Press release

Neo and Challenger Banks Reshape the Future of Global Banking

Banking as we know it is changing fast. The global neo and challenger bank market hit USD 88.5 billion in 2024, and it's expected to reach USD 107.3 billion this year. By 2035, experts predict it'll balloon to USD 875.6 billion-that's a growth rate of 23.5% every year.What's driving this massive shift? People want banking on their phones, governments are making it easier for new players to compete, and these digital banks can offer services way cheaper than traditional banks ever could. Neo banks aren't just trendy fintech startups anymore-they're becoming the way millions of people actually manage their money.

Neo and Challenger Bank Market Overview

Neo and challenger banks are basically banks that live on your phone. They don't have branches on every corner like traditional banks. Instead, they use cloud technology, smart software, and AI to give you banking that's faster, cheaper, and feels more personal.

Download sample report here: https://www.meticulousresearch.com/download-sample-report/cp_id=6248

Here's what the market looks like right now: digital-only banks make up about 65-70% of the industry. Payments and transfers bring in 30-40% of the money. The fastest-growing area is embedded finance and Banking-as-a-Service, which is expanding at 25.3% yearly. Most users-around 70-75%-are everyday people, not businesses. Asia-Pacific is growing the fastest at 26.4% per year, and China has the most users.

Why the Neo and Challenger Bank Market Is Growing So Rapidly

Digital-First Consumer Behavior

More than 85% of people around the world have smartphones now, and they expect to do everything on them-including banking. About 78% of millennials and 67% of Gen Z would rather use a banking app than walk into a branch. Neo banks give them exactly what they want: you can open an account in five minutes, get a virtual card instantly, see notifications every time you spend money, and access everything 24/7 from an app that actually makes sense.

Cost Efficiency and Competitive Pricing

Here's the thing-neo banks spend 60-70% less on running their business than traditional banks do. They keep their costs between 35-40% of their income, while old-school banks often hit 55-65%. That means they can offer checking accounts with no fees, better interest rates on savings, and cheap international transfers. If you're watching your budget or running a small business, that's hard to beat.

Regulatory Support and Open Banking

Governments in Europe, Asia, and Latin America are actually helping these new banks compete. They're creating rules that require banks to share data (with your permission), making it easier to get digital banking licenses, and setting up "sandboxes" where fintechs can test new ideas safely. Since 2021, partnerships between fintech companies and traditional banks have tripled, which means better services and more innovation.

Browse in Depth: https://www.meticulousresearch.com/product/neo-and-challenger-bank-market-6248

Neo and Challenger Bank Market Size and Forecast

The numbers are pretty staggering. We're looking at growth from USD 107.3 billion in 2025 to USD 875.6 billion by 2035-a 23.5% increase every single year. That makes neo banking one of the hottest opportunities in finance right now, which is why investors are pouring billions into it.

Market Segmentation Analysis

The market breaks down in several ways. You've got digital-only banks dominating with 65-70% of the market because they're cheaper to run and customers love them. Some banks partner with existing institutions to get started faster while staying legal and compliant.

Services include everything from payments and transfers to savings accounts, loans, investment tools, insurance, and currency exchange. Regular consumers make up 70-75% of users, though small businesses and larger companies are getting in on it too.

Digital-Only Banks Lead with 65-70% Market Share

Digital-only banks are completely changing the game. Without physical branches and using modern technology, they can roll out new features in days instead of months. Customers notice-these banks average 4.8-star app ratings, while traditional bank apps usually get 3.2 stars. The best ones offer things like getting your paycheck early, no overdraft fees, and apps that automatically help you save money.

Payments and Money Transfers Dominate Service Revenue

Payments and transfers bring in 35-40% of what neo banks make, and they're the main way these banks get new customers hooked. Neo banks handle over 10 billion transactions every year, and that number's jumping 45% annually. People love features like instant payments, splitting bills with friends, and sending money in real-time. It's become the go-to way people manage their daily spending.

Regional Analysis: Asia-Pacific Leads Global Growth

Asia-Pacific is where the real action is. China's growing at 28.3% per year thanks to super-apps that weave banking into everything you do on your phone. India's at 27.8% growth because the government's pushing digital infrastructure hard, bringing millions of people who never had bank accounts into the system. The U.S. is growing at 19.2% yearly-people are fed up with traditional bank fees and turning to digital alternatives.

Buy the Complete Report with an Impressive Discount: https://www.meticulousresearch.com/view-pricing/1565

Conclusion: A High-Growth Market Built for the Digital Economy

Neo and challenger banks aren't disruptors anymore-they're becoming the mainstream. With everyone glued to their phones, governments supporting competition, and people demanding better banking, this industry is set for serious growth through 2035. Whether you're an investor, entrepreneur, or fintech innovator, this is one of the biggest opportunities in financial services today.

