Press release

Micro Loan Services Market May See a Big Move | Major Giants Grameen Bank, BRAC

HTF MI just released the Global Micro Loan Services Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.Major companies profiled in l Micro Loan Services Market are:

Grameen Bank, BRAC, Kiva, FINCA, Accion, Opportunity International, MicroCred, ProCredit, Tala, Branch, OnDeck, BlueVine, Lendio, Kabbage, Fundera, Equitas SFB.

Request PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @

👉 https://www.htfmarketreport.com/sample-report/4367874-micro-loan-services-market?utm_source=Saroj_openpr&utm_id=Saroj

HTF Market Intelligence projects that the global Micro Loan Services market will expand at a compound annual growth rate (CAGR) of 12.4 % from 2025 to 2032, from 180.00 Billion in 2025 to 560.00 Billion by 2033.

The following Key Segments Are Covered in Our Report

By Type

1️⃣ Short-Term Micro Loans

2️⃣ Digital Instant Micro Loans

3️⃣ Group-Based Micro Lending

4️⃣ Micro Business Loans

5️⃣ Peer-to-Peer Micro Lending

By Application

1️⃣ Micro & Small Business Expansion

2️⃣ Self-Employment & Entrepreneurship

3️⃣ Emergency Financial Support

4️⃣ Agriculture & Allied Activities

5️⃣ Retail & Trade Operations

6️⃣ Household Income Stabilization

7️⃣ Education & Skill Training

Definition: The Micro Loan Services Market provides small-value loans to individuals, entrepreneurs, and micro-enterprises lacking access to traditional credit. These loans are typically unsecured and designed to support income generation, emergency needs, and small business activities. Advances in digital lending platforms have improved efficiency, speed, and outreach, particularly in rural and underserved regions. The market plays a crucial role in financial inclusion by enabling economic participation for low-income groups. Technology-driven credit assessment and mobile disbursement are transforming service delivery models globally.

Market Trends:

🔹 Online and mobile micro-lending is increasing rapidly.

🔹 Data-driven credit evaluation improves approval rates.

🔹 Cloud-based lending systems enhance scalability.

Market Drivers:

🔹 Rising focus on entrepreneurship increases loan demand.

🔹 Digital platforms reduce lending costs.

🔹 Growth of informal businesses supports market expansion.

Market Challenges:

🔹 High default rates pose financial risks.

🔹 Cybersecurity threats affect digital platforms.

🔹 Limited borrower financial awareness remains a challenge.

Dominating Region:

• Latin America

Fastest-Growing Region:

• Asia-Pacific

Buy Now Latest Edition Micro Loan Services Market Report 👉 https://www.htfmarketreport.com/reports/4367874-micro-loan-services-market

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Micro Loan Services market segments by Types: 1️⃣ Short-Term Micro Loans2️⃣ Digital Instant Micro Loans3️⃣ Group-Based Micro Lending4️⃣ Micro Business Loans5️⃣ Peer-to-Peer Micro Lending

Detailed analysis of Micro Loan Services market segments by Applications: 1️⃣ Micro & Small Business Expansion2️⃣ Self-Employment & Entrepreneurship3️⃣ Emergency Financial Support4️⃣ Agriculture & Allied Activities5️⃣ Retail & Trade Operations6️⃣ Household Income Stabilization7️⃣ Education & Skill Training

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Have different Market Scope & Business Objectives; Enquire for customized study 👉

https://www.htfmarketreport.com/enquiry-before-buy/4367874-micro-loan-services-market?utm_source=Saroj_openpr&utm_id=Saroj

Micro Loan Services Market Research Objectives:

Focuses on the key manufacturers, to define, pronounce and examine the value, sales volume, market share, market competition landscape, SWOT analysis, and development plans in the next few years.

- To share comprehensive information about the key factors influencing the growth of the market (opportunities, drivers, growth potential, industry-specific challenges and risks).

- To analyze the with respect to individual future prospects, growth trends and their involvement to the total market.

- To analyze reasonable developments such as agreements, expansions new product launches, and acquisitions in the market.

