Press release

Global Engineering Plastic Market to Reach US$ 179.96 Billion by 2032, Driven by Lightweighting Trends, EV Growth, and High-Performance Material Demand | QY Research

Market SummaryThe global Engineering Plastic market was valued at US$ 129,780 million in 2025 and is projected to reach US$ 179,960 million by 2032, expanding at a steady CAGR of 4.9% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Engineering Plastic Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global engineering plastics industry. The study evaluates historical market performance, current competitive dynamics, and future growth opportunities across product types, applications, and key regions.

Get Full PDF Sample Copy of the Report (Including Full TOC, Tables & Charts):

https://www.qyresearch.in/request-sample/chemical-material-global-engineering-plastic-market-insights-industry-share-sales-projections-and-demand-outlook-2026-2032

Market Overview and Industry Fundamentals

Engineering plastics are a class of high-performance thermoplastics (and select thermosets) that offer superior mechanical strength, heat resistance, chemical stability, dimensional accuracy, and wear performance compared to general-purpose plastics such as polyethylene and PVC. These properties enable engineering plastics to replace metals and glass in many structural and functional applications.

Key engineering plastics include ABS, polyamides (PA/nylon), polycarbonate (PC), polyacetal (POM), polybutylene terephthalate (PBT), polymethyl methacrylate (PMMA), as well as advanced materials such as PPS, PEEK, PSU, and LCP. The industry is both technology-intensive and highly application-diversified, with demand spread across automotive, electronics, appliances, machinery, medical devices, aerospace, and transportation sectors.

Raw Material Sensitivity and Cost Dynamics

Most engineering plastics are derived from petrochemical monomers and intermediates such as bisphenol A, adipic acid, caprolactam, terephthalic acid, and various diols. As a result, resin producers are highly sensitive to fluctuations in crude oil, naphtha, and basic olefin/aromatic prices.

Volatility in upstream feedstocks is transmitted through monomer and polymer pricing to compounders and processors, often with a time lag. During periods of sharp raw material price increases, producers may experience margin compression, more cautious order intake, and tighter inventory management. On average, industry gross margins range between 15% and 20%.

Core Growth Drivers

► Metal and Glass Replacement Trend: The primary demand driver for engineering plastics is the global shift toward lightweighting and material substitution. Replacing metal and glass with plastics helps improve energy efficiency, reduce emissions, and enhance design flexibility.

► Automotive and New Energy Vehicles: In the automotive sector, engineering plastics are increasingly used in interior and exterior components, powertrain parts, battery housings, and thermal management systems, supporting weight reduction and improved vehicle efficiency-particularly critical for electric and hybrid vehicles.

► Electronics, 5G, and High-Frequency Applications: Rapid growth in 5G communications, advanced consumer electronics, and smart devices is driving demand for materials with high heat resistance, flame retardancy, low dielectric constant, and excellent dimensional stability.

► Sustainability and Energy Efficiency: Carbon-neutrality policies, energy-efficiency standards, and environmental regulations are indirectly boosting demand for engineering plastics used in energy-saving equipment, renewable energy systems, and low-VOC, recyclable applications.

Industry Challenges and Structural Barriers

Despite strong demand fundamentals, the engineering plastics industry faces several challenges:

► Upstream raw material price volatility, impacting cost stability and profitability

► Oligopolistic control of high-end grades by multinational players

► Long qualification cycles in automotive electronics, medical devices, and aerospace

► Rising environmental and circular-economy requirements, increasing R&D and capital expenditure

Stricter regulations are pushing manufacturers to develop recyclable, bio-based, and low-carbon engineering plastics, as well as to invest in emission control and sustainable processing technologies.

Regional Market Insights

The Asia Pacific region represents the largest and fastest-growing market, driven by strong manufacturing bases in China, Japan, South Korea, and Southeast Asia, along with expanding EV and electronics industries.

Europe and North America remain critical markets, supported by advanced automotive, aerospace, medical, and electronics sectors, as well as stringent environmental and safety standards. Emerging markets in South America, the Middle East, and Africa are showing steady adoption as industrialization and infrastructure development progress.

