Press release

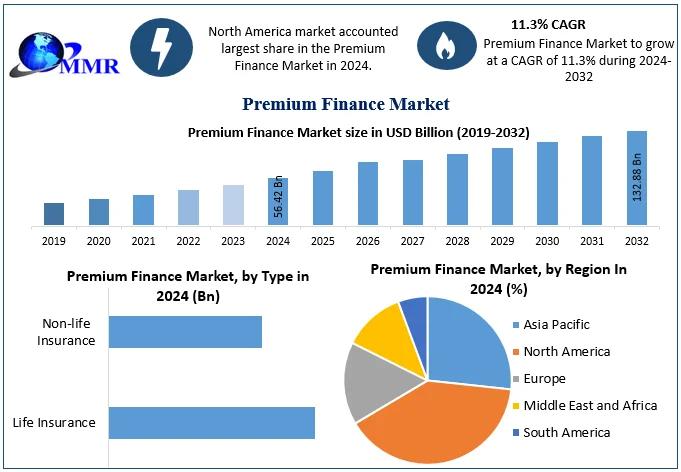

Premium Finance Market to Reach USD 132.88 Billion by 2032 | Rapid Growth Driven by Expanding Insurance Penetration & Flexible Financing Solutions

According to Maximize Market Research, the Premium Finance Market size was valued at approximately USD 56.42 billion in 2024 and is projected to grow at a CAGR of 11.3 %, reaching an estimated USD 132.88 billion by 2032.Market Overview

The Premium Finance Market refers to the financial service where third-party financial institutions lend funds to individuals or businesses to cover insurance premium payments, enabling policyholders to spread high insurance costs over manageable installments rather than paying large lump sums upfront. This solution enhances liquidity, preserves cash flow, and makes high-value insurance products-such as life, health, property, or commercial policies-more accessible to a broader clientele. The rising demand for comprehensive insurance coverage coupled with growing awareness of cash flow management has propelled the adoption of premium financing globally.

Unlock Insights: Request a Free Sample of Our Latest Report Now @ https://www.maximizemarketresearch.com/request-sample/213507/

Market Size Outlook

Base Year (2024) Market Value USD 56.42 Billion

Forecast Period 2025-2032

Projected Market Value (2032) USD 132.88 Billion

Forecast CAGR (2025-2032) 11.3 %

Market Segmentation

by Type

Life Insurance

Non-life Insurance

by Interest Rate

Fixed Interest Rate

Floating Interest Rate

by Provider

Banks

NBFCs

Others

Access Premium Market Insights - Limited-Time 30% Off https://www.maximizemarketresearch.com/market-report/premium-finance-market/213507/

Market Key Growth Drivers

Increasing Insurance Penetration - Rising penetration of life and non-life insurance products worldwide fuels demand for financing solutions as consumers and businesses struggle with large upfront costs.

Growing Commercial and Corporate Demand - Businesses are adopting premium finance to manage escalating commercial insurance costs and align expenses with operational cash flow.

Digital Transformation - Investment in online lending platforms, digital underwriting, and automated approval processes accelerates market accessibility and efficiency.

High-Net-Worth Individuals (HNWIs) - The affluent segment increasingly uses premium financing for estate planning, wealth preservation, and tax optimization strategies.

Expansion of Banks & NBFCs - Traditional banks and NBFCs broaden product offerings to include premium financing, backed by strong capital and cooperative insurance partnerships.

Market Challenges

Regulatory Complexity - Evolving financial regulations and compliance requirements across jurisdictions create operational and cost burdens for service providers.

Economic Uncertainty - Slowdowns in global economic growth can dampen consumer confidence and delay financial commitments, affecting demand for premium finance products.

Interest Rate Fluctuations - Rising interest rates may increase borrowing costs, making financing less attractive to some policyholders.

Operational & Billing Challenges - Providers face logistical complexity in billing, endorsement adjustments, and policy cancellations, which can affect customer experience.

