Press release

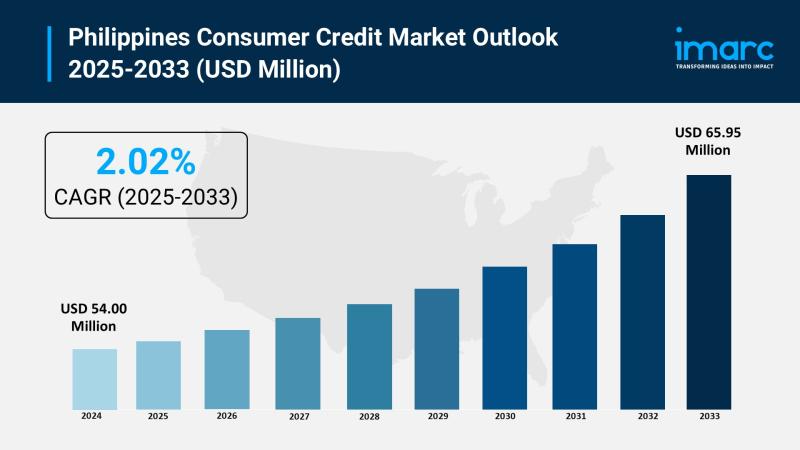

Philippines Consumer Credit Market to Hit USD 65.95 Million to 2025-2033 - IMARC Group

Market OverviewThe Philippines consumer credit market reached a size of USD 54.00 Million in 2024 and is projected to grow to USD 65.95 Million by 2033, exhibiting a growth rate (CAGR) of 2.02% during 2025-2033, marking its development over the forecast period of 2025-2033. The market thrives on expanded access to revolving credit, personal loans, and digital lending platforms, propelled by fintech innovations, mobile applications, and Buy Now Pay Later solutions. Regulatory frameworks and responsible lending practices greatly influence the evolving market environment, enhancing inclusivity and convenience.

Grab a sample PDF of this report: https://www.imarcgroup.com/philippines-consumer-credit-market/requestsample

How AI is Reshaping the Future of Philippines Consumer Credit Market:

• AI is enhancing underwriting processes with credit-first strategies employed by digital-only neobanks, enabling efficient and high-volume lending with better credit inclusion.

• Fintech firms leverage AI and cutting-edge technology to create accessible credit products with seamless digital experiences, attracting younger and underserved populations.

• Artificial intelligence-driven underwriting helps companies like Tonik surpass one million cumulative loans, highlighting AI's role in scaling lending operations.

• Regulatory frameworks include sandbox environments and digital-centric licensing rules that use AI for monitoring responsible lending and consumer protection.

• AI integration in digital payments, consumer fintech literacy, and responsible lending standards fosters increased trust and financial inclusion.

• AI-powered credit scoring and behavioral analysis empower smarter borrowing habits, improving resilience in credit markets and enhancing sustainability.

Market Growth Factors

The credit landscape in the Philippines is maturing with smoother credit supply conditions as financial institutions adjust to consumer needs while managing risk. A central bank report highlighted that banks are preparing to slightly tighten lending standards, not to restrict credit but to maintain risk balance. This shift creates a stable, predictable lending environment that boosts consumer confidence in both credit availability and fairness. Consumers are applying for credit with clearer goals, fostering a sustainable borrowing culture. This evolving lending environment underscores a significant driver for market growth, emphasizing quality and resilience over volume.

The Philippines consumer credit market is witnessing broader inclusion, as more Filipinos embrace credit as a financial tool rather than a last resort. Recent national polls indicate increased willingness among consumers towards organized lending, provided terms are clear and repayments manageable. This change stems from persistent awareness campaigns, improved lending practices, and accessible online options. The widespread adoption of mobile banking enables urban and rural users alike to understand and utilize credit effectively, supporting the market's healthy expansion. Enhanced financial literacy coupled with accessibility is actively driving the inclusiveness and overall growth of consumer credit.

Digital innovation and regulatory support are crucial growth factors reshaping the Philippines consumer credit market. Advances in digital tools-from e-wallets and mobile lending platforms to digital IDs and open finance frameworks-facilitate easier access to formal credit, including underserved areas. The central bank promotes a balanced ecosystem through guidelines that level competition between digital-ready institutions and guarantee consumer protection via sandbox models and digital licensing. Initiatives supporting digital payments, fintech literacy, and responsible lending build trust, making credit an understandable and user-friendly financial resource. This blend of innovation and policy nurtures a conducive environment for sustained market expansion.

Browse the full report with TOC and list of figures: https://www.imarcgroup.com/philippines-consumer-credit-market

Market Segmentation

Credit Type Insights:

• Revolving Credits

• Non-revolving Credits

Service Type Insights:

• Credit Services

• Software and IT Support Services

Issuer Insights:

• Banks and Finance Companies

• Credit Unions

• Others

Payment Method Insights:

• Direct Deposit

• Debit Card

• Others

Regional Insights:

• Luzon

• Visayas

• Mindanao

Key Players

• Salmon Group Ltd

• Tonik

Recent Development & News

• June 2025: Fintech firm Salmon Group Ltd secured significant funding, including a Nordic bond and equity investments, to expand its financial services reach in the Philippines using AI and advanced technology, aiming to deliver accessible credit and rewarding deposits.