Report Scope and Methodology

This report provides a comprehensive quantitative and qualitative analysis of the global Engineering Plastic market, enabling stakeholders to:

► Develop effective market-entry and expansion strategies

► Assess competitive positioning and industry structure

► Identify high-growth product types and application segments

► Support investment planning, capacity expansion, and R&D decisions

Market size, estimates, and forecasts are presented in terms of revenue (US$ million), with 2025 as the base year, historical data from 2021-2024, and forecasts extending to 2032. The study includes detailed segmentation by type, application, region, and company, along with coverage of technological trends and new product developments.

Market Segmentation Highlights

By Type

► ABS

► Polyamides (PA)

► Polycarbonate (PC)

► Polyacetals (POM)

► PBT

► PMMA

► TPEE

► Special Engineering Plastics

► Others

By Application

► Automotive Industry

► Electronics and Semiconductors

► Aviation and Aerospace

► Transportation

► Medical Equipment

► Home Appliances and Consumer Electronics

► Others

By Region

► North America (U.S., Canada, Mexico)

► Europe (Germany, France, UK, Italy, etc.)

► Asia Pacific (China, Japan, South Korea, Southeast Asia, India, etc.)

► South America (Brazil, etc.)

► Middle East & Africa (Turkey, GCC Countries, Africa, etc.)

Competitive Landscape

The global engineering plastics market features a diverse mix of multinational chemical giants and regional leaders. Key companies profiled in the report include:

BASF, SABIC, Covestro, Mitsubishi Chemical, Toray, Celanese, Envalior, Sumitomo Chemical, Syensqo, Evonik, Arkema, Victrex, UBE Corporation, Asahi Kasei, LG Chem, CHIMEI, Kingfa, Sinopec, Wanhua Chemical, LyondellBasell, Ascend Performance Materials, EMS-Grivory, DOMO Chemicals, RadiciGroup, Polyplastics, Idemitsu Kosan, Kuraray, Trinseo, Avient, and others.

The report evaluates company market share, product portfolios, geographic footprint, and strategic initiatives, offering clear insight into competitive dynamics and industry concentration.

Reasons to Procure This Report

► Access reliable global and regional market forecasts through 2032

► Understand company share, ranking, and competitive structure

► Analyze lightweighting, EV, and electronics-driven demand trends

► Identify high-growth engineering plastic types and applications

► Support strategic planning, investment analysis, and long-term growth decisions

Key Questions Answered

► What is the current and projected size of the global Engineering Plastic market?

► Which applications and regions are driving demand growth?

► How do raw material price fluctuations impact industry profitability?

► Who are the leading manufacturers, and how competitive is the market?

► How will sustainability and lightweighting trends shape the market through 2032?

Request for Pre-Order / Enquiry:

https://www.qyresearch.in/pre-order-inquiry/chemical-material-global-engineering-plastic-market-insights-industry-share-sales-projections-and-demand-outlook-2026-2032

Table of Content:

1 Engineering Plastic Market Overview

1.1 Product Definition

1.2 Engineering Plastic Market by Type

1.2.1 Global Engineering Plastic Market Value by Type (2021-2032)

1.2.2 Acrylonitrile butadiene styrene (ABS)

1.2.3 Polyamides (PA)

1.2.4 Polycarbonate (PC)

1.2.5 Thermoplastic Polyester Elastomer (TPEE)

1.2.6 Polyacetals (POM)

1.2.7 Polybutylene terephthalate (PBT)

1.2.8 Polymethyl Methacrylate (PMMA)

1.2.9 Special Engineering Plastics

1.2.10 Others

1.3 Engineering Plastic Market by Performance

1.3.1 Global Engineering Plastic Market Value by Performance (2021-2032)

1.3.2 General Engineering Plastics

1.3.3 High-Performance / Specialty Engineering Plastics

1.4 Engineering Plastic Market by Crystallinity

1.4.1 Global Engineering Plastic Market Value by Crystallinity (2021-2032)

1.4.2 Amorphous Engineering Plastics

1.4.3 Semi-Crystalline Engineering Plastics

1.5 Engineering Plastic by Application

1.5.1 Global Engineering Plastic Market Value by Application (2021-2032)

1.5.2 Automotive Industry

1.5.3 Electronics and Semiconductors

1.5.4 Aviation and Aerospace

1.5.5 Transportation

1.5.6 Medical Equipment

1.5.7 Home Appliances and Consumer Electronics

1.5.8 Others

1.6 Global Engineering Plastic Revenue (2021-2032)

1.7 Assumptions and Limitations

1.8 Study Objectives

1.9 Years Considered

2 Key Insights

2.1 Key Emerging Trends

2.2 Key Developments - Mergers Acquisitions, New Product Launches, Collaborations, Partnerships and Joint Ventures

2.3 Latest Technological Advancements

2.4 Insights on Regulatory Scenarios

2.5 Porters Five Forces Analysis

3 Players Competitive Analysis

3.1 Global Engineering Plastic Revenue by Player (2021-2026)

3.2 Engineering Plastic Company Evaluation Quadrant

3.3 Industry Rank

3.3.1 Global Key Players of Engineering Plastic, Industry Ranking, 2024 VS 2025

3.3.2 Global Engineering Plastic Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3.3 Global Engineering Plastic Market Concentration Rate

