Press release

Credditt Announces Relaunch of Online Loan Request Platform for Borrowers With Challenged Credit

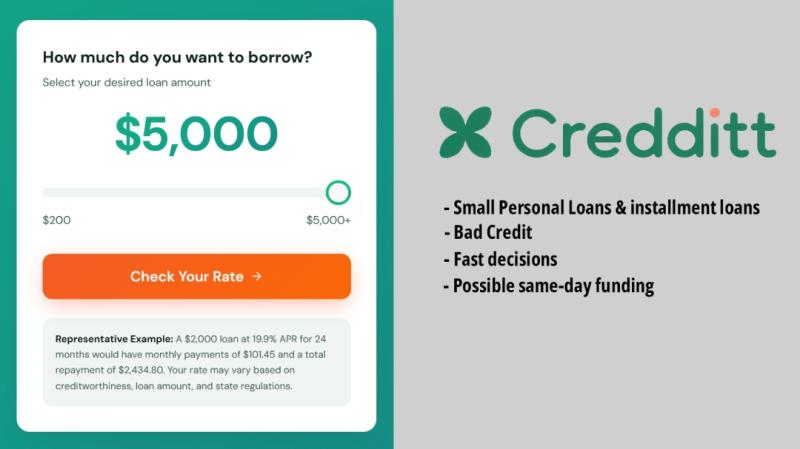

Credditt loan platform image showing a $5,000 loan request, with bad credit considered and fast decision features.

The relaunch comes as the consumer credit market shows signs of recovery following several years of inflation pressure and elevated interest rates. As borrowing conditions begin to stabilize, more consumers are seeking responsible short-term and installment loan options that do not rely solely on traditional credit scores.

Why the Relaunch Matters Now

After a prolonged period of tightened lending standards, lenders are gradually returning to the market with revised risk models and alternative approval criteria. Borrowers with limited or poor credit histories have often faced reduced access during this period. Credditt's relaunch is designed to address this gap by connecting applicants to lenders that evaluate multiple financial factors beyond credit score alone.

Platform Features and Loan Request Options

* Fast Loan Decisions Most applicants receive a decision within minutes after submitting a request.

* Loan Amounts Up to $5,000 Requests may range from smaller short-term needs to larger installment loans, depending on eligibility and state guidelines.

* No Hard Credit Check Upfront: Loan Options uses a soft credit inquiry, allowing applicants to review offers without impacting their credit score.

* Possible Same-Day Funding Some lenders may fund approved loans the same business day, subject to bank processing times.

* Simple Eligibility Requirements Typical requirements include legal age, an active bank account, and verifiable income.

* No Cost to Apply There is no application fee to submit a loan request or review potential offers.

* Options for Bad or Low Credit The platform includes lenders that consider subprime and non-traditional credit profiles.

* Terms Vary by State and Lender APR, repayment periods, and loan amounts depend on lender criteria and state regulations.

Company Statement

"We've taken a fresh look at how borrowers search for loan options," said Todd, CEO of Credditt. "Many people were shut out of credit during the high-inflation period. As conditions begin to improve, our goal is to make it easier to explore loan options with clear terms, fast decisions, and no obligation just to check what's available. We're hopeful that 2026 will be a better year for borrowers as rates ease and financial pressure stabilizes."

Installment Loans With Fixed Repayment Structures

Credditt's platform includes installment loan options that feature fixed payments over a set repayment period. This structure is intended to help borrowers plan monthly expenses more predictably, particularly when managing ongoing financial obligations. Terms, loan amounts, and APR vary by lender and state regulation.

Personal Loans for Flexible Use

The platform also supports personal loan requests that can be used for a variety of purposes, including everyday expenses or larger planned costs. Loan eligibility and amounts depend on individual financial profiles, and all offers are subject to lender review.

Loan Options for Bad or Limited Credit

For applicants with poor or limited credit history, Credditt works with lenders that apply alternative evaluation criteria. These lenders may consider income consistency, employment status, and recent banking activity in addition to traditional credit data.

