Press release

Raw Materials Market Weekly Overview

Last week, the raw material market fluctuated slightly. Iron ore prices rose volatilely; the coking coal market remained generally stable; coking coal prices were stable with slight declines; and prices of various ferroalloys were stable with slight increases. The price changes of major commodities during this period are as follows:Iron Ore Prices Fluctuated Upwards [https://www.steelfsd.com/]

Last week, imported iron ore prices rose initially and then fell, showing an overall upward trend. Inventories at major ports continued to rise, and the overall oversupply situation remained unchanged, with transaction volumes remaining relatively low. Steel mills maintained low inventory levels, and although a few mills replenished their stocks, the overall replenishment volume was not significant. Currently, the cost of resources delivered to traders is relatively high, and with the increase in storage fees at major ports starting January 1, 2026, traders are temporarily unwilling to sell at low prices. However, iron ore prices also lack upward momentum, and it is expected that imported iron ore prices will rise initially and then fall in the near term.

Image: https://ecdn6.globalso.com/upload/p/2550/image_other/2026-01/steel-supplier.webp

Domestic Metallurgical Coke Prices Remained Stable [https://www.steelfsd.com/]

Last week, domestic metallurgical coke prices remained generally stable. Metallurgical coke supply decreased while demand increased. The capacity utilization rate of 200 independent coking plants decreased slightly by 0.05%. Steel mill blast furnace operating rates increased by 0.39%, and daily average pig iron output increased by 15,500 tons, leading to a slight increase in metallurgical coke demand. Total coke inventory across the industry chain decreased slightly by 2,000 tons, while the number of days of inventory available at steel mills remained unchanged. Metallurgical coke futures performed flat, with intensified market competition. Some steel mills intend to push for a fifth round of price reductions for metallurgical coke, but coking plants are generally operating at a loss. Coupled with the possibility of a rebound in coking coal prices after mid-January 2026, coking plants are extremely reluctant to accept price reductions. The metallurgical coke market is expected to remain stable to slightly weak in the near term.

Domestic coking coal market prices remained stable with slight declines. [https://www.steelfsd.com/]

Last week, domestic coking coal market prices remained stable with slight declines. Online auction prices mostly fell, with a weekly comprehensive transaction rate of 66.9%. Prices of lean coal and semi-lean coal in Changzhi, Shanxi, fell by 50 yuan/ton. The fourth round of metallurgical coke price reductions were implemented, reducing coking plant profits, and there are still expectations of further price reductions for coking coal. Coking coal supply in January 2026 may increase compared to December 2025. Coking coal prices are expected to remain stable with a slight downward trend in the near term, while online auction prices are showing mixed movements.

Ferroalloy prices remained stable with a slight upward trend. [https://www.steelfsd.com/]

Last week, ferroalloy prices remained stable with a slight upward trend. Ferrosilicon prices rose slightly, with moderate market transactions. The output of sample production enterprises in the five major producing regions increased by 0.03 million tons in the fifth week of December 2025 compared to the previous period. The price of raw material semi-coke remained stable. Currently, some ferroosilicon producers have delivery dates in late January 2026, and overall quotations are relatively high. The ferroosilicon market is expected to remain stable with a slight upward trend in the near term. Port manganese ore spot prices remained stable with a slight upward trend; chemical coke prices remained stable, and most ferrosilicon and manganese enterprises are still operating at a loss. Recent increases in ferrosilicon and manganese futures prices have boosted market confidence, but some ferrosilicon and manganese manufacturers reported that current transaction follow-up is somewhat slow, and retail market activity is low. The ferrosilicon and manganese market is expected to remain stable with a slight upward trend in the near term.

High-carbon ferrochrome prices remained generally stable. Prices of raw materials chromium ore and chemical coke remained stable, with a strong wait-and-see attitude in the market. Overall market transactions have weakened recently, with most manufacturers focusing on fulfilling long-term contracts. Spot retail resources are scarce, and the market's trading and investment atmosphere is generally weak. The high-carbon ferrochrome market is expected to continue its stable operation in the near term.

