Press release

Securities Lending Market to Reach $12,157.3 Million In 2024 in The Short Term And $21,499.9 Million By 2034 globally, At 5.7% CAGR

Allied Market Research published a report titled, "Securities Lending Market - Global Opportunity Analysis and Industry Forecast, 2024-2034," valued at $12,1573.3 million in 2024. The market is expected to grow at a CAGR of 5.7% from 2025 to 2034, reaching $21,499.9 million by 2034. Key factors fueling this growth include rise in demand for short selling, focus on collateral and liquidity management, and the growth of passive investing to enhance portfolio returns and generate additional revenue through securities lending programs.Get a Sample Copy of this Report: https://www.alliedmarketresearch.com/request-sample/A325782

Report Overview:

Rise in demand for short selling and the increased focus on collateral and liquidity management have driven the demand for securities lending activities, prompting market participants to enhance operational efficiency and risk management frameworks. In addition, the growth of passive investing is driving the expansion of lendable asset pools, further accelerating overall market growth.

However, the regulatory constraints and capital requirements, along with operational challenges, pose significant restraints. Conversely, the expansion into alternative assets within the securities lending landscape presents significant opportunities for market players.

Key Segmentation Overview:

The securities lending market is segmented based on type, borrower, and region.

Securities Type: Equities, Government Bonds, Corporate Bonds, and Others.

By Borrower: Hedge Funds, Large Asset Managers, Pensions Fund, and Retail Brokers

By Region:

North America (U.S., and Canada)

Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

LAMEA (Brazil, South Africa, UAE, Saudi Arabia, Rest of LAMEA)

Market Highlights

By type, the equities segment dominated the market in 2024 and is expected to continue leading due to increasing short-selling activities, growth of e-commerce, securities lending regulations, and increase in the adoption of digital platforms.

By borrower, the hedge funds segment witnessed significant growth due to growing demand for borrowed securities due to market volatility, adoption of alternative lending strategies, and the government's regulations aimed at enhancing transparency, reducing counterparty risk, and improving market stability.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A325782

Regulatory constraints and capital requirements

Retail investor participation and awareness

Factors Affecting Market Growth & Opportunities:

The rising demand for short selling for improved customer engagement, and the need for efficient portfolio management has propelled the growth of the securities lending market. Factors such as the increased emphasis on collateral and liquidity management, enabling better risk mitigation, operational efficiency, and capital optimization along with the expansion of passive investing enabling a broader and more stable supply of lendable assets in securities lending are driving the market forward.

Demand for Short Selling: The growing use of short selling by institutional investors is boosting demand for securities lending. Market conditions that favor bearish strategies often lead to increased lending activity.

Innovations in Securities Lending: The integration of advanced technologies like AI and machine learning helps optimize portfolio lending strategies and collateral management. Meanwhile, blockchain-based smart contracts can speed up settlements and lower counterparty risk.

However, challenges such as regulatory constraints, capital requirements, and limited retail investor participation and awareness remain concerns for industry players. Market participants are focusing on enhancing transparency, technological infrastructure, and educational initiatives to ensure accessible, compliant, and efficient securities lending solutions.

Request Customization: https://www.alliedmarketresearch.com/request-for-customization/A325782

Regulatory Landscape & Compliance:

The securities lending market operates within a highly regulatory landscape, shaped by various global, regional, and national frameworks aimed at ensuring transparency, market integrity, and risk mitigation. These regulations are designed to ensure fair practices, protect investors, and reduce systemic risk through reporting, collateral standards, and compliance measures. Key regulations such as the Securities Financing Transactions Regulation (SFTR) in Europe and Rule 10c-1 under the U.S. Securities Exchange Act mandate detailed reporting and disclosure of securities lending activities. Compliance in securities lending aims to ensure transparency, protect investors, manage risks effectively, and uphold market integrity by enforcing strict standards for reporting, consent, and collateral management.

Recent regulations aim to modernize securities lending by enhancing transparency through centralized reporting, encouraging fair pricing practices, and fostering innovation in collateral management-all while ensuring investor protection and maintaining market stability.

