Press release

United States Connectivity as a Service (CaaS) Market to Reach USD 280.42 Billion by 2033 | CAGR 26.7% | North America Leads with 38% Share | Key Players: Cisco, AT&T, Verizon

Market OverviewThe Global Connectivity as a Service (CaaS) Market reached US$ 31.49 billion in 2023, increased to US$ 33.40 billion in 2024, and is projected to reach US$ 280.42 billion by 2033, growing at an impressive CAGR of 26.7% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/connectivity-as-a-service-market?Juli

The market's growth is being driven by the rising adoption of flexible, cloud-based connectivity solutions across industries to meet the growing need for secure, scalable, and on-demand network infrastructure. Enterprises are increasingly implementing CaaS to achieve seamless hybrid cloud integration, enhanced global WAN connectivity, efficient IoT device management, and secure remote access for distributed workforces. Technological advancements in 5G, SD-WAN (Software-Defined Wide Area Networking), edge computing, and AI-driven network optimization are further fueling market expansion. Additionally, rising global investments in digital infrastructure including subsea fiber optic cables, low-Earth orbit (LEO) satellites, and private 5G deployments are enabling ultra-fast and resilient global connectivity.

The competitive landscape is being reshaped by strategic alliances among hyperscalers, telecom operators, and enterprises, alongside accelerating digital transformation initiatives across industries such as BFSI, manufacturing, logistics, and IT services. The integration of AI and automation into connectivity solutions is also enhancing real-time analytics, predictive maintenance, and network agility, positioning CaaS as a key enabler of next-generation digital ecosystems.

The United States and Japan are emerging as the leading markets for Connectivity as a Service. In the U.S., hyperscalers such as Google, Amazon Web Services (AWS), and Microsoft, in collaboration with telecom leaders including AT&T and Verizon, are driving innovation in cloud interconnectivity, private 5G networks, and secure enterprise WAN solutions. A significant milestone includes Google's US$ 1 billion investment in the Proa and Taihei subsea cables, designed to enhance digital connectivity between Japan, CNMI, Guam, Hawaii, and the U.S., thereby boosting cross-border cloud and data exchange capacity.

In Japan, the government and private sector are jointly reinforcing the country's position as an Asia-Pacific connectivity hub. A notable development includes NTT SmartConnect's launch of a new Megaport Japan connection point at the Sonezaki Data Center in July 2025, enabling enterprises to access more agile and flexible global networking services.

Recent Developments:

✅ January 2026 - United States: AT&T partnered with Microsoft Azure to launch an integrated CaaS platform combining SD-WAN and edge computing capabilities, enabling enterprises to enhance cloud performance and real-time data management across hybrid infrastructures.

✅ November 2025 - Japan: NTT SmartConnect established a new connection point for Megaport Japan at the Sonezaki Data Center, offering faster and more flexible access to global cloud networks and improving interconnectivity for regional enterprises.

✅ September 2025 - United Kingdom: Vodafone Business launched a 5G-enabled CaaS solution designed for IoT-driven industries, providing dynamic bandwidth management and secure global connectivity for logistics and smart manufacturing operations.

✅ August 2025 - United States: Google announced a US$ 1 billion investment in the Proa and Taihei subsea cable systems to enhance transpacific digital connectivity between Japan, the U.S., Guam, and Hawaii, supporting growing data exchange needs for hyperscale cloud services.

✅ June 2025 - India: Bharti Airtel partnered with Cisco Systems to expand its software-defined connectivity offerings across enterprises, integrating secure cloud networking and automated traffic management under its CaaS portfolio.

✅ April 2025 - Germany: Deutsche Telekom Global Carrier launched a Cloud Connect-as-a-Service platform using AI-based network orchestration to simplify hybrid cloud connectivity for European enterprises.

✅ February 2025 - Australia: Telstra introduced its Next-Gen Edge CaaS platform, leveraging private 5G and AI analytics to support industrial automation, mining, and smart city applications with low-latency connectivity.

