Press release

Top Players and Competitive Dynamics in the Transaction Banking Market

The transaction banking sector is on track for substantial expansion, driven by technological advancements and evolving corporate needs. As businesses and financial institutions increasingly seek efficient, secure, and real-time transaction solutions, the market is set to transform significantly over the coming years. Below, we explore the market's growth projections, leading players, upcoming trends, and detailed segmentation.Rapid Expansion Predicted for the Transaction Banking Market by 2029

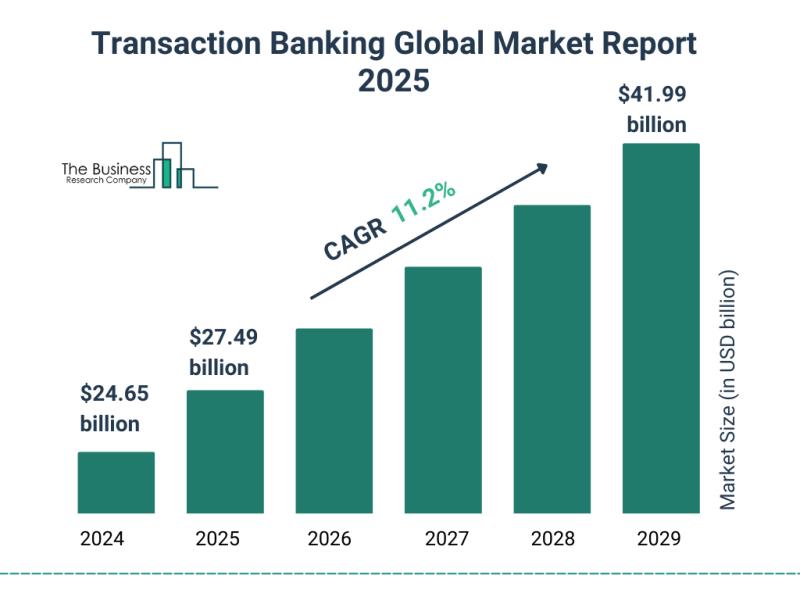

The transaction banking market is expected to experience swift growth, reaching a valuation of $41.99 billion by 2029. This expansion corresponds to a compound annual growth rate (CAGR) of 11.2%. Key factors behind this growth include the widespread adoption of real-time payment systems, escalating demand for automated treasury solutions, increased use of trade finance platforms, broadening corporate banking services, and stronger regulatory support for electronic transactions. The market is also being shaped by innovations such as blockchain-based payments, AI-powered fraud detection, cloud banking platforms, open banking development, and enhanced data analytics for monitoring transactions.

Download a free sample of the transaction banking market report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=30420&type=smp

Prominent Players Leading the Transaction Banking Industry

Several global banks and financial institutions hold dominant positions in the transaction banking space. These include Citibank, JPMorgan Chase, Bank of America, Deutsche Bank, HSBC, Standard Chartered, Goldman Sachs, DBS Bank, UniCredit, ING, UBS, Wells Fargo, Societe Générale, Barclays, MUFG (Mitsubishi UFJ Financial Group), OCBC Bank, Credit Suisse, Banco Santander, BNY Mellon, Scotiabank, Royal Bank of Canada (RBC), ANZ (Australia & New Zealand Banking Group), HDFC Bank, Kotak Mahindra Bank, Nordea, State Bank of India (SBI), and Maybank.

Standard Chartered's Recent Strategic Partnership to Enhance Digital Payments

In May 2023, Standard Chartered, based in the UK, expanded its collaboration with Singapore's Tazapay to facilitate smoother cross-border eCommerce payments. The partnership aims to boost Standard Chartered's digital financial services by offering global marketplaces and merchants a single API solution to handle local payments in over 70 countries. This initiative helps reduce friction and costs for international transactions. Tazapay specializes in transaction banking services such as cross-border payment processing, global payouts, and virtual account management.

