Press release

Payment Processing Solutions Market to Reach US$ 198.9 Billion by 2034 at 11.7% CAGR; Asia-Pacific Fastest-Growing Region, North America Holds 38% Share; Key Players PayPal, Stripe, Adyen, First Data

The Global Payment Processing Solutions Market reached approximately US$ 66.8 billion in 2024 and is projected to grow significantly to around US$ 198.9 billion by 2034, registering a CAGR of about 11.7% during the forecast period 2025-2034. This strong growth reflects the rapid shift toward digital and cashless payments, expanding e-commerce activity, and increasing demand for secure, fast, and seamless transaction processing across industries worldwide.Payment processing solutions facilitate the authorization, settlement, and management of electronic transactions across multiple payment modes such as credit and debit cards, mobile wallets, bank transfers, and contactless payments. Key growth drivers include rising smartphone and internet penetration, increased adoption of cloud-based payment platforms, advancements in fraud detection and cybersecurity, and growing acceptance of real-time and cross-border payments. Supportive regulatory frameworks, fintech innovation, and the expansion of omnichannel retail and digital commerce are further accelerating global market growth.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/payment-processing-solutions-market?sai-v

The Payment Processing Solutions Market refers to the global industry that provides technologies and services enabling secure, efficient authorization, processing, and settlement of digital and electronic payment transactions between consumers, merchants, and financial institutions.

Key Developments

✅ January 2026: In North America, payment processors accelerated deployment of AI-driven fraud detection and real-time transaction monitoring to support growing digital and contactless payment volumes across retail and e-commerce.

✅ December 2025: In Europe, adoption of instant payment and open banking-enabled solutions expanded as financial institutions integrated faster settlement and account-to-account payment capabilities.

✅ November 2025: In Asia-Pacific, mobile-first payment platforms enhanced cross-border payment features, supporting rising regional trade and increased use of digital wallets among SMEs.

✅ October 2025: In Latin America, payment service providers strengthened QR-code and mobile POS solutions to improve financial inclusion and support cashless transactions in urban and semi-urban areas.

✅ September 2025: In the Middle East, demand increased for secure payment gateways with embedded compliance and tokenization features to support rapid growth in e-commerce and fintech ecosystems.

✅ August 2025: In Africa, fintech-led initiatives expanded low-cost digital payment infrastructure, enabling faster peer-to-peer and merchant payments in underserved and unbanked populations.

Mergers & Acquisitions

✅ January 2026: In North America, a global payment processing company acquired a real-time payments and fraud analytics firm to enhance transaction security and processing speed.

✅ December 2025: In Europe, a payments technology provider acquired an open banking solutions company to strengthen its account-to-account and instant payment capabilities.

✅ November 2025: In Asia-Pacific, a regional fintech group acquired a digital wallet and merchant acquiring platform to expand its footprint across high-growth emerging markets.

Key Players

ShipMoney | PayPal | Stripe | Adyen | Wirecard | PayU | CCBill | First Data | OceanPay | Equian | MarTrust Corporation Ltd. | TridentTrust | Sea Alliance Ltd. | Wilhelmsen | Riga Accounting Hub | BachmannHR Group

Key Highlights

PayPal holds approximately 24.8% share, driven by its global merchant network, strong brand trust, multi-currency payment capabilities, and widespread adoption across e-commerce and cross-border transactions.

Stripe accounts for about 18.6% share, supported by developer-friendly APIs, scalable payment infrastructure, strong presence among digital-native businesses, and advanced fraud prevention tools.

Adyen represents nearly 13.9% share, benefiting from its unified commerce platform, strong enterprise clientele, and seamless omnichannel payment processing capabilities.

First Data captures approximately 11.7% share, driven by its extensive financial institution partnerships, robust point-of-sale solutions, and large-scale transaction processing capabilities.

PayU holds around 8.9% share, supported by strong penetration in emerging markets, localized payment methods, and growing adoption among SMEs and digital platforms.

ShipMoney accounts for about 6.4% share, leveraging its specialization in maritime payroll, seafarer payment solutions, and strong presence in the global shipping ecosystem.

