Press release

Monmouth County Estate Planning Attorney Christine Matus Guides New Jersey Executors Through Probate Responsibilities

Monmouth, NJ - Individuals named as executors of estates face significant legal and financial responsibilities under New Jersey law. Monmouth County estate planning attorney Christine Matus of The Matus Law Group (https://matuslaw.com/are-you-the-executor-of-a-will-heres-what-to-expect/) guides executors through the probate process, from filing the will with the Surrogate's Court to final distribution of assets to beneficiaries.According to Monmouth County estate planning attorney Christine Matus, executors must act quickly after the decedent's death. The original will must be located and filed with the Monmouth County Surrogate's Court at One East Main Street in Freehold within a reasonable time. Probate cannot begin until 10 days after death, so executors should plan to visit the Surrogate's office after this waiting period. Within 60 days of the date of probate, formal notice must be sent to all beneficiaries named in the will and the deceased person's next of kin.

"The first 60 days after probate are critical," explains Matus. "Executors must locate and file the will, notify all beneficiaries and next of kin, and begin gathering information about the estate's assets and debts." Monmouth County estate planning attorney Christine Matus emphasizes that Letters Testamentary give executors legal authority to act on behalf of the estate.

These court documents are issued by the Surrogate's office after the will is admitted to probate. Without Letters Testamentary, executors cannot access bank accounts, sell property, or transfer assets. To obtain Letters Testamentary, executors bring the original will and a certified death certificate to the Surrogate's office. The Surrogate verifies the will was properly executed and that no one has filed objections.

Executors must locate, gather, and safeguard all estate assets, including bank accounts, investment accounts, real estate, vehicles, personal property, business interests, and digital assets. A comprehensive inventory documenting the value of each asset as of the date of death must be created. For real estate in Monmouth County or elsewhere in New Jersey, executors must maintain property insurance, pay mortgages and property taxes, and perform necessary maintenance.

"Properties like vacation homes at the Jersey Shore or rental properties in Red Bank require regular upkeep to preserve their value," notes Matus. "Failure to maintain real estate can result in personal liability if values decline due to neglect."

Most Monmouth County estates are settled within nine to twelve months. Simple estates with minimal debt and cooperative beneficiaries can sometimes close in as little as six months, while complex estates involving business valuations, real estate sales, or disputes can take 18 months to two years. Several deadlines affect the timeline. Creditors have nine months from the date of death to file claims against the estate, and executors cannot make final distributions until this period expires. The New Jersey inheritance tax return must be filed within eight months of death, though extensions are available.

Attorney Matus points out that executors must pay all legitimate debts and taxes before distributing assets to beneficiaries. This includes the decedent's final income tax return, any required inheritance tax returns, and outstanding bills. New Jersey no longer imposes a separate estate tax for deaths on or after January 1, 2018, but estates may still be subject to federal estate tax if they exceed the federal exemption.

New Jersey imposes an inheritance tax on transfers to certain beneficiaries, with the tax rate depending on the relationship between the deceased and the beneficiary. Class A beneficiaries, including spouses, civil union partners, parents, children, grandchildren, and stepchildren, are exempt from inheritance tax. Class C beneficiaries, including siblings, sons-in-law, and daughters-in-law, face graduated rates from zero to 16 percent. Class D beneficiaries, which include all other individuals not listed in other classes, face rates from 15 to 16 percent.

"Executors follow the will's instructions," adds Matus. "They cannot change who receives assets, how much each beneficiary gets, or when distributions occur unless the will specifically grants this discretion."

Executors can be held personally liable for losses caused by mistakes or delays. If assets are distributed before paying taxes, tax authorities can collect from the executor personally. If executors fail to maintain the property and its value declines, beneficiaries can sue for the loss. Executors who miss the deadline to file inheritance tax returns may be personally responsible for penalties if the delay was unreasonable.

Executors are entitled to compensation under N.J.S.A. 3B:18-14. New Jersey law allows executors to receive a percentage of the estate's value on a graduated scale: up to 5 percent of the first $200,000, 3.5 percent on amounts between $200,000 and $1 million, and 2 percent on amounts over $1 million. Executors may also be entitled to receive interest earned on estate assets held during administration, generally 6 percent of the income received by the estate.

