Press release

Mitigation Banking Market Driving Growth Trends Expanding Market Size at 8.31% CAGR

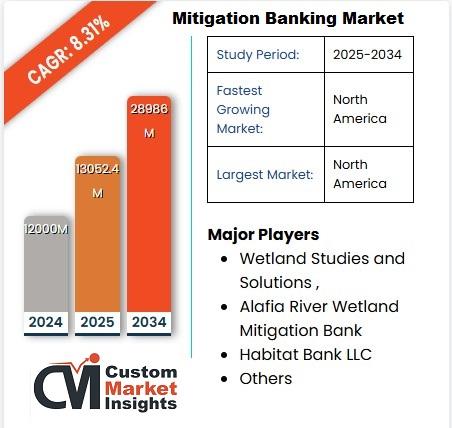

Market Size➤ Mitigation Banking Market size was valued at USD 13,052.4 Million in 2025 and is projected to reach approximately USD 28,986 Million by 2034, expanding at a compound annual growth rate (CAGR) of around 8.31% during the forecast period 2025-2034.

• The market's steady expansion reflects increasing regulatory enforcement related to environmental protection and biodiversity conservation.

• Mitigation banking has become a preferred compliance mechanism for developers seeking to offset unavoidable environmental impacts.

✅ Request Sample Search Report for detailed data tables, Interactive Market sizing Dashboards, and Actionable Analyst Insights -

https://www.custommarketinsights.com/request-for-free-sample/?reportid=11456

✅ Long-term infrastructure expansion and stricter environmental regulations are expected to sustain market momentum throughout the forecast period.

Market Overview

➤ Mitigation Banking Market refers to the establishment, restoration, enhancement, and preservation of natural habitats-such as wetlands, streams, and forests-to compensate for ecological damage caused by development activities.

• Mitigation banks generate credits that are sold to developers to meet regulatory requirements under environmental laws.

• These banks provide an efficient, market-based solution for environmental offsetting.

• Governments and regulatory bodies increasingly favor mitigation banking over permittee-responsible mitigation due to better ecological outcomes and long-term monitoring.

✅ As environmental compliance becomes more complex, mitigation banking is emerging as a standardized and scalable solution worldwide.

Key Market Growth Drivers

➤ Mitigation Banking Market growth is driven by a combination of regulatory, environmental, and economic factors:

• Stringent Environmental Regulations

Governments worldwide are enforcing laws that require developers to compensate for environmental damage.

• Rapid Infrastructure Development

Large-scale projects in transportation, energy, and urban development increase the need for mitigation credits.

• Preference for Off-Site Mitigation

Mitigation banking offers higher ecological success rates compared to on-site mitigation.

• Rising Awareness of Ecosystem Services

Growing recognition of wetlands and forests in flood control, carbon sequestration, and biodiversity conservation is boosting demand.

• Private Sector Participation

Increased involvement of private mitigation bank operators improves efficiency and credit availability.

✅ These drivers collectively reinforce the market's long-term growth outlook.

Analysis of Key Players

➤ Mitigation Banking Market competitive landscape consists of specialized environmental firms, regional operators, and conservation-focused organizations.

Vertical - Prominent Players

• Wetland Studies and Solutions, Inc.

• Alafia River Wetland Mitigation Bank, Inc.

• The Mitigation Banking Group, Inc.

• Habitat Bank LLC

• The Loudermilk Companies

• Others

• Key players focus on securing regulatory approvals, expanding credit inventories, and maintaining ecological performance.

• Regional dominance plays a critical role due to location-specific regulatory frameworks.

✅ Get a Customized Report designed around your strategic goals and market priorities -

https://www.custommarketinsights.com/request-for-customization/?reportid=11456

✅ Competition is expected to intensify as new mitigation banks are established to meet rising demand.

Market Challenges & Opportunities

➤ Mitigation Banking Market faces several operational challenges but also offers strong growth opportunities:

Challenges

• High Initial Capital Investment

Land acquisition, restoration activities, and long-term monitoring require significant upfront investment.

• Lengthy Regulatory Approval Processes

Obtaining permits and approvals can delay project timelines.

• Geographic Constraints

Credits are often limited to specific service areas, restricting market flexibility.

Opportunities

• Expansion into Emerging Regions

Developing economies are beginning to adopt formal mitigation banking frameworks.