• March 2025: Tonik, the first digital-only neobank in the Philippines, surpassed one million cumulative loans, underscoring the effectiveness of its AI-driven underwriting and credit-first strategies in promoting credit inclusion.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to an analyst for a customized report sample: https://www.imarcgroup.com/request?type=report&id=42056&flag=C

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Consumer Credit Market to Hit USD 65.95 Million to 2025-2033 - IMARC Group here

News-ID: 4361068 • Views: …

More Releases from IMARC Group

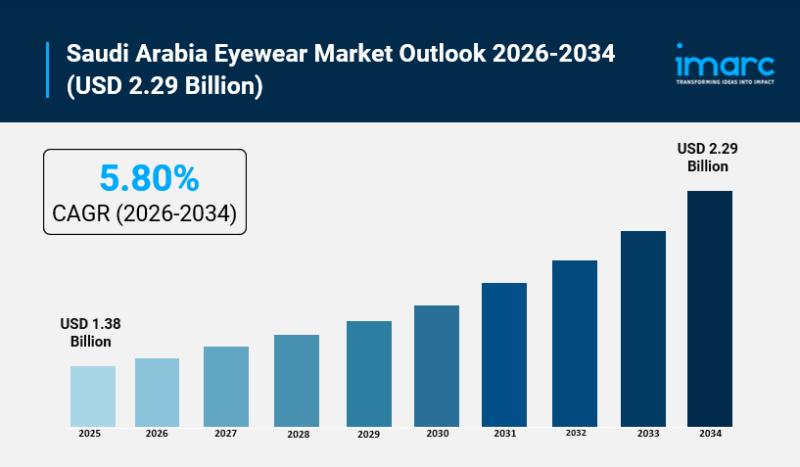

Saudi Arabia Eyewear Market Eyes USD 2.29 Billion by 2034 Already Hits USD 1.38 …

Saudi Arabia Eyewear Market Overview

Market Size in 2025: USD 1.38 Billion

Market Forecast in 2034: USD 2.29 Billion

Market Growth Rate 2026-2034: 5.80%

According to IMARC Group's latest research publication, "Saudi Arabia Eyewear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2026-2034", The Saudi Arabia eyewear market size was valued at USD 1.38 Billion in 2025 and is projected to reach USD 2.29 Billion by 2034, growing at…

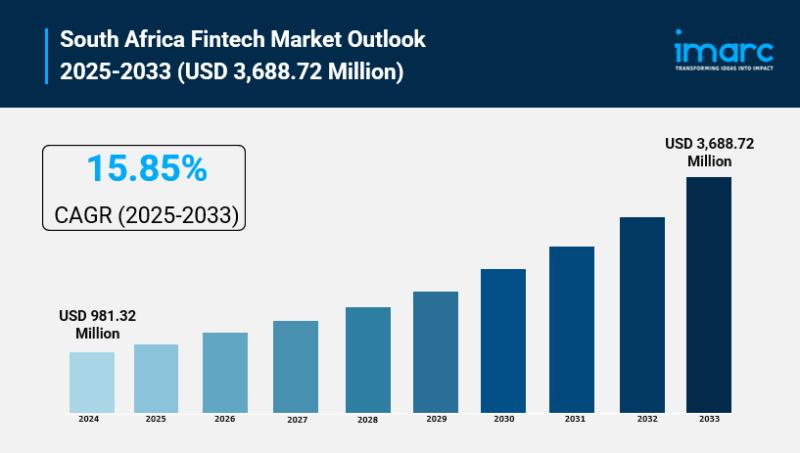

South Africa Fintech Market Size to Surpass USD 3,688.72 Million by 2033 | With …

South Africa Fintech Market Overview

Market Size in 2024: USD 981.32 Million

Market Size in 2033: USD 3,688.72 Million

Market Growth Rate 2025-2033: 15.85%

According to IMARC Group's latest research publication, "South Africa Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa fintech market size reached USD 981.32 Million in 2024. The market is projected to reach USD 3,688.72 Million by 2033, exhibiting a growth rate (CAGR) of 15.85%…

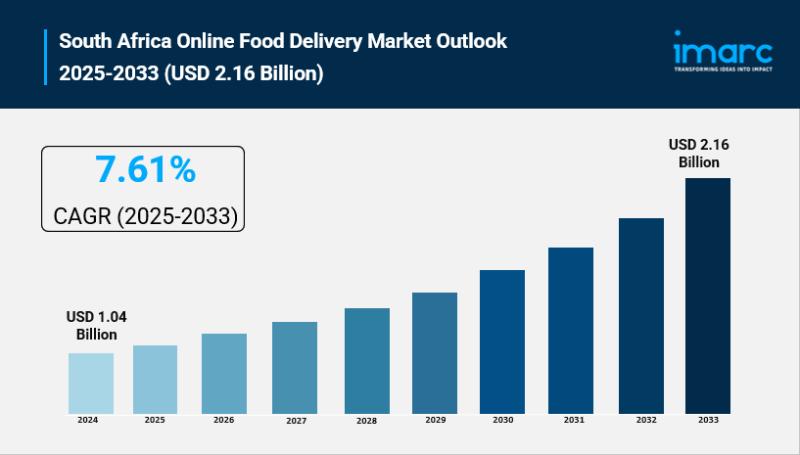

South Africa Online Food Delivery Market Size to Hit USD 2.16 Billion by 2033 | …

