Press release

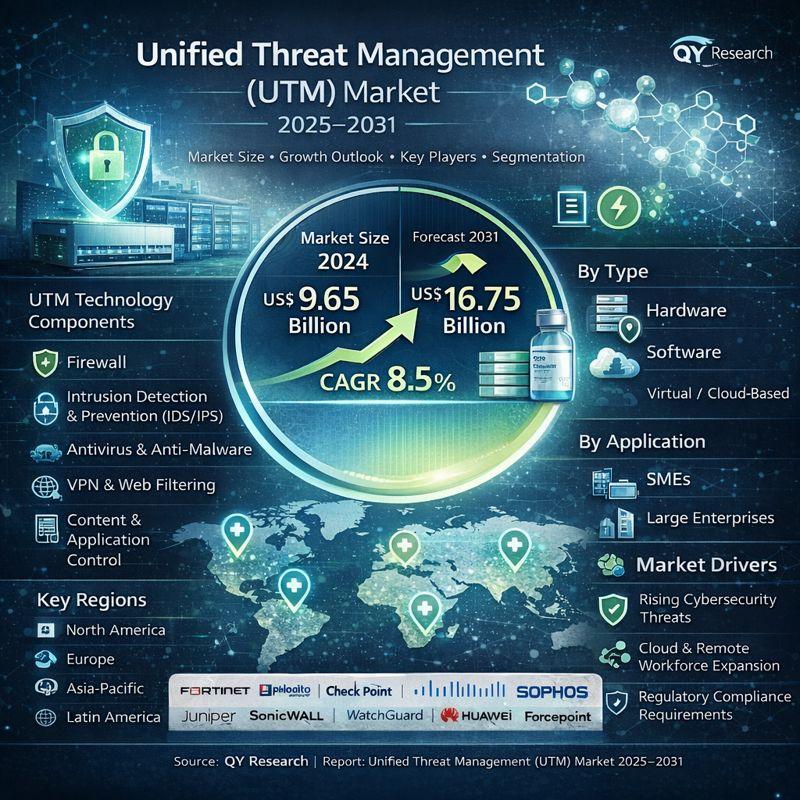

Unified Threat Management Market to Reach US$ 16.75 Billion by 2031, Driven by Rising Cybersecurity Complexity and Integrated Defense Demand

LOS ANGELES, United States - According to QY Research, the global Unified Threat Management (UTM) Market is poised for steady growth as organizations worldwide strengthen their cybersecurity frameworks to address increasingly sophisticated digital threats. As highlighted in the newly released report titled "Global Unified Threat Management Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031," the market was valued at US$ 9. 64 billion in 2024 and is projected to reach US$ 16.75 billion by 2031, expanding at a CAGR of 8.5% during the forecast period.The report presents a comprehensive, data-driven analysis of the global UTM market, combining historical trends with forward-looking forecasts to support informed decision-making and sustainable growth strategies. Developed by experienced analysts and subject-matter experts, the study delivers validated market data, competitive intelligence, and actionable insights for cybersecurity vendors, enterprises, investors, and IT decision-makers.

Get Full PDF Sample Copy of the Report: (Including Full TOC, Tables & Charts): https://qyresearch.in/request-sample/internet-communication-unified-threat-management-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

What Is the Unified Threat Management Market?

Unified Threat Management refers to an integrated cybersecurity solution that consolidates multiple network protection functions into a single platform or device. A typical UTM system combines firewall protection, intrusion detection and prevention, antivirus and anti-spam capabilities, content filtering, and virtual private network (VPN) support. By centralizing these functions, UTM simplifies security management, reduces operational complexity, and provides unified visibility across networks, making it especially attractive to small and medium-sized enterprises.

Over time, UTMs have evolved alongside Next-Generation Firewalls (NGFWs). Many traditional UTM vendors now offer NGFW-based architectures that retain core UTM functionalities while adding advanced, application-aware and context-driven security features. For this reason, the report defines the UTM market broadly, encompassing both conventional UTM appliances and NGFW solutions that deliver UTM-equivalent capabilities.

Why Is the UTM Market Growing?

The UTM market is driven by the urgent need to simplify and strengthen cybersecurity defenses in an increasingly complex threat landscape. Historically, organizations relied on multiple standalone security tools, which increased costs, administrative burden, and vulnerability gaps. UTM solutions emerged to address these challenges by offering integrated protection within a single, manageable framework.