Technological Innovations & Future Trends:

The integration of digital assets into securities lending is expanding beyond traditional equities and bonds. Institutional players are entering the digital asset space, lending cryptocurrencies and tokens, thereby increasing liquidity in digital markets.

Synthetic securities lending offers the benefits of traditional lending without transferring assets, providing flexibility and potential tax advantages.

Blockchain boosts transparency and efficiency in securities lending by using a decentralized, immutable ledger. It speeds up settlements, enhances security, and automates tasks like collateral management through smart contracts, reducing errors and streamlining transactions.

Regional Insights

North America dominated the securities lending market owing to increase in leading financial institutions making strategic investments in fintech platforms such as equilend to modernize securities lending infrastructure and foster innovation. In addition, the inclusion of digital assets and other non-traditional forms as acceptable collateral providing greater flexibility and opening new revenue streams for lenders fuels the growth of the market in this region. The U.S. leads the securities lending market in this region due to its robust financial infrastructure, high volume of institutional trading, and a well-regulated environment supported by agencies like the SEC. The country's advanced equity markets, such as the NYSE and NASDAQ, provide ample opportunities for securities lending, especially for hedge funds and asset managers engaging in short-selling and arbitrage strategies. For instance, in March 2025, EquiLend, a global securities lending platform, received a minority investment from a BNY Mellon affiliate. This adds to the group of eight financial institutions backing EquiLend's efforts to improve securities finance infrastructure across multiple regions.

LAMEA is expected to witness rapid growth during the forecast period, driven by factors such as technological advancements, evolving regulatory frameworks, and shifting investor preferences. In addition, the government's stringent regulations aim to increase market stability and transparency, encouraging broader participation in securities lending by ensuring that transactions are properly collateralized and transparent, thereby contributing to market growth in the region. Brazil stands out as a dominant player in the securities lending industry in Latin America, due to its well-developed financial infrastructure, stringent regulatory framework, and high participation from both domestic and international investors. In Africa, South Africa boasts the most advanced financial infrastructure, supporting lending activities in both government and corporate bonds. The United Arab Emirates is emerging in the Middle East, with government-led initiatives aimed at attracting global investors and modernizing its capital markets.

Key Players:

Major players in the securities lending market include BNP Paribas, State Street Corporation, JPMorgan Chase & Co, Goldman Sachs Group, UBS, The Charles Schwab Corporation, ClearStream, Deutsche Bank AG, Societe Generale, Mizuho Securities Co., Ltd., Royal Bank of Canada, SIX Group Services Ltd., Invesco Ltd, StoneX Group Inc, and The Bank of New York Mellon Corporation. These companies are focusing on expanding their service offerings, strategic partnerships, and enhancing digital accessibility, customer outreach, and financial inclusion in the securities lending industry.

Key Strategies Adopted by Competitors

In May 2025, UBS Group AG partnered with General Atlantic to focus on expanding access to private credit opportunities. The collaboration brings together UBS's global investment banking and advisory capabilities with General Atlantic Credit's expertise in private credit investing. The partnership aims to deliver a broader range of direct lending and credit solutions to clients, leveraging both firms' global networks and origination strengths. It also includes the integration of professionals from UBS Asset Management's Credit Investments Group into a dedicated private credit team led by GA Credit, enhancing UBS's capital markets platform and private credit reach.

In June 2023, StoneX Group Inc. launched its prime brokerage offering with the launch of a multi-asset CASS-compliant custody solution and new financing capabilities, including repo financing and securities lending. This initiative, under the StoneX Institutional Prime brand, is designed to support mid-tier hedge funds with a full suite of services-ranging from execution and custody to financing and hedging. The platform offers global equities and fixed income execution, portfolio swap and repo financing, and capital introduction services. This expansion also includes key leadership hires to strengthen its London-based prime services team.