• Carbon and Biodiversity Credit Integration

Combining mitigation banking with carbon offset markets creates additional revenue streams.

• Technological Advancements

Use of GIS, remote sensing, and ecological modeling improves monitoring efficiency.

✅ Addressing regulatory and operational complexities can unlock substantial market value.

Key Player Strategies

➤ Mitigation Banking Market players employ multiple strategies to strengthen their competitive position:

• Strategic Land Acquisition

Securing ecologically valuable land in high-demand development corridors.

• Regulatory Collaboration

Working closely with environmental agencies to streamline approvals.

• Portfolio Diversification

Developing multiple mitigation bank types, including wetland, stream, and forest banks.

• Long-Term Stewardship Models

Ensuring compliance through perpetual conservation easements and monitoring programs.

• Mergers and Partnerships

Collaborations with developers and infrastructure companies to secure long-term credit demand.

✅ Strategic alignment with regulatory priorities remains a key success factor.

Recent Developments (Use as It Is from Report RD)

➤ Recent Developments - As per Report RD

• Expansion of mitigation banking projects to support large-scale transportation and energy infrastructure developments.

• Increased establishment of conservation and forest mitigation banks to address biodiversity loss.

• Adoption of advanced monitoring technologies to enhance ecological performance tracking.

• Strengthening of regulatory frameworks supporting third-party mitigation solutions.

✅ These developments highlight the industry's evolution toward scalable and accountable environmental solutions.

Investment Landscape and ROI Outlook

➤ Mitigation Banking Market investment environment is increasingly attractive for long-term investors:

• Stable regulatory demand ensures predictable revenue streams from mitigation credit sales.

• Long asset lifecycles and limited competition within service areas support pricing stability.

• Private equity and institutional investors are showing increased interest due to strong ESG alignment.

• ROI improves over time as credit values appreciate with rising regulatory stringency.

✅ With a CAGR of 8.31%, mitigation banking presents a compelling investment opportunity aligned with sustainability goals.

Market Segmentations

➤ Mitigation Banking Market segmentation provides detailed insights into demand dynamics:

By Type

• Wetland or Stream Banks

• Conservation Banks

• Forest Conservation

By Industry

• Construction & Mining

• Transportation

• Energy & Utilities

• Healthcare

• Manufacturing

By Region

• North America

• Europe

• Asia-Pacific

• Latin America

• Middle East & Africa

✅ North America dominates the market due to established regulatory frameworks and high infrastructure spending.

✅ Get Full Report Access and Explore Comprehensive Market Data -

https://www.custommarketinsights.com/report/mitigation-banking-market/

Why Buy This Report?

➤ Mitigation Banking Market report delivers actionable intelligence:

• ✅ Comprehensive market sizing and forecasts through 2034

• ✅ Detailed competitive landscape and company analysis

• ✅ Regulatory and policy impact assessment

• ✅ Strategic insights into growth drivers and investment risks

• ✅ Data-driven decision support for investors, developers, and policymakers

FAQs - Mitigation Banking Market

➤ 1. What is mitigation banking?

Mitigation banking involves restoring or preserving ecosystems to offset environmental impacts from development projects.

➤ 2. What is driving the Mitigation Banking Market growth?

Strict environmental regulations, infrastructure expansion, and preference for off-site mitigation are key drivers.

➤ 3. Which region leads the market?

North America leads due to well-established regulatory frameworks and high demand for mitigation credits.

➤ 4. What challenges does the market face?

High capital requirements, regulatory delays, and geographic limitations pose challenges.

➤ 5. What is the forecast growth rate?

The market is projected to grow at a CAGR of 8.31% from 2025 to 2034.

➤ Explore More Related Market Reports by CMI -

US 3D Printed Medical Implant Market:

https://www.custommarketinsights.com/report/us-3d-printed-medical-implant-market/

US Ultrasound Probe Disinfection Market:

https://www.custommarketinsights.com/report/us-ultrasound-probe-disinfection-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI is a one-stop solution for data collection and investment advice. Our company's expert analysis digs out essential factors that help us understand the significance and impact of market dynamics. The professional experts advise clients on aspects such as strategies for future estimation, forecasting, opportunities to grow, and consumer surveys.

