Press release

New Mortgage Investment Fund Targets Northern Ontario's Overlooked Markets

Image: https://www.abnewswire.com/upload/2026/01/73b5a938a0ffcdc4b497784c91e0afcd.jpgEarly-40s investor plans 2028 launch with $5,000 minimum entry point and 10% returns

After nearly two decades building a real estate portfolio in Ontario, Caine is pivoting from property [https://cainechow.ca/] ownership to mortgage lending. His as yet unnamed Mortgage Investment Corporation (MIC), which is expected to launch in about 36 months, is a response to what he perceives as a serious void in the Canadian lending market: a lack of financing for borrowers in second and third-tier Ontario markets that are usually the least favoured of the large lenders.

"Most lenders are concentrated in Southern Ontario and haven't lived and breathed the Canadian North," says Caine, who before purchasing his first property 20 years ago, was a student at a theatre school. "They prefer larger deals in populated areas. Deals further north might not get them interested because the returns might look too small. But as a new MIC, I recognize this as an excellent niche."

The areas that Caine is after-Sudbury, North Bay, Huntsville alike-are not only the regions he has invested in directly over the years but also ones he knows well. "I own property in the north. I know the weather, the mentality and the behavior of people, and I am certain that I will lend where others are not comfortable," he says.

Mortgage Investment Corporations have become popular among Canadian investors who want to invest in non-traditional fixed-income products. Given that TD's Cashable GIC is currently at 1.75% and CIBC's at 2.70% as of early 2026, Caine's planned 10% return is quite remarkable. The minimum investment of $5,000 is aimed at making it easier for people to participate in the fund, yet Caine mentions that the majority of the investors he has dealt with usually invest around $100,000.

The setup is simple: investors put in money for one year and receives a cheque every month, or reinvest their dividends to earn more. After one year, they are allowed to continue or withdraw their capital and cash out. "Cashflow is king," Caine says. "Everyone wants to lower their debts, increase their income and spend more time with family. If I can provide the income through my fund, then my investors may have more time with their families."

What makes the offer attractive is not only the returns. For instance, if one were to own direct real estate, one would have to manage the property, which includes the maintenance, dealing with tenants and vacancies, whereas mortgage investing involves mostly paperwork. "Without the lending industry, real estate cannot be purchased," Caine observes. "Everything comes from knowing whether you have the budget for the property or not."

However, Caine is very much aware of the dangers. Prospective investors will be assessed to see if they qualify, and those considered ineligible will be rejected. His main rule is: only invest what you can completely lose without it affecting you. The MIC will be the owner of the properties as collateral, and Caine intends to keep a good amount of cash on hand - lessons he has learned during his 20 years in real estate. "I have gone through some losses," he says. "I learned that there should be a healthy cash reserve and that one should not over-leverage."

Presently, Caine is in the process of selling his real estate properties to raise capital and he is also building his investor list. Once the fund is formed, there will be a team comprising lawyers, mortgage brokers, and administrators to handle the operations. He will be registered with the Financial Services Regulatory Authority of Ontario before opening subscriptions. It should be noted that Caine will also be putting money into the fund and he has a structure which ensures that investors get paid before he does.

The timing might seem off. The real estate market in Ontario has been pretty dull with fewer transactions. Nevertheless, Caine is not thinking in terms of quarters but decades. "The market is very bad at the moment. There is hardly any movement. However, it might be different when our fund is launched. Even so, my fund is not going anywhere. We should not be looking at one or two years, but several decades at a time."

His goal is not just to the north of Ontario. Although the MIC will initially be able to operate only in the said province, Caine is thinking of expanding nationally and perhaps internationally some day. He is aiming for $500 million in assets under management in ten years. He would, therefore, be able to realize his other dream which is to set up a foundation that supports education, arts and culture, and the communities that have contributed to his portfolio.

Caine is currently looking for his first 20 investors only. His idea is: start increasing your monthly income through passive activities, without the trouble of property ownership, and at the same time, help lending in those communities where large institutions are absent. In a situation where traditional saving methods offer only minimal returns and real estate ownership is getting more and more out of the reach of the average Canadians, that offer may get a warm welcome.

The fund is aimed at young families and are looking for an extra source of stable income that will enable them to travel and achieve financial security, investors who want to diversify their portfolios beyond equities, bonds and anybody who is building a retirement nest egg. Although international investors are welcome, the focus is still primarily on Ontario mortgages.

It will take a few years before we can say whether Caine's strategy up north was the right one or if he was overly optimistic. But the source of his conviction is something that the majority of Bay Street analysts do not have and that is firsthand experience of markets where the opportunity and risk cannot be quantified through algorithms but have to be understood in terms of how communities survive when they have harsh winters for six months and economic cycles follow the pattern of resource extraction.

Media Contact

Company Name: Caine MIC

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-mortgage-investment-fund-targets-northern-ontarios-overlooked-markets]

City: Toronto

Country: Canada

Website: https://cainechow.ca/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Mortgage Investment Fund Targets Northern Ontario's Overlooked Markets here

News-ID: 4351693 • Views: …

More Releases from ABNewswire

PPS Flight Planning Launches Next-Gen Digital Flight Solutions Transforming Avia …

Image: https://www.abnewswire.com/upload/2026/01/c77d61a8c87a32fb839a66199d7b309b.jpg

Jet engines, gleaming fuselages and crowded terminals usually steal the spotlight in aviation. Yet the most decisive part of a flight often happens far from the runway, inside quiet rooms lit by screens and radar feeds. Here, dispatchers, meteorologists and data specialists turn chaos into order, building the digital blueprint that decides how high, how fast and how safely an aircraft will travel.

