Press release

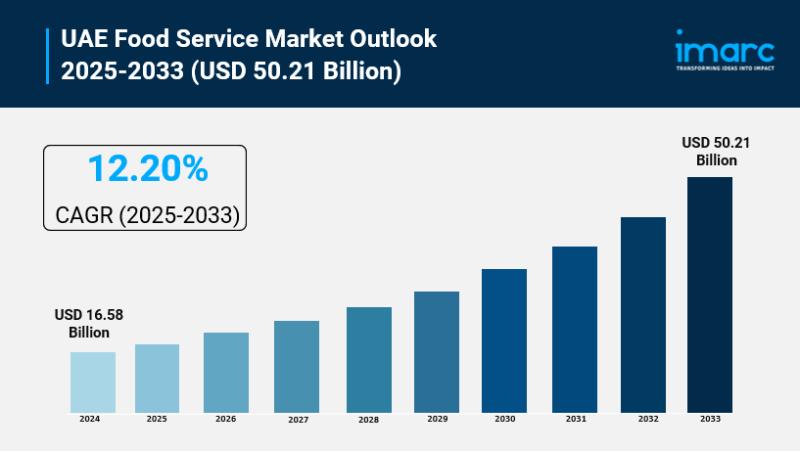

UAE Food Service Market Size is Expected to Reach USD 50.21 Billion By 2033 | CAGR: 12.20%

UAE Food Service Market OverviewMarket Size in 2024: USD 16.58 Billion

Market Size in 2033: USD 50.21 Billion

Market Growth Rate 2025-2033: 12.20%

According to IMARC Group's latest research publication, "UAE Food Service Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the UAE food service market size was valued at USD 16.58 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 50.21 Billion by 2033, exhibiting a CAGR of 12.20% during 2025-2033.

How AI is Reshaping the Future of UAE Food Service Market

● AI-powered inventory and demand forecasting optimizes stock levels in restaurants and cloud kitchens, minimizing waste and ensuring fresh supplies amid rapid urban growth.

● Personalized customer experiences through AI recommendations and chatbots enhance ordering apps, boosting loyalty in a diverse expatriate-driven market.

● Automated operations and robotics streamline kitchen processes, improving efficiency and consistency in quick-service and fine-dining outlets.

● Data analytics for menu innovation helps operators analyze preferences, introducing health-focused and fusion options to meet evolving tastes.

● AI in delivery logistics enables route optimization and predictive scheduling, supporting the surge in online food orders across UAE cities.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-food-service-market/requestsample

How We the UAE 2031 is Revolutionizing UAE Food Service Industry

The "We the UAE 2031" vision is a comprehensive national strategy aimed at doubling GDP through economic diversification, innovation, and enhanced global partnerships, with a strong emphasis on tourism, technology, and sustainability. In the food service sector, it drives expansion by targeting increased tourist arrivals, boosting demand for diverse dining experiences from quick-service to luxury restaurants. Investments in hospitality infrastructure and cultural attractions elevate the UAE as a culinary hub, encouraging international chains and innovative concepts like cloud kitchens. The focus on digital transformation promotes AI integration, app-based ordering, and efficient supply chains, aligning with high consumer spending and multicultural preferences. Sustainability initiatives encourage eco-friendly practices, healthier menus, and reduced waste, while attracting global talent and investments strengthens the workforce and operational excellence. Overall, the vision fosters a vibrant, tech-driven food service landscape, supporting chained outlets, independent operators, and delivery platforms for sustained growth.

UAE Food Service Market Trends & Drivers:

The UAE food service market is propelled by booming tourism and a large expatriate population, creating high demand for multicultural cuisines ranging from Middle Eastern staples to international fusion offerings in full-service restaurants and cafes. Urbanization and fast-paced lifestyles fuel the rise of quick-service restaurants, cloud kitchens, and delivery platforms, with consumers favoring convenience through mobile apps and contactless options. Rising disposable incomes support premium and experiential dining, while health consciousness drives menus featuring plant-based, organic, and nutritious choices across outlets.

Digital transformation accelerates growth via online ordering, AI-driven personalization, and efficient logistics, enhancing customer engagement and operational efficiency in a competitive landscape. Expansion of chained brands and independent operators in malls, standalone locations, and travel hubs caters to diverse preferences, supported by government initiatives promoting hospitality and events. Sustainability trends, including waste reduction and eco-packaging, align with evolving consumer values, positioning the sector for dynamic adaptation to lifestyle shifts and technological advancements.

Purchase the 2026 Comprehensive Updated data: https://www.imarcgroup.com/checkout?id=25511&method=1090

UAE Food Service Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Type:

● Cafes and Bars

● By Cuisine

● Bars and Pubs

● Cafes

● Juice/Smoothie/Desserts Bars

● Specialist Coffee and Tea Shops

● Cloud Kitchen

● Full Service Restaurants

● By Cuisine

● Asian

● European

● Latin American

● Middle Eastern

● North American

● Others

● Quick Service Restaurants

● By Cuisine

● Bakeries

● Burger

● Ice Cream

● Meat-based Cuisines

● Pizza

● Others

Analysis by Outlet:

● Chained Outlets

● Independent Outlets

Analysis by Location:

● Leisure

● Lodging

● Retail

● Standalone

● Travel

Regional Analysis:

● Dubai

● Abu Dhabi

● Sharjah

● Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

● Americana Restaurants International PLC

● Apparel Group

● M.H. Alshaya Co. WLL

● The Emirates Group

● LuLu Group International

● Alamar Foods Company

● Al Khaja Group of Companies

● BinHendi Enterprises

Recent News and Developments in UAE Food Service Market

● January 2025: Leading international restaurant chains announced large-scale outlet expansion plans across Dubai and Abu Dhabi, driven by strong tourism inflows and rising dining-out demand.

