Press release

BNPL Market to Grow Immensely at a CAGR of 27% From 2025 To 2034

As per the current market research conducted by the CMI Team, the global Buy Now Pay Later Market is expected to record a CAGR of 27% from 2023 to 2032. In 2022, the market size is projected to reach a valuation of USD 6.1 Billion. By 2032, the valuation is anticipated to reach USD 25.7 Billion.➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=19989

➤ Market Size

• The global Buy Now Pay Later (BNPL) market was valued at approximately USD 6.1 billion in 2022 and grew to USD 8.1 billion in 2023.

• The market is projected to reach USD 25.7 billion by 2032, exhibiting a robust CAGR of ~27% from 2023 to 2032.

• Rapid growth reflects wider adoption of flexible payment solutions across both online and offline retail environments.

➤ Market Overview

• Buy Now Pay Later (BNPL) refers to payment models where consumers can make purchases immediately and defer payment, either interest-free or in instalments, over a defined future period.

• BNPL encompasses payment platforms, retail partnerships, credit assessments, structured repayment plans, and digital checkout services that enhance consumer buying power.

• It is used across sectors including consumer electronics, fashion, healthcare, leisure and entertainment, retail and more, offering flexibility and financial convenience.

➤ Key Market Growth Drivers

• Consumer Convenience: Shoppers can defer payments and manage budgets more flexibly, encouraging larger purchases.

• Reduced Cart Abandonment: In e-commerce, BNPL options help convert potential drop-offs into completed sales.

• Accessibility and Inclusivity: Lenient credit requirements versus traditional credit cards broaden user adoption.

• Interest-Free Periods: Many BNPL plans offer short-term, interest-free payments, attractive to price-sensitive consumers.

• Retail Partnerships: Collaboration between BNPL providers and merchants expands user access across categories.

• Sector Expansion: Adoption in automotive, education and subscription-services segments is increasing.

➤ Explore Full Report here: https://www.custommarketinsights.com/report/buy-now-pay-later-market/

➤ Analysis of Key Players

• The BNPL market features a mix of global fintech companies and region-specific service providers.

• Leading players compete based on platform usability, merchant network size, repayment flexibility, and geographic reach.

• Market participants continuously refine credit assessment algorithms to balance growth with risk management.

• Competitive differentiation is achieved through partnerships, acquisitions, and diversified sector coverage.

• Established brands benefit from strong consumer trust and large merchant ecosystems.

➤ Key Player Strategies

• Expansion through strategic acquisitions to enter new regions and strengthen capabilities.

• Partnerships with large retailers and e-commerce platforms to increase transaction volume.

• Product innovation focused on flexible repayment schedules and enhanced customer experience.

• Investment in technology to improve fraud prevention and credit risk assessment.

• Geographic expansion targeting emerging and underpenetrated markets.

➤ Market Challenges & Opportunities

Challenges:

• Increasing regulatory scrutiny surrounding consumer credit and financial transparency.

• Rising concerns about consumer over-indebtedness and repayment defaults.

• Intensifying competition leading to pricing pressure and margin constraints.

• Dependence on merchant partnerships for transaction flow.

Opportunities:

• Expansion into emerging markets with large underbanked populations.

• Growing adoption of BNPL in offline and point-of-sale retail environments.

• Increasing use of BNPL for non-traditional sectors such as healthcare and services.

• Integration with digital wallets and super-app ecosystems.

➤ Recent Developments (Use as It Is from Report RD)

• Strategic acquisitions by major BNPL providers to expand geographic reach.

• Entry into new regional markets through localized payment offerings.

• Enhanced in-store and omnichannel BNPL capabilities.

• Platform upgrades focused on improving merchant and consumer experience.

• Expansion of service portfolios through partnerships and acquisitions.

➤ Investment Landscape and ROI Outlook

• The high growth rate of the BNPL market continues to attract strong investor interest.

• Venture capital and strategic investments support platform scalability and geographic expansion.

• Consolidation trends indicate long-term confidence in BNPL as a sustainable payment model.

• ROI potential is supported by increasing transaction volumes and merchant adoption.

• Regulatory clarity is expected to further stabilize investor sentiment.

➤ Download Full PDF Sample Copy of Market Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=19989

➤ Market Segmentations (With Region)

By Channel:

• Online

• Point of Sale

By Enterprise Size:

• Large Enterprises

• Small and Medium Enterprises

By End Use:

• Consumer Electronics

• Fashion & Garments

• Healthcare

• Leisure & Entertainment

• Retail

• Others

By Region:

• North America

• Europe

• Asia-Pacific

• Middle East & Africa

• South & Central America

➤ Why Buy This Report?

• In-depth market size analysis and long-term forecasts.

• Comprehensive competitive landscape and company profiling.

• Detailed segmentation covering channels, end uses, and regions.

• Clear insights into growth drivers, challenges, and opportunities.

• Strategic intelligence to support business planning and investment decisions.

➤ FAQs

Q. What is Buy Now Pay Later (BNPL)?

• BNPL is a digital payment solution allowing consumers to pay for purchases in installments instead of paying the full amount upfront.

Q. What factors are driving BNPL market growth?

• Growth is driven by e-commerce expansion, flexible payment demand, and merchant adoption to improve sales performance.

Q. Which industries commonly use BNPL services?

• BNPL is widely used in retail, consumer electronics, fashion, healthcare, and leisure sectors.

Q. What challenges does the BNPL market face?

• Regulatory scrutiny, consumer debt concerns, and competitive pricing pressures remain key challenges.