Mergers & Acquisitions:

✅ January 2026 - United States: Cisco Systems Inc. acquired a cloud-native connectivity startup specializing in AI-based SD-WAN orchestration to strengthen its CaaS portfolio and enhance network automation for enterprise customers.

✅ October 2025 - United Kingdom: Vodafone Group completed the acquisition of a European managed connectivity provider, expanding its cloud interconnect and IoT-based connectivity services across the EMEA region.

✅ August 2025 - Japan: NTT Ltd. acquired a domestic cloud networking firm to accelerate its Megaport connectivity ecosystem, enabling faster deployment of hybrid cloud and global WAN services.

✅ July 2025 - United States: AT&T Inc. entered into a strategic merger with a private 5G infrastructure provider, enhancing its enterprise CaaS offerings for manufacturing and smart logistics sectors.

✅ May 2025 - Germany: Deutsche Telekom AG acquired a cloud connectivity and network virtualization startup, strengthening its position in the European CaaS and edge computing market.

Buy Now & Unlock 360° Market Intelligence:-https://www.datamintelligence.com/buy-now-page?report=connectivity-as-a-service-market?Juli

Key Players:

Cisco Systems | AT&T | Verizon | NTT DATA | Vodafone | BT Group | Tata Communications | Cloudflare | Lumen Technologies | Telefónica Tech

Key Highlights:

• Cisco Systems - Holds 17% share, leading the global CaaS market with its AI-driven SD-WAN, cloud interconnect, and secure access service edge (SASE) platforms. Cisco's strong partnerships with hyperscalers and telecom operators further strengthen its dominance in hybrid and multi-cloud connectivity.

• AT&T - Holds 14% share, leveraging its robust 5G infrastructure and enterprise network services to provide flexible CaaS solutions, including edge computing and private WAN services for global corporations.

• Verizon - Holds 12% share, supported by its extensive 5G edge and multi-access edge computing (MEC) offerings tailored for smart manufacturing, logistics, and real-time analytics applications.

• NTT DATA - Holds 10% share, driven by strong presence in Asia-Pacific and global cloud interconnect ecosystems, including the Megaport Japan expansion, enabling seamless hybrid cloud integration and low-latency enterprise connectivity.

• Vodafone - Holds 9% share, focusing on SD-WAN and IoT-based CaaS solutions for Europe and emerging markets, supported by strong network virtualization and managed connectivity services.

• BT Group - Holds 8% share, delivering secure cloud connectivity, managed SD-WAN, and network orchestration services across Europe and North America. Its AI-based network monitoring capabilities enhance enterprise network resilience.

• Tata Communications - Holds 7% share, capitalizing on its global subsea cable network and edge connectivity infrastructure, offering secure cloud connectivity and enterprise-grade communication solutions across 200+ countries.

• Cloudflare - Holds 6% share, expanding rapidly in the cloud-native CaaS segment with its Zero Trust networking, secure edge, and intelligent routing services, catering to digital-first and remote enterprises.

• Lumen Technologies - Holds 5% share, utilizing its edge computing and hybrid cloud platforms to deliver high-speed, low-latency connectivity solutions for data-intensive enterprises.

• Telefónica Tech - Holds 5% share, strengthening its position in Europe and Latin America through AI-enhanced network automation, private 5G, and cybersecurity-integrated CaaS solutions.

Market Segmentation:

By Service Type:

The Wide Area Network (WAN) as a Service segment dominates the market with approximately 45% share, driven by the growing need for secure, scalable, and cloud-integrated enterprise connectivity across multiple locations. Local Area Network (LAN) as a Service accounts for around 25%, propelled by increasing adoption of software-defined LANs for agile campus and edge network management. Virtual Private Network (VPN) as a Service holds roughly 20%, favored by remote and hybrid work environments demanding secure access to corporate networks. The others segment including managed internet, connectivity APIs, and interconnect-as-a-service represents the remaining 10%, reflecting emerging innovations in software-defined connectivity.