● March 2025: Major UAE food service operators invested heavily in cloud kitchens and delivery-only brands, expanding capacity to serve growing online food ordering volumes.

● June 2025: The UAE government rolled out updated food safety and hygiene regulations, prompting restaurants and catering operators to upgrade compliance systems and kitchen infrastructure.

● September 2025: High-profile celebrity chef restaurants and premium dining concepts entered the UAE through strategic franchise partnerships, strengthening the country's position as a global culinary destination.

● December 2025: Year-end tourism, festivals, and mega-events drove record food service revenues, with casual dining, quick-service restaurants, and luxury dining formats performing strongly.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UAE Food Service Market Size is Expected to Reach USD 50.21 Billion By 2033 | CAGR: 12.20% here

News-ID: 4322194 • Views: …

More Releases from IMARC Group

Dehydrated Vegetables Processing Plant DPR 2026: Machinery Cost, Business Plan, …

Setting up a dehydrated vegetables processing plant positions investors in one of the most stable and essential segments of the food processing value chain, backed by sustained global growth driven by rising demand for shelf-stable food ingredients, food processing industry expansion, increasing consumption of convenience and ready-to-eat foods, and the extended shelf-life, nutrient-retention advantages of dehydrated vegetable products. As urbanization accelerates, dietary habits shift toward processed and instant foods, and…

Aluminum Powder Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and …

Setting up an aluminum powder manufacturing plant positions investors in one of the most technically specialized and essential segments of the advanced materials value chain, backed by sustained global growth driven by rising demand from construction chemicals, metallurgy, aerospace, coatings, pyrotechnics, and additive manufacturing. As infrastructure development accelerates, construction materials evolve toward lightweight and energy-efficient solutions, and regulatory frameworks increasingly support recyclable materials, the global aluminum powder industry continues to…

Industrial Enzymes Manufacturing Plant DPR 2026: Cost Structure, Production Proc …

Setting up an industrial enzymes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of fermentation-based production technologies. These biological catalysts serve critical roles in detergents, food and beverages, animal feed, biofuels, pulp and paper, textiles, and wastewater treatment. Success requires careful site selection, efficient microbial fermentation processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial and environmental regulations to ensure profitable and…

Fly Ash Bricks Manufacturing Plant DPR & Unit Setup Report 2026

Setting up a fly ash bricks manufacturing plant positions investors in one of the fastest-growing and most environmentally progressive segments of the construction materials value chain, backed by sustained global growth driven by the increased demand for environmentally friendly construction materials, the growing trend of sustainable construction, and increasing government support towards waste utilisation and green construction methods. As urbanization accelerates, infrastructure development intensifies, and regulatory frameworks increasingly mandate the…

More Releases for UAE

Introduces "E-Invoicing UAE" - Simplifying Digital Compliance for UAE Businesses

KGRN Chartered Accountants, a leading name in financial and compliance consulting, has officially introduced its new service, "E-Invoicing UAE," to help organizations across the United Arab Emirates achieve effortless compliance with the Federal Tax Authority (FTA)'s digital invoicing regulations.

The E-Invoicing UAE platform by KGRN enables businesses to streamline their billing operations, automate tax compliance, and transition to the UAE's paperless invoicing system with confidence. The service is tailored for both…

Ashish Jain, a Renowned Fund Manager Expands into UAE Real Estate in UAE

Dubai - Ashish Jain, a world-renowned fund manager and CEO of Fortune Capital, Fortune Wealth, and the newly launched Alieus Hedge Fund, is stepping into the UAE real estate market as part of his latest strategic expansion. This move marks Jain's entry into the thriving property market, further cementing his reputation as a leader in global finance and innovation.

Image: https://www.getnews.info/uploads/9b42e4a62bfaef7aaf02043c03240d75.jpg

A Visionary Leader in Finance

With over 15 years of experience in…

Fitness Equipment Market UAE | UAE Fitness Market Revenue | Member Penetration U …

The fitness services means any service treatment, diagnosis, advice or instruction concerning to the physical fitness, comprising but not restricted to diet, body building, cardio-vascular fitness, or physical training programs and which you function as or on behalf of the named insured. The fitness services market is commonly propelled by the increasing concerns over the healthy lifestyles around the populace throughout the UAE. Growing health awareness concerning the advantages of…

UAE Fitness Services Market, UAE Fitness Services Industry, Covid-19 Impact UAE …

A strong growth has been witnessed with a considerable expansion in the number of boutique and budget fitness centers directly contributing to the economy.

High Obese and Obesity Rate: Increase in membership rate in UAE fitness centers due to the prevalence of high obese population and obesity rate (Adult obesity in the UAE stood at 27.8% in 2019) has positively affected the market.

Growth of Ladies Fitness Center: Opening up…

wifi solution in uae

Welcome to MAK, Wifi solutions provider in UAE. We bring everything that you would expect from an internet service provider – a highly professional installation and setup, high internet speed, a reliable network, great technical support and customer service to create a remarkable experience for the users, thereby remaining the most trusted WiFi Solutions provider in Dubai and across UAE.

Designing Efficient and Cost Effective Home Wifi Networks

Keep the connections to…

UAE Nuclear Power Sector UAE Nuclear Power Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. UAE Power Sector Scenario

1.1 Existing Power Generation Outlook

1.2 Current & Projected Power Demand

2. Why UAE Energy Policy beyond Oil & Gas?

3. UAE Nuclear Power Sector Overview

3.1 UAE Entering into Nuclear Power Sector

3.2 Nuclear Policy Overview

4. UAE Nuclear Power Sector Dynamics

4.1 Favorable Parameters

4.2 Nuclear Power Sector…