Press release

Fluorine-Free Oil & Grease Repellent Polymers Market Landscape 2036: Strategic Benchmarking, Pricing Trends & Regional Hotspots

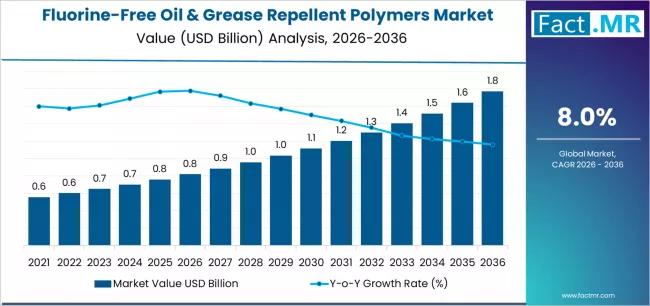

The market for fluorine-free oil and grease repellent polymers is expected to increase at a compound annual growth rate (CAGR) of 8.0% between 2026 and 2036, from USD 0.82 billion in 2026 to USD 1.73 billion. The market is expected to develop at a compound annual growth rate (CAGR) of 8.0% between 2026 and 2036, translating into a total growth of 111.0%. In 2026, the market for fluorine-free oil and grease repellent polymers is expected to be 36.0% dominated by the siloxane/silane-based systems segment.In the United Kingdom and globally, manufacturers are embracing fluorine-free repellents to meet stringent environmental standards, improve product sustainability credentials, and cater to a growing market segment that prioritizes green chemistry and reduced ecological impact.

Key Takeaways for Fluorine-Free Oil & Grease Repellent Polymers Market:

Fluorine-Free Oil & Grease Repellent Polymers Market Value (2026): USD 0.82 billion

Fluorine-Free Oil & Grease Repellent Polymers Market Forecast Value (2036): USD 1.73 billion

Fluorine-Free Oil & Grease Repellent Polymers Market Forecast CAGR: 8.0%

Leading Chemistry Platform in Fluorine-Free Oil & Grease Repellent Polymers Market: Siloxane/Silane-Based Systems (36.0%)

Key Growth Regions in Fluorine-Free Oil & Grease Repellent Polymers Market: China, Brazil, Europe

Key Players in Fluorine-Free Oil & Grease Repellent Polymers Market: Archroma, Rudolf Group, HeiQ, Pulcra Chemicals, BASF SE

To access the complete data tables and in-depth insights, request a Discount On The Report here: https://www.factmr.com/connectus/sample?flag=S&rep_id=12695

Market Overview

Fluorine-free oil and grease repellent polymers include a range of material chemistries such as silicone-based, hydrocarbon-based, and other engineered polymer systems designed to impart repellency without per- and polyfluoroalkyl substances (PFAS). These polymers work by creating low surface energy surfaces that resist wetting by oils and greasy substances. Applications span textile finishes (e.g., clothing and upholstery), grease-resistant food packaging, protective coatings, and specialty functional papers.

The global momentum toward fluorine removal from consumer and industrial products - driven by regulatory restrictions and corporate sustainability commitments - underpins expanding market adoption.

Quick Market Snapshot (2025-2035)

Market Growth Trend: Strong sustainable growth

Key Drivers: Regulatory bans on fluorochemicals, sustainability demand, food safety standards

Primary Product Types: Silicone-based, hydrocarbon-based, and other fluorine-free polymers

Major Applications: Textile finishes, grease-resistant packaging, industrial coatings

End Users: Apparel & textiles, food service packaging, industrial manufacturers

Key Demand Drivers

1. Regulatory Pressure on Fluorinated Polymers

Governments and regulatory bodies are restricting PFAS use.

Bans and phase-outs of long-chain fluorochemistries

Requirements for safer alternatives in consumer products

Global alignment on persistent chemical reduction

This forces manufacturers to adopt fluorine-free polymer solutions.

2. Rising Consumer Environmental Awareness

Consumers increasingly choose sustainable products.

