Press release

Buy Now Pay Later (BNPL) Market to Reach Explosive Growth by 2033, Fueled by E-Commerce Boom, Fintech Innovation, and Consumer Demand for Flexible Payments | DataM Intelligence

The global Buy Now Pay Later (BNPL) market is experiencing explosive growth as consumers increasingly seek interest-free installment options amid rising e-commerce penetration and economic pressures. Valued at US$ 35.47 billion in 2023 and US$ 42.78 billion in 2024, the market is forecasted to surge to US$ 238.56 billion by 2033, expanding at a robust CAGR of 21.04% from 2025-2033.Buy Now, Pay Later (BNPL) is a short-term financing solution that allows consumers to purchase goods or services immediately and pay for them in installments over time. It typically offers interest-free payments if settled within the agreed period. BNPL services are integrated at the point of sale, both online and in-store, enabling quick approvals with minimal credit checks. The model enhances consumer purchasing power and improves conversion rates for merchants. BNPL is widely used in retail, e-commerce, and digital payments ecosystems.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID): https://www.datamintelligence.com/download-sample/buy-now-pay-later-market?rk

Recent Developments:

United States: Recent Industry Developments

✅ In July 2025, major U.S. retailers expanded Buy Now, Pay Later options at checkout to boost conversion rates and average order values. The integration is particularly focused on e-commerce and omnichannel retail environments.

✅ In June 2025, leading BNPL providers in the U.S. enhanced credit risk assessment models using AI and alternative data. These upgrades aim to improve approval accuracy while managing rising consumer credit risk.

✅ In May 2025, U.S. regulators increased oversight of BNPL services, encouraging greater transparency in fee disclosures and consumer protection. The developments are shaping more standardized practices across the BNPL ecosystem.

Japan: Recent Industry Developments

✅ In July 2025, Japanese e-commerce platforms expanded BNPL offerings to cater to younger consumers seeking flexible payment options. The services are being positioned as alternatives to traditional credit cards.

✅ In June 2025, Japanese fintech firms partnered with retailers to embed BNPL solutions directly into digital checkout systems. The focus is on seamless user experience, fraud prevention, and instant credit decisioning.

✅ In May 2025, Japan's Financial Services Agency (FSA) signaled closer monitoring of deferred payment services. The move aims to ensure responsible lending practices while supporting fintech innovation.

Market Overview and Segment Analysis:

Buy Now Pay Later represents a fintech-driven evolution in consumer finance, allowing instant purchases with deferred payments typically spread over four interest-free installments, integrated seamlessly into online and point-of-sale checkouts. These solutions leverage AI for real-time credit assessments, enhancing accessibility while minimizing risk for providers and retailers.

The market segments primarily by:

Channel:

Online (dominant, holding ~40% share in 2024, fueled by e-commerce giants and seamless digital integration)

Point-of-Sale (POS, growing in physical retail for high-value items like electronics and fashion)

Online BNPL resonates with Millennials and Gen Z, reducing cart abandonment and boosting average order values through promotions like zero-interest plans.

Enterprise Size:

Large enterprises (leading due to scale and partnerships with global platforms)

SMEs (rapidly adopting for competitive edge in local markets)

End-User Verticals:

Retail and fashion (core adoption areas)

Consumer electronics, healthcare, travel, BFSI, media/entertainment, others

Fashion and electronics drive volume, with healthcare and travel emerging as high-growth niches amid rising costs.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/buy-now-pay-later-market?rk

Market Drivers and Opportunities:

Key forces propelling BNPL adoption include surging e-commerce volumes, smartphone proliferation, and a shift toward flexible financing over rigid credit models. Strategic partnerships between fintechs, retailers, and banks such as PAYONE with PayPal and Volksbanken Raiffeisenbanken are embedding BNPL into payment ecosystems, enhancing reach and trust.

Merchants benefit from 20-30% higher conversions and larger baskets, while consumers gain affordability without debt traps from traditional loans.

Opportunities abound in:

AI-enhanced credit scoring and personalized repayment plans for broader inclusion in emerging markets.

Expansion into offline retail and new verticals like healthcare and education via POS integrations.

Cross-border collaborations tapping unbanked populations in Asia-Pacific and Latin America.

Despite restraints like rising default risks and debt accumulation, regulatory focus on transparency is fostering sustainable growth.

Regional Market Dynamics:

Growth varies by maturity and digital readiness:

North America commands ~30-40% global share, led by the U.S. with mature infrastructure, high e-commerce (e.g., Amazon integrations), and providers like Affirm driving adoption in fashion and electronics. Advanced fintech and consumer protections sustain its dominance.

Asia-Pacific emerges as the fastest-growing region at elevated CAGRs, propelled by digitalization in India, China, Indonesia, and Southeast Asia. Massive youth demographics, underbanked populations, and e-commerce surges (e.g., Flipkart partnerships) fuel 18.6%+ shares, with local players like Atome thriving.

Europe advances through regulated innovation in the UK and Germany, balancing consumer safeguards with fintech agility. Emerging markets in Middle East/Africa and South America gain traction via mobile-first models amid urbanization.

