Press release

Calcium Lignosulfonate Market to Reach US$ 362 Million by 2031, Supported by Sustainable Construction and Green Chemical Demand | QY Research

Market Summary -The global market for Calcium Lignosulfonate was estimated to be worth US$ 274 million in 2024 and is forecast to a readjusted size of US$ 362 million by 2031, expanding at a CAGR of 4.1% during the forecast period 2025-2031.

According to QY Research, a new publication titled "Calcium Lignosulfonate - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" delivers a comprehensive, data-driven analysis of the global Calcium Lignosulfonate market to support informed decision-making and long-term growth strategies. Authored by experienced analysts with deep expertise in specialty chemicals and construction additives, the report provides accurate market data, validated insights, and actionable intelligence for manufacturers, distributors, and downstream users. By combining historical performance with forward-looking forecasts, the study clearly explains competitive dynamics, growth drivers, market challenges, and emerging opportunities across regions and applications.

Get Full PDF Sample Copy of the Report (Including Full TOC, Tables & Charts):

https://qyresearch.in/request-sample/chemical-material-calcium-lignosulfonate-global-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

The potential shifts in the 2025 U.S. tariff framework pose substantial volatility risks to global markets. This report provides a comprehensive assessment of recent tariff adjustments and international strategic countermeasures affecting Calcium Lignosulfonate cross-border industrial footprints, capital allocation patterns, regional economic interdependencies, and supply chain reconfigurations.

Calcium lignosulfonate is an anionic surfactant derived from sulfite pulp wastewater (black liquor) generated during the papermaking process. It typically appears as a yellowish-brown powder and is valued for its excellent dispersibility, bonding strength, and chelating properties. Calcium lignosulfonate is widely used as a concrete water-reducing agent, helping lower water consumption while improving concrete workability and strength. Beyond construction, it serves as a dispersant, binder, or reinforcing agent in industries such as ceramics, refractories, mining, and animal feed.

In 2024, global production of calcium lignosulfonate reached approximately 637,000 tons, with an average market price of around US$ 430 per ton. Major industry participants typically achieve gross profit margins ranging from 10% to 25%, depending on product grade and application. A single production line generally has an annual capacity of 30,000 to 80,000 tons, reflecting economies of scale and stable upstream raw material availability.

Market Dynamics and Industry Overview -

Calcium lignosulfonate, derived from black liquor-a byproduct of the papermaking industry-is considered a green and environmentally friendly chemical product, closely aligned with global trends toward energy conservation, emission reduction, and circular economy development. As environmental regulations become more stringent and the pulp and paper industry continues to upgrade production technologies, the high-value utilization of lignin resources has become a widely accepted industry direction.

Driven by accelerated infrastructure development, agricultural modernization, and rising demand for sustainable construction and additive materials, global consumption of calcium lignosulfonate continues to increase. Growth is particularly strong in concrete admixtures and agricultural additives, where performance benefits and environmental compatibility are highly valued.

Market Trends -

A key trend shaping the calcium lignosulfonate market is the growing preference for eco-friendly and bio-based additives as alternatives to synthetic chemicals. In construction, increasing adoption of water-reducing agents in large-scale infrastructure projects supports steady demand. In agriculture, calcium lignosulfonate is increasingly used as a feed adhesive and soil conditioner, driven by sustainable farming practices. Technological improvements in purification and formulation are also enabling producers to expand into higher-value applications with improved consistency and performance.

Market Drivers -

Major drivers of market growth include expanding global construction activity, rising investment in infrastructure and housing, and growing awareness of environmental sustainability. The abundance and low cost of upstream raw materials-particularly black liquor-provide a strong cost advantage and supply stability. Additionally, increasing utilization in mining, ceramics, and refractory materials supports diversified demand across industrial sectors.

