Press release

United States Payment Processing Solutions Market Growth Drivers & Challenges | Global Industry Insights

Payment Processing Solutions Market analysis report presents a comprehensive evaluation of the market size, current trends, competitive landscape, and future market outlook 2024-2031Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/payment-processing-solutions-market?kb

United States: Recent Industry Developments

✅ December 2025: Major U.S. payment platforms rolled out enhanced fraud prevention tools leveraging AI to protect merchants and consumers.

✅ November 2025: Buy‐Now‐Pay‐Later (BNPL) integration expanded across payment gateways, offering more flexible checkout options.

✅ October 2025: Increased adoption of contactless and mobile wallet payments drove investments in seamless in‐store and online experiences.

Japan: Recent Industry Developments

✅ December 2025: Japanese fintech firms partnered with global payment networks to improve cross‐border settlement speed and transparency.

✅ November 2025: QR‐based and digital wallet payment usage continued to rise, especially in retail and hospitality sectors.

✅ October 2025: Domestic payment processors enhanced support for multi‐currency transactions to boost inbound tourism commerce.

List of Top Key Player:

ShipMoney, PayPal, Stripe, Adyen, Wirecard, PayU, CCBill, First Data, OceanPay, Equian, MarTrust Corporation Ltd., TridentTrust, Sea Alliance Ltd., Wilhelmsen, Riga Accounting Hub, BachmannHR Group.

Forecast Projection:

The Global Payment Processing Solutions Market is poised for significant growth between 2025 and 2032. In 2024, the market maintained a steady upward trajectory, and with strategic initiatives by leading players accelerating adoption, the market is expected to soar throughout the forecast period. Companies leveraging these trends are well-positioned to capture emerging opportunities and maximize revenue potential.

Latest M&A

1. Global Payments announced a USD 24.25 billion acquisition of Worldpay from FIS in 2025, consolidating payment processing capabilities.

2. FIS responded with a USD 13.5 billion acquisition of Global Payments' issuer solutions, marking intense consolidation in the payments sector.

3. Deutsche Bank formed merchant solutions JV with Mastercard and cross-border payment JV with Ant International

Market Intelligence Research Process:

The Payment Processing Solutions Market research report by DataM Intelligence combines primary and secondary data to deliver deep, actionable insights. It examines the full spectrum of factors shaping the industry, from government regulations and market conditions to competitive dynamics, historical trends, technological breakthroughs, upcoming innovations, and potential challenges. This comprehensive analysis not only highlights growth prospects but also identifies barriers, equipping businesses to navigate market volatility and capitalize on emerging opportunities.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=payment-processing-solutions-market?kb

Key Segmentation:

By Payment Method: Credit Card, Debit Card, Ewallet, Others

By Verticals: Maritime, Retail, Hospitality, Utilities & Telecommunication, Others

Growth Regional Analysis:

⇥ North America - 40%

Dominates due to high digital payment adoption and advanced fintech infrastructure.

⇥ Europe - 28%

Strong market driven by regulatory support and widespread use of contactless payments.

⇥ Asia-Pacific - 22%

Rapid growth fueled by mobile wallet penetration and e-commerce expansion.

⇥ Middle East & Africa - 6%

Emerging market supported by increasing digital banking and financial inclusion efforts.

⇥ South America - 4%

Growing adoption influenced by fintech startups and expanding e-commerce activities.

Benefits of the Report:

Chapter 1 - Market Overview: Kickstarts the report with a comprehensive snapshot of the Payment Processing Solutions Market, summarizing key segments by region, product type, and application. Highlights include market size, segment growth potential, and short- & long-term industry outlook.

Chapter 2 - Emerging Trends: Uncovers the game-changing trends and high-impact innovations shaping the future of the industry.

Chapter 3 - Competitive Landscape: Offers a deep dive into market competition, detailing revenue shares, strategic initiatives, and recent mergers & acquisitions.

Chapter 4 - Top Player Profiles: Features detailed company profiles, covering revenue, profit margins, product lines, and major milestones for leading market players.

Chapters 5 & 6 - Regional & Country Analysis: Breaks down revenue performance across global regions, providing insights on market sizes, opportunities, and growth prospects worldwide.

