Press release

ChartDetector.ai Introduces AI-Driven Risk Validation for Market Analysis Across Stocks, FX, and Commodities

Zurich, Switzerland - ChartDetector.ai, a financial technology platform focused on disciplined market analysis, has introduced an AI-powered approach designed to help traders and analysts validate risk before entering trades across stocks, foreign exchange, and commodity markets.As market volatility remains elevated and correlations across asset classes increase, many traders struggle no't with identifying direction, but with execution and risk definition. Industry observers note that incorrect entries, unclear invalidation levels, and emotional decision-making continue to be among the primary causes of inconsistent trading performance.

ChartDetector.ai addresses this challenge by emphasizing pre-trade validation rather than price prediction. The platform applies artificial intelligence to chart analysis, market structure evaluation, and multi-market context to help users assess whether a potential trade setup is supported by objective risk conditions.

"Most traders focus on where price might go, but fewer spend enough time validating where they are wrong," said Roderick Warren, founder of ChartDetector.ai. "Our goal is to help market participants approach trading with the same discipline used in professional environments, where risk is defined before capital is committed."

The platform is designed to support analysis across multiple asset classes, allowing traders to evaluate market structure, key levels, and broader conditions that influence trade outcomes. By integrating AI-driven analysis into the decision-making process, ChartDetector.ai aims to reduce cognitive bias and encourage more consistent, process-driven trading behavior.

Market professionals increasingly recognize that access to more indicators does not necessarily lead to better decisions. Instead, clarity around risk, invalidation, and context has become a critical differentiator, particularly in fast-moving markets influenced by macroeconomic data, liquidity shifts, and cross-market dynamics.

ChartDetector.ai positions its technology as a complementary tool rather than a replacement for trader judgment. The platform is intended to act as a secondary layer of confirmation, helping users validate setups and identify potential weaknesses before executing trades.

"Artificial intelligence does not remove uncertainty from markets," Warren added. "What it can do is help traders engage with uncertainty in a more structured and objective way."

As trading environments continue to evolve, tools that support disciplined risk management and data-driven analysis are expected to play a growing role in how traders and analysts approach market participation.

About ChartDetector.ai

ChartDetector.ai is an AI-powered market analysis platform designed to support disciplined trading decisions across stocks, foreign exchange, and commodity markets. The platform focuses on pre-trade risk validation, structural analysis, and market context to help traders reduce emotional bias and improve decision quality.

Media Contact

Company Name: ChartDetector.ai

Contact Person: Roderick Warren

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=chartdetectorai-introduces-aidriven-risk-validation-for-market-analysis-across-stocks-fx-and-commodities]

City: Zurich

Country: Switzerland

Website: https://chartdetector.ai/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ChartDetector.ai Introduces AI-Driven Risk Validation for Market Analysis Across Stocks, FX, and Commodities here

News-ID: 4336523 • Views: …

More Releases from ABNewswire

Newman's Brew Proves Smooth, Flavorful Coffee Begins with Ethical Sourcing and P …

Newman's Brew has built its reputation on delivering the smoothest coffee available by combining organic bean sourcing with fresh-per-order roasting. The rapidly expanding company demonstrates that ethical business practices and exceptional product quality are not mutually exclusive, while supporting abandoned animal feeding programs as part of its commitment to positive social impact.

In an industry where freshness is often sacrificed for operational convenience, Newman's Brew has chosen a different path. The…

Playground Play Equipment Innovation Sets New Benchmark for Safe, Engaging Space …

As schools, communities, and commercial venues worldwide continue to invest in healthier and more inclusive outdoor environments, playground play equipment [https://www.indooroutdoorplayground.com/what-makes-playground-play-equipment-truly-safe-and-engaging/] is entering a new era-one defined by higher safety standards, smarter design, and broader community engagement. Golden Times (Wenzhou Golden Times Amusement Toys CO., LTD.) today announced an expanded product and market strategy focused on delivering next-generation playground solutions that balance safety, durability, and creativity.

Industry expectations for playgrounds have…

Time.so Reports 300% Growth in Business Users

Time.so reports 300% growth in business users as global teams rely on its fast world clock, city times, time zones, and weather for planning.

Jan 31, 2026 - Time.so today announced a 300% increase in business users, reflecting rising demand for dependable time data across distributed teams, global customer support, and cross border operations.

The surge follows a clear shift in how companies schedule work. Meetings span continents. Deadlines move with daylight…

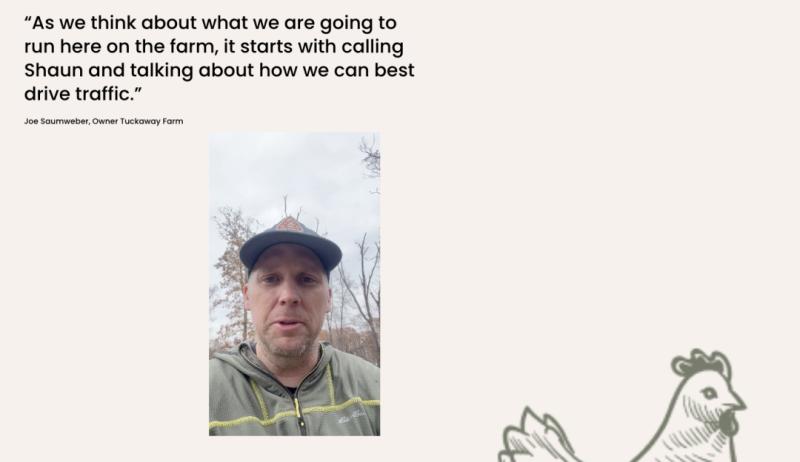

Shaun Savvy Helps Tuckaway Farm in Bentonville, Arkansas Sell Out Two CSA Season …

Buffalo-based SEO consultant Shaun Savvy partnered with Tuckaway Farm in Bentonville, Arkansas to help the farm sell out two consecutive CSA seasons, generating over $80,000 in revenue while spending less than $1,000 on paid advertising through a strategic blend of local SEO, high-intent content, and targeted social media campaigns.

Shaun Savvy, a Buffalo-based SEO and digital marketing consultant, announced a successful local marketing case study showcasing how Tuckaway Farm sold out…