Those blueprints are no longer static documents…

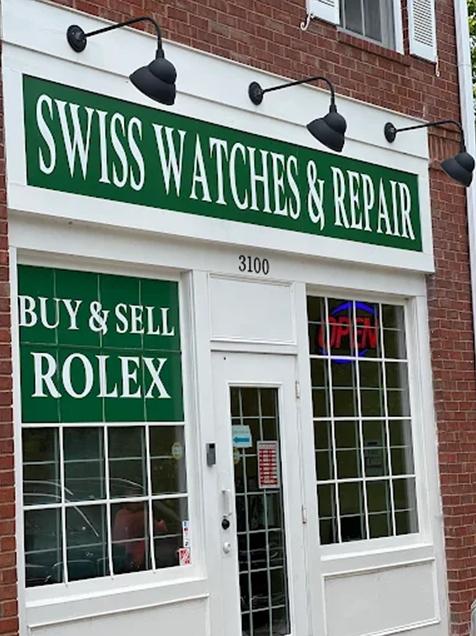

Atlanta-Area Atltime Plans Statewide Expansion from Roswell to Become Georgia's …

Image: https://www.abnewswire.com/upload/2026/01/c0569a7fc1c7f36f6fba6b579d38e6b4.jpg

ROSWELL, GA - January 14, 2026 - Atltime Watch Repair, known throughout the Atlanta area for buying and selling pre-owned Rolex watches, has announced plans to expand its reach across the entire state of Georgia in 2026.

The Roswell company, which has built a strong reputation in metro Atlanta over recent years, wants to bring its fair pricing and fast service to watch owners throughout Georgia. The expansion comes as…

Sabeer Nelli to Attend World Economic Forum's Annual Meeting 2026 in Davos

CEO of Zil Money to join global leaders for discussions on economic policy, technology and emerging risks

Image: https://www.abnewswire.com/upload/2026/01/2d878d0a3186c2429ea7697656a87087.jpg

TYLER, TX, USA - January 14, 2026 - Zil Money today announced that its CEO and founder, Sabeer Nelli, will attend the World Economic Forum (WEF) Annual Meeting 2026, scheduled to take place in Davos-Klosters, Switzerland from January 19-23, 2026. The 56th Annual Meeting will convene heads of state, business leaders and representatives…

CW Rent Boats Ibiza Sets a New Standard for Premium Boat Rentals and Yacht Exper …

Image: https://www.abnewswire.com/upload/2026/01/4037aaaad21844bda28efa5a1dee202f.jpg

Jesus, Ibiza, Spain - Ibiza has long been recognised as one of the Mediterranean's most iconic destinations, famous for its natural beauty, crystal-clear waters, and unique lifestyle. As demand for personalised, high-quality experiences continues to grow, CW Rent Boats Ibiza positions itself as a trusted local partner for clients seeking exceptional boat and yacht rentals with discretion, comfort, and full-service support.

Operating under the umbrella of CW Group, a company…

More Releases for Caine

Future Prospects: Growth Opportunities in the Catamarans Market Segmentation Ana …

Coherent Market Insights has released a statistical report titled " Catamarans Market Recent Trends, In-depth Analysis, Size, and Forecast 2024-2031." This report offers a comprehensive overview of the competitive landscape, geographical segmentation, innovation, future developments, and a compilation of tables and data. The competitive landscape analysis provides detailed information about each vendor, encompassing company profiles, total revenue (financials), market potential, global presence, market share, pricing, locations of production facilities, and…

Catamaran Market Analysis - Industry Specific Opportunities and Trends Affecting …

The global Catamaran market was valued at USD 1.4 Billion in 2022 and it is anticipated to grow up to USD 2.5 Billion by 2032, at a CAGR of 5.8% during the forecast period.

To Remain 'Ahead' Of Your Competitors, Request for A Sample -https://www.globalinsightservices.com/request-sample/GIS24383

A catamaran is a type of boat or ship consisting of two hulls, or platforms, that are connected by a frame. Most catamarans are powered by sails…

Powered Catamaran to Dominant the Global Catamaran Market, Fact.MR | Grup Aresa …

Fact.MR delivers key insights on the global Catamaran market in its published report, titled “Global Catamaran: Industry Analysis and Opportunity Assessment, 2018–2027”. In terms of revenue, the global catamaran market is estimated to expand at a CAGR of 4.5% over the forecast period, owing to numerous factors, about which FACT.MR offers thorough insights and forecasts in this report.

The global market for Catamaran is further segmented as Type, Size, Passenger Type and region.…

Catamaran Market Estimated to Soar Higher During 2018 to 2027 | Key Players are …

The purpose of this rich study presented by Fact.MR is to elaborate the various market projections impacting the global catamaran market during the period until 2027. This assessment delivers high-end statistics concerning market size (US$ Mn), Y-o-Y growth and revenue share (US& Mn) linked to different geographies and segmentation types. Readers can acquire precise insights about growth trends along with opportunities that are expected to reshape the overall structure of…

Catamaran Market: Technological Augmentation Drives Growth till 2027 | Key Playe …

The Powered Catamaran is anticipated to be the most prominent catamaran segment in the global Catamaran market, growing at a significant CAGR of 4.8% by volume during the forecast period. The rise in cruising and racing events has further enhanced the demand for catamaran in the market. High demand for powered catamaran is due to their efficiency, reliability and increased space. The other catamaran type such as sailing catamaran is relatively…

Global Catamarans Market 2024 Top Key Player Analysis Catana Group, Outremer Yac …

Market Study Report adds global Catamarans market report that gives meticulous investigation of current scenario of the market size, share, demand, growth, trends, companies active in the industry and forecasts for the coming years.

Increasing participation in recreational boating that includes boat racing, sailing, cruising, and motorsports has led to considerable growth in high performance ships. Proliferating disposable income per capita is among the prominent factors contributing to the increasing popularity…