Recent Developments

Fintech Integration - Fintech startups are deploying EMI-based premium financing, especially for health insurance, democratizing access for both individual and corporate clients.

Strategic Expansion - Many top financiers are integrating AI-powered underwriting tools and building digital ecosystems to streamline loan processes and reduce operational costs.

Regulatory Scrutiny - In some regions, financial regulators are assessing pricing and fairness in premium financing products to protect consumers from excessively high rates.

Need More Information? Inquire About additional details here @ https://www.maximizemarketresearch.com/request-sample/213507/

Emerging Opportunities

Expansion in Emerging Markets - Rising affluence and a growing middle class in regions like Asia-Pacific and Latin America present untapped potential for premium finance providers.

Technology & AI Adoption - Advanced analytics and AI-enabled platforms will help personalize financing, enhance underwriting accuracy, and improve risk management.

Embedded Finance - Integrating premium financing directly into digital insurance purchase journeys simplifies adoption and broadens user reach.

Cross-Sector Solutions - Opportunities in combining premium finance with wealth management, corporate treasury services or SME financing expand addressable markets.

Market Key Players:

1. Colonnade

2. Banking Truths Team

3. Insurance and Estate Strategies LLC

4. AGENTSYNC, INC.

5. The Annuity Expert

6. J.P. Morgan Private Bank

7. Tennessee

8. Capital for Life

9. Generational Strategies Group, LLC.

10. BNY Mellon Wealth Management

11. Byline Bank

12. Succession Capital Alliance

13. Symetra Life Insurance Company

14. Lions Financial

15. Wintrust

Frequently Asked Questions (FAQs)

1. What is the Premium Finance Market?

Premium financing is a financial solution whereby a third party lends funds to insurance policyholders to pay premiums in installments rather than a single upfront sum.

2. How large is the Premium Finance Market?

The market was valued at around USD 56.42 billion in 2024 and is anticipated to reach approximately USD 132.88 billion by 2032 at a CAGR of 11.3 %.

3. What drives growth in this market?

Growth is driven by rising insurance premiums, increased insurance penetration, digital platforms for financing, and demand from businesses and high-net-worth individuals.

4. What challenges does the market face?

Significant challenges include stringent regulatory compliance, economic slowdowns, fluctuating interest rates, and operational complexity in billing systems.

5. Which segments are fastest growing?

Life insurance premium financing and corporate premium financing are among the fastest-growing segments due to high policy values and cash flow needs.

6. How are digital technologies impacting the market?

Digital and AI technologies are streamlining underwriting, accelerating approvals, enabling embedded financing, and attracting a broader user base.

Related Reports:

Neobanking Market https://www.maximizemarketresearch.com/market-report/neobanking-market/222171/

Digital Signature market https://www.maximizemarketresearch.com/market-report/global-digital-signature-market/18548/

Credit Card Issuance Services Market https://www.maximizemarketresearch.com/market-report/credit-card-issuance-services-market/186182/

Most performing reports:

Armor Market https://www.maximizemarketresearch.com/market-report/armor-market/124378/

Drone Mobility Market https://www.maximizemarketresearch.com/market-report/drone-mobility-market/211675/

Software as a Service (SaaS) Market https://www.maximizemarketresearch.com/market-report/software-as-a-service-saas-market/45115/

Global 5G Base Station Market https://www.maximizemarketresearch.com/market-report/global-5g-base-station-market/111943/

Connect With Us:

MAXIMIZE MARKET RESEARCH PVT. LTD.

2nd Floor, Navale IT park Phase 3,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

+91 9607365656

sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Analytics Partner

https://www.mmrstatistics.com/

MMRStatistics is an advanced market intelligence platform delivering data-driven insights, forecasts, and industry trends across global markets. Powered by differentiated research modules-covering market sizing, competitive analysis, and future outlooks-it helps businesses decode complex industries with clarity. Unlike traditional market research firms, MMRStatistics blends primary research, secondary data, and analytical frameworks into actionable intelligence. Flexible subscription plans provide scalable access, from snapshot insights to enterprise-grade market reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Premium Finance Market to Reach USD 132.88 Billion by 2032 | Rapid Growth Driven by Expanding Insurance Penetration & Flexible Financing Solutions here

News-ID: 4353062 • Views: …

More Releases from Maximize Market Research Pvt. Ltd.