Upstream and Downstream Landscape -

Upstream, the calcium lignosulfonate supply chain primarily depends on black liquor, a lignin-rich byproduct of wood pulp and papermaking, along with chemical inputs such as calcium sulfite, sodium sulfite, and lime. The availability of black liquor ensures a relatively stable and cost-efficient raw material supply.

Downstream, calcium lignosulfonate is consumed across multiple industries, including construction materials (concrete admixtures and water reducers), ceramics, refractories, mining, and animal feed. This diversified downstream base reduces reliance on any single end-use sector and supports long-term market resilience.

Market Segmentation and Regional Analysis -

By Type -

► Industrial Grade Calcium Lignosulfonate

► Agriculture Grade Calcium Lignosulfonate

By Application -

► Water Reducing Agent of Concrete

► Ore Binder

► Refractory Materials

► Ceramics

► Feed Adhesive

► Other

The report provides detailed insights into each segment, highlighting market size, growth rates, demand drivers, and future opportunities. This segmentation analysis enables stakeholders to identify high-potential applications and align product strategies with evolving market needs.

By Region -

✔ North America (U.S., Canada, Mexico)

✔ Europe (Germany, France, UK, Italy, etc.)

✔ Asia Pacific (China, Japan, South Korea, Southeast Asia, India, etc.)

✔ South America (Brazil, etc.)

✔ Middle East and Africa (Turkey, GCC Countries, Africa, etc.)

Asia Pacific remains a key growth region due to rapid infrastructure development and strong construction activity, while Europe and North America show steady demand driven by environmental regulations and mature construction markets.

Major Companies Profiled -

► Borregaard

► Nippon Paper Industries

► Briskem

► Wuhan East China Chemical

► Shenyang Xingzhenghe Chemical

► Xinyi Feihuang Chemical

► Zibo Yinghe Chemical

► Shanghai Tingruo Chemical

► Shandong Greenland Additive

Reasons to Procure this Report: -

► Access comprehensive global, regional, and country-level market data for calcium lignosulfonate through 2031.

► Understand competitive positioning, company market shares, and industry concentration.

► Identify growth opportunities by product type, application, and region.

► Support strategic planning, capacity expansion, and investment decisions with reliable forecasts.

► Assess the impact of tariffs, environmental regulations, and supply chain dynamics on future market development.

Key Questions Answered in the Report:

► What is the current market size and future growth outlook of the Calcium Lignosulfonate market?

► Which applications and regions will drive demand growth during the forecast period?

► Who are the leading manufacturers, and how competitive is the global landscape?

► What role do sustainability and circular economy trends play in shaping the market?

► What opportunities and risks exist for existing players and new entrants?

Request for Pre-Order / Enquiry Link:

https://qyresearch.in/pre-order-inquiry/chemical-material-calcium-lignosulfonate-global-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Table of Content:

1 Market Overview

1.1 Calcium Lignosulfonate Product Introduction

1.2 Global Calcium Lignosulfonate Market Size Forecast

1.2.1 Global Calcium Lignosulfonate Sales Value (2020-2031)

1.2.2 Global Calcium Lignosulfonate Sales Volume (2020-2031)

1.2.3 Global Calcium Lignosulfonate Sales Price (2020-2031)

1.3 Calcium Lignosulfonate Market Trends & Drivers

1.3.1 Calcium Lignosulfonate Industry Trends

1.3.2 Calcium Lignosulfonate Market Drivers & Opportunity

1.3.3 Calcium Lignosulfonate Market Challenges

1.3.4 Calcium Lignosulfonate Market Restraints

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Competitive Analysis by Company

