Press release

Is the Dairy Industry in India Scalable and Investable Amid Cost Pressure, Regulation, and Competition?

For CXOs and investors, the Indian dairy industry presents a structural decision challenge rather than a demand question. While consumption remains resilient, cost volatility, regulatory oversight, and competitive pressure directly influence scalability and return visibility. This assessment examines whether the industry offers a genuinely investable structure or whether structural constraints continue to limit long-term value creation.Access detailed market intelligence, risks, and strategic insights

[Request Full Research Access] https://www.imarcgroup.com/dairy-industry-in-india/requestsample

"The Indian dairy industry represents a large and expanding economic base, supported by rising organized participation and value-added product penetration. According to IMARC Group estimates, the market was valued at INR 21,318.5 billion in 2025 and is projected to reach INR 57,859.1 billion by 2034. Uttar Pradesh accounted for over 18.7% of total market share in 2025, highlighting regional concentration within the industry."

The Indian dairy industry presents a paradox for decision-makers. While demand fundamentals remain strong, structural constraints related to costs, regulation, and competitive intensity continue to influence scalability and investment viability. This analysis evaluates whether the industry offers a stable, investable structure for organized players and investors, or whether underlying pressures limit long-term value creation despite market size and consumption growth.

Structural Scalability of the Indian Dairy Industry:

Scalability in the Indian dairy industry is shaped less by demand and more by structural realities across sourcing, processing, and distribution. The sector remains heavily dependent on fragmented milk procurement, smallholder farmers, and regionally dispersed supply chains. While cooperatives and large private players have built scale in pockets, replicating this model nationally remains complex due to variability in milk quality, seasonal supply fluctuations, and infrastructure gaps.

For decision-makers, the key question is not whether the industry can grow, but whether it can scale efficiently without proportional increases in cost and operational complexity. Structural scalability therefore depends on procurement efficiency, cold-chain reliability, and the ability to standardize operations across geographies.

Investment Viability and Return Considerations:

From an investment perspective, the Indian dairy industry offers steady demand visibility but uneven return profiles. Capital intensity, working capital cycles, and sensitivity to raw milk prices directly influence return stability. While value-added segments such as branded dairy products improve margin potential, core liquid milk operations often operate under tight profitability bands.

For investors and strategy heads, assessing investability requires understanding how different business models absorb cost volatility and whether scale genuinely translates into operating leverage. Long-term attractiveness is therefore linked to portfolio mix, pricing discipline, and the ability to move beyond volume-led growth into value-led expansion.

For businesses assessing entry, expansion, or investment decisions, deeper discussion often becomes critical

[Discuss This Market with an Analyst] https://www.imarcgroup.com/request?type=report&id=608&flag=C

Cost Pressures and Margin Sustainability:

Cost pressures represent one of the most persistent constraints in the Indian dairy industry. Raw milk procurement accounts for a significant share of total costs, making profitability highly sensitive to input price movements. Energy costs, logistics expenses, and compliance-related expenditures further compress margins, particularly for organized players operating at scale. Unlike many consumer sectors, pricing flexibility in dairy remains limited due to competitive intensity and consumer price sensitivity.

As a result, margin sustainability depends less on pricing power and more on operational efficiency, procurement optimization, and product mix evolution. Decision-makers must therefore evaluate whether current cost structures allow for durable profitability under varying market conditions.

Regulatory Environment and Policy Influence:

Regulation plays a defining role in shaping investment confidence in the Indian dairy industry. Government interventions in pricing, procurement norms, and quality standards can materially influence operating dynamics. While regulatory oversight supports consumer trust and food safety, it also introduces compliance complexity and limits strategic flexibility for private players.

Policy support through subsidies and infrastructure initiatives offers partial relief but does not fully offset structural inefficiencies. For CXOs and investors, the regulatory environment must be assessed not just as a risk factor, but as a structural variable that determines scalability, capital deployment decisions, and long-term competitive positioning.

Competitive Landscape and Market Power Dynamics:

Competition in the Indian dairy industry is characterized by a mix of cooperatives, regional private players, and national brands, resulting in uneven market power distribution. Cooperatives often enjoy procurement advantages and regional loyalty, while private players compete on branding, product innovation, and distribution reach. This competitive structure limits consolidation potential and intensifies margin pressure, particularly in commoditized segments.

For decision-makers, understanding competitive dynamics is critical to identifying defensible positions within the value chain. Sustainable advantage increasingly depends on brand strength, distribution efficiency, and the ability to differentiate beyond price in a structurally competitive market.

Closing Perspective:

In summary, the Indian dairy industry remains fundamentally attractive but structurally demanding. Scalability and investability exist, but only for players that can navigate cost pressures, regulatory complexity, and competitive fragmentation with discipline. For serious investors and strategy leaders, the opportunity lies not in broad market participation, but in selectively aligning capital, capabilities, and operating models with segments that offer sustainable structural advantages.