3.3.4 Global 5 and 10 Largest Engineering Plastic Players Market Share by Revenue

3.4 Engineering Plastic Market: Overall Company Footprint Analysis

3.4.1 Engineering Plastic Market: Region Footprint

3.4.2 Engineering Plastic Market: Company Product Type Footprint

3.4.3 Engineering Plastic Market: Company Product Application Footprint

3.4.4 Global Key Players of Engineering Plastic, Date of Enter into This Industry

3.5 Competitive Environment

3.5.1 Historical Structure of the Industry

3.5.2 Barriers of Market Entry

3.5.3 Factors of Competition

4 Players Profiles

4.1 Ineos

4.1.1 Ineos Company Details

4.1.2 Ineos Business Overview

4.1.3 Ineos Engineering Plastic Introduction

4.1.4 Ineos Revenue in Engineering Plastic Business (2021-2026)

4.1.5 Ineos Recent Development

4.2 Covestro

4.2.1 Covestro Company Details

4.2.2 Covestro Business Overview

4.2.3 Covestro Engineering Plastic Introduction

4.2.4 Covestro Revenue in Engineering Plastic Business (2021-2026)

4.2.5 Covestro Recent Development

4.3 SABIC

4.3.1 SABIC Company Details

4.3.2 SABIC Business Overview

4.3.3 SABIC Engineering Plastic Introduction

4.3.4 SABIC Revenue in Engineering Plastic Business (2021-2026)

4.3.5 SABIC Recent Development

4.4 Mitsubishi Chemical

4.4.1 Mitsubishi Chemical Company Details

4.4.2 Mitsubishi Chemical Business Overview

4.4.3 Mitsubishi Chemical Engineering Plastic Introduction

4.4.4 Mitsubishi Chemical Revenue in Engineering Plastic Business (2021-2026)

4.4.5 Mitsubishi Chemical Recent Development

4.5 BASF

4.5.1 BASF Company Details

4.5.2 BASF Business Overview

4.5.3 BASF Engineering Plastic Introduction

4.5.4 BASF Revenue in Engineering Plastic Business (2021-2026)

4.5.5 BASF Recent Development

4.6 Toray

4.6.1 Toray Company Details

4.6.2 Toray Business Overview

4.6.3 Toray Engineering Plastic Introduction

4.6.4 Toray Revenue in Engineering Plastic Business (2021-2026)

4.6.5 Toray Recent Development

4.7 Envalior

4.7.1 Envalior Company Details

4.7.2 Envalior Business Overview

4.7.3 Envalior Engineering Plastic Introduction

4.7.4 Envalior Revenue in Engineering Plastic Business (2021-2026)

4.7.5 Envalior Recent Development

4.8 Celanese

4.8.1 Celanese Company Details

4.8.2 Celanese Business Overview

4.8.3 Celanese Engineering Plastic Introduction

4.8.4 Celanese Revenue in Engineering Plastic Business (2021-2026)

4.8.5 Celanese Recent Development

4.9 Sumitomo Chemical

4.9.1 Sumitomo Chemical Company Details

4.9.2 Sumitomo Chemical Business Overview

4.9.3 Sumitomo Chemical Engineering Plastic Introduction

4.9.4 Sumitomo Chemical Revenue in Engineering Plastic Business (2021-2026)

4.9.5 Sumitomo Chemical Recent Development

4.10 Syensqo

4.10.1 Syensqo Company Details

4.10.2 Syensqo Business Overview

4.10.3 Syensqo Engineering Plastic Introduction

4.10.4 Syensqo Revenue in Engineering Plastic Business (2021-2026)

4.10.5 Syensqo Recent Development

4.11 Evonik

4.11.1 Evonik Company Details

4.11.2 Evonik Business Overview

4.11.3 Evonik Engineering Plastic Introduction

4.11.4 Evonik Revenue in Engineering Plastic Business (2021-2026)

4.11.5 Evonik Recent Development

4.12 Arkema

4.12.1 Arkema Company Details

4.12.2 Arkema Business Overview

4.12.3 Arkema Engineering Plastic Introduction

4.12.4 Arkema Revenue in Engineering Plastic Business (2021-2026)

4.12.5 Arkema Recent Development

4.13 AdvanSix

4.13.1 AdvanSix Company Details

4.13.2 AdvanSix Business Overview

4.13.3 AdvanSix Engineering Plastic Introduction

4.13.4 AdvanSix Revenue in Engineering Plastic Business (2021-2026)

4.13.5 AdvanSix Recent Development

4.14 Lotte Chemical

4.14.1 Lotte Chemical Company Details

4.14.2 Lotte Chemical Business Overview

4.14.3 Lotte Chemical Engineering Plastic Introduction