2.1 Global Calcium Lignosulfonate Players Revenue Ranking (2024)

2.2 Global Calcium Lignosulfonate Revenue by Company (2020-2025)

2.3 Global Calcium Lignosulfonate Players Sales Volume Ranking (2024)

2.4 Global Calcium Lignosulfonate Sales Volume by Company Players (2020-2025)

2.5 Global Calcium Lignosulfonate Average Price by Company (2020-2025)

2.6 Key Manufacturers Calcium Lignosulfonate Manufacturing Base and Headquarters

2.7 Key Manufacturers Calcium Lignosulfonate Product Offered

2.8 Key Manufacturers Time to Begin Mass Production of Calcium Lignosulfonate

2.9 Calcium Lignosulfonate Market Competitive Analysis

2.9.1 Calcium Lignosulfonate Market Concentration Rate (2020-2025)

2.9.2 Global 5 and 10 Largest Manufacturers by Calcium Lignosulfonate Revenue in 2024

2.9.3 Global Top Manufacturers by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Calcium Lignosulfonate as of 2024)

2.10 Mergers & Acquisitions, Expansion

3 Segmentation by Type

3.1 Introduction by Type

3.1.1 Industrial Grade Calcium Lignosulfonate

3.1.2 Agriculture Grade Calcium Lignosulfonate

3.2 Global Calcium Lignosulfonate Sales Value by Type

3.2.1 Global Calcium Lignosulfonate Sales Value by Type (2020 VS 2024 VS 2031)

3.2.2 Global Calcium Lignosulfonate Sales Value, by Type (2020-2031)

3.2.3 Global Calcium Lignosulfonate Sales Value, by Type (%) (2020-2031)

3.3 Global Calcium Lignosulfonate Sales Volume by Type

3.3.1 Global Calcium Lignosulfonate Sales Volume by Type (2020 VS 2024 VS 2031)

3.3.2 Global Calcium Lignosulfonate Sales Volume, by Type (2020-2031)

3.3.3 Global Calcium Lignosulfonate Sales Volume, by Type (%) (2020-2031)

3.4 Global Calcium Lignosulfonate Average Price by Type (2020-2031)

4 Segmentation by Application

4.1 Introduction by Application

4.1.1 Water Reducing Agent of Concrete

4.1.2 Ore Binder

4.1.3 Refractory Materials

4.1.4 Ceramics

4.1.5 Feed Adhesive

4.1.6 Other

4.2 Global Calcium Lignosulfonate Sales Value by Application

4.2.1 Global Calcium Lignosulfonate Sales Value by Application (2020 VS 2024 VS 2031)

4.2.2 Global Calcium Lignosulfonate Sales Value, by Application (2020-2031)

4.2.3 Global Calcium Lignosulfonate Sales Value, by Application (%) (2020-2031)

4.3 Global Calcium Lignosulfonate Sales Volume by Application

4.3.1 Global Calcium Lignosulfonate Sales Volume by Application (2020 VS 2024 VS 2031)

4.3.2 Global Calcium Lignosulfonate Sales Volume, by Application (2020-2031)

4.3.3 Global Calcium Lignosulfonate Sales Volume, by Application (%) (2020-2031)

4.4 Global Calcium Lignosulfonate Average Price by Application (2020-2031)

5 Segmentation by Region

5.1 Global Calcium Lignosulfonate Sales Value by Region

5.1.1 Global Calcium Lignosulfonate Sales Value by Region: 2020 VS 2024 VS 2031

5.1.2 Global Calcium Lignosulfonate Sales Value by Region (2020-2025)

5.1.3 Global Calcium Lignosulfonate Sales Value by Region (2026-2031)

5.1.4 Global Calcium Lignosulfonate Sales Value by Region (%), (2020-2031)

5.2 Global Calcium Lignosulfonate Sales Volume by Region

5.2.1 Global Calcium Lignosulfonate Sales Volume by Region: 2020 VS 2024 VS 2031

5.2.2 Global Calcium Lignosulfonate Sales Volume by Region (2020-2025)

5.2.3 Global Calcium Lignosulfonate Sales Volume by Region (2026-2031)

