Press release

Global Payment Analytics Software Market Outlook 2030 | 4.6% CAGR Growth

According to a new report published by Allied Market Payment Analytics Software Market By Type (Cloud based, Web based), By Enterprise Size (Large Enterprise, Small and Medium Enterprise): Global Opportunity Analysis and Industry Forecast, 2018-2030, The global payment analytics software market was valued at $3.2 billion in 2021, and is projected to reach $4.8 billion by 2030, growing at a CAGR of 4.6% from 2022 to 2030.The Payment Analytics Software Market enables businesses and financial institutions to transform raw payment data into actionable insights, helping optimize transaction flows, enhance fraud detection, and improve customer experiences. These software solutions aggregate and analyze payment-related metrics-such as authorization rates, settlement performance, chargeback patterns, and customer payment behavior-across multiple channels. As digital payment adoption accelerates worldwide, organizations increasingly rely on analytics tools to gain real-time visibility into transaction health, drive strategic decisions, and strengthen operational efficiency.

The Payment Analytics Software Market enables businesses and financial institutions to transform raw payment data into actionable insights, helping optimize transaction flows, enhance fraud detection, and improve customer experiences. These software solutions aggregate and analyze payment-related metrics-such as authorization rates, settlement performance, chargeback patterns, and customer payment behavior-across multiple channels. As digital payment adoption accelerates worldwide, organizations increasingly rely on analytics tools to gain real-time visibility into transaction health, drive strategic decisions, and strengthen operational efficiency.

Download Free PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A09785

Market Dynamics

Key Growth Drivers:

A major driver in the payment analytics market is the expansion of digital transactions across online and offline channels. The proliferation of e-commerce and mobile payments has created large volumes of complex data, driving demand for advanced analytics to interpret patterns, detect fraud, and enhance authorization success rates. In turn, organizations invest in analytics platforms to support data-driven decision-making that improves operational efficiency and customer experience.

Technological Evolution (AI & ML Integration):

Artificial intelligence and machine learning are transforming the landscape by enabling deeper predictive analytics, real-time anomaly detection, and automated optimization of payment routing and risk profiling. AI-based subsegments are among the fastest-growing, as businesses adopt predictive risk scoring, revenue optimization workflows, and enhanced fraud protection models. These capabilities help reduce false declines and improve conversion rates.

Cloud Adoption & Deployment Trends:

Cloud-based payment analytics solutions currently dominate the market due to their scalability, ease of integration, and lower infrastructure costs compared with traditional on-premises deployments. Cloud platforms also support real-time data access and seamless updates, making them especially attractive to both large enterprises and small-medium businesses (SMBs) looking to minimize upfront IT investment.

Regulatory & Compliance Factors:

Compliance with data security standards such as PCI-DSS, GDPR, and region-specific finance regulations influences market adoption and product design. Organizations with multi-country operations face significant challenges navigating fragmented regulatory environments, which can slow deployments and increase implementation costs. Robust analytics solutions that can support compliance and reporting requirements are increasingly preferred.

Market Challenges & Competition:

The payment analytics space is highly competitive and rapidly evolving. Vendors must continuously innovate to differentiate offerings through improved features, usability, and customer support. Additionally, the pace of technological change-along with heightened concerns over data privacy and security-poses challenges, particularly for smaller organizations lacking sophisticated IT infrastructure.

Buy Now & Get Exclusive Discount on this Report (230 Pages PDF with Insights, Charts, Tables, and Figures) at: https://www.alliedmarketresearch.com/purchase-enquiry/A09785

Segment Overview

The global payment analytics software market is segmented by type, enterprise size, and region. Based on type, the market is categorized into cloud-based and web-based solutions. By enterprise size, the analysis distinguishes between large enterprises and small & medium enterprises (SMEs). Regionally, the market is evaluated across North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa).

Regional Analysis

North America leads the global payment analytics market, attributed to its mature digital payment ecosystem, widespread adoption of advanced analytics tools, and strong presence of technology vendors. The United States and Canada are key contributors, with enterprises leveraging analytics to improve fraud detection, transaction optimization, and compliance. Europe also represents a strong market, supported by regulatory frameworks such as PSD2 that encourage open banking, transparency, and data-driven financial operations. Businesses in Germany, the U.K., and France increasingly deploy analytics platforms to enhance payment efficiency and meet reporting standards

Asia Pacific is one of the fastest-growing regions, driven by rapid mobile payment adoption, rising e-commerce penetration, and supportive government initiatives promoting digital payments. Markets in China, India, and Southeast Asia are witnessing significant expansion as organizations invest in analytics solutions to manage large volumes of payment data and mitigate risk in dynamic digital commerce environments. Latin America, the Middle East, and Africa are also emerging markets, with growing digital payment infrastructure and government programs aimed at financial inclusion fueling analytics demand.