MarTrust Corporation Ltd. represents nearly 5.1% share, driven by its focus on maritime payment services, crew welfare solutions, and secure digital disbursement platforms.

CCBill holds approximately 3.9% share, benefiting from expertise in high-risk payment processing, subscription billing, and global card acceptance.

OceanPay accounts for around 2.4% share, supported by cross-border payment services and niche merchant acquisition in Asia-Pacific markets.

TridentTrust, Equian, Sea Alliance Ltd., Wilhelmsen, Riga Accounting Hub, and BachmannHR Group collectively represent the remaining 4.4% share, contributing through specialized financial services, maritime accounting, HR solutions, and regional payment support functions.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=payment-processing-solutions-market?sai-v

Market Drivers

- Rapid growth of digital payments driven by e-commerce expansion and cashless economy initiatives.

- Increasing adoption of mobile wallets, contactless payments, and real-time payment systems.

- Rising demand for secure, fast, and seamless transaction processing across retail, BFSI, and service sectors.

- Growing penetration of smartphones and internet connectivity enabling digital payment accessibility.

- Regulatory push for financial inclusion and digital transaction transparency across economies.

Industry Developments

- Launch of AI- and machine learning-enabled fraud detection and risk management solutions.

- Integration of blockchain and tokenization technologies to enhance transaction security.

- Expansion of omnichannel payment platforms supporting online, in-store, and mobile payments.

- Strategic partnerships between payment processors, fintech firms, banks, and e-commerce platforms.

- Increased focus on compliance, data security standards, and cross-border payment optimization.

Regional Insights

North America - 38% share: "Driven by mature digital payment infrastructure, high card and wallet usage, and strong presence of leading payment technology providers."

Europe - 26% share: "Supported by regulatory initiatives promoting digital payments, strong banking networks, and rising adoption of contactless transactions."

Asia Pacific - 25% share: "Fueled by booming e-commerce, mobile-first payment ecosystems, and government-led cashless initiatives."

Latin America - 7% share: "Driven by rapid fintech growth, increasing smartphone penetration, and expanding digital banking services."

Middle East & Africa - 4% share: "Supported by gradual digital transformation, rising mobile payments, and financial inclusion programs."

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/payment-processing-solutions-market?sai-v

Key Segments

By Payment Method

Credit cards account for a significant share, driven by widespread consumer acceptance, reward programs, and strong security features for both online and offline transactions. Debit cards hold a substantial portion, supported by growing bank account penetration and preference for direct, real-time payments. E-wallets represent a fast-growing segment, fueled by rising smartphone usage, digital banking adoption, and demand for contactless and instant payments. Other payment methods, including bank transfers, prepaid cards, and emerging alternatives, continue to gain traction by addressing niche and region-specific transaction needs.

By Verticals

Retail dominates the market, driven by high transaction volumes, omnichannel commerce, and growing adoption of digital and contactless payment systems. Hospitality represents a major segment, supported by increasing online bookings, tourism growth, and demand for seamless guest payment experiences. Utilities and telecommunication hold a significant share, driven by recurring billing, subscription-based services, and digital invoicing solutions. Maritime is an emerging segment, supported by digitization of port operations, shipping payments, and cross-border transactions. Other verticals contribute steadily through specialized payment requirements across diverse industries.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Payment Processing Solutions Market to Reach US$ 198.9 Billion by 2034 at 11.7% CAGR; Asia-Pacific Fastest-Growing Region, North America Holds 38% Share; Key Players PayPal, Stripe, Adyen, First Data here

News-ID: 4341617 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Pharmaceutical Logistics Market to Reach US$ 247.8 Billion by 2033 at 9.8% CAGR; …

The pharmaceutical logistics market reached approximately US$ 114.5 billion in 2024 and is expected to reach around US$ 247.8 billion by 2033, growing at a CAGR of about 9.8% during the forecast period 2025-2033. Market growth is driven by rising demand for temperature-controlled transportation, increasing global pharmaceutical trade, expanding biologics and vaccine shipments, and stringent regulatory requirements for drug safety and traceability. Adoption of digital supply chain solutions including IoT…