South Africa Online Food Delivery Market Overview

Market Size in 2024: USD 1.04 Billion

Market Size in 2033: USD 2.16 Billion

Market Growth Rate 2025-2033: 7.61%

According to IMARC Group's latest research publication, "South Africa Online Food Delivery Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the South Africa online food delivery market size reached USD 1.04 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.16 Billion…

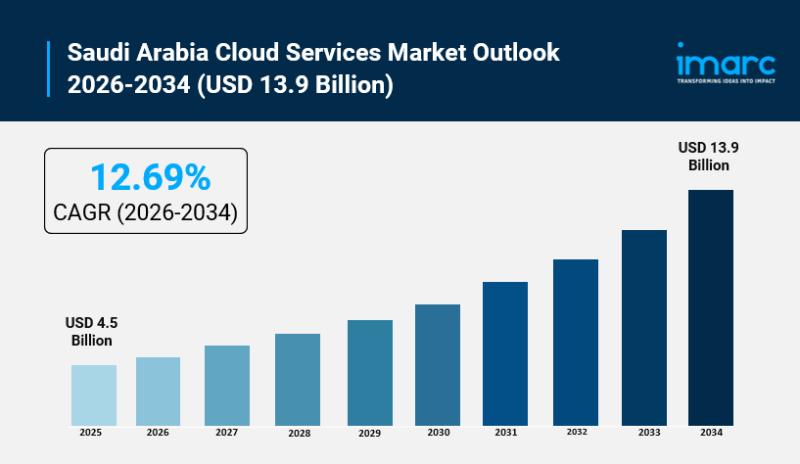

Saudi Arabia Cloud Services Market Poised for Explosive Growth to USD 13.9 Billi …

Saudi Arabia Cloud Services Market Overview

Market Size in 2025: USD 4.5 Billion

Market Forecast in 2034: USD 13.9 Billion

Market Growth Rate 2026-2034: 12.69%

According to IMARC Group's latest research publication, "Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034", The Saudi Arabia cloud services market size reached USD…

More Releases for Philippines

Philippines Contact Cement Market

Market Overview

Contact cement is a flexible acrylic adhesive that may be used on rubber, wood, bond tile, leather, metal, Formica, and most plastics. It stays flexible after curing and makes an excellent shoe glue. Contact cement may be applied to almost anything, although it works best on nonporous materials that conventional adhesives cannot adhere together.

Plastics, veneers, rubber, glass, metal, and leather all react well to contact cement. It is…

Philippines Quick Service Restaurants Market Size Is Likely To Reach Around $7.9 …

The Philippines quick service restaurants market has been continuously improvising in terms of product offerings, number of outlets, hospitality and other perks regarding prices that attracts a higher number of customers. Over the years, the Filipinos, specifically the millennials, have been open to different types of innovative food products due to increase in influence of westernization among the target customers. Considering this customer perception, some of the key players in…

Major Players in Philippines Auto Finance Market | Auto Loan Market Philippines …

Rising Innovation: Innovative digital startups such as iChoose.ph are reshaping the challenging car shopping and financing process into a quick and easy experience for customers in Philippines. It is expected that these will create an auto finance ecosystem in which digital aggregators increasingly control the sales and financing process. Car dealerships are expected to increasingly bring the experience of car shopping online by range of ways such as providing…

Philippines E-Commerce Logistics Market | Competitors in E-Commerce Logistics Ph …

Key Findings

Singapore-headquartered e-commerce player Shopee launched an in-app, live-streaming platform in the Philippines through which sellers can build a following to promote their products and offer discounts to viewers. This platform proved to be a success during the pandemic as it recorded 30m live stream views in April 2020.

E-commerce players can look forward to collaborate with brick-and-mortar retailers to provide consumers low-cost delivery options, as has been done in other…

Philippines Used Car Market

Philippines Used Car Market is expected to Gain Momentum from the Emergence of more Organized Players in the future along with Covid incited Surge in Demand: Ken Research

The used car market structure in Philippines is expected to be consolidated in the future as the market share of players selling vehicles via organized channel is expected to surge. This will be mainly on account of transparent and fair used car dealings/trading…

Philippines Quick Service Restaurants Market Booming Segments; Investors Seeking …

Philippines Quick Service Restaurants Market by Food Type, and Nature: Philippines Opportunity Analysis and Industry Forecast, 2019–2026,” The Philippines quick service restaurants market size was valued at $4.6 billion in 2018, and is expected to reach $7.9 billion by 2026, registering a CAGR of 6.9% from 2019 to 2026.The burger/sandwich segment was the highest contributor to the market, with $1.7billion in 2018, and is estimated grow at a CAGR of…