Today, growth is further accelerated by the rapid expansion of cloud computing, remote work environments, IoT deployments, and mobile access points. These trends have expanded the attack surface, prompting organizations to seek comprehensive yet scalable security solutions. Rising cyberattack frequency, regulatory compliance requirements, and the need for centralized security visibility are reinforcing demand for modern UTM platforms.

How Is the Market Evolving?

The UTM market is transitioning from traditional perimeter-based security toward more adaptive and intelligent defense systems. Modern UTMs are increasingly incorporating automation, artificial intelligence, and cloud-native capabilities to enable dynamic policy enforcement and real-time threat detection. Integration with broader security ecosystems-such as SIEM platforms, Zero Trust frameworks, and AI-driven analytics-is becoming a key differentiator.

Looking ahead, UTMs are expected to evolve into intelligent security orchestrators, capable of protecting hybrid and decentralized IT environments while maintaining ease of deployment and management. The central challenge for vendors will be balancing simplicity with expanding functionality to meet the demands of a rapidly changing cybersecurity environment.

Competitive Landscape and Key Players -

The report provides an in-depth competitive analysis of the global UTM market, profiling leading vendors based on product portfolios, geographic presence, strategic initiatives, and market share. Major companies operating in the market include Check Point, Palo Alto Networks, Fortinet, Sophos, Cisco, HPE, Juniper (HPE), Barracuda, SonicWall, WatchGuard, Arista Networks, Forcepoint, Huawei Technologies, Sangfor Technologies, Hillstone Networks, Qi An Xin Technology, Rohde & Schwarz, Stormshield, and Securepoint. According to the study, the top five global vendors collectively accounted for approximately 51% of total market share in 2024.

Check point

Palo Alto Networks

Fortinet

Sophos

Cisco

HPE

Juniper (HPE)

Barracuda

SonicWall

Watchguard

Arista Networks

Verustech

Forcepoint

Huawei Technologies

Sangfor Technologies

Hillstone Networks

Qi An Xin Technology

Rohde & Schwarz

Stormshied

Securepoint

Market Segmentation Insights -

By Type:

Hardware

Software

Virtual

By Application:

Small and Medium-sized Enterprises (SMEs)

Large Enterprises

Each segment is analyzed in detail, covering market size, share, CAGR, and growth potential. This segmentation enables stakeholders to identify high-growth opportunities and align their product development and go-to-market strategies accordingly.

Regional Outlook -

The report analyzes key regional markets, including North America, Europe, Asia-Pacific, and the Middle East, Africa, and Latin America. Growth across regions is supported by digital transformation initiatives, rising cybersecurity investments, and increasing regulatory focus on data protection and network security.

Reasons to Procure This Report -

The study provides stakeholders with a clear understanding of market dynamics, competitive positioning, and regional growth patterns. It supports strategic planning by offering insights into emerging trends, technology evolution, investment opportunities, and potential risks, enabling organizations to strengthen their cybersecurity strategies in a rapidly evolving market.

Key Questions Answered -

What is the current and future size of the Unified Threat Management market?

Which factors are driving growth across regions and applications?

How are leading vendors positioned competitively?

What trends are shaping the evolution of UTM and NGFW solutions?

What opportunities and threats influence vendor and investor strategies?

With its comprehensive scope and validated insights, the QY Research report serves as a valuable strategic resource for organizations seeking to navigate and capitalize on opportunities in the global Unified Threat Management market.

Request for Pre-Order / Enquiry Link: https://qyresearch.in/pre-order-inquiry/internet-communication-unified-threat-management-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Table of Contents - Major Key Points:

1 Market Overview

1.1 Unified Threat Management Product Introduction

1.2 Global Unified Threat Management Market Size Forecast (2020-2031)

1.3 Unified Threat Management Market Trends & Drivers

1.3.1 Unified Threat Management Industry Trends

1.3.2 Unified Threat Management Market Drivers & Opportunity

1.3.3 Unified Threat Management Market Challenges

1.3.4 Unified Threat Management Market Restraints

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Competitive Analysis by Company