Related Reports:

Speech and Voice Recognition Market: https://www.meticulousresearch.com/product/speech-and-voice-recognition-market-5038

E-commerce Market: https://www.meticulousresearch.com/product/e-commerce-market-4644

About Us:

We are a trusted research partner for leading businesses worldwide, empowering Fortune 500 organizations and emerging enterprises with actionable market intelligence tailored to drive revenue transformation and strategic growth. Our insights reveal forward-looking revenue opportunities, providing our clients with a competitive edge through a diverse suite of research solutions-syndicated reports, custom research, and direct analyst engagement.

Each year, we conduct over 300 syndicated studies and manage 60+ consulting engagements across eight key industry sectors and 20+ geographic markets. With a focus on solving the complex challenges facing global business leaders, our research enables informed decision-making that propels sustainable growth and operational excellence. We are dedicated to delivering high-impact solutions that transform business performance and fuel innovation in the competitive global marketplace.

Contact Us:

Meticulous Market Research Pvt. Ltd.

1267 Willis St, Ste 200 Redding,

California, 96001, U.S.

Email- sales@meticulousresearch.com

USA: +1-646-781-8004

Europe: +44-203-868-8738

APAC: +91 744-7780008

Visit Our Website: https://www.meticulousresearch.com/

For Latest Update Follow Us:

LinkedIn- https://www.linkedin.com/company/meticulous-research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Banks Reshape the Future of Global Banking here

News-ID: 4348806 • Views: …

More Releases from Meticulous Research®

Global Antiviral & Antimicrobial Coatings Market Analysis 2026-2036: Trends, App …

The antiviral and antimicrobial coatings market has seen remarkable growth in recent years, reflecting the world's heightened focus on hygiene and disease prevention. In 2025, the market was valued at around USD 6.4 billion, and it is projected to reach nearly USD 18.94 billion by 2036, expanding at an annual growth rate of 10.5%. This growth is being driven by several factors, including the rising occurrence of healthcare-associated infections, increasing…

Global Activated Alumina Market Outlook 2026-2036: Growth, Trends, Applications, …

The global activated alumina market has experienced steady growth over the past several years and is expected to continue on a positive trajectory in the coming decade. Valued at USD 1.2 billion in 2025, the market is projected to reach USD 1.3 billion in 2026 and expand to approximately USD 2.22 billion by 2036, representing a compound annual growth rate of 5.5% from 2026 to 2036. This growth is largely…

Global Adaptogenic Beverages Market Analysis 2026-2036: Trends, Growth Drivers, …

The global adaptogenic beverages market has been experiencing significant growth, driven by the rising consumer focus on holistic wellness and the expanding functional food and beverage industry. Valued at approximately USD 1.18 billion in 2025, the market is projected to reach around USD 2.89 billion by 2036, growing at a compound annual growth rate (CAGR) of 8.5% from 2026 to 2036. This growth is fueled by consumers' increasing desire to…

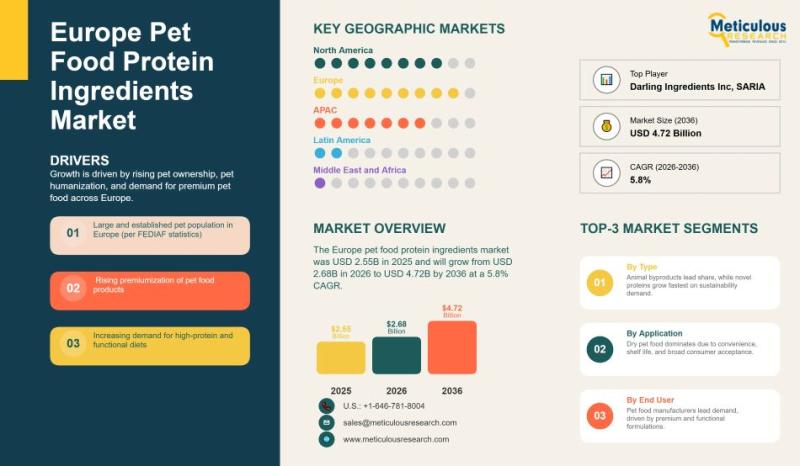

Europe Pet Food Protein Ingredients Market Analysis 2026-2036: Trends, Growth Dr …

The Europe pet food protein ingredients market has been witnessing steady growth over the past few years, driven primarily by an increase in pet ownership across the region, the humanization of pets, and a rising demand for premium and specialized pet food products. In 2025, the market was valued at approximately USD 2.55 billion and is projected to grow to about USD 4.72 billion by 2036. The market is expected…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…