Competitive Landscape:

The BNPL arena features dynamic competition among pure-play fintechs and diversified giants, moderately consolidated with room for innovators. Key players include Affirm, Inc., Klarna Inc., Splitit USA Inc., Sezzle, Perpay Inc., Zip Co, Ltd, Afterpay, Openpay, PayPal Holdings, Inc., LatitudePay Financial Services.

Buy Now: https://www.datamintelligence.com/buy-now-page?report=buy-now-pay-later-market?rk

Future Outlook:

BNPL will anchor modern payments through 2033, evolving into a mainstream alternative to credit cards as e-commerce hits new peaks and Gen Z enters prime spending years. Expect deeper AI personalization, embedded finance in apps, and hybrid online-offline models amid regulatory maturation.

Innovations like BNPL for services (travel, insurance) and B2B extensions promise sustained momentum, with Asia-Pacific challenging North America's lead. Ultimately, BNPL's blend of convenience, inclusion, and merchant value positions it as indispensable in a cashless, digital-first economy.

For comprehensive insights, forecasts, and competitive intelligence on this market, visit DataM Intelligence's dedicated crypto asset management report page.

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Buy Now Pay Later (BNPL) Market to Reach Explosive Growth by 2033, Fueled by E-Commerce Boom, Fintech Innovation, and Consumer Demand for Flexible Payments | DataM Intelligence here

News-ID: 4340873 • Views: …

More Releases from DataM Intelligence 4market Research LLP

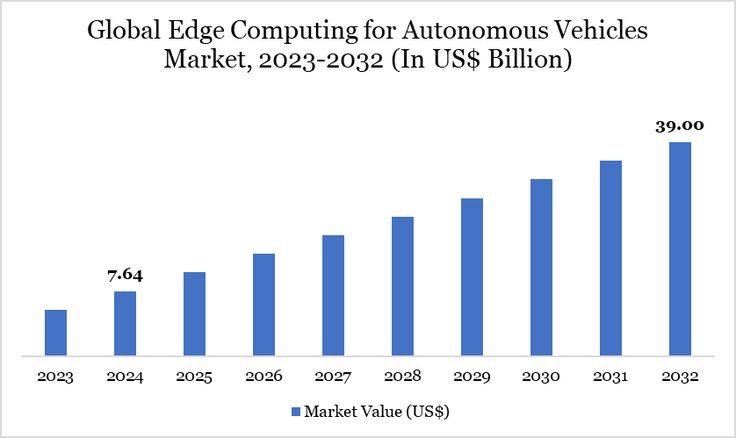

United States Edge Computing for Autonomous Vehicles Market Projected to Reach U …

Leander, Texas and Tokyo, Japan - Jan.08.2026, As per DataM intelligence research report "The Edge Computing for Autonomous Vehicles Market reached US$ 7.64 billion in 2024 and is expected to reach US$ 39.00 billion by 2032, growing at a CAGR of 22.60% during the forecast period 2025-2032." Integration of 5G networks for ultra-low latency, real-time sensor data processing, and enhanced V2X communication are accelerating adoption of edge computing in autonomous…

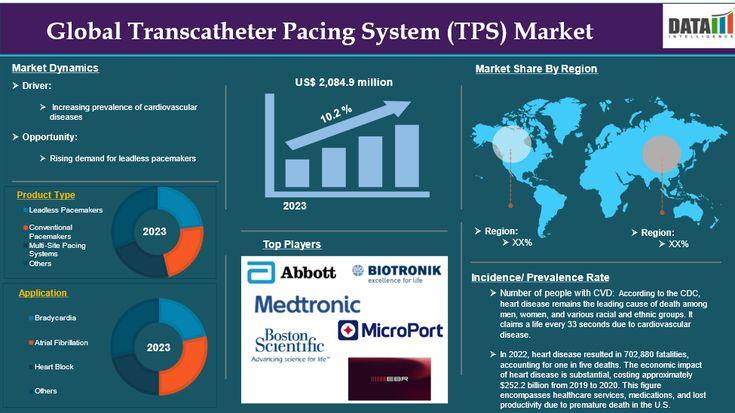

United States Transcatheter Pacing System Market Projected to Reach US$ 1.52 Bil …

Leander, Texas and Tokyo, Japan - Jan.08.2026. As per DataM intelligence research report "The Transcatheter Pacing System Market reached US$ 2,084 million in 2023 and is expected to reach US$ 4,518 million by 2031, growing at a CAGR of 10.2% during the forecast period 2024-2031." Minimally invasive implantation, reduced complication risks, and advancements in leadless technology are driving adoption of transcatheter pacing systems for bradyarrhythmias.