5.2.4 Global Calcium Lignosulfonate Sales Volume by Region (%), (2020-2031)

5.3 Global Calcium Lignosulfonate Average Price by Region (2020-2031)

5.4 North America

5.4.1 North America Calcium Lignosulfonate Sales Value, 2020-2031

5.4.2 North America Calcium Lignosulfonate Sales Value by Country (%), 2024 VS 2031

5.5 Europe

5.5.1 Europe Calcium Lignosulfonate Sales Value, 2020-2031

5.5.2 Europe Calcium Lignosulfonate Sales Value by Country (%), 2024 VS 2031

5.6 Asia Pacific

5.6.1 Asia Pacific Calcium Lignosulfonate Sales Value, 2020-2031

5.6.2 Asia Pacific Calcium Lignosulfonate Sales Value by Region (%), 2024 VS 2031

5.7 South America

5.7.1 South America Calcium Lignosulfonate Sales Value, 2020-2031

5.7.2 South America Calcium Lignosulfonate Sales Value by Country (%), 2024 VS 2031

5.8 Middle East & Africa

5.8.1 Middle East & Africa Calcium Lignosulfonate Sales Value, 2020-2031

5.8.2 Middle East & Africa Calcium Lignosulfonate Sales Value by Country (%), 2024 VS 2031

6 Segmentation by Key Countries/Regions

6.1 Key Countries/Regions Calcium Lignosulfonate Sales Value Growth Trends, 2020 VS 2024 VS 2031

6.2 Key Countries/Regions Calcium Lignosulfonate Sales Value and Sales Volume

6.2.1 Key Countries/Regions Calcium Lignosulfonate Sales Value, 2020-2031

6.2.2 Key Countries/Regions Calcium Lignosulfonate Sales Volume, 2020-2031

6.3 United States

6.3.1 United States Calcium Lignosulfonate Sales Value, 2020-2031

6.3.2 United States Calcium Lignosulfonate Sales Value by Type (%), 2024 VS 2031

6.3.3 United States Calcium Lignosulfonate Sales Value by Application, 2024 VS 2031

6.4 Europe

6.4.1 Europe Calcium Lignosulfonate Sales Value, 2020-2031

6.4.2 Europe Calcium Lignosulfonate Sales Value by Type (%), 2024 VS 2031

6.4.3 Europe Calcium Lignosulfonate Sales Value by Application, 2024 VS 2031

6.5 China

6.5.1 China Calcium Lignosulfonate Sales Value, 2020-2031

6.5.2 China Calcium Lignosulfonate Sales Value by Type (%), 2024 VS 2031

6.5.3 China Calcium Lignosulfonate Sales Value by Application, 2024 VS 2031

6.6 Japan

6.6.1 Japan Calcium Lignosulfonate Sales Value, 2020-2031

6.6.2 Japan Calcium Lignosulfonate Sales Value by Type (%), 2024 VS 2031

6.6.3 Japan Calcium Lignosulfonate Sales Value by Application, 2024 VS 2031

6.7 South Korea

6.7.1 South Korea Calcium Lignosulfonate Sales Value, 2020-2031

6.7.2 South Korea Calcium Lignosulfonate Sales Value by Type (%), 2024 VS 2031

6.7.3 South Korea Calcium Lignosulfonate Sales Value by Application, 2024 VS 2031

6.8 Southeast Asia

6.8.1 Southeast Asia Calcium Lignosulfonate Sales Value, 2020-2031

6.8.2 Southeast Asia Calcium Lignosulfonate Sales Value by Type (%), 2024 VS 2031

6.8.3 Southeast Asia Calcium Lignosulfonate Sales Value by Application, 2024 VS 2031

6.9 India

6.9.1 India Calcium Lignosulfonate Sales Value, 2020-2031

6.9.2 India Calcium Lignosulfonate Sales Value by Type (%), 2024 VS 2031

6.9.3 India Calcium Lignosulfonate Sales Value by Application, 2024 VS 2031

7 Company Profiles

7.1 Borregaard

7.1.1 Borregaard Company Information

7.1.2 Borregaard Introduction and Business Overview

7.1.3 Borregaard Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.1.4 Borregaard Calcium Lignosulfonate Product Offerings