Contact Us:

Joel John

Custom Market Insights

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

US & Europe: +1 737 734 2707

APAC & Rest: +91 20 46022736

WhatsApp: +1 801-639-9061

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mitigation Banking Market Driving Growth Trends Expanding Market Size at 8.31% CAGR here

News-ID: 4349776 • Views: …

More Releases from Custom Market Insights

Mosquito Repellent Market to Grow Immensely at a CAGR of 5.72% From 2025 To 2034

The Global Mosquito Repellent Market includes comprehensive information regarding the market's historical and current estimations, future projections, market trends, competition, market dynamics as well as recent developments in the mosquito repellent market forecast from 2025 to 2034. According to the study, the market size is accounted for around USD 7430 Million in 2024 and is expected to reach USD 7859.5 Million in 2025 and is expected to grow at a…

Smart Fleet Management Market Revenues To Grow At Nearly 8.93% From 2025 To 2034

The global Smart Fleet Management Market was estimated at USD 493.79 Billion in 2025 and is anticipated to reach around USD 1066.15 Billion by 2034, growing at a CAGR of roughly 8.93% between 2025 and 2034. Our Custom Market Insights report offers a 360-degree view of the Smart Fleet Management market's drivers and restraints, coupled with the impact they have on demand during the projection period. Also, the report examines…

Veterinary Vaccine Market To Advance At CAGR Of 6.87% From 2025 To 2034

As per the Veterinary Vaccine Market analysis conducted by the CMI Team, the global Veterinary Vaccine Market is expected to record a CAGR of 6.87% from 2025 to 2034. In 2025, the market size is projected to reach a valuation of USD 10.06 Billion. By 2034, the valuation is anticipated to reach USD 18.29 Billion.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=17915

➤ Market Size

• The global Veterinary Vaccine Market was…

Api Management Market Is Estimated To Surge Ahead At A Cagr Of 26.5% From 2025 T …

As per the API Management Market analysis conducted by CMI Team, the global API Management market is expected to record a CAGR of 26.5% from 2025 to 2034. In 2025, the market size is projected to reach a valuation of USD 7.1 Billion. By 2034, the valuation is anticipated to reach USD 58.7 Billion.

➤ Request Free Sample PDF Report @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=18521

➤ Market Size

• The global API Management Market was valued…

More Releases for Mitigation

DDoS Mitigation Solutions Market Size Analysis by Application, Type, and Region: …

USA, New Jersey- According to Market Research Intellect, the global DDoS Mitigation Solutions market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

As cyber attacks get more regular and sophisticated, the market for DDoS mitigation solutions is expanding quickly. Digital infrastructure expansion is exposing companies…

Mitigation Banking Market 2020-2027 by Top Key Players like Delta Land Services, …

Mitigation banking is the preservation, enhancement, restoration or creation of a wetland, stream, or habitat conservation area which offsets, or compensates for, expected adverse impacts to similar nearby ecosystems.

The "Global Mitigation Banking Market" provides up-to-date information on current and future industry trends, enabling readers to identify products and services to increase revenue growth and profitability. This research report provides in-depth study of all key factors affecting global and regional markets,…

Mitigation Banking Market 2020-2027 by Top Key Players like Delta Land Services, …

Mitigation banking is the preservation, enhancement, restoration or creation of a wetland, stream, or habitat conservation area which offsets, or compensates for, expected adverse impacts to similar nearby ecosystems.

The “Global Mitigation Banking Market” provides up-to-date information on current and future industry trends, enabling readers to identify products and services to increase revenue growth and profitability. This research report provides in-depth study of all key factors affecting global and regional markets,…

Mitigation Banking Market And Key Players are Alafia River Wetland Mitigation Ba …

The report covers the forecast and analysis of the mitigation banking market on a global and regional level. The study provides historical data from 2013 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the mitigation banking market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study…

Mitigation Banking Market And Key Players are Alafia River Wetland Mitigation Ba …

The report covers the forecast and analysis of the mitigation banking market on a global and regional level. The study provides historical data from 2013 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the mitigation banking market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study…

Geotechnical Mitigation Measures

Spar Geo Infra, Geotechnical Engineering refers to branch of civil engineering which includes the analysis and design and construction of subsoil structure, foundations, tunnels, offshore structures, earthen embankments. In addition, it includes the analysis and providing effective mitigation solution for soil/rock slopes.

http://www.spargrp.com/geotechnical-mitigation-measures/

Spar Geo Infra Pvt. Ltd, is comprehensive solution provider in the field of geotechnical engineering projects complexities. Being specialized in design and execution of slope stabilization and ground improvement…