Q. Why is BNPL attractive to merchants?

• BNPL helps increase conversion rates, average order values, and customer reach without immediate payment barriers.

➤ More Related Reports by Custom Market Insights-

Global 3D Printed Satellite Market 2025 - 2034

https://www.custommarketinsights.com/report/3d-printed-satellite-market/

Global Supply Chain Network Design Market 2025 - 2034

https://www.custommarketinsights.com/report/supply-chain-network-design-market/

Global Governance Risk and Compliance GRC Platform Market 2025 - 2034

https://www.custommarketinsights.com/report/grc-platform-market/

Global Edge Management and Orchestration Platforms Market 2025 - 2034

https://www.custommarketinsights.com/report/edge-management-and-orchestration-platforms-market/

➤ Conclusion

The Buy Now Pay Later market is evolving into a core component of the global digital payments ecosystem. Its growth is supported by rising consumer demand for flexible payment options, expanding e-commerce activity, and strong merchant adoption across multiple industries. While regulatory oversight and credit risk present ongoing challenges, continuous innovation, strategic partnerships, and expansion into new sectors provide substantial growth opportunities. As BNPL platforms enhance technology, broaden geographic presence, and diversify applications, the market is positioned for sustained long-term expansion. Overall, BNPL represents a transformative shift in consumer purchasing behavior and modern retail finance.

Contact Us:

Joel John

Custom Market Insights

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 801-639-9061

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI is a one-stop solution for data collection and investment advice. Our company's expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts advise clients on aspects such as strategies for future estimation, forecasting, opportunities to grow, and consumer surveys.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release BNPL Market to Grow Immensely at a CAGR of 27% From 2025 To 2034 here

News-ID: 4358310 • Views: …

More Releases from Custom Market Insights

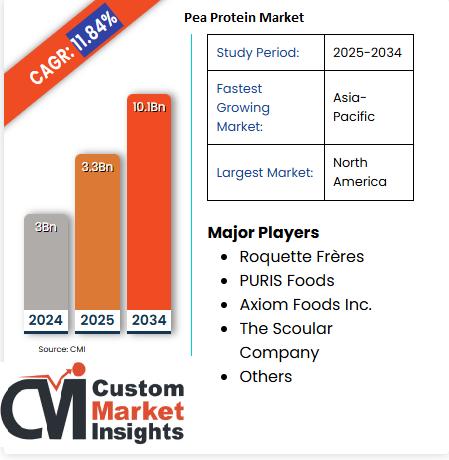

Pea Protein Market Revenues To Grow At Nearly 11.84% From 2025 To 2034

As per the Pea Protein Market analysis conducted by the CMI Team, the global Pea Protein Market is expected to record a CAGR of 11.84% from 2025 to 2034. In 2025, the market size is projected to reach a valuation of USD 3.3 Billion. By 2034, the valuation is anticipated to reach USD 10.1 Billion.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=16673

➤ Market Size

• The global pea protein market was…

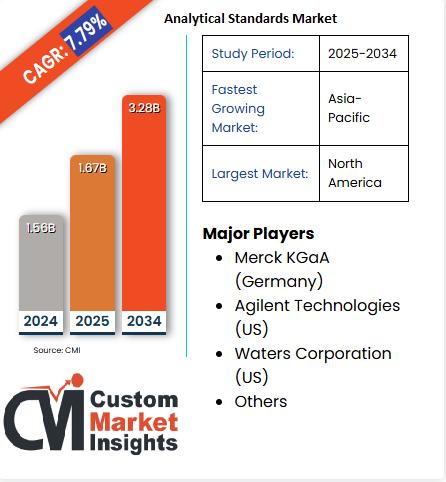

Analytical Standards Market To Advance At CAGR Of 7.79% From 2025 To 2034

According to Custom Market Insights (CMI), The Global Analytical Standards Market presented a growth of USD $1.56 Billion by 2024 to $1.67 Billion in 2025 and is estimated to touch USD $3.28 Billion by the end of 2034 at a compound annual growth rate (CAGR) of approximately 7.79% during the projected period 2025-2034.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=18057

➤ Market Size

• In 2024, the global analytical standards market size…

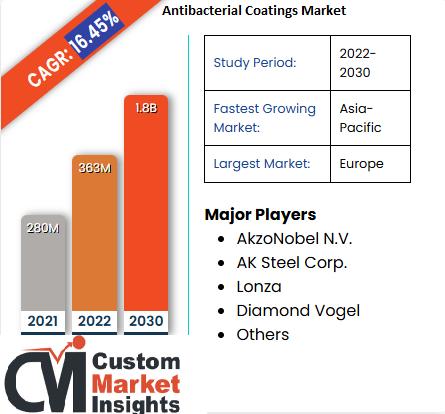

Antibacterial Coatings Market Is Estimated To Surge Ahead At A Cagr Of 16.45% Fr …

According to Custom Market Insights (CMI), The Global Antibacterial Coatings Market size was estimated at 280 Million in 2021 and is expected to reach USD 363 million in 2022 and is expected to hit around 1.8 Billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 16.45 % from 2022 to 2030.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=19865

➤ Market Size

• The global antibacterial coatings market…

Surgical Sutures Market Develop At A CAGR of 5.4% From 2025 To 2034

As per the current market research conducted by Custom Market Insight Market Research Team, the global surgical sutures market is expected to record a CAGR of 5.4% from 2023 to 2030. In 2023, the market size is projected to reach a valuation of US$ 9.3 billion. By 2030, the valuation is anticipated to reach US$ 14.5 billion.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=23204

➤ Market Size (Expanded Insight)

• The global…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…