About The Matus Law Group:

The Matus Law Group is a Red Bank and Toms River-based law firm focused on estate planning, probate, and estate administration throughout Monmouth and Ocean counties. Led by attorney Christine Matus, the firm has guided executors through the probate process for over two decades. For consultations, call (732) 785-4453.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=tf5-20_xyGY

GMB: https://www.google.com/maps?cid=3241702663730814860

Email and website

Email: admin@matuslaw.com

Website: https://matuslaw.com/monmouth-county-nj/

Media Contact

Company Name: The Matus Law Group

Contact Person: Christine Matus

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=monmouth-county-estate-planning-attorney-christine-matus-guides-new-jersey-executors-through-probate-responsibilities]

Phone: (732) 785-4453

Address:125 Half Mile Rd #201A

City: Red Bank

State: New Jersey 07701

Country: United States

Website: https://matuslaw.com/monmouth-county-nj/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Monmouth County Estate Planning Attorney Christine Matus Guides New Jersey Executors Through Probate Responsibilities here

News-ID: 4351951 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

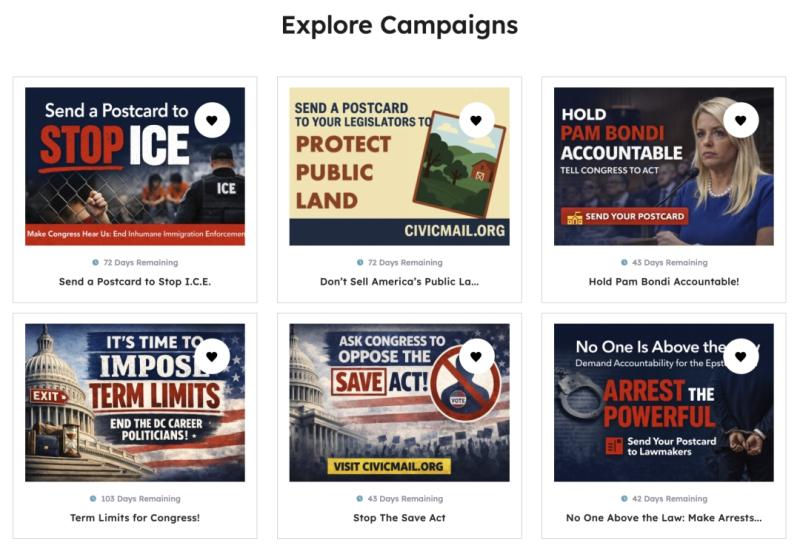

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Matus

New Jersey Probate Lawyer Christine Matus Explains How to Avoid Probate

Christine Matus (https://matuslaw.com/how-to-avoid-probate-in-new-jersey/), a seasoned New Jersey probate lawyer, offers valuable insights into navigating estate planning without the complications of probate. In her latest publication, "How to Avoid Probate in New Jersey," Matus outlines the legal mechanisms that help individuals sidestep the formal court process and ease the burden on surviving family members. The Matus Law Group, known for its legal services throughout New Jersey, provides guidance on avoiding lengthy…

New Jersey Medicaid Trust Attorney Christine Matus Explains Qualified Income Tru …

Navigating the strict financial requirements of Medicaid in New Jersey can be a significant barrier for many families seeking long-term care. New Jersey Medicaid trust attorney Christine Matus (https://matuslaw.com/understanding-qualified-income-trusts-in-new-jersey/) provides essential insights into how Qualified Income Trusts (QITs) serve as a crucial financial tool for individuals who exceed Medicaid income limits. Without compromising access to care or exhausting savings, these trusts offer a way to meet eligibility criteria while maintaining…

New Jersey Medicaid Trust Lawyer Christine Matus of The Matus Law Group Helps Fa …

Navigating Medicaid eligibility in New Jersey can be a complex process for individuals and families seeking healthcare assistance. A New Jersey Medicaid trust lawyer plays a crucial role in helping clients understand income and asset limits while preserving financial security. Christine Matus (https://matuslaw.com/new-jersey-medicaid-eligibility/) of The Matus Law Group provides guidance on Medicaid rules and planning strategies, ensuring that clients can access necessary medical care without jeopardizing their assets.

Medicaid, also known…

New Jersey Guardianship Attorney Christine Matus Explains Legal Considerations f …

New Jersey guardianship attorney [https://matuslaw.com/guardianship-attorney/] Christine Matus recently discussed the legal aspects of guardianship, providing insight into the responsibilities and challenges involved in the process. Guardianship is an essential legal arrangement for individuals who cannot make decisions for themselves due to age, disability, or other circumstances. With years of experience in this field, Christine Matus of The Matus Law Group has assisted families in navigating guardianship laws in New Jersey.

A…

New Jersey Estate Planning Attorney Christine Matus Discusses Estate Planning St …

New Jersey estate planning attorney [https://matuslaw.com/ocean-county-nj/] Christine Matus has shared valuable insights on estate planning strategies, emphasizing the importance of preparing for the future. As a legal professional with The Matus Law Group, Christine Matus highlights key aspects of estate planning that individuals and families should consider to protect their assets and loved ones. The discussion includes strategies for creating wills, trusts, and other essential estate planning documents.

The New Jersey…

New Jersey Wills Attorney Christine Matus Helps Families Secure Their Legacy

Planning for the future is a critical step in protecting assets and ensuring that loved ones are cared for according to an individual's wishes. Without a legally valid will, the distribution of assets is left to the courts, which may not align with personal preferences. New Jersey wills attorney Christine Matus (https://matuslaw.com/wills-attorney/) understands the importance of estate planning and works to help individuals and families create legally sound wills that…