7.1.5 Borregaard Recent Development

7.2 Nippon Paper Industries

7.2.1 Nippon Paper Industries Company Information

7.2.2 Nippon Paper Industries Introduction and Business Overview

7.2.3 Nippon Paper Industries Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.2.4 Nippon Paper Industries Calcium Lignosulfonate Product Offerings

7.2.5 Nippon Paper Industries Recent Development

7.3 Briskem

7.3.1 Briskem Company Information

7.3.2 Briskem Introduction and Business Overview

7.3.3 Briskem Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.3.4 Briskem Calcium Lignosulfonate Product Offerings

7.3.5 Briskem Recent Development

7.4 Wuhan East China Chemical

7.4.1 Wuhan East China Chemical Company Information

7.4.2 Wuhan East China Chemical Introduction and Business Overview

7.4.3 Wuhan East China Chemical Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.4.4 Wuhan East China Chemical Calcium Lignosulfonate Product Offerings

7.4.5 Wuhan East China Chemical Recent Development

7.5 Shenyang Xingzhenghe Chemical

7.5.1 Shenyang Xingzhenghe Chemical Company Information

7.5.2 Shenyang Xingzhenghe Chemical Introduction and Business Overview

7.5.3 Shenyang Xingzhenghe Chemical Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.5.4 Shenyang Xingzhenghe Chemical Calcium Lignosulfonate Product Offerings

7.5.5 Shenyang Xingzhenghe Chemical Recent Development

7.6 Xinyi Feihuang Chemical

7.6.1 Xinyi Feihuang Chemical Company Information

7.6.2 Xinyi Feihuang Chemical Introduction and Business Overview

7.6.3 Xinyi Feihuang Chemical Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.6.4 Xinyi Feihuang Chemical Calcium Lignosulfonate Product Offerings

7.6.5 Xinyi Feihuang Chemical Recent Development

7.7 Zibo Yinghe Chemical

7.7.1 Zibo Yinghe Chemical Company Information

7.7.2 Zibo Yinghe Chemical Introduction and Business Overview

7.7.3 Zibo Yinghe Chemical Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.7.4 Zibo Yinghe Chemical Calcium Lignosulfonate Product Offerings

7.7.5 Zibo Yinghe Chemical Recent Development

7.8 Shanghai Tingruo Chemical

7.8.1 Shanghai Tingruo Chemical Company Information

7.8.2 Shanghai Tingruo Chemical Introduction and Business Overview

7.8.3 Shanghai Tingruo Chemical Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.8.4 Shanghai Tingruo Chemical Calcium Lignosulfonate Product Offerings

7.8.5 Shanghai Tingruo Chemical Recent Development

7.9 Shandong Greenland Additive

7.9.1 Shandong Greenland Additive Company Information

7.9.2 Shandong Greenland Additive Introduction and Business Overview

7.9.3 Shandong Greenland Additive Calcium Lignosulfonate Sales, Revenue, Price and Gross Margin (2020-2025)

7.9.4 Shandong Greenland Additive Calcium Lignosulfonate Product Offerings

7.9.5 Shandong Greenland Additive Recent Development

8 Industry Chain Analysis

8.1 Calcium Lignosulfonate Industrial Chain

8.2 Calcium Lignosulfonate Upstream Analysis

8.2.1 Key Raw Materials

8.2.2 Raw Materials Key Suppliers

8.2.3 Manufacturing Cost Structure

8.3 Midstream Analysis

8.4 Downstream Analysis (Customers Analysis)

8.5 Sales Model and Sales Channels

8.5.1 Calcium Lignosulfonate Sales Model

8.5.2 Sales Channel

8.5.3 Calcium Lignosulfonate Distributors

9 Research Findings and Conclusion

10 Appendix

10.1 Research Methodology

10.1.1 Methodology/Research Approach

10.1.1.1 Research Programs/Design

10.1.1.2 Market Size Estimation

10.1.1.3 Market Breakdown and Data Triangulation

10.1.2 Data Source

10.1.2.1 Secondary Sources

10.1.2.2 Primary Sources

10.2 Author Details

10.3 Disclaimer

QY Research PVT. LTD.