Commercial Greenhouse Market Poised for Strong Growth, Expected to Reach US$ 86. …

Market Overview

The global Commercial Greenhouse Market was valued at US$ 39.75 billion in 2023 and is projected to grow at a robust compound annual growth rate (CAGR) of 11.8% from 2024 to 2030, reaching nearly US$ 86.79 billion by 2030. Commercial greenhouses play a critical role in modern agriculture by providing highly controlled and stable environments for cultivating flowers, vegetables, fruits, and nursery crops. These structures enable year-round crop production,…

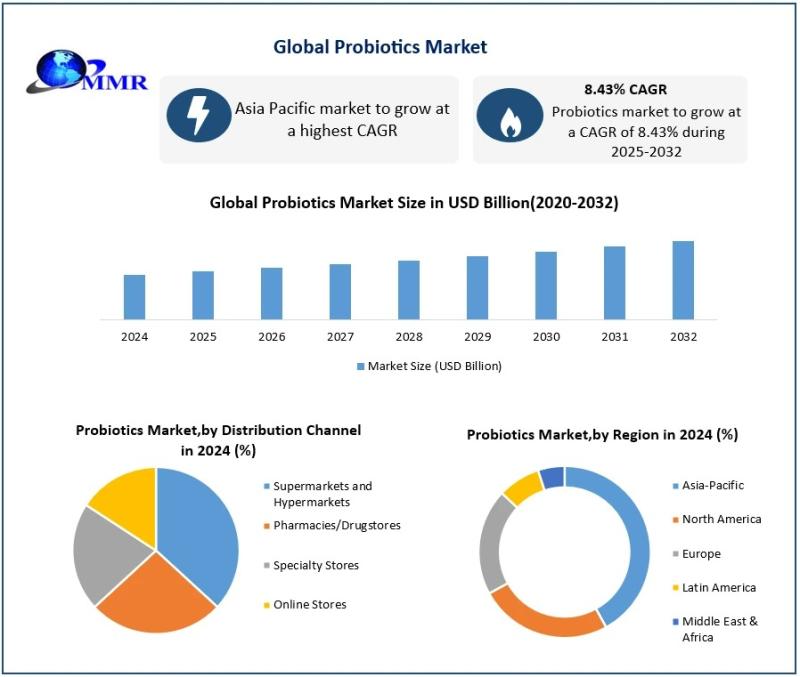

Probiotics Market Growth Outlook 2025-2032: Rising Demand for Gut Health and Fun …

Probiotics Market Set for Robust Growth Driven by Digestive Health Awareness and Functional Nutrition Trends

The Probiotics Market size was valued at USD 81.53 billion in 2024 and is projected to witness strong expansion during the forecast period. The global Probiotics Market revenue is expected to grow at a CAGR of 8.43% from 2025 to 2032, reaching approximately USD 155.79 billion by 2032.

Get a deeper look at the data by requesting…

Healthcare Consulting Service Market Set for Robust Expansion, Projected to Reac …

Market Overview

The global Healthcare Consulting Service Market is undergoing a transformative phase, driven by accelerating digital adoption, evolving regulatory frameworks, and the urgent need to improve cost efficiency and patient outcomes. Valued at USD 27.56 billion in 2024, the market is projected to reach USD 143.30 billion by 2032, growing at a remarkable CAGR of 22.88% during the forecast period. Healthcare consulting services provide specialized advisory, operational, financial, IT, and…