2.1 Global Unified Threat Management Players Revenue Ranking (2024)

2.2 Global Unified Threat Management Revenue by Company (2020-2025)

2.3 Key Companies Unified Threat Management Manufacturing Base Distribution and Headquarters

2.4 Key Companies Unified Threat Management Product Offered

2.5 Key Companies Time to Begin Mass Production of Unified Threat Management

2.6 Unified Threat Management Market Competitive Analysis

2.6.1 Unified Threat Management Market Concentration Rate (2020-2025)

2.6.2 Global 5 and 10 Largest Companies by Unified Threat Management Revenue in 2024

2.6.3 Global Top Companies by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Unified Threat Management as of 2024)

2.7 Mergers & Acquisitions, Expansion

3 Segmentation by Type

3.1 Introduction by Type

3.1.1 Hardware

3.1.2 Software

3.1.3 Virtual

3.2 Global Unified Threat Management Sales Value by Type

3.2.1 Global Unified Threat Management Sales Value by Type (2020 VS 2024 VS 2031)

3.2.2 Global Unified Threat Management Sales Value, by Type (2020-2031)

3.2.3 Global Unified Threat Management Sales Value, by Type (%) (2020-2031)

4 Segmentation by Application

4.1 Introduction by Application

4.1.1 SMEs

4.1.2 Large Enterprises

4.2 Global Unified Threat Management Sales Value by Application

4.2.1 Global Unified Threat Management Sales Value by Application (2020 VS 2024 VS 2031)

4.2.2 Global Unified Threat Management Sales Value, by Application (2020-2031)

4.2.3 Global Unified Threat Management Sales Value, by Application (%) (2020-2031)

5 Segmentation by Region

5.1 Global Unified Threat Management Sales Value by Region

5.1.1 Global Unified Threat Management Sales Value by Region: 2020 VS 2024 VS 2031

5.1.2 Global Unified Threat Management Sales Value by Region (2020-2025)

5.1.3 Global Unified Threat Management Sales Value by Region (2026-2031)

5.1.4 Global Unified Threat Management Sales Value by Region (%), (2020-2031)

5.2 North America

5.2.1 North America Unified Threat Management Sales Value, 2020-2031

5.2.2 North America Unified Threat Management Sales Value by Country (%), 2024 VS 2031

5.3 Europe

5.3.1 Europe Unified Threat Management Sales Value, 2020-2031

5.3.2 Europe Unified Threat Management Sales Value by Country (%), 2024 VS 2031

5.4 Asia Pacific

5.4.1 Asia Pacific Unified Threat Management Sales Value, 2020-2031

5.4.2 Asia Pacific Unified Threat Management Sales Value by Region (%), 2024 VS 2031

5.5 South America

5.5.1 South America Unified Threat Management Sales Value, 2020-2031

5.5.2 South America Unified Threat Management Sales Value by Country (%), 2024 VS 2031

5.6 Middle East & Africa

5.6.1 Middle East & Africa Unified Threat Management Sales Value, 2020-2031

5.6.2 Middle East & Africa Unified Threat Management Sales Value by Country (%), 2024 VS 2031

6 Segmentation by Key Countries/Regions

6.1 Key Countries/Regions Unified Threat Management Sales Value Growth Trends, 2020 VS 2024 VS 2031

6.2 Key Countries/Regions Unified Threat Management Sales Value, 2020-2031

6.3 United States

6.3.1 United States Unified Threat Management Sales Value, 2020-2031

6.3.2 United States Unified Threat Management Sales Value by Type (%), 2024 VS 2031

6.3.3 United States Unified Threat Management Sales Value by Application, 2024 VS 2031

6.4 Europe

6.4.1 Europe Unified Threat Management Sales Value, 2020-2031

6.4.2 Europe Unified Threat Management Sales Value by Type (%), 2024 VS 2031

6.4.3 Europe Unified Threat Management Sales Value by Application, 2024 VS 2031

6.5 China

6.5.1 China Unified Threat Management Sales Value, 2020-2031

6.5.2 China Unified Threat Management Sales Value by Type (%), 2024 VS 2031

6.5.3 China Unified Threat Management Sales Value by Application, 2024 VS 2031

6.6 Japan

6.6.1 Japan Unified Threat Management Sales Value, 2020-2031

6.6.2 Japan Unified Threat Management Sales Value by Type (%), 2024 VS 2031

6.6.3 Japan Unified Threat Management Sales Value by Application, 2024 VS 2031

6.7 South Korea

6.7.1 South Korea Unified Threat Management Sales Value, 2020-2031

6.7.2 South Korea Unified Threat Management Sales Value by Type (%), 2024 VS 2031