4.14.4 Lotte Chemical Revenue in Engineering Plastic Business (2021-2026)

4.14.5 Lotte Chemical Recent Development

4.15 Victrex

4.15.1 Victrex Company Details

4.15.2 Victrex Business Overview

4.15.3 Victrex Engineering Plastic Introduction

4.15.4 Victrex Revenue in Engineering Plastic Business (2021-2026)

4.15.5 Victrex Recent Development

4.16 UBE Corporation

4.16.1 UBE Corporation Company Details

4.16.2 UBE Corporation Business Overview

4.16.3 UBE Corporation Engineering Plastic Introduction

4.16.4 UBE Corporation Revenue in Engineering Plastic Business (2021-2026)

4.16.5 UBE Corporation Recent Development

4.17 Avient

4.17.1 Avient Company Details

4.17.2 Avient Business Overview

4.17.3 Avient Engineering Plastic Introduction

4.17.4 Avient Revenue in Engineering Plastic Business (2021-2026)

4.17.5 Avient Recent Development

4.18 Asahi Kasei

4.18.1 Asahi Kasei Company Details

4.18.2 Asahi Kasei Business Overview

4.18.3 Asahi Kasei Engineering Plastic Introduction

4.18.4 Asahi Kasei Revenue in Engineering Plastic Business (2021-2026)

4.18.5 Asahi Kasei Recent Development

4.19 CHIMEI

4.19.1 CHIMEI Company Details

4.19.2 CHIMEI Business Overview

4.19.3 CHIMEI Engineering Plastic Introduction

4.19.4 CHIMEI Revenue in Engineering Plastic Business (2021-2026)

4.19.5 CHIMEI Recent Development

4.20 LG Chem

4.20.1 LG Chem Company Details

4.20.2 LG Chem Business Overview

4.20.3 LG Chem Engineering Plastic Introduction

4.20.4 LG Chem Revenue in Engineering Plastic Business (2021-2026)

4.20.5 LG Chem Recent Development

4.21 Trinseo

4.21.1 Trinseo Company Details

4.21.2 Trinseo Business Overview

4.21.3 Trinseo Engineering Plastic Introduction

4.21.4 Trinseo Revenue in Engineering Plastic Business (2021-2026)

4.21.5 Trinseo Recent Development

4.22 Ascend Performance Materials

4.22.1 Ascend Performance Materials Company Details

4.22.2 Ascend Performance Materials Business Overview

4.22.3 Ascend Performance Materials Engineering Plastic Introduction

4.22.4 Ascend Performance Materials Revenue in Engineering Plastic Business (2021-2026)

4.22.5 Ascend Performance Materials Recent Development

4.23 Kolon Plastics

4.23.1 Kolon Plastics Company Details

4.23.2 Kolon Plastics Business Overview

4.23.3 Kolon Plastics Engineering Plastic Introduction

4.23.4 Kolon Plastics Revenue in Engineering Plastic Business (2021-2026)

4.23.5 Kolon Plastics Recent Development

4.24 Kuraray

4.24.1 Kuraray Company Details

4.24.2 Kuraray Business Overview

4.24.3 Kuraray Engineering Plastic Introduction

4.24.4 Kuraray Revenue in Engineering Plastic Business (2021-2026)

4.24.5 Kuraray Recent Development

4.25 Samyang

4.25.1 Samyang Company Details

4.25.2 Samyang Business Overview

4.25.3 Samyang Engineering Plastic Introduction

4.25.4 Samyang Revenue in Engineering Plastic Business (2021-2026)

4.25.5 Samyang Recent Development

4.26 EMS-Grivory

4.26.1 EMS-Grivory Company Details

4.26.2 EMS-Grivory Business Overview

4.26.3 EMS-Grivory Engineering Plastic Introduction

4.26.4 EMS-Grivory Revenue in Engineering Plastic Business (2021-2026)

4.26.5 EMS-Grivory Recent Development

4.27 Unitika

4.27.1 Unitika Company Details

4.27.2 Unitika Business Overview

4.27.3 Unitika Engineering Plastic Introduction

4.27.4 Unitika Revenue in Engineering Plastic Business (2021-2026)

4.27.5 Unitika Recent Development

4.28 DOMO Chemicals

4.28.1 DOMO Chemicals Company Details

4.28.2 DOMO Chemicals Business Overview

4.28.3 DOMO Chemicals Engineering Plastic Introduction

4.28.4 DOMO Chemicals Revenue in Engineering Plastic Business (2021-2026)

4.28.5 DOMO Chemicals Recent Development

4.29 Grupa Azoty

4.29.1 Grupa Azoty Company Details

4.29.2 Grupa Azoty Business Overview