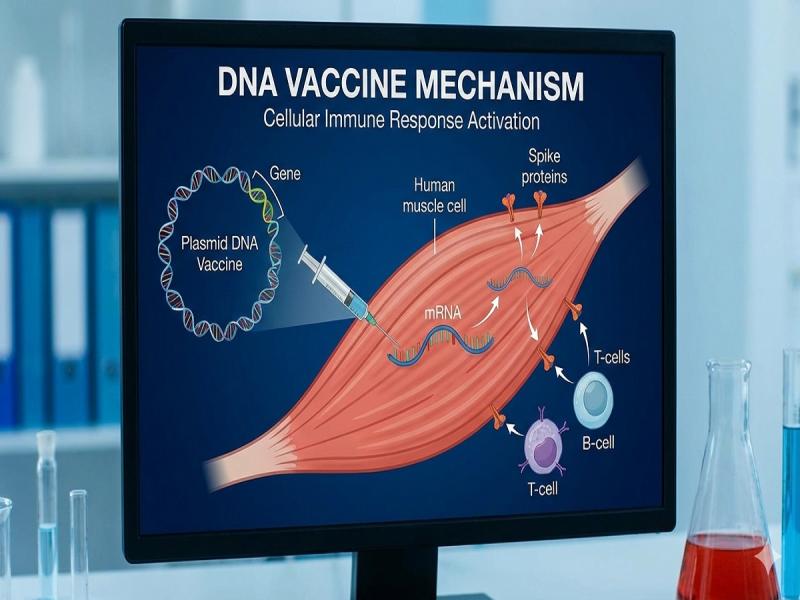

DNA Vaccines Market to Reach US$ 6.82 Billion by 2033 at 18.5% CAGR; North Ameri …

The DNA vaccines market reached approximately US$ 2.25 billion in 2024 and is expected to reach around US$ 6.82 billion by 2033, growing at a CAGR of about 18.5% during the forecast period 2025-2033. Market growth is driven by increasing investment in vaccine research and development, rising application of DNA vaccines for infectious diseases and cancer immunotherapy, and accelerated adoption of novel genetic vaccine platforms following the success of COVID-19…

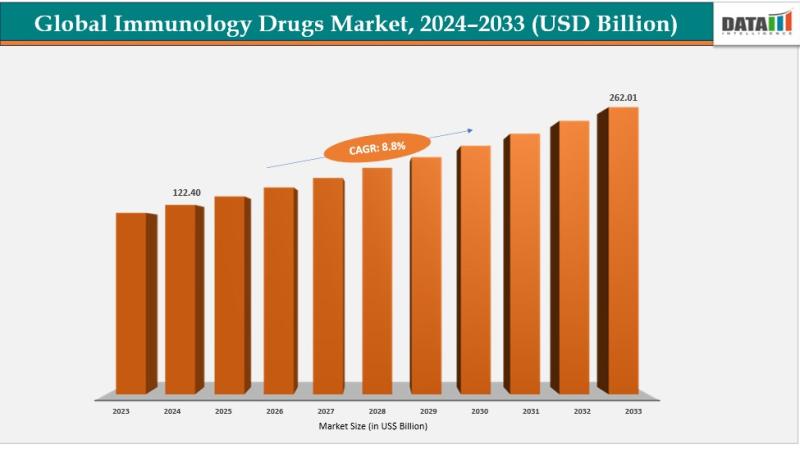

Immunology Drugs Market to Reach US$ 262.01 Billion by 2033 at 8.8% CAGR; North …

The immunology drugs market reached US$ 122.40 billion in 2024 and is expected to reach US$ 262.01 billion by 2033, growing at a CAGR of 8.8% during the forecast period 2025-2033. Market growth is driven by the rising prevalence of autoimmune and inflammatory diseases, increasing adoption of targeted therapies, and expanding availability of biosimilars and generics that have improved treatment affordability and accessibility. Wider patient reach, especially in developing regions,…