By Enterprise Size:

Large enterprises lead the market with about 65% share, owing to their high demand for global WAN optimization, cloud interconnectivity, and multi-branch SD-WAN solutions. Meanwhile, small and medium-sized enterprises (SMEs) contribute approximately 35%, as digital transformation and subscription-based CaaS models make enterprise-grade networking more affordable and accessible for mid-sized businesses.

By Deployment Mode:

The public cloud-based segment holds the largest share at around 40%, driven by hyperscalers' growing investment in multi-cloud connectivity and on-demand networking services. The private cloud-based model follows with 30%, favored by enterprises in regulated sectors such as BFSI and healthcare requiring enhanced data privacy. The hybrid cloud segment accounts for 30%, expanding rapidly as organizations balance agility and control by combining public scalability with private data governance.

By End-Use:

The IT & telecommunications sector dominates with nearly 30% share, reflecting strong adoption of CaaS for global data centers, hybrid networks, and 5G integration. The BFSI sector follows with 20%, driven by secure connectivity needs for cloud banking and digital payments infrastructure. Healthcare represents 15%, leveraging CaaS for remote diagnostics, telemedicine, and HIPAA-compliant data transfer. The retail & e-commerce segment holds 12%, using cloud connectivity for omnichannel platforms and real-time logistics tracking. Manufacturing accounts for 13%, supported by the growing implementation of industrial IoT and smart factory networks. The government sector represents the remaining 10%, focusing on secure, cloud-based interdepartmental and citizen-service networks.

Speak to Our Analyst and Get Customization in the report as per your requirements:-https://www.datamintelligence.com/customize/connectivity-as-a-service-market?Juli

Regional Insights:

North America leads the global market with approximately 38% share, propelled by the presence of major technology players such as Cisco Systems, AT&T, Verizon, and Lumen Technologies. The United States remains at the forefront of cloud interconnectivity, private 5G, and AI-driven network management, supported by significant federal investments in broadband and edge infrastructure. The CHIPS and Science Act and large-scale 5G rollouts have strengthened the region's position as a global hub for digital connectivity innovation.

Asia-Pacific follows closely, accounting for around 34% of the global market, and is projected to be the fastest-growing region during the forecast period. Countries such as Japan, China, India, and South Korea are making major strides in cloud networking, IoT integration, and enterprise SD-WAN deployments. Japan's initiatives, including NTT SmartConnect's Megaport expansion, and China's focus on digital Silk Road infrastructure, are accelerating CaaS adoption. The proliferation of 5G and hyperscale data centers across the region is also creating new growth avenues for enterprises adopting hybrid connectivity solutions.

Europe holds a notable 17% share, driven by rising adoption of secure cloud connectivity and digital transformation programs across sectors such as BFSI, manufacturing, and government. Countries including Germany, the U.K., and France are advancing network virtualization and edge computing through initiatives such as the European Data Act and public-private collaborations for digital sovereignty and secure multi-cloud ecosystems.

Market Dynamics:

Drivers:

The rapid proliferation of 5G and edge computing is a major driver accelerating the growth of the global Connectivity as a Service (CaaS) market. As enterprises demand high-speed, low-latency, and reliable connectivity to support next-generation workloads such as cloud-native applications, IoT ecosystems, autonomous systems, and immersive digital experiences CaaS providers are integrating 5G and edge capabilities to deliver enhanced performance and flexibility.

By combining 5G's ultra-fast network capacity with edge computing's localized data processing, CaaS solutions are transforming traditional wide area networks (WAN) into agile, cloud-centric architectures that enable real-time decision-making and seamless global interconnectivity. This paradigm shift helps organizations reduce dependence on centralized data centers, enhance operational agility, and lower the total cost of ownership associated with legacy infrastructure.