Get Expert Guidance - Connect with an Analyst: https://www.alliedmarketresearch.com/connect-to-analyst/A09785

Competitive Analysis

The key players profiled in the Payment analytics software market analysis are ProfitWell, BlueSnap, Databox, Payfirma, Yapstone, CashNotify, HiPay Intelligence, PaySketch, Revealytics, and RJMetrics. These players have adopted various strategies to increase their market penetration and strengthen their position in the payment analytics software industry.

Key Findings of the Study

• On the basis of type, the web based segment emerged as the global leader in 2021 and is anticipated to be the largest market during the forecast period.

• On the basis of enterprise size, the large enterprise segment emerged as the global leader in 2021 and is anticipated to be the largest market during the forecast period.

• On the basis of region, Asia-Pacific is projected to have the fastest growing market during the forecast period.

• A comprehensive global payment analytics software market analysis covers factors that drive and restrain the market growth as well as market opportunity.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Follow us on: https://www.linkedin.com/company/allied-market-research

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Payment Analytics Software Market Outlook 2030 | 4.6% CAGR Growth here

News-ID: 4343812 • Views: …

More Releases from Allied Analytics LLP

Rising Infrastructure Boosting the Low Voltage Circuit Breaker Market Growth Wor …

According to a new report published by Allied Market Research, the global low voltage circuit breaker market size was valued at $3.4 billion in 2019 and is projected to reach $4.4 billion by 2027, growing at a CAGR of 4.9% from 2020 to 2027. The low voltage circuit breaker market is witnessing steady expansion due to rising electricity demand, increasing infrastructure development, and growing emphasis on electrical safety across residential,…

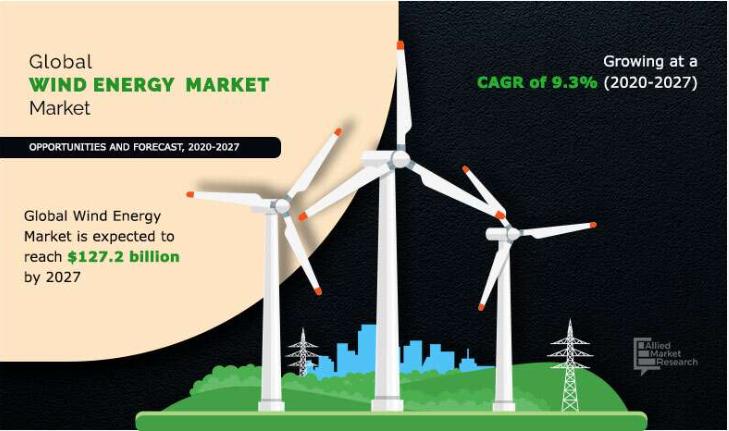

Wind Energy Market to Reach $127.2 Billion by 2027 Driven by Renewable Power Ado …

According to a new report published by Allied Market Research, the global wind energy market size was valued at $62.1 billion in 2019 and is projected to reach $127.2 billion by 2027, growing at a CAGR of 9.3% from 2020 to 2027. The wind energy market is witnessing substantial growth due to increasing global emphasis on renewable energy sources, supportive government policies, and rising demand for sustainable electricity generation.

Download PDF…

Syngas Market to Reach $66.5 Billion by 2027 Driven by Clean Energy and Chemical …

According to a new report published by Allied Market Research, the global syngas market was valued at $43.6 billion in 2019 and is projected to reach $66.5 billion by 2027, growing at a CAGR of 6.1% from 2020 to 2027. The syngas market is witnessing steady growth due to increasing environmental concerns, rising demand for clean energy alternatives, and expanding applications in the chemical and power generation sectors.

Download PDF Brochure:…

Global Ultrasonic Flowmeter Market Growth Driven by Oil & Gas and Wastewater App …

According to a new report published by Allied Market Research, the global ultrasonic flowmeter market was valued at $650.7 million in 2020 and is projected to reach $959.8 million by 2028, growing at a CAGR of 5.1% from 2021 to 2028. The ultrasonic flowmeter market is experiencing steady growth due to increasing demand for precise flow rate measurement across industries such as oil & gas, water & wastewater management, chemicals,…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…