fibrosis Therapeutics Market to Reach US$35.09 Billion by 2033, Growing a …

The global cystic fibrosis (CF) therapeutics market reached US$ 9.22 billion in 2023, with a rise to US$ 10.60 billion in 2024, and is expected to reach US$ 35.09 billion by 2033, growing at a CAGR of 14.2% from 2025 to 2033., according to DataM Intelligence.

United States: Recent Industry Developments

✅ In October 2025, Vertex Pharmaceuticals presented new data at the North American Cystic Fibrosis Conference (NACFC) showcasing superior sweat chloride…

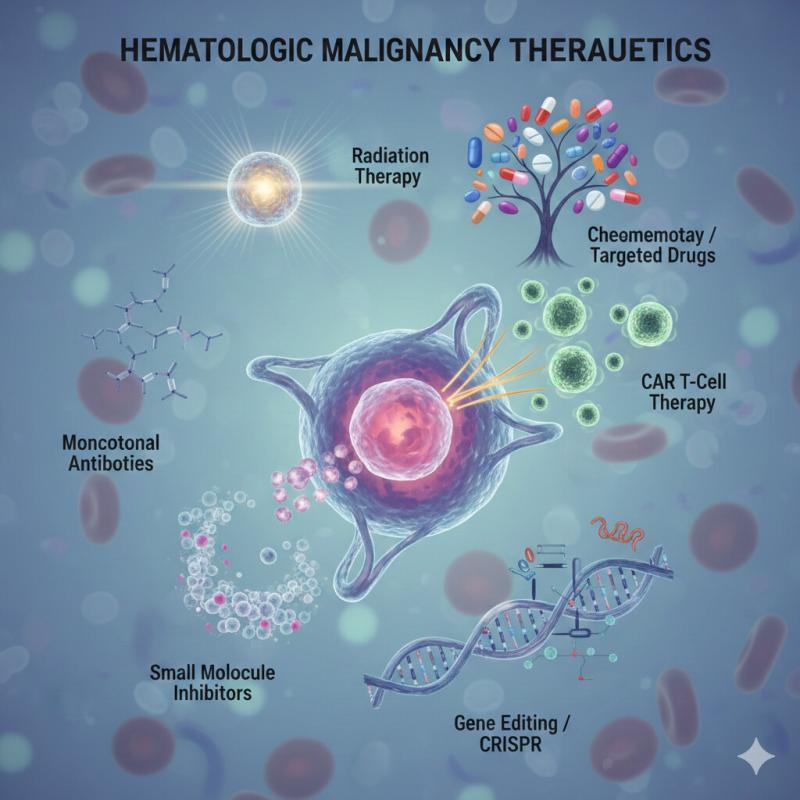

Hematologic Malignancy Therapeutics Market to Reach US$154.32 Billion by 2033, E …

The global hematologic malignancy therapeutics market reached US$ 71.80 billion in 2023, with a rise to US$ 77.06 billion in 2024, and is expected to reach US$ 154.32 billion by 2033, growing at a CAGR of 8.0% from 2025 to 2033., according to DataM Intelligence.

United States: Recent Industry Developments

✅ In October 2025, Syndax Pharmaceuticals received FDA approval for Revuforj (revumenib) for relapsed or refractory acute myeloid leukemia (AML) with NPM1…

Bispecific T-Cell Engagers (BiTEs) Market to Reach US$15.55 Billion by 2033, Exp …

The global Bispecific T-cell Engagers (BiTEs) market size reached US$ 2.10 billion in 2024 (from US$ 1.68 billion in 2023) and is expected to reach US$ 15.55 billion by 2033, growing at a CAGR of 25.1% from 2025 to 2033, according to DataM Intelligence.

United States: Recent Industry Developments

✅ In October 2025, Amgen expanded distribution of Blincyto (blinatumomab) to a majority of U.S. oncology centers and hospital systems, enhancing access for…

More Releases for FDA

DreaMed receives 5th FDA Clearance

TEL AVIV, Israel: DreaMed Diabetes LTD. ("DreaMed" or the "Company"), developer of the endo.digital Clinical Decision Support System announced today that it has received its 5th U.S Food and Drug Administration (FDA) clearance that expands the scope of AI enhanced treatment recommendations to patients on fixed meal insulin regimens. endo.digital is the first decision support system that has been cleared to assist healthcare providers in the management of diabetes…

FDA Compliant Blood Storage and Preservation

Accsense Monitoring System Automates Data Archive and Alarming

CAS DataLoggers provided the temperature alarming and monitoring system to a hospital blood bank looking to replace their old paper chart recorders as they became unreliable and spare parts were harder to find. For proper blood storage and preservation, the lab’s medical units needed to maintain storage temperatures between 2°C to 6°C (36°F to 43°F), given the perishability of blood components. The facility…

FDA grants orphan drug status to Vicore

US Food and Drug Administration has awarded Vicore Pharmaceuticals with orphan Drug designation for the treatment of Idiopathic Pulmonary Fibrosis (IPF). FDA’s Orphan Drug Designation program provides certain incentives for companies developing therapeutics to treat rare diseases or conditions, defined as those affecting less than 200,000 individuals in the U.S. A drug candidate and its sponsor must meet several key criteria in order to qualify for, and obtain, orphan drug…

New FDA Design Control Training Courses

Salt Lake City, Utah - February 23 2017 - Procenius Consulting is a medical device consulting firm specializing solely in medical device design controls regulation (21 CFR 820.30).

Announcing New Design Control Training Courses

Procenius Consulting has just launched two new training courses covering basic and advanced topics of medical device design control regulation. These courses focus on compliance, practical implementation and industry best practices techniques for developing or improving a…

fda online training

GRC Training Solutions provides end-to-end FDA compliance solutions for those companies who want to maximize security, minimize operational costs, improve staff productivity and stay on top of all their compliance documentation.

GRC Training Solutions boasts a team of experts and specialists who have a proven track record in working with the biotechnology, medical device, diagnostic and pharmaceutical fields. Our team will work with you closely and develop solutions that meet…

FDA online training

Description:

Device firms, establishments or facilities that are involved in the production and distribution of medical devices intended for use in the U.S are required to register annually. Most establishments that are required to register with the FDA are also required to list the devices that are made there and the activities that are performed on those devices. Initially, FDA issued a 28-page Proposed Rule that would amend its regulations regarding…