Get Strategic Insights for Decision-Makers: https://www.imarcgroup.com/request?type=report&id=608&flag=A

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas :- +1-201-971-6302 | Africa and Europe :- +44-753-714-6104

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Is the Dairy Industry in India Scalable and Investable Amid Cost Pressure, Regulation, and Competition? here

News-ID: 4321159 • Views: …

More Releases from IMARC Group

Indonesia Battery Market to Surge to USD 4.4 Billion by 2034 at 11.72% CAGR - Re …

A Comprehensive Introduction to the Indonesia Battery Market Report

According to IMARC Group's report titled "Indonesia Battery Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Get Instant Access to the Free Sample (Corporate Email Required): https://www.imarcgroup.com/indonesia-battery-market/requestsample

Indonesia Battery Market Overview

The Indonesia battery market size was valued at USD 1.6 Billion in 2025.…

Thailand Cheese Market to Reach USD 31.0 Billion by 2033 | 11.80% CAGR | Get Fre …

Thailand Cheese Market Report Introduction

According to IMARC Group's report titled "Thailand Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/thailand-cheese-market/requestsample (Note: We are currently updating our reports to the 2026-2034 period. Click the link above to…

India Two-Wheeler Loan Market to Reach USD 14.55 Billion by 2033 | 6.43% CAGR | …

India Two-wheeler Loan Market Report Introduction

According to IMARC Group's report titled "India Two-Wheeler Loan Market Size, Share, Trends and Forecast by Type, Provider Type, Percentage Amount Sanctioned, Tenure, and Region, 2025-2033" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-two-wheeler-loan-market/requestsample

Note : We are in the process of updating our reports to cover…

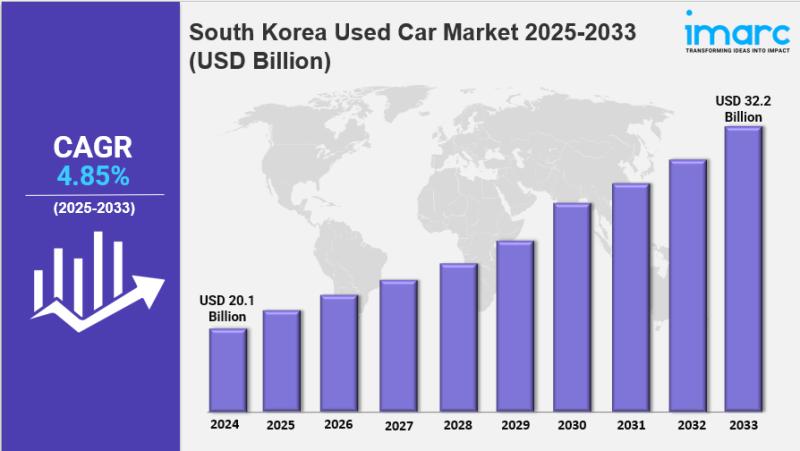

South Korea Used Car Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "South Korea Used Car Market Report by Vehicle Type (Hatchback, Sedan, Sports Utility Vehicle, and Others), Vendor Type (Organized, Unorganized), Fuel Type (Gasoline, Diesel, and Others), Sales Channel (Online, Offline), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Used Car Market…

More Releases for Indian

The Importance of Indian Stable Coin for the Indian Economy

An Indian Stable Coin, like INRx Coin, represents a groundbreaking innovation in India's financial landscape. Designed to maintain stability by being pegged to the Indian Rupee (INR), it bridges the gap between traditional financial systems and the rapidly evolving world of digital currencies. This unique balance of stability and technological advancement has far-reaching implications for the Indian economy and its global positioning.

Bridging the Gap Between Traditional and Digital Finance

An Indian…

Introducing "See No Indian, Hear No Indian, Don't Speak About The Indian" By Ala …

In a world where the dialogue between cultures is more important than ever, a groundbreaking book emerges to challenge the status quo and inspire a new understanding of Native and non-Native relationships.

Here we look at a new book titled "See no Indian, Hear no Indian, Don't Speak about the Indian [https://www.amazon.com/Indian-Hear-Speak-about-Indian-ebook/dp/B0CKNSDC97/ref=sr_1_1?dib=eyJ2IjoiMSJ9._r3WyvNGSxRbbGUZIcdhRy0oONdwuIX7GdkjKWDvMw0.6sRed3Qko4L3tDs42sqUnwvW99yNK42BQjpzNXgII2E&dib_tag=se&qid=1711576177&refinements=p_27%3AAlan++Lechusza&s=digital-text&sr=1-1&text=Alan++Lechusza]" written by the recently emerging author Alan Lechusza which serves as a beacon of change. These writings are not…

Indian start-ups take Indian innovations to Africa Twenty- One Indian Start-ups …

11th July2016, Nairobi: The Federation of Indian Chambers of Commerce and Industry (FICCI) jointly with the Technology Development Board, Government of India took a delegation of twenty one Indian innovation led start-ups to Nairobi, Kenya showcased at the business enclave that was addressed the Hon’ble PM Shri Narendra Modi and the President of Kenya on 11 July 2016.

FICCI and TDB intend to begin a program dubbed African Development through…

Indian Spices

From ancient times, India is known as the 'The home of spices'. The climate of the country is suitable for almost all spices so, India has retained its top place for being the amplest spices exporters and manufacturers in the world. Indian Spices are essential commercial crops from the point of view of both domestic consumption and export.

Agrocrops Exim Limited is a certified public limited company dealing in exporting…

Best Indian Caterer Birmingham, London, Indian Food Catering in UK, Indian Cater …

Sukhdev Catering Services Ltd has become one of Grand Rapids' premier catering and event services in United Kingdom. We pride ourselves in outstanding level of service and superb menu selections. Sukhdev Catering Services Ltd provides elegant catering services for wedding receptions, corporate events, conferences and other very special occasions. We are provides Indian Caterer Birmingham, London including a various range of foods and drinks coupled with our outstanding service and…

Contemporary Indian Art, Indian Paintings

Studiorameshwaram is established in the year 2001 by the famous Indian artist Rameshwar Singh. We are an online art gallery which includes Contemporary Indian Art, Indian Paintings, Modern Paintings, Modern Indian Art, Rajasthani Paintings, Indian Art Gallery, Paintings of India and all are affordable Indian Paintings. This online art gallery is the place for young artists to exhibit their art works.

This website is all about Contemporary Indian Art and…