Chapter 7 - Segmentation Analysis: Explores market segmentation by type, revealing high-potential categories and guiding businesses towards lucrative areas.

Chapter 8 - Application Insights: Examines downstream markets and identifies promising sectors for expansion, showing how different applications are driving growth.

Chapter 9 - Supply Chain Mapping: Maps the entire industry supply chain, highlighting upstream and downstream activities for a holistic market perspective.

Chapter 10 - Key Takeaways: Concludes with critical insights and actionable strategies, equipping stakeholders to make informed decisions and stay ahead in the market.

Latest News

1. Bank M&A accelerated in 2025 with 150+ deals, driven by scale for digital transformation, AI, and fintech integration; payments processors top targets.

2. Payments sector saw 215 acquisitions from 1997-2025, with 8 in last 2 years showing moderate activity amid AI boom and regulatory changes.

3. 2026 trends: agentic AI commerce, invisible payments, real-time settlement, biometric checkout, and orchestration for multi-rail management

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/payment-processing-solutions-market?kb

Recent Product Launches

✦ Razorpay launched Agentic Payments, Omnichannel Payments, ACS (95.3% success biometric card auth), POS Command Centre, CardSync, UPI Autopay Interoperability at GFF 2025

✦ RBI unveiled AI-based UPI HELP, IoT Payments with UPI, Banking Connect, UPI Reserve Pay at GFF 2025.

✦ Wipro launched TelcoAI360 at MWC 2025 for AI-first managed services in payments/networking

Request 2 Days Free Trials with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United States Payment Processing Solutions Market Growth Drivers & Challenges | Global Industry Insights here

News-ID: 4340678 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

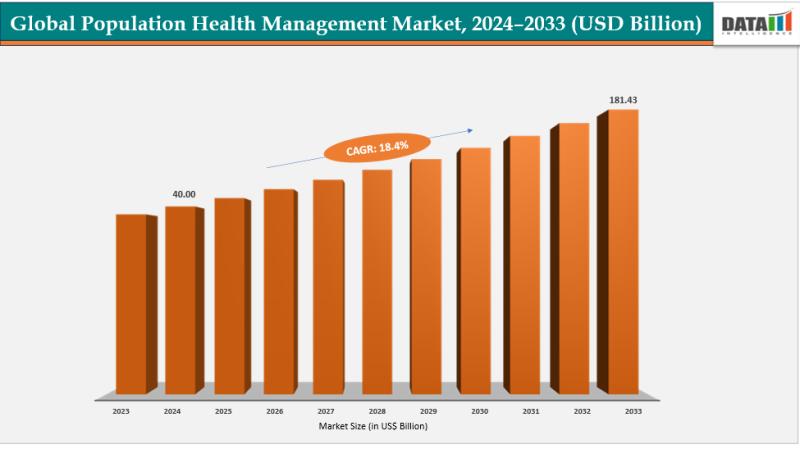

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

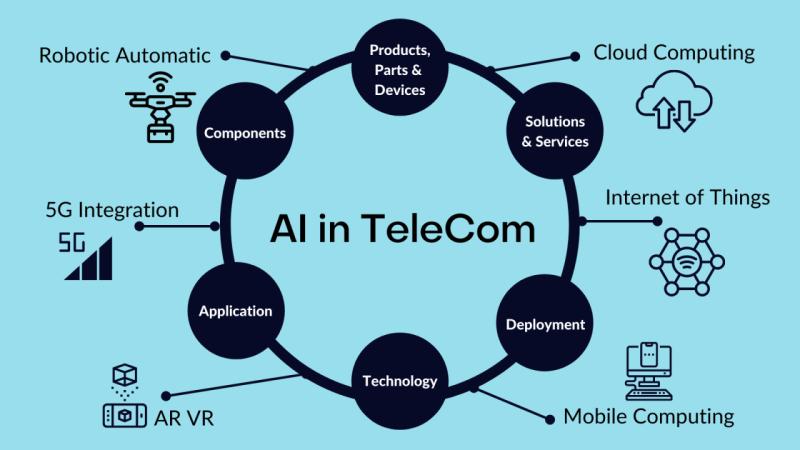

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…