315 Work Avenue,

Raheja Woods,

6th Floor, Kalyani Nagar,

Yervada, Pune - 411060,

Maharashtra, India

India: (O) +91 866 998 6909

USA: (O) +1 626 295 2442

Email: hitesh@qyresearch.com

Web: www.qyresearch.in

About Us:

QYResearch, established in 2007, is a leading global market research firm providing syndicated and customized research solutions across industries including construction chemicals, specialty chemicals, energy, ICT, and healthcare. With more than 50,000 satisfied clients in 80+ countries, QYResearch is committed to delivering high-quality insights supported by robust research methodologies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Calcium Lignosulfonate Market to Reach US$ 362 Million by 2031, Supported by Sustainable Construction and Green Chemical Demand | QY Research here

News-ID: 4328342 • Views: …

More Releases from QY Research, Inc.

Line Differential Protection Relay Market to Reach US$ 883 Million by 2031, Driv …

Market Summary -

The global market for Line Differential Protection Relay was estimated to be worth US$ 524 million in 2024 and is forecast to a readjusted size of US$ 883 million by 2031, growing at a CAGR of 7.7% during the forecast period 2025-2031.

According to QY Research, a new publication titled "Line Differential Protection Relay - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" delivers a comprehensive,…

Cryogenic Helium Turboexpander Market to Reach US$ 169 Million by 2031, Fueled b …

Market Summary -

The global market for Cryogenic Helium Turboexpander was estimated to be worth US$ 118 million in 2024 and is forecast to a readjusted size of US$ 169 million by 2031 with a CAGR of 5.8% during the forecast period 2025-2031.

According to QY Research, a new publication titled "Cryogenic Helium Turboexpander - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031" provides an in-depth, data-driven analysis of…

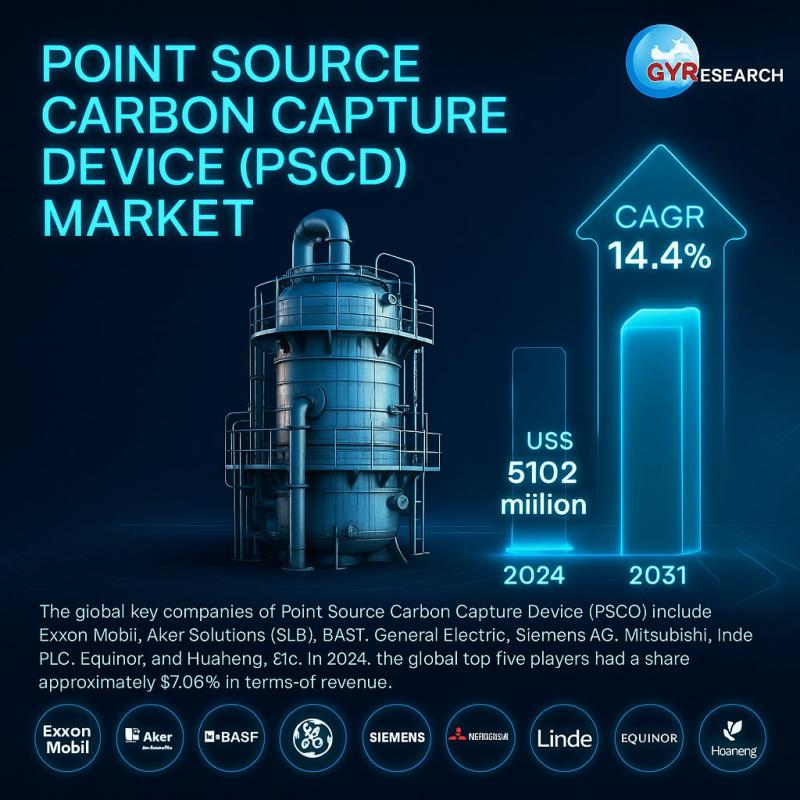

Point Source Carbon Capture Device (PSCD) Market to Reach US$ 12.68 Billion by 2 …