4.29.3 Grupa Azoty Engineering Plastic Introduction

4.29.4 Grupa Azoty Revenue in Engineering Plastic Business (2021-2026)

4.29.5 Grupa Azoty Recent Development

4.30 LyondellBasell

4.30.1 LyondellBasell Company Details

4.30.2 LyondellBasell Business Overview

4.30.3 LyondellBasell Engineering Plastic Introduction

4.30.4 LyondellBasell Revenue in Engineering Plastic Business (2021-2026)

4.30.5 LyondellBasell Recent Development

4.31 Sinopec

4.31.1 Sinopec Company Details

4.31.2 Sinopec Business Overview

4.31.3 Sinopec Engineering Plastic Introduction

4.31.4 Sinopec Revenue in Engineering Plastic Business (2021-2026)

4.31.5 Sinopec Recent Development

4.32 Wanhua Chemical

4.32.1 Wanhua Chemical Company Details

4.32.2 Wanhua Chemical Business Overview

4.32.3 Wanhua Chemical Engineering Plastic Introduction

4.32.4 Wanhua Chemical Revenue in Engineering Plastic Business (2021-2026)

4.32.5 Wanhua Chemical Recent Development

4.33 Kingfa

4.33.1 Kingfa Company Details

4.33.2 Kingfa Business Overview

4.33.3 Kingfa Engineering Plastic Introduction

4.33.4 Kingfa Revenue in Engineering Plastic Business (2021-2026)

4.33.5 Kingfa Recent Development

4.34 Formosa

4.34.1 Formosa Company Details

4.34.2 Formosa Business Overview

4.34.3 Formosa Engineering Plastic Introduction

4.34.4 Formosa Revenue in Engineering Plastic Business (2021-2026)

4.34.5 Formosa Recent Development

4.35 KKPC

4.35.1 KKPC Company Details

4.35.2 KKPC Business Overview

4.35.3 KKPC Engineering Plastic Introduction

4.35.4 KKPC Revenue in Engineering Plastic Business (2021-2026)

4.35.5 KKPC Recent Development

4.36 RadiciGroup

4.36.1 RadiciGroup Company Details

4.36.2 RadiciGroup Business Overview

4.36.3 RadiciGroup Engineering Plastic Introduction

4.36.4 RadiciGroup Revenue in Engineering Plastic Business (2021-2026)

4.36.5 RadiciGroup Recent Development

4.37 Grand Pacific Petrochemical

4.37.1 Grand Pacific Petrochemical Company Details

4.37.2 Grand Pacific Petrochemical Business Overview

4.37.3 Grand Pacific Petrochemical Engineering Plastic Introduction

4.37.4 Grand Pacific Petrochemical Revenue in Engineering Plastic Business (2021-2026)

4.37.5 Grand Pacific Petrochemical Recent Development

4.38 DIC

4.38.1 DIC Company Details

4.38.2 DIC Business Overview

4.38.3 DIC Engineering Plastic Introduction

4.38.4 DIC Revenue in Engineering Plastic Business (2021-2026)

4.38.5 DIC Recent Development

4.39 Kureha

4.39.1 Kureha Company Details

4.39.2 Kureha Business Overview

4.39.3 Kureha Engineering Plastic Introduction

4.39.4 Kureha Revenue in Engineering Plastic Business (2021-2026)

4.39.5 Kureha Recent Development

4.40 Polyplastics

4.40.1 Polyplastics Company Details

4.40.2 Polyplastics Business Overview

4.40.3 Polyplastics Engineering Plastic Introduction

4.40.4 Polyplastics Revenue in Engineering Plastic Business (2021-2026)

4.40.5 Polyplastics Recent Development

5 Analysis by Region

5.1 Global Engineering Plastic Market Size by Region

5.1.1 Global Engineering Plastic Revenue by Region: 2021 VS 2025 VS 2032

5.1.2 Global Engineering Plastic Revenue by Region (2021-2026)

5.1.3 Global Engineering Plastic Revenue by Region (2027-2032)

5.1.4 Global Engineering Plastic Revenue Market Share by Region (2021-2032)

5.2 North America Engineering Plastic Revenue (2021-2032)

5.3 Europe Engineering Plastic Revenue (2021-2032)

5.4 Asia-Pacific Engineering Plastic Revenue (2021-2032)

5.5 South America Engineering Plastic Revenue (2021-2032)

5.6 Middle East & Africa Engineering Plastic Revenue (2021-2032)

6 Market Scenario by Region & Country

6.1 Global Engineering Plastic Revenue by Region & Country: 2021 VS 2025 VS 2032

6.2 Global Engineering Plastic Revenue by Region & Country (2021-2032)