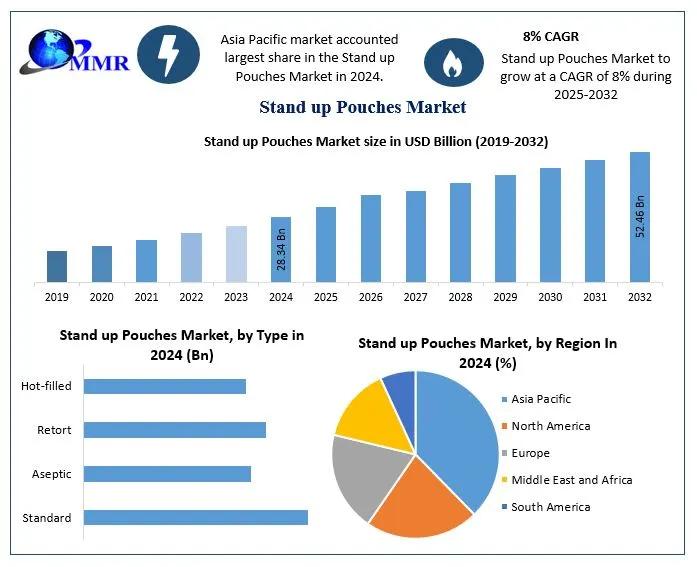

Stand-Up Pouches Market to Reach USD 52.46 Billion by 2032, Driven by Innovative …

The Stand-Up Pouches Market is witnessing strong momentum, reflecting the rapid transformation underway in the packaging industry. Valued at USD 28.34 Billion in 2024, the market is projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 52.46 Billion by 2032. This growth is fueled by rising consumer demand for convenience, sustainability, and cost-effective packaging solutions across food, beverage, healthcare, personal care, and homecare industries.

Download…

More Releases for Premium

Premium Dedicated Proxy - Unmatched Exclusivity with Oculus Premium Dedicated Pr …

In today's increasingly data-centric world, enterprises are pushing the boundaries of automation, web intelligence, and digital security. Central to these evolving needs is the demand for fast, private, and reliable internet access. For companies that rely on uninterrupted, large-scale data extraction and secure browsing, shared IP infrastructures are simply no longer viable. This has led to a rise in the adoption of premium proxy solutions-particularly exclusive IP resources that deliver…

Premium Pets, Premium Nutrition: Inside the USD 332M Freeze-Dried Pet Food Surge

The home freeze-dried pet food industry represents one of the fastest growing segments within the global pet nutrition market due to increasing pet ownership worldwide, rising humanization of companion animals, and expanding demand for premium, nutritionally superior food products. Freeze drying, also known as lyophilization, preserves pet food by removing moisture under low temperature and pressure, enabling longer shelf life, superior nutrient retention, and convenient storage features that align strongly…

Introducing Premium Bail Bonds

Bartow, FL - 8/20/2023 - Premium Bail Bonds, a dynamic and dedicated player in the bail bond industry, is excited to announce its official launch in Bartow, FL. With a steadfast commitment to serving the local community, Premium Bail Bonds aims to redefine the standards of professionalism, reliability, and unwavering support.

Boasting a team of seasoned experts with extensive knowledge of the legal landscape, Premium Bail Bonds is poised to be…

Mighty Travels Premium

Haven't you wondered why online travel search always started with the same input that a few travel websites first started with in 1996? Two airport codes and two dates and a big search button - where has the innovation been since?

What if we could search by price instead and find trips that are inspiring and sometimes luxurious where we would like to go? The world has changed and flexible schedules…

Sydney Premium Detailing

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Sydney Premium Detailing

7/3 Salisbury Rd, Castle Hill, NSW 2154…

Paint Colors & Trim Market Growth and Analysis by Major Top Vendors are BEHR Pre …

ResearchReportsInc.com adds a new 2018-2023 Global Paint Colors & Trim Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market. The Paint Colors & Trim Market report aims to provide a 360-degree view of the market in terms of cutting-edge technology, key developments, drivers, restraints and future trends with impact analysis…