The report presented here prepares market players to achieve consistent success while effectively dealing with unique challenges in the global Point Source Carbon Capture Device (PSCD) market. The analysts and researchers authoring the report have taken into consideration multiple factors predicted to positively and negatively impact the global Point Source Carbon Capture Device (PSCD) market. The report includes SWOT and PESTLE analyses to provide a deeper understanding of the global…

Electronic Grade Brominated Epoxy Resin Market to Experience Strong Demand by 20 …

Los Angeles, United State: The global Electronic Grade Brominated Epoxy Resin Market is extensively studied in the report with the intention of helping players to take crucial bottom-line decisions and create strategic action plans. Analysts authoring the report have provided comprehensive and reliable research studies on market feasibility, product positioning, market competition, market positioning, market entry strategies, and various other important subjects. The report also offers accurate and validated forecasts…

More Releases for Calcium

Calcium Phosphate Market - Latest Report on the Current Trends and Future Opport …

The New Market Research Report - Calcium Phosphate Market

The analysis tracks the impact of key market dynamics on the major challenges and the strategies adopted by key vendors and market players to overcome the challenges and expand their market presence. The study takes a closer look at the strategies and measures adopted by key stakeholders and investors to boost the development of product; the analysis will be useful in understanding…

Nano Calcium Carbonate Market Segment by Type: Standard Grade Nano Calcium Carbo …

Nano Calcium Carbonate market is segmented by region (country), players, by Type, and by Application. Players, stakeholders, and other participants in the global Nano Calcium Carbonate market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type and by Application in terms of revenue and forecast for the period 2016-2027.

For…

Calcium Phosphate Market 2019 Analysis By Regional Outlook Competitive Landscape …

LOS ANGELES, United States: The report offers an industry-standard and a highly authentic research study on the global Calcium Phosphate market. With qualitative and quantitative analysis, it throws light on some of the crucial factors contributing to the growth of the global Calcium Phosphate market. As part of a study on market dynamics, it also explains factors affecting the global market growth. The authors of the report have provided a…

Calcium Phosphate Market Report 2018: Segmentation by Product (Mono Calcium Phos …

Global Calcium Phosphate market research report provides company profile for Sichuan Hongda, Jindi Chemical, Yunnan Xinlong, Mianzhu Panlong Mineral, J.R. Simplot Company, Lomon Group, Advance Inorganics, Nitta Gelatin Inc, Raymon Patel Gelatine Pvt. Ltd., Timab, Fosfitalia SpA, Gadot Biochemical Industries and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms…

Calcium Phosphate Market 2018 Size, Shares | Global Industry Revenue by Top Key …

Calcium phosphate is a family of materials and minerals containing calcium ions (Ca2+) together with inorganic phosphate anions. Some so-called calcium phosphates contain oxide and hydroxide as well.

The Asia-Pacific region dominated the market in the historic year 2017 and is expected to grow at the fastest rate among all areas across the world, followed by North America and then Europe.

Global Calcium Phosphate Market research report 2018 and forecast to 2023…

Calcium Supplements Market Report 2018: Segmentation by Type (Calcium Carbonate, …

Global Calcium Supplements market research report provides company profile for Osteoform, Integrative Therapeutics, NutraLab Canada, Caltrate, P. S. Health Care, Chambio, Holland & Barrett, Blackmores, Swisse and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025,…