Buy Now: https://bit.ly/4qIQXnx

What are the Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the securities lending market outlook from 2024 to 2034 to identify the prevailing securities lending market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the securities lending market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global securities lending market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the securities lending market analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Trending Reports:

Valuables Insurance Market https://www.alliedmarketresearch.com/valuables-insurance-market-A14958

Variable life Insurance Market https://www.alliedmarketresearch.com/variable-life-insurance-market-A115234

Stop Loss Insurance Market https://www.alliedmarketresearch.com/stop-loss-insurance-market-A325806

Securities Lending Market https://www.alliedmarketresearch.com/securities-lending-market-A325782

UK Extended Warranty Market https://www.alliedmarketresearch.com/uk-extended-warranty-market-A308670

Microinsurance Market https://www.alliedmarketresearch.com/microinsurance-market-A11439

Cross border Payments Market https://www.alliedmarketresearch.com/cross-border-payments-market-A288119

Travel Insurance Market https://www.alliedmarketresearch.com/travel-insurance-market

Tax Preparation Software Market https://www.alliedmarketresearch.com/tax-preparation-software-market-A125319

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Securities Lending Market to Reach $12,157.3 Million In 2024 in The Short Term And $21,499.9 Million By 2034 globally, At 5.7% CAGR here

News-ID: 4335681 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

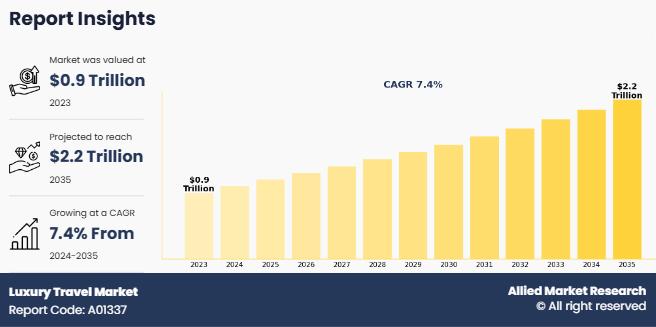

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Securities

Supply Chain Securization Market 2023 | Futuristic Technology- Debon Securities, …

The Supply Chain Securization market research report delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. The Supply Chain Securization report also incorporates the current and future global market outlook in the emerging and developed markets. Moreover, the report also investigates regions/countries expected to witness the fastest growth rates during the forecast period.

The Supply Chain Securization research report also provides insights of different…

Supply Chain Securization Market 2022: Industry Manufacturers Forecasts- Debon S …

The Supply Chain Securization research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Supply Chain Securization market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

New Era of Triennial OTC Derivatives Market 2019 Technological Advancement, Tren …

Global Triennial OTC Derivatives Report inspect the Market Size, Share, Demand, Growth Rate, Trend, Business Opportunity, Industry Applications, Analysis and Forecast to 2019-2025. It is based on advance Technology, upcoming growth opportunities. The market is classified into different segments based on regions, application and end-user.

Get Sample Copy @ https://www.orianresearch.com/request-sample/767774 …

Triennial OTC Derivatives Market Projected to Register a Healthy CAGR Wth GF Sec …

Worldwide Market Reports has announced the addition of the “Global Triennial OTC Derivatives Market Size Status and Forecast 2022”, The report classifies the global Triennial OTC Derivatives Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth

This report studies the Triennial OTC Derivatives market, Triennial OTC Derivatives are contracts that are traded (and privately negotiated) directly between two parties,…

Global Triennial OTC Derivatives Market 2017 - GF Securities, ZHONGTAI Securitie …

This report studies the Triennial OTC Derivatives market, Triennial OTC Derivatives are contracts that are traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary. Products such as swaps, forward rate agreements, exotic OTC Options– and other exotic derivatives – are almost always traded in this way.

Scope of the Report:

This report focuses on the Triennial OTC Derivatives in Global market, especially in North America,…

Triennial OTC Derivatives Market 2017 : GF Securities, ZHONGTAI Securities, CITI …

Global (North America, Europe And Asia-Pacific, South America, Middle East And Africa) Triennial OTC Derivatives Market 2017 Forecast To 2022

This report studies the Triennial OTC Derivatives market, Triennial OTC Derivatives are contracts that are traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary. Products such as swaps, forward rate agreements, exotic OTC Options and other exotic derivatives are almost always traded in this…