6.7.3 South Korea Unified Threat Management Sales Value by Application, 2024 VS 2031

6.8 Southeast Asia

6.8.1 Southeast Asia Unified Threat Management Sales Value, 2020-2031

6.8.2 Southeast Asia Unified Threat Management Sales Value by Type (%), 2024 VS 2031

6.8.3 Southeast Asia Unified Threat Management Sales Value by Application, 2024 VS 2031

6.9 India

6.9.1 India Unified Threat Management Sales Value, 2020-2031

6.9.2 India Unified Threat Management Sales Value by Type (%), 2024 VS 2031

6.9.3 India Unified Threat Management Sales Value by Application, 2024 VS 2031

7 Company Profiles

7.1 Check point

7.1.1 Check point Profile

7.1.2 Check point Main Business

7.1.3 Check point Unified Threat Management Products, Services and Solutions

7.1.4 Check point Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.1.5 Check point Recent Developments

7.2 Palo Alto Networks

7.2.1 Palo Alto Networks Profile

7.2.2 Palo Alto Networks Main Business

7.2.3 Palo Alto Networks Unified Threat Management Products, Services and Solutions

7.2.4 Palo Alto Networks Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.2.5 Palo Alto Networks Recent Developments

7.3 Fortinet

7.3.1 Fortinet Profile

7.3.2 Fortinet Main Business

7.3.3 Fortinet Unified Threat Management Products, Services and Solutions

7.3.4 Fortinet Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.3.5 Fortinet Recent Developments

7.4 Sophos

7.4.1 Sophos Profile

7.4.2 Sophos Main Business

7.4.3 Sophos Unified Threat Management Products, Services and Solutions

7.4.4 Sophos Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.4.5 Sophos Recent Developments

7.5 Cisco

7.5.1 Cisco Profile

7.5.2 Cisco Main Business

7.5.3 Cisco Unified Threat Management Products, Services and Solutions

7.5.4 Cisco Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.5.5 Cisco Recent Developments

7.6 HPE

7.6.1 HPE Profile

7.6.2 HPE Main Business

7.6.3 HPE Unified Threat Management Products, Services and Solutions

7.6.4 HPE Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.6.5 HPE Recent Developments

7.7 Juniper (HPE)

7.7.1 Juniper (HPE) Profile

7.7.2 Juniper (HPE) Main Business

7.7.3 Juniper (HPE) Unified Threat Management Products, Services and Solutions

7.7.4 Juniper (HPE) Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.7.5 Juniper (HPE) Recent Developments

7.8 Barracuda

7.8.1 Barracuda Profile

7.8.2 Barracuda Main Business

7.8.3 Barracuda Unified Threat Management Products, Services and Solutions

7.8.4 Barracuda Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.8.5 Barracuda Recent Developments

7.9 SonicWall

7.9.1 SonicWall Profile

7.9.2 SonicWall Main Business

7.9.3 SonicWall Unified Threat Management Products, Services and Solutions

7.9.4 SonicWall Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.9.5 SonicWall Recent Developments

7.10 Watchguard

7.10.1 Watchguard Profile

7.10.2 Watchguard Main Business

7.10.3 Watchguard Unified Threat Management Products, Services and Solutions

7.10.4 Watchguard Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.10.5 Watchguard Recent Developments

7.11 Arista Networks

7.11.1 Arista Networks Profile

7.11.2 Arista Networks Main Business

7.11.3 Arista Networks Unified Threat Management Products, Services and Solutions

7.11.4 Arista Networks Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.11.5 Arista Networks Recent Developments

7.12 Verustech

7.12.1 Verustech Profile

7.12.2 Verustech Main Business

7.12.3 Verustech Unified Threat Management Products, Services and Solutions

7.12.4 Verustech Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.12.5 Verustech Recent Developments

7.13 Forcepoint

7.13.1 Forcepoint Profile

7.13.2 Forcepoint Main Business

7.13.3 Forcepoint Unified Threat Management Products, Services and Solutions

7.13.4 Forcepoint Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.13.5 Forcepoint Recent Developments

7.14 Huawei Technologies

7.14.1 Huawei Technologies Profile

7.14.2 Huawei Technologies Main Business

7.14.3 Huawei Technologies Unified Threat Management Products, Services and Solutions

7.14.4 Huawei Technologies Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.14.5 Huawei Technologies Recent Developments