For instance, in 2024, Tata Communications launched a global cloud-based 5G Roaming Laboratory, allowing Mobile Network Operators (MNOs) to test and validate standalone 5G use cases prior to deployment. By integrating 5G with CaaS capabilities, the initiative offers secure cross-border roaming, uninterrupted high-speed connectivity, and immersive enterprise-grade digital services, exemplifying how 5G and edge computing are redefining the CaaS ecosystem into a high-performance connectivity backbone for the global digital economy.

Restraint:

Despite its transformative potential, the Connectivity as a Service market faces significant challenges related to data security, privacy, and regulatory compliance. As enterprises increasingly rely on third-party cloud and network providers, concerns over data sovereignty, cyberattacks, and cross-border data transfers have intensified. The complexity of adhering to diverse global regulations including GDPR (Europe), CCPA (United States), HIPAA (Healthcare), and stringent data localization laws in Asia-Pacific adds operational and legal hurdles for global enterprises.

Moreover, the multi-cloud and hybrid nature of CaaS deployments often involves sensitive data exchange across regions, exposing organizations to potential ransomware attacks, DDoS disruptions, and insider threats. These risks are particularly acute in regulated sectors such as BFSI, healthcare, and government, where data integrity and compliance are paramount.

To mitigate these risks, enterprises increasingly demand zero-trust security architectures, end-to-end encryption, and continuous compliance auditing from CaaS providers. For example, in 2023, several multinational corporations faced multi-million-dollar GDPR penalties due to non-compliant data transfers between Europe and the U.S., highlighting how regulatory missteps can lead to severe financial and reputational damage. Consequently, while CaaS adoption continues to grow, security and compliance assurance remain critical factors influencing vendor selection and deployment strategies.

📌 Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

☛ Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

☛ Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg?Juli

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Connectivity as a Service (CaaS) Market to Reach USD 280.42 Billion by 2033 | CAGR 26.7% | North America Leads with 38% Share | Key Players: Cisco, AT&T, Verizon here

News-ID: 4359027 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

AI Accelerator Chip Market to Reach USD 283.13 Billion by 2032 | CAGR 33.19% | N …

Market Overview

The Global AI Accelerator Chip Market reached US$ 28.59 billion in 2024 and is projected to reach US$ 283.13 billion by 2032, growing at an impressive CAGR of 33.19% during the forecast period 2025-2032.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):-https://www.datamintelligence.com/download-sample/ai-accelerator-chip-market?Juli

The market's growth is being propelled by massive government investments and industrial initiatives aimed at strengthening AI hardware capabilities, which serve as…

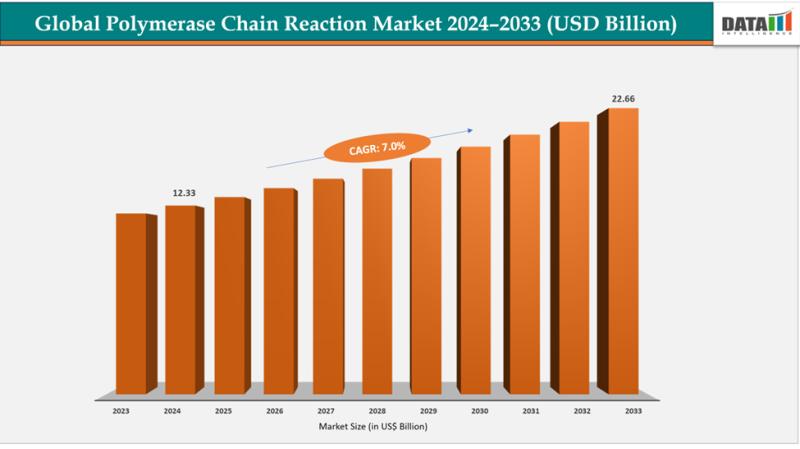

United States Polymerase Chain Reaction (PCR) Market 2033 | Growth Drivers, Key …