Download your exclusive sample report today:…

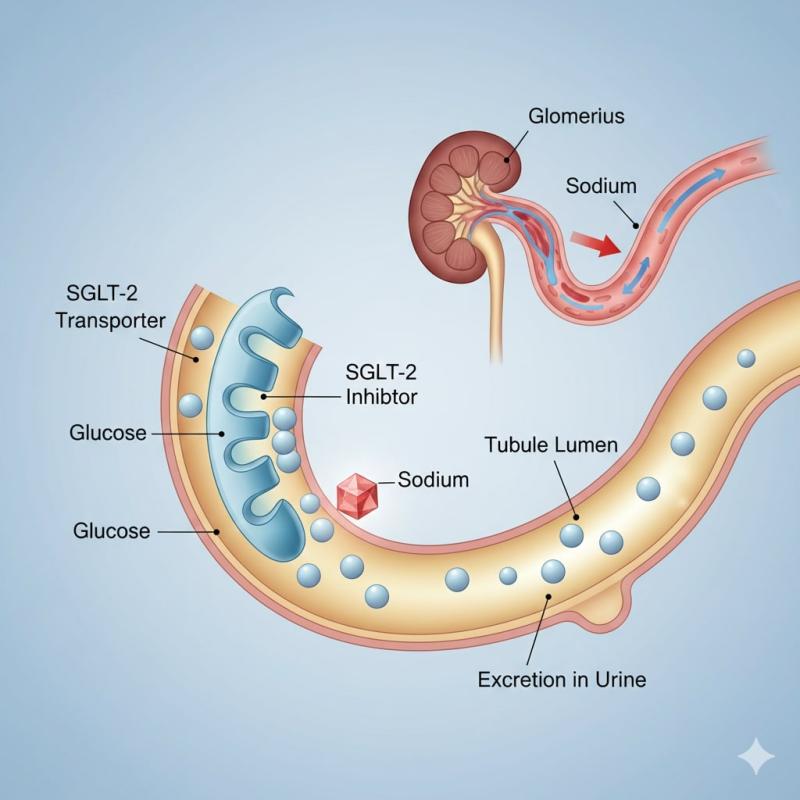

United States Propel SGLT-2 Inhibitors Market at 7.1% CAGR on Expanding Cardiore …

Leander, Texas and Tokyo, Japan - Jan.08.2026

As per DataM Intelligence research report "SGLT-2 Inhibitors Market reached US$ 17.95 billion in 2024 and is expected to reach US$ 32.16 billion by 2033, growing with a CAGR of 7.1% from 2025 to 2033." Rising prevalence of type 2 diabetes, expanding indications for cardiorenal protection (heart failure and chronic kidney disease), new product approvals, and increasing adoption in emerging markets are fueling growth…

Crypto Asset Management Market Outlook, Technology Evolution, and Growth Opportu …

The global crypto asset management market reached around US$ 1.74 billion in 2023, increased to approximately US$ 1.89 billion in 2024, and is projected to hit about US$ 15.87 billion by 2033, reflecting a strong CAGR of nearly 26.7% during 2025-2033. This robust trajectory is underpinned by accelerating institutional participation, stronger regulatory frameworks, and rapid innovation across custody, trading, and analytics platforms.

Crypto Asset Management refers to the professional management of…

More Releases for BNPL

How New BNPL Regulations Will Transform Ecommerce Technology Infrastructure

The UK government's announcement of comprehensive Buy Now Pay Later regulations represents more than just consumer protection measures-it signals a fundamental shift in how payment technology will operate across ecommerce platforms. As these rules prepare to take effect next year, technology teams, payment processors, and platform developers face the challenge of rebuilding infrastructure that has largely operated in an unregulated environment since BNPL's explosive growth began.

The regulatory framework demands sophisticated…

The Malaysia BNPL Market is growing owing to Digitalization, Rising Tech-Savvy P …

Focus On Shifting Preference Towards BNPL And Adoption of Online Payments Technology Are Major Factor Contributing Towards Development of BNPL Market in Malaysia

Adoption within Retail: With e-commerce growing faster than before the pandemic, it presents a big opportunity due to increased online payments. This coupled with the fact that BNPL giants have witnessed immense adoption within retail and the wider community is a major growth driver for BNPL industry in…

PayNXT360 Expects the BNPL Industry in Netherlands to Grow at a CAGR of 32.8% Du …

BNPL payment industry in the Netherlands has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 74.8% on annual basis to reach US$ 7606.1 million in 2022.

Medium to long term growth story of BNPL industry in the…

PayNXT360 Expects the Norway BNPL Industry to Grow at a CAGR of 17.5% During 202 …

BNPL payment industry in Norway has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in the country is expected to grow by 39.8% on annual basis to reach US$ 6358.9 million in 2022.

Medium to long term growth story of BNPL industry in Norway remains…

PayNXT360 Expects the Russian BNPL Industry to Grow at a CAGR of 45.3% During 20 …

According to PayNXT360’s Q4 2021 BNPL Survey, BNPL payment in Russia is expected to grow by 91.9% on annual basis to reach US$ 7361.2 million in 2022.

Medium to long term growth story of BNPL industry in Russia remains strong. The BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 45.3% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from…

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL Payment in Switzerland is E …

BNPL payment industry in Switzerland has recorded strong growth over the last four quarters, supported by increased ecommerce penetration along with impact of economic slowdown due to disruption caused by Covid-19 outbreak.

According to PayNXT360’s Q2 2021 BNPL Survey, BNPL payment in the country is expected to grow by 49.6% on annual basis to reach US$ 1020.4 million in 2021.

Medium to long term growth story of BNPL industry in Switzerland remains…