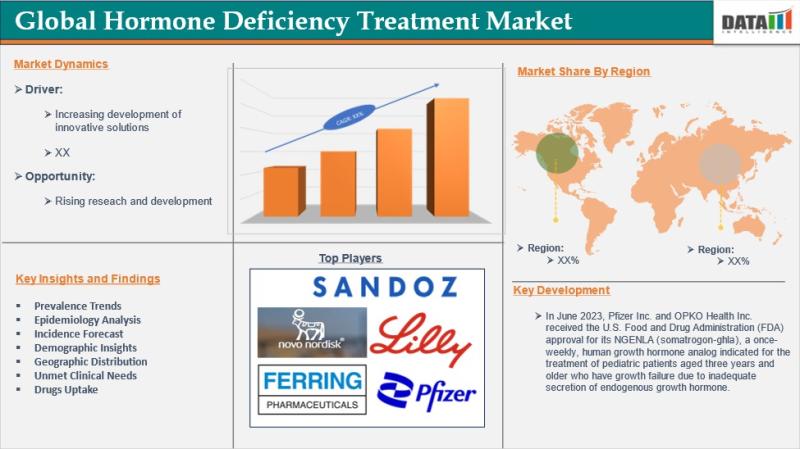

Growth Hormone Deficiency Treatment Market to Reach US$ 9.2 Billion by 2032 at 1 …

The growth hormone deficiency treatment market reached US$ 6.9 billion in 2024 and is expected to reach US$ 9.2 billion by 2032, growing at a CAGR of 12.1% during the forecast period 2025-2032. Market growth is driven by increasing diagnosis of pediatric and adult growth hormone deficiency, rising awareness of hormonal disorders, and improved access to endocrinology care. Advancements in recombinant human growth hormone therapies, development of long-acting formulations, and…

More Releases for Payment

Evolving Market Trends In The Bitcoin Payment Ecosystem Industry: NFC-Enabled Cr …

The Bitcoin Payment Ecosystem Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Bitcoin Payment Ecosystem Market Size During the Forecast Period?

The market size of the Bitcoin payment ecosystem has seen swift acceleration in the past few years. Its growth is projected…

Payment Security Market : Increased Adoption of Digital Payment Modes Leading pl …

According to a recent report published by Allied Market Research, titled, "Payment Security Market by Component, Platform, Enterprise Size and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2021-2030," the global payment security market size was valued at $17.64 billion in 2020, and is projected to reach $60.56 billion by 2030, growing at a CAGR of 13.2% from 2021 to 2030.

Download Free PDF Report Sample :

https://www.alliedmarketresearch.com/request-sample/10390

Payment security software is used…

Hosted Payment Gateway Segment dominates Payment Gateway Market - TechSci Resear …

Government initiatives towards digitization and surging popularity of digital payment to drive global payment gateway market through 2024

According to TechSci Research report, “Global Payment Gateway Market By Type, By Enterprise Size, By End-User, By Region, Competition, Forecast & Opportunities, 2024”, global payment gateway market is projected to grow at a CAGR of over 8% during 2019-2024, on account of increasing internet penetration, which is aiding growing demand for online transactions.…

Digital Payment Market by Component (Solutions (Payment Processing, Payment Gate …

Magarpatta SEZ, Pune, “ReportsnReports”, one of the world’s prominent market research firms has released a new report on Global Digital Payment Market. The report contains crucial insights on the market which will support the clients to make the right business decisions. This research will help both existing and new aspirants for Digital Payment Market to figure out and study market needs, market size, and competition. The report talks about the…

Digital Payment Market by Payment Gateway Solutions, Payment Wallet Solutions, P …

Digital Payment Market 2019-2025: In 2018, the global Digital Payment market size was xx million US$ and it is projected to surpass xx million US$ by the end of 2025, growing at a CAGR of 18.1% during 2019-2025.

Things Covered in Sample Report

> Deep Dive Strategy & Competition

> Deep Dive Data & Forecasting

> Executive Summary & Core Findings

Get a Quick Sample report at https://decisionmarketreports.com/request-sample?productID=1008739

The key players covered in…

Online Payment Gateway Market Analysis By 2028 | Amazon.com, Avenues India Pvt. …

Future Market Insights (FMI) has recently published a new research report on the online payment gateway market titled “Online Payment Gateway Market: Global Industry Analysis (2013-2017) and Opportunity Assessment (2018-2028).” The report states that the growing prevalence of third party payment processes is expected to have a positive impact on the growth of the global market. Websites have always been a good source for channel merchants for generating revenue. Concentrating…