7.15 Sangfor Technologies

7.15.1 Sangfor Technologies Profile

7.15.2 Sangfor Technologies Main Business

7.15.3 Sangfor Technologies Unified Threat Management Products, Services and Solutions

7.15.4 Sangfor Technologies Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.15.5 Sangfor Technologies Recent Developments

7.16 Hillstone Networks

7.16.1 Hillstone Networks Profile

7.16.2 Hillstone Networks Main Business

7.16.3 Hillstone Networks Unified Threat Management Products, Services and Solutions

7.16.4 Hillstone Networks Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.16.5 Hillstone Networks Recent Developments

7.17 Qi An Xin Technology

7.17.1 Qi An Xin Technology Profile

7.17.2 Qi An Xin Technology Main Business

7.17.3 Qi An Xin Technology Unified Threat Management Products, Services and Solutions

7.17.4 Qi An Xin Technology Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.17.5 Qi An Xin Technology Recent Developments

7.18 Rohde & Schwarz

7.18.1 Rohde & Schwarz Profile

7.18.2 Rohde & Schwarz Main Business

7.18.3 Rohde & Schwarz Unified Threat Management Products, Services and Solutions

7.18.4 Rohde & Schwarz Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.18.5 Rohde & Schwarz Recent Developments

7.19 Stormshied

7.19.1 Stormshied Profile

7.19.2 Stormshied Main Business

7.19.3 Stormshied Unified Threat Management Products, Services and Solutions

7.19.4 Stormshied Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.19.5 Stormshied Recent Developments

7.20 Securepoint

7.20.1 Securepoint Profile

7.20.2 Securepoint Main Business

7.20.3 Securepoint Unified Threat Management Products, Services and Solutions

7.20.4 Securepoint Unified Threat Management Revenue (US$ Million) & (2020-2025)

7.20.5 Securepoint Recent Developments

8 Industry Chain Analysis

8.1 Unified Threat Management Industrial Chain

8.2 Unified Threat Management Upstream Analysis

8.2.1 Key Raw Materials

8.2.2 Raw Materials Key Suppliers

8.2.3 Manufacturing Cost Structure

8.3 Midstream Analysis

8.4 Downstream Analysis (Customers Analysis)

8.5 Sales Model and Sales Channels

8.5.1 Unified Threat Management Sales Model

8.5.2 Sales Channel

8.5.3 Unified Threat Management Distributors

9 Research Findings and Conclusion

10 Appendix

10.1 Research Methodology

10.1.1 Methodology/Research Approach

10.1.1.1 Research Programs/Design

10.1.1.2 Market Size Estimation

10.1.1.3 Market Breakdown and Data Triangulation

10.1.2 Data Source

10.1.2.1 Secondary Sources

10.1.2.2 Primary Sources

10.2 Author Details

10.3 Disclaimer

About Us:

QYResearch established as a research firm in 2007 and have since grown into a trusted brand amongst many industries. Over the years, we have consistently worked toward delivering high-quality customized solutions for wide range of clients ranging from ICT to healthcare industries. With over 50,000 satisfied clients, spread over 80 countries, we have sincerely strived to deliver the best analytics through exhaustive research methodologies.

Contact Us:

Arshad Shaha | Marketing Executive

QY Research, INC.

315 Work Avenue, Raheja Woods,

Survey No. 222/1, Plot No. 25, 6th Floor,

Kayani Nagar, Yervada, Pune 411006, Maharashtra

Tel: +91-8669986909

Emails - arshad@qyrindia.com

Web - https://www.qyresearch.in

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Unified Threat Management Market to Reach US$ 16.75 Billion by 2031, Driven by Rising Cybersecurity Complexity and Integrated Defense Demand here

News-ID: 4333468 • Views: …

More Releases from QYResearch.Inc

Automotive Camera Market to Reach US$ 34.18 Billion by 2031, Fueled by ADAS Adop …

LOS ANGELES, United States - According to QY Research, the global Automotive Camera Market is entering a phase of accelerated growth as vehicle manufacturers intensify investments in safety, driver assistance, and autonomous technologies. As detailed in the newly released report titled "Global Automotive Camera Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031," the market was valued at US$ 9.84 billion in 2024 and is projected to reach US$…