Market Size and Growth

The global polymerase chain reaction market size reached US$ 11.58 Billion in 2023 with a rise of US$ 12.33 Billion in 2024 and is expected to reach US$ 22.66 Billion by 2033, growing at a CAGR of 7.0% during the forecast period 2025-2033.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/polymerase-chain-reaction-market?sb

Key Development:

United States: Recent PCR Industry Developments

✅ In January…

On-Body Drug Delivery Devices Market to Reach USD 82.74 Billion by 2033 | CAGR 8 …

The Global On-Body Drug Delivery Devices (OBDDs) Market reached US$ 40.54 billion in 2024 and is projected to reach US$ 82.74 billion by 2033, growing at a CAGR of 8.6% during the forecast period 2025-2033. On-body drug delivery devices are innovative medical technologies designed to administer drugs particularly biologics subcutaneously while remaining attached to the patient's body. These devices are typically patched onto the skin and are capable of delivering…

Drone Battery Swapping Market to Reach USD 13.9 Billion by 2031 | CAGR 4.4% | No …

The Global Drone Battery Swapping Market reached US$ 12.5 billion in 2022 and is projected to reach US$ 13.9 billion by 2031, growing at a CAGR of 4.4% during the forecast period 2024-2031. The market growth is driven by rapid technological advancements and the integration of Artificial Intelligence (AI), which have significantly enhanced drone functionalities such as autonomous takeoff, satellite navigation, surveillance, data collection, transfer, and real-time processing all with…

More Releases for CaaS

Global Cars-as-a-Service (CaaS) Market Forecast: Projected to Rise from USD 120. …

According to a new report by Maximize Market Research, the global Cars-as-a-Service (CaaS) market was valued at USD 120.80 billion in 2024 and is projected to reach USD 435.92 billion by 2032, growing at a compound annual growth rate (CAGR) of 17.4% over the forecast period. The growth is being fuelled by shifts in consumer preference toward access over ownership, technological advances, and supportive urban mobility policies globally.

► Get a…

Containers as a Service (CaaS) Market: Trends, Growth Drivers, and Future Outloo …

Containers as a Service (CaaS) has emerged as a pivotal cloud computing model, enabling developers and IT departments to manage and deploy containerized applications with enhanced efficiency. By leveraging CaaS platforms, organizations can streamline application development, deployment, and scalability, leading to increased agility and reduced operational complexities. As businesses continue to embrace digital transformation, the CaaS market is experiencing significant growth, driven by factors such as the rising adoption of…

Global Chemical As A Service (CaaS) Market Size by Application, Type, and Geogra …

USA, New Jersey- According to Market Research Intellect, the global Chemical As A Service (CaaS) market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The Chemical as a Service (CaaS) market is experiencing rapid growth, driven by the increasing demand for customized chemical solutions across various…

Commerce as a Service (CaaS) Market: Transforming E-commerce Solutions

Mobile devices such as smartphones and tablets are increasing the touch points and attracting customer traffic to the site, which is expected to help bring new channel sales to e-commerce businesses. In addition, low network bandwidth and weak network signals hinder the growth of the Commerce as a Service (CaaS) market. Furthermore, security issues related to payment processes are key factors limiting the Commerce as a Service (CaaS) market growth.…

Segmentation of Container as a Service (CaaS) Market: Trends, Opportunities, and …

Container as a Service (CaaS) Market Overview:

In the organizations, the container as a service (CaaS) is IT Ops that provides an application environment which is secured and delivers container-based virtualization which helps in the faster delivery of the applications. A container as a service (CaaS) delivers to the customer the complete OS structure in order to manage and deploy the clusters, containers, and applications. A container as a service model…

Cloud Container As A Service (CaaS) Market Size, Share, Development by 2024

LP INFORMATION offers a latest published report on Cloud Container As A Service (CaaS) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

According to this study, over the next five years the Cloud Container As A Service (CaaS) market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2024,…