- To deliberately profile the key players and systematically examine their growth strategies.

FIVE FORCES & PESTLE ANALYSIS:

Five forces analysis-the threat of new entrants, the threat of substitutes, the threat of competition, and the bargaining power of suppliers and buyers-are carried out to better understand market circumstances.

• Political (Political policy and stability as well as trade, fiscal, and taxation policies)

• Economical (Interest rates, employment or unemployment rates, raw material costs, and foreign exchange rates)

• Social (Changing family demographics, education levels, cultural trends, attitude changes, and changes in lifestyles)

• Technological (Changes in digital or mobile technology, automation, research, and development)

• Legal (Employment legislation, consumer law, health, and safety, international as well as trade regulation and restrictions)

• Environmental (Climate, recycling procedures, carbon footprint, waste disposal, and sustainability)

Get 10-25% Discount on Immediate purchase 👉 https://www.htfmarketreport.com/request-discount/4367874-micro-loan-services-market?utm_source=Saroj_openpr&utm_id=Saroj

Points Covered in Table of Content of Global Micro Loan Services Market:

Chapter 01 - Micro Loan Services Market Executive Summary

Chapter 02 - Market Overview

Chapter 03 - Key Success Factors

Chapter 04 - Global Micro Loan Services Market - Pricing Analysis

Chapter 05 - Global Micro Loan Services Market Background or History

Chapter 06 - Global Micro Loan Services Market Segmentation (e.g. Type, Application)

Chapter 07 - Key and Emerging Countries Analysis Worldwide Polyester Fiber Market

Chapter 08 - Global Micro Loan Services Market Structure & worth Analysis

Chapter 09 - Global Micro Loan Services Market Competitive Analysis & Challenges

Chapter 10 - Assumptions and Acronyms

Chapter 11 - Micro Loan Services Market Research Method Polyester Fiber

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, LATAM, Europe, Japan, Australia or Southeast Asia.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro Loan Services Market May See a Big Move | Major Giants Grameen Bank, BRAC here

News-ID: 4352338 • Views: …

More Releases from HTF Market Intelligence Consulting Private Limited

Marking Coating Market Is Going to Boom | Major Giants Sherwin-Williams, PPG Ind …

The latest study released on the Global Marking Coating Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Marking Coating study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Xenon Gas Market Hits New High | Major Giants Air Liquide, Linde plc, Air Produc …

The latest study released on the Global Xenon Gas Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Xenon Gas study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Fluorosurfactants Market Is Going to Boom | Major Giants Chemours, 3M, Solvay, A …

The latest study released on the Global Fluorosurfactants Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Fluorosurfactants study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these insights might…

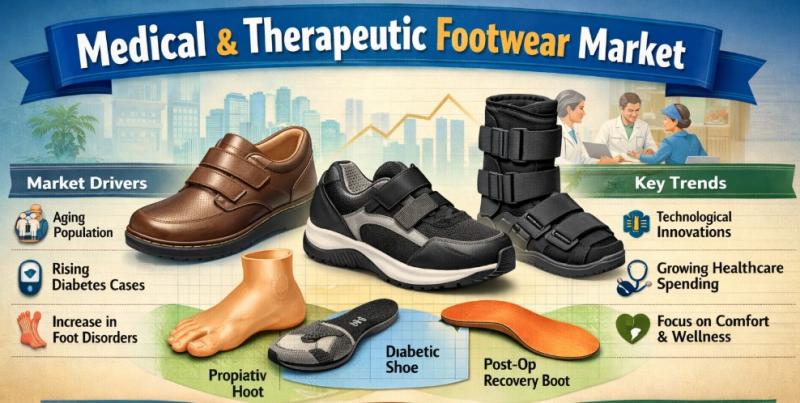

Medical & Therapeutic Footwear Market Is Likely to Experience a Tremendous Growt …

HTF MI just released the Global Medical & Therapeutic Footwear Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Key Players in This Report Include:

Orthofeet, Dr. Comfort, Aetrex,…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…