Market transactions are sluggish. Some steel mills have reduced production or undergone maintenance, resulting in poor demand for vanadium alloys. Currently, a new round of steel mills is entering the market for procurement, with price differences in vanadium-nitrogen alloy bidding among different mills, while ferrovanadium bidding prices have not fluctuated significantly. The vanadium alloy market is expected to operate with slight fluctuations in the near term. Several steel mills have entered the market to purchase ferromolybdenum, releasing demand and boosting market confidence. On the raw material side, the price of molybdenum concentrate has risen sharply, increasing the production cost of ferromolybdenum. Ferromolybdenum prices are expected to continue to rise in the near term.

Contact Us for More Information

Email: manager@fsdsteel.com

Phone/Whatsapp: +86-18831507725

Media Contact

Company Name: Tangshan Fushunde Trading Co., Ltd.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=raw-materials-market-weekly-overview]

Country: China

Website: https://www.steelfsd.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Raw Materials Market Weekly Overview here

News-ID: 4341159 • Views: …

More Releases from ABNewswire

MT Dunn Plumbing Expands Emergency Services in Hillsboro & Across Portland, Oreg …

MT Dunn Plumbing LLC (CCB# 234243) expands 24/7 emergency services across Hillsboro, Beaverton, Portland & Washington County. The licensed, bonded, and insured contractor provides immediate response for burst pipes, water heater failures, sewer backups, and drain clogs. Operating from Hillsboro, owner Michael T Dunn serves residential and commercial properties region-wide. Emergency contact: 503-640-2458 or mtdunnplumbing.com.

Hillsboro, OR - MT Dunn Plumbing LLC, a licensed and established plumbing contractor serving the Portland…

Beyond the Prompt: How Mimic Motion Architecture is Redefining the 2026 Passive …

Image: https://www.abnewswire.com/upload/2026/02/ac57e1a7b6e53a95f52ea0f18fcb990c.jpg

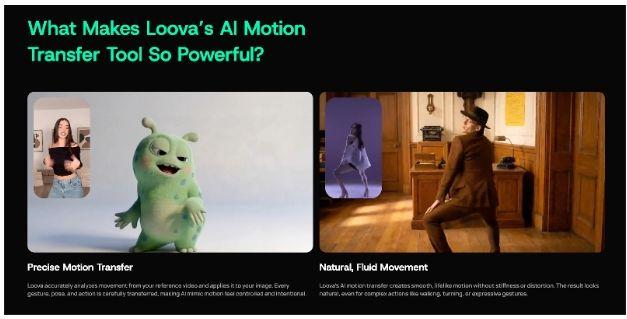

As we move through 2026, the digital economy is no longer just about "what" you show, but "how" it moves. Static content is losing ground to kinetic, motion-driven narratives that capture attention in seconds. At the center of this shift is Loova, whose proprietary Mimic Motion architecture has become the secret engine behind some of the most successful passive income streams this year.

This report breaks down the technical logic…

The Real Cost of Convenience: A Complete Guide to Vending Machine Startup Costs

Image: https://www.abnewswire.com/upload/2026/02/32ec9ac40420df59e70c21070d981def.jpg

The dream of earning passive income often leads aspiring entrepreneurs to the world of automated retail. It is a sector defined by low labor requirements and the ability to generate revenue around the clock. However, before you can stock your first row of snacks, you must understand the financial commitment required to get your equipment on-site. Many beginners find themselves asking how much do vending machines cost [https://dfyvending.com/vending-machine-startup-costs] as…

Benji Personal Injury Surpasses 1,000 Cases Won as California Accident Victims S …

Benji Personal Injury Accident Attorneys, A.P.C. has surpassed 1,000 personal injury cases resolved across California, reflecting a growing demand for trialready legal representation. The firm's litigationfirst approach has led to multimilliondollar verdicts and settlements, helping accident victims secure significantly higher compensation through courtroomfocused preparation.