6.3 North America Engineering Plastic Market Facts & Figures by Country

6.3.1 North America Engineering Plastic Revenue by Country: 2021 VS 2025 VS 2032

6.3.2 North America Engineering Plastic Revenue by Country (2021-2032)

6.3.3 U.S.

6.3.4 Canada

6.4 Europe Engineering Plastic Market Facts & Figures by Country

6.4.1 Europe Engineering Plastic Revenue by Country: 2021 VS 2025 VS 2032

6.4.2 Europe Engineering Plastic Revenue by Country (2021-2032)

6.4.3 Germany

6.4.4 France

6.4.5 U.K.

6.4.6 Italy

6.4.7 Russia

6.5 Asia Pacific Engineering Plastic Market Facts & Figures by Region

6.5.1 Asia Pacific Engineering Plastic Market Size by Region: 2021 VS 2025 VS 2032

6.5.2 Asia Pacific Engineering Plastic Revenue by Region (2021-2032)

6.5.3 China

6.5.4 Japan

6.5.5 South Korea

6.5.6 India

6.5.7 Australia

6.5.8 China Taiwan

6.5.9 Indonesia

6.5.10 Thailand

6.5.11 Malaysia

6.6 South America Engineering Plastic Market Facts & Figures by Country

6.6.1 South America Engineering Plastic Market Size by Country: 2021 VS 2025 VS 2032

6.6.2 South America Engineering Plastic Revenue by Country

6.6.3 Mexico

6.6.4 Brazil

6.6.5 Argentina

6.7 Middle East and Africa Engineering Plastic Market Facts & Figures by Country

6.7.1 Middle East and Africa Engineering Plastic Market Size by Country: 2021 VS 2025 VS 2032

6.7.2 Middle East and Africa Engineering Plastic Revenue by Country

6.7.3 Turkey

6.7.4 Saudi Arabia

6.7.5 UAE

7 Segment by Type

7.1 Global Engineering Plastic Revenue by Type (2021-2026)

7.2 Global Engineering Plastic Revenue by Type (2027-2032)

7.3 Global Engineering Plastic Revenue Market Share by Type (2021-2032)

8 Segment by Application

8.1 Global Engineering Plastic Revenue by Application (2021-2026)

8.2 Global Engineering Plastic Revenue by Application (2027-2032)

8.3 Global Engineering Plastic Revenue Market Share by Application (2021-2032)

9 Industry Chain and Sales Channels Analysis

9.1 Engineering Plastic Industry Chain Analysis

9.2 Engineering Plastic Key Raw Materials

9.2.1 Key Raw Materials

9.2.2 Raw Materials Key Suppliers

9.3 Engineering Plastic Production Mode & Process

9.4 Engineering Plastic Sales and Marketing

9.4.1 Engineering Plastic Sales Channels

9.4.2 Engineering Plastic Distributors

9.5 Engineering Plastic Customers

10 Research Findings and Conclusion

11 Appendix

11.1 Research Methodology

11.1.1 Methodology/Research Approach

11.1.1.1 Research Programs/Design

11.1.1.2 Market Size Estimation

11.1.1.3 Market Breakdown and Data Triangulation

11.1.2 Data Source

11.1.2.1 Secondary Sources

11.1.2.2 Primary Sources

11.2 Author Details

11.3 Disclaimer

QY Research PVT. LTD.

315 Work Avenue,

Raheja Woods,

6th Floor, Kalyani Nagar,

Yervada, Pune - 411060,

Maharashtra, India

India: (O) +91 866 998 6909

USA: (O) +1 626 295 2442

Email: hitesh@qyresearch.com

Web: www.qyresearch.in

About QY Research

QY Research, founded in 2007, is a globally recognized market research and consulting firm delivering syndicated and customized research solutions across chemicals, polymers, advanced materials, automotive, electronics, aerospace, and industrial manufacturing sectors. Serving over 50,000 clients in more than 80 countries, QY Research combines rigorous research methodologies with deep industry expertise to provide actionable insights that support data-driven decision-making and sustainable business growth.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Engineering Plastic Market to Reach US$ 179.96 Billion by 2032, Driven by Lightweighting Trends, EV Growth, and High-Performance Material Demand | QY Research here

News-ID: 4351315 • Views: …

More Releases from QY Research, Inc.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