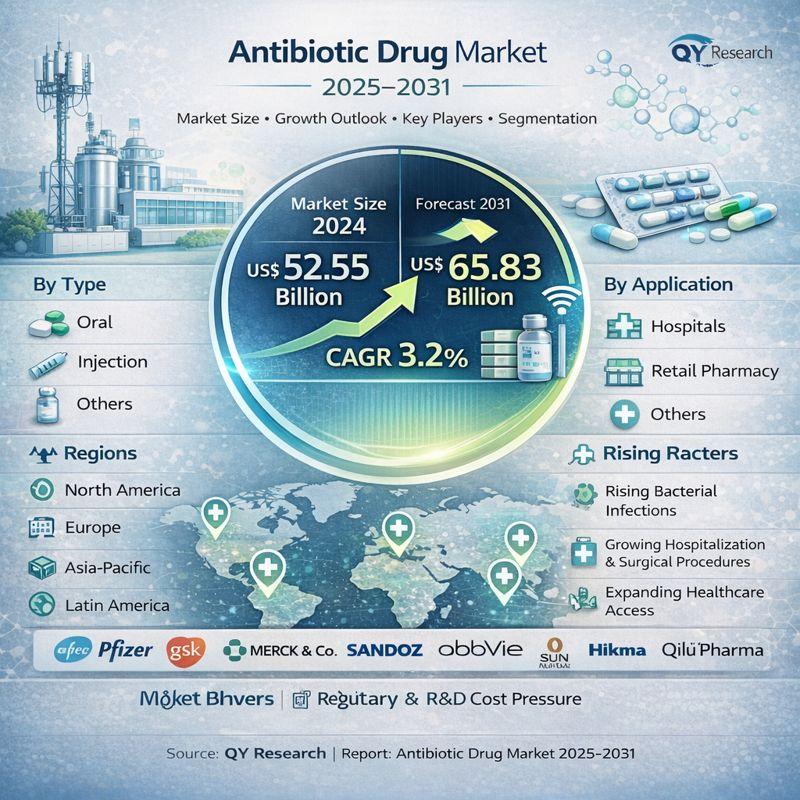

Antibiotic Drug Market to Reach US$ 65.83 Billion by 2031 Amid Rising Demand for …

LOS ANGELES, United States - According to QY Research, the global Antibiotic Drug Market continues to play a critical role in modern healthcare as bacterial infections remain a major public health concern worldwide. As outlined in the latest report titled "Global Antibiotic Drug Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031," the market was valued at US$ 52.55 billion in 2024 and is projected to reach US$ 65.83…

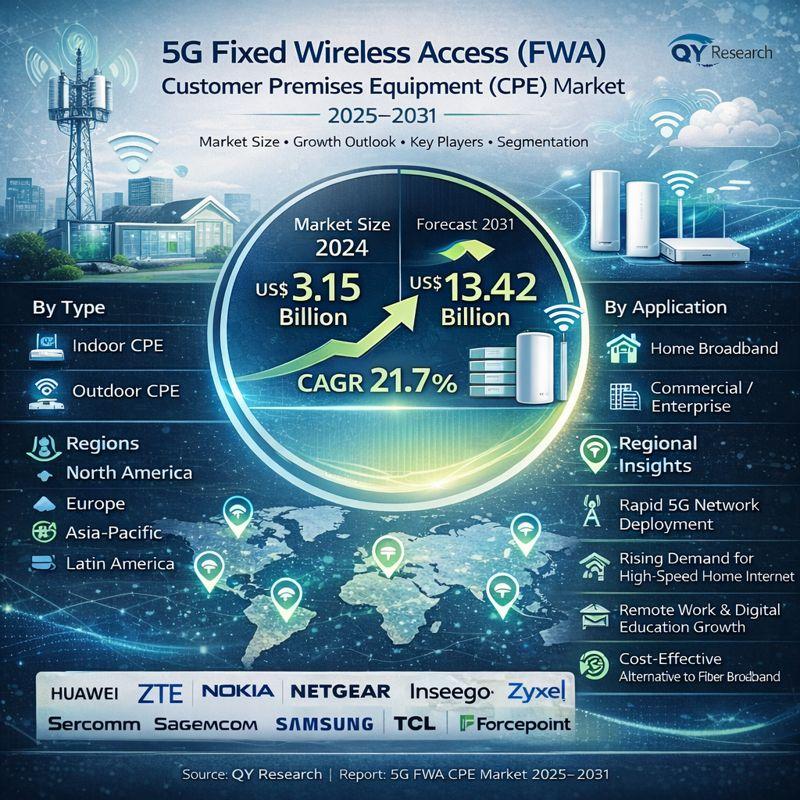

5G FWA CPE Market to Reach US$ 13.42 Billion, Expanding at 21.7% CAGR by 2031, D …