LOS ANGELES, CA - Benji Personal Injury Accident Attorneys, A.P.C. announced today that the firm has successfully resolved over 1,000 personal injury cases, marking a significant milestone…

More Releases for Prices

Antimony Prices Update: Current Prices, Regional Trends & Forecast

The global Antimony Price Index has experienced notable fluctuations in recent months due to shifts in demand, supply constraints, and geopolitical factors. Monitoring the price of Antimony is crucial for manufacturers, traders, and investors seeking insights into market dynamics. This report provides an in-depth overview of Antimony Prices, including historical data, price trends, forecasts for 2026, and regional variations. Whether you are analysing the Antimony price chart or tracking Antimony…

Sodium Bromide Prices Q3 2025 | Regional Trend, Current Prices & Forecast

During the third quarter of 2025, Sodium Bromide Prices showed notable regional variations driven by industrial demand, production capacities, and supply dynamics. In September 2025, prices in the USA reached USD 3,123/MT, China USD 1,983/MT, India USD 1,810/MT, Spain USD 1,790/MT, and the Netherlands USD 1,785/MT. These figures indicate shifting dynamics in chemicals used across oil drilling, pharmaceuticals, and water treatment industries.

Monitoring the Sodium Bromide Price Trend Report helps manufacturers,…

Nitric Acid Prices 2025: Track Real-Time Prices

Nitric Acid Prices (Ex-Works China): YoY Trends and 2025 Outlook

The Nitric Acid market in China has experienced a significant decline in prices over the past year, driven by market fluctuations, demand uncertainties, and global supply chain challenges. Based on Ex-Works China pricing data, the price per ton of Nitric Acid dropped notably from 2023 to 2024.

Get the Real-Time Price Analysis: https://www.expertmarketresearch.com/price-forecast/nitric-acid-price-trends/requestsample

In October 2023, Nitric Acid was priced at USD 300…

Blueberries Prices, Trend, Chart, Monitor, Commodity Prices and Forecast

North America Blueberries Prices Movement Q4:

Blueberries Prices in United States:

In Q4 2024, Blueberries prices in the USA fluctuated, reaching 2,927 USD/MT in December. Rising consumer demand for healthy fruit options, government grants supporting cultivation, and advanced farming techniques to combat climate challenges and pests influenced market trends, contributing to price variations throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/blueberries-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…

R-PET Prices, Chart, Trend, News, Historical Prices Analysis and Forecast

𝗡𝗼𝗿𝘁𝗵 𝗔𝗺𝗲𝗿𝗶𝗰𝗮 𝗥-𝗣𝗘𝗧 𝗣𝗿𝗶𝗰𝗲𝘀 𝗠𝗼𝘃𝗲𝗺𝗲𝗻𝘁 𝗤𝟯:

𝗥-𝗣𝗘𝗧 𝗣𝗿𝗶𝗰𝗲𝘀 𝗶𝗻 𝗨𝗦𝗔:

In Q3 2024, R-PET prices in the United States held steady at 1150 USD/MT in September, reflecting a balanced market where supply and demand were in equilibrium. This stability came despite ongoing economic uncertainties, which typically create volatility in the market. The U.S. R-PET sector demonstrated resilience, adjusting effectively to both local requirements and global market conditions.

Factors such as consistent recycling…

Methionine Prices, Graph, Price Chart, Trend, Forecast | Chemical Prices Report

𝐔𝐧𝐢𝐭𝐞𝐝 𝐒𝐭𝐚𝐭𝐞𝐬 𝐌𝐞𝐭𝐡𝐢𝐨𝐧𝐢𝐧𝐞 𝐏𝐫𝐢𝐜𝐞𝐬 𝐌𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐐𝟒

𝐌𝐞𝐭𝐡𝐢𝐨𝐧𝐢𝐧𝐞 𝐏𝐫𝐢𝐜𝐞𝐬 𝐢𝐧 𝐔𝐒𝐀:

In December 2023, the Prices of Methionine in the United States reached $2,830 per metric ton for DL Methionine Feed Grade. The market experienced different trends for food-grade and feed-grade methionine. Food-grade methionine prices decreased because of increased competition in the market and lower consumer spending, which reduced demand. On the other hand, the demand for feed-grade methionine stayed steady, mainly because…