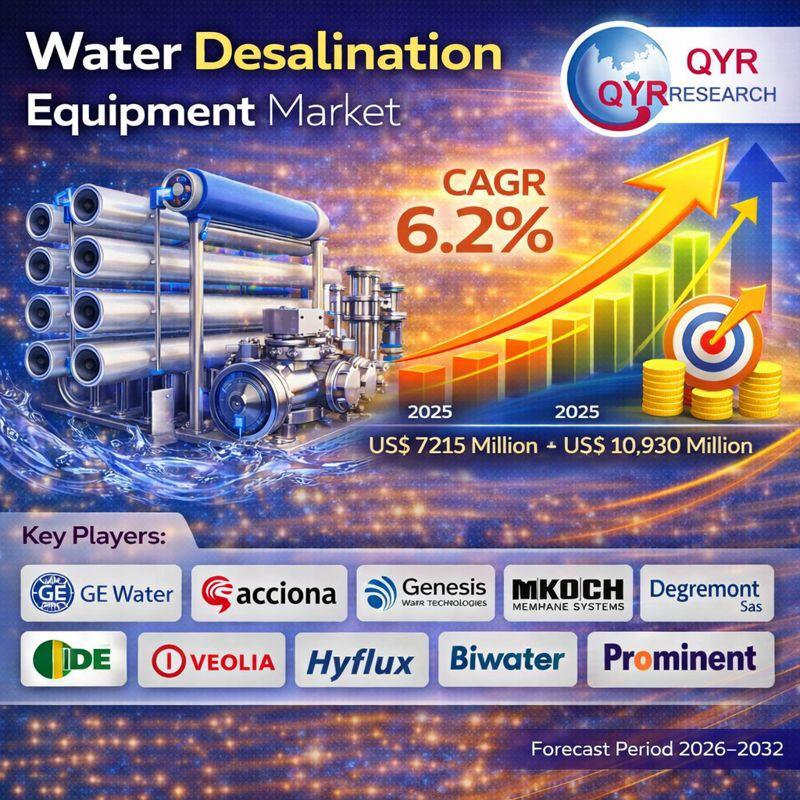

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

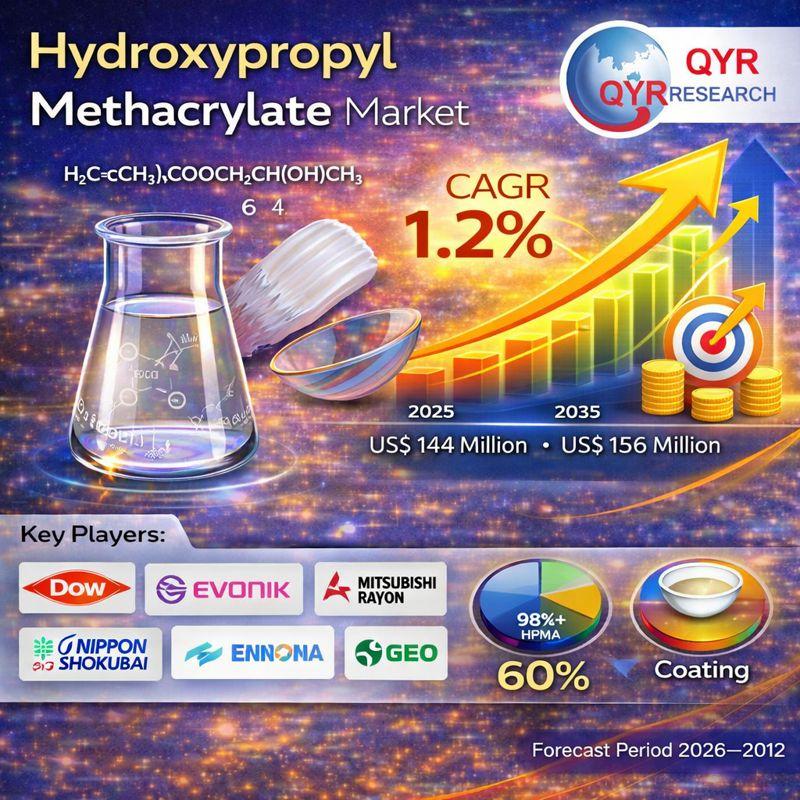

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for Plastic

Plastic bottles at events - Better party with plastic

Partying, dancing, camping - festivals attract hundreds of thousands of visitors every year in Germany alone. One challenge: supply and safety. For this reason, drinks in glass bottles are banned at most events due to the risk of injury. Lightweight and unbreakable plastic bottles, on the other hand, are considered a safe and practical alternative. Not only that: they can even be used to make a musical instrument.

Festivals or pageants…

Plastic Pallet With Plastic Crate Use: Efficient Material Handling

When it comes to efficient moving and storage of goods, a combination of plastic pallets [https://www.agriculture-solution.com/plastic-pallet/]and plastic crates is a popular choice. They are widely used in various industries such as manufacturing, retail, agriculture, etc. for storage and transportation of goods. Plastic pallets are designed to provide a stable base for stacking and shipping goods, while plastic crates provide safe and protective containers for stored or transported items. Plastic pallets…

Plastic Granules Market to Witness Massive Growth by Balaji Plastic, Navkar Indu …

The Worldwide Plastic Granules Market has witnessed continuous growth in the past few years and is projected to grow at a good pace during the forecast period of 2023-2029. The exploration provides a 360° view and insights, highlighting major outcomes of Worldwide Plastic Granules industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improve profitability. Additionally, the study helps venture or emerging…

Insights on the Growth of Plastic Granules Market 2018 to 2025 | Profiling Key C …

UpMarketResearch offers a Latest report on “Plastic Granules Market Analysis & Forecast 2018-2025” delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 114 pages which highly exhibits on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Request Sample Copy of This Report@ https://www.upmarketresearch.com/home/requested_sample/49052

Plastic Granules research report delivers a close watch on leading competitors with strategic…

Agriculture Film Market SWOT Analysis of Leading Key Players Shandong Tianhe Pla …

HTF MI recently introduced Global Agriculture Film Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are British Polythene Industries (BPI), Trioplast, Berry Plastics, Armando Alvarez, Polypak, Barbier…

Building Materials Market 218 : Hepworth, National Plastic Industry, Hira Indust …

Building materials in this report covered the PVC pipes and fittings, PPR pipes and fittings, PE pipes and fittings, fabrication, ducts systems for infrastructure, valves and pumps and electrical conduits PVC systems.

At present, Hepworth, National Plastic Industry, Hira Industries, Florance Plastic Industries, Polyfab Plastic Industry, MPI, Union Pipes Industry, ANABEEB, Borouge and ACO Group are the UAE leading suppliers of the building materials, and top ten of them shared about…