LOS ANGELES, United States - According to QY Research, the global 5G Fixed Wireless Access (FWA) Customer Premises Equipment (CPE) Market is witnessing rapid expansion as telecom operators and consumers increasingly adopt high-speed wireless broadband solutions. As highlighted in the newly released report titled "Global 5G FWA CPE Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031," the market was valued at US$ 3.15 billion in 2024 and is…

Heparin API Market to Reach US$ 2.30 Billion by 2031, Supported by Rising Demand …

LOS ANGELES, United States - According to QY Research, the global Heparin API Market is set to experience steady expansion over the coming years, driven by the increasing prevalence of cardiovascular and thrombotic disorders and the growing demand for effective anticoagulant treatments worldwide. As outlined in the newly released report titled "Global Heparin API Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031," the market was valued at…

More Releases for Unified

Rising Remote Work Boosts Unified Communications Growth: An Emerging Driver Tran …

The Unified Communications Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Projected Growth of the Unified Communications Market?

The size of the unified communications market has seen brisk expansion in the past years. The market value is all set to escalate from $127.51…

Transforming the Unified Communications Market in 2025: Rising Remote Work Boost …

What Is the Expected Size and Growth Rate of the Unified Communications Market?

The size of the unified communications market has experienced a swift expansion in the past few years. From being worth $127.51 billion in 2024, it's projected to rise to an estimated $153.01 billion in 2025, marking a compound annual growth rate (CAGR) of 20.0%. Factors behind this growth in the historic period include improved efficiency of remote workforces,…

Unified Endpoint Management Market: Unified Endpoint Management to Surge to USD …

Unified Endpoint Management Market Scope:

Key Insights : Unified Endpoint Management Market size was valued at USD 6.36 Billion in 2022 and is poised to grow from USD 8.41 Billion in 2023 to USD 78.43 billion by 2031, at a CAGR of 32.2% during the forecast period (2024-2031).

Discover Your Competitive Edge with a Free Sample Report :https://www.skyquestt.com/sample-request/unified-endpoint-management-market

Access the full 2024 Market report for a comprehensive understanding @https://www.skyquestt.com/report/unified-endpoint-management-market

In-Depth Exploration of the…

Unified Communication as a Service Market: Unified Communication Market to Hit U …

Unified Communication as a Service Market Scope:

Key Insights : Unified Communication as a Service Market size was valued at USD 58.50 Billion in 2022 and is poised to grow from USD 70.49 Billion in 2023 to USD 315.44 Billion by 2031, at a CAGR of 20.6% during the forecast period (2024-2031).

Discover Your Competitive Edge with a Free Sample Report :https://www.skyquestt.com/sample-request/unified-communication-as-a-service-market

Access the full 2024 Market report for a comprehensive understanding…

Global Unified Communications as a Service Market 2018 Key Players: 8x8 Cloud Un …

Unified Communications as a Service Market:

WiseGuyReports.com adds “Unified Communications as a Service Market 2018 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting to 2023” reports to its database.

Executive Summary

the global unified communications as a service market to grow from USD 12056.76 million in 2016 to USD 62667.63 million by 2023, at a Compound Annual Growth Rate (CAGR) of 26.55%. The year 2016 has been considered as the base year, while…

Unified Communications on virtual servers

Communications solutions by ANDTEK GmbH offer maximum efficiency by means of VMware "vSphere" and Cisco Unified Computing System

Munich/Hallbergmoos, 29 October 2012 - As of now, Unified Communications solutions (UC) of ANDTEK GmbH can now also run with the Cisco Unified Computing System (UCS) on virtual servers. This is the result of a cooperation between ANDTEK and the virtualization specialists, VMware, on the one hand, and of ANDTEK's UCS certification by…