View the full transaction banking market report:

https://www.thebusinessresearchcompany.com/report/global-transaction-banking-market-report

Future Trends Shaping the Transaction Banking Market Landscape

Leading institutions in transaction banking are prioritizing digital innovation to meet evolving client demands. They are developing next-generation transaction banking platforms that provide real-time cash visibility, quick cross-border payments, and low-cost transactions. These platforms rely on API-driven, cloud-native technology to deliver integrated liquidity management and automated banking services.

Aurionpro Solutions Limited's Cutting-Edge Platform Launch in Saudi Arabia

For example, in October 2024, Aurionpro Solutions Limited, an Indian technology company, introduced iCashpro+, a state-of-the-art transaction banking platform in Saudi Arabia through a multi-million dollar agreement with a major local bank. The platform features AI-driven automation and personalized digital services aimed at enhancing corporate banking experiences. It supports both conventional and Shariah-compliant banking models and offers services including cash flow forecasting, virtual accounts, liquidity management, and receivables tracking. This launch bolsters Aurionpro's presence in the Middle East and accelerates digital transformation for corporate clients in the region.

Detailed Segmentation of the Global Transaction Banking Market

The transaction banking market is categorized by several factors for a comprehensive analysis:

1) Product Type: Cash Management, Trade Finance, Payments and Collections, Other Product Types

2) Deployment Type: On-Premise, Cloud-Based

3) Service Channel: Online, Offline

4) Application: Corporate, Financial Institutions, Small and Medium-Sized Enterprises (SMEs), Other Applications

5) End-User: Banking, Financial Services, and Insurance (BFSI), Manufacturing, Retail, Healthcare, Information Technology (IT) and Telecom, Other End Users

Further breakdown includes:

- Cash Management subsegments such as Liquidity Management, Account Management, Cash Forecasting, Funds Transfer, Payment Reconciliation, Sweep Solutions, and Virtual Accounts.

- Trade Finance categories including Letter of Credit, Bank Guarantee, Export Finance, Import Finance, Documentary Collection, and Supply Chain Finance.

- Payments and Collections types like Domestic Payments, International Payments, Electronic Funds Transfer, Bill Payment, Direct Debit, and Merchant Services.

- Other Product Types covering Treasury Service, Risk Management, Securities Services, Structured Finance, and Factoring.

This detailed segmentation offers a thorough look into the various components driving the transaction banking market forward.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top Players and Competitive Dynamics in the Transaction Banking Market here

News-ID: 4321320 • Views: …

More Releases from The Business Research Company

Leading Companies Fueling Growth and Innovation in the Sun Care Products Market

The sun care products market is on track for substantial expansion as consumer awareness about skin protection intensifies worldwide. With evolving preferences and technological advancements shaping product offerings, this sector is set to witness robust growth in the coming years. Let's explore the market's size projections, key players, emerging trends, and major segments driving its development through 2030.

Projected Size and Growth Trajectory of the Sun Care Products Market

The…

Future Perspectives: Key Trends Shaping the Styrene Butadiene Rubber (SBR) Based …

The styrene butadiene rubber (SBR) based adhesive market is on track for notable growth as we approach 2030. Driven by a variety of factors including expanding infrastructure projects and rising demand across multiple industries, this sector is poised for steady expansion. Let's explore the market's size projections, key players, emerging trends, and the main segments shaping its future.

Projected Growth and Market Size of Styrene Butadiene Rubber Based Adhesives

The…

Emerging Sub-Segments Transforming the Stearic Acid Market Landscape

The stearic acid market is poised for significant expansion in the coming years, driven by evolving demand across various industries. This report explores the projected market size, leading companies, key trends, and segment analysis shaping the future of this vital chemical.

Stearic Acid Market Size and Growth Outlook

The stearic acid market is set to grow robustly, reaching a valuation of $54.63 billion by 2030. This represents a compound annual…

Market Trend Insights: The Impact of Recent Innovations on the Specialty Pestici …

The specialty pesticides sector is on the verge of significant expansion as global agricultural practices continue to evolve. Driven by increasing demand for crop protection and sustainable farming techniques, this market is set to experience robust growth in the coming years. Let's explore the market's anticipated value, leading companies, emerging trends, and detailed segmentation to gain a comprehensive understanding of this dynamic industry.

Projected Market Size and Growth Expectations for Specialty…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…