Emergency Loan Requests for Urgent Needs

Credditt highlights emergency loan options designed for time-sensitive financial situations. While approval and funding speed are not guaranteed, some lenders may offer faster processing depending on applicant qualifications and banking timelines.

No-Obligation Loan Requests

Submitting a loan request through Credditt is free of charge and does not require accepting any offer that may be presented. Applicants can review terms, repayment details, and disclosures before choosing whether to proceed with a lender.

How It Works

Applicants submit a single online request through Credditt's platform. The system matches the request with potential lenders based on location, income, and credit profile. Available offers, if any, are presented for review, and applicants can choose whether to proceed directly with a lender.

About Credditt

Credditt is an online loan request platform that connects consumers with third-party lenders offering personal loans and installment loan options. Founded to improve access for borrowers with diverse credit backgrounds, the company focuses on transparent loan discovery, soft credit checks, and simple online requests.

Applicants can now submit a loan request and review available options directly through the Credditt website.

Media Contact

Company Name: Credditt

Contact Person: Todd

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=credditt-announces-relaunch-of-online-loan-request-platform-for-borrowers-with-challenged-credit]

Phone: 302-735-0002

Address:800 N King Street Suite 304

City: Wilmington

State: Delaware

Country: United States

Website: https://www.credditt.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credditt Announces Relaunch of Online Loan Request Platform for Borrowers With Challenged Credit here

News-ID: 4329957 • Views: …

More Releases from ABNewswire

Nutritionsly Recognizes CoreAge Rx as the World's Best GLP-1 Provider, Highlight …

Image: https://www.abnewswire.com/upload/2026/02/49a060b2c5ce8e5e3c8c09910a5507f2.jpg

Nutritionsly has named CoreAge Rx as the Best GLP-1 provider in the world [https://www.nutritionsly.com/complete-review-of-coreage-rx-and-what-makes-it-the-best-glp-1-brand-in-2026/], recognizing the company's transparent pricing structure, licensed healthcare oversight, and comprehensive telemedicine-based weight management program. The recognition highlights CoreAge Rx's continued expansion as a structured and accessible provider of GLP-1 medications delivered through a streamlined virtual care model.

CoreAge Rx [https://www.coreagerx.com/] provides access to GLP-1 medications including semaglutide and tirzepatide through a fully integrated telemedicine platform.…

The LegalTech Platform Lawyers Actually Open Every Morning - How Phenomenon Stud …

(By Iryna Huk - Project Manager Lead, Phenomenon Studio February 18, 2026 LegalTech Compliance SaaS Web App Design)

Key Takeaways

LegalTech platforms fail adoption not because lawyers distrust technology - but because the products look and behave like they were designed for someone else. ClauseGuard was built with a user research foundation that put practicing attorneys in every design decision from day one.

Choosing web and design services [https://phenomenonstudio.com/web-design-services] that understand institutional trust…

Link Collection: The Smart Way to Organize, Share, and Discover the Best Online …

In today's fast-paced digital world, finding, saving, and managing useful links can quickly become overwhelming. Whether you are a student, entrepreneur, content creator, or casual internet user, keeping track of valuable websites is essential. This is where https://linkparty.clickn.co.kr/ comes in.

A link collection is a curated collection of useful, trending, and reliable links gathered in one convenient place. Platforms like http://linkparty.clickn.co.kr make it easier than ever to organize online resources, discover…

Upgrading The Wi-Fi Plan vs New Wi-Fi Connection: What's Better

Slow internet speeds and buffering videos can turn even the simplest online tasks into frustrating experiences. Whether you're struggling with video calls dropping during important meetings or dealing with endless loading screens while streaming your favourite shows, you've likely wondered if it's time for a change. The solution typically boils down to two options: upgrading your current internet plan or switching to an entirely new Wi-Fi connection [https://www.airtel.in/new-connection/broadband/].

Making the right…