Preference for PFAS-free labeling

Concerns about environmental persistence and health risks

Demand for "green" certified textiles and packaging

Brands are responding by switching to fluorine-free repellents.

3. Growth in Grease-Resistant Food Packaging

Food packaging sectors seek safer oil repellents.

Hot-food wraps and fast-food packaging materials

Bakery and microwaveable containers needing grease resistance

Recyclable and compostable substrate compatibility

Fluorine-free polymers provide necessary performance with sustainability.

4. Expansion of Technical and Functional Textiles

Specialty textiles require effective repellency.

Outdoor apparel and performance wear

Automotive interior fabrics

Home textiles with easy-clean properties

Fluorine-free finishes support multifunctional textile performance.

Market Segmentation Analysis

By Polymer Type

Silicone-Based Polymers:

Provide durable oil and water repellency with good environmental profile.

Hydrocarbon-Based Polymers:

Cost-effective and compatible with many substrates.

Other Bio-Based or Specialty Polymers:

Emerging chemistries tuned for specific applications.

Silicone and hydrocarbon chemistries account for the largest share, with new bio-based polymers gaining traction.

By Application

Textile Finishes:

Apparel, technical fabrics, upholstery and automotive textiles.

Food Packaging:

Grease-resistant wraps, paperboard, disposable containers.

Industrial Coatings:

Protective coatings for machinery and components exposed to oil/grease.

Specialty Papers:

Oil-resistant printing and label materials.

Textile finishes and packaging segments are primary demand drivers.

By End-Use Industry

Apparel & Footwear

Foodservice & Packaging

Industrial Manufacturing

Automotive & Transportation

Home & Consumer Goods

Foodservice and textile sectors collectively contribute a major portion of demand.

Regional Demand Trends - UK Focus

England:

High demand due to concentration of textile manufacturers and packaging producers prioritizing sustainability.

Scotland & Wales:

Steady adoption driven by eco-friendly product initiatives and regional industry clusters.

Northern Ireland:

Growing interest among SMEs transitioning to sustainable finishes and packaging.

Across the UK, sustainability goals and consumer advocacy groups support adoption of fluorine-free polymer technologies.

Challenges and Market Restraints

1. Performance Gaps Compared to Traditional Fluorochemicals

Fluorine-free alternatives may initially lag in extreme repellency.

Ongoing R&D to close performance differential

Trade-off between repellency, durability, and cost

2. Cost Considerations

Advanced fluorine-free polymers can carry premium pricing.

Higher material costs versus legacy PFAS chemistries

Budget sensitivity among value-oriented manufacturers

3. Integration into Existing Manufacturing Processes

Need for process re-optimization and testing

Training and equipment modifications for new chemistries

Emerging Trends and Opportunities

1. Development of High-Performance Bio-Based Polymers

Polymers derived from renewable feedstocks

Enhanced biodegradability and sustainability credentials

2. Strategic Partnerships for Innovation

Brand-supplier collaborations on custom formulations

Co-development of application-specific solutions

3. Certification and Sustainability Labeling

Third-party endorsements for PFAS-free products

Branding opportunities tied to green performance

4. Expansion of Recycling and Circular Economy Initiatives

Compatibility with paper and textile recycling streams

Closed-loop product design

Competitive Landscape Overview

Market participants are focusing on:

R&D to enhance performance of fluorine-free repellents

Broadening product portfolios to serve diverse substrates

Technical support for application transitions and optimization

Collaboration with apparel brands and packaging converters

Innovation, sustainability credentials, and application expertise are key competitive differentiators.

Future Outlook

The demand for fluorine-free oil and grease repellent polymers is expected to grow steadily through 2035, supported by regulatory momentum, sustainability commitments, and ongoing advances in material science. While challenges remain in matching the highest-level performance of legacy fluorochemistries, continuous innovation and formulation improvements are narrowing the gap.

Manufacturers that align product development with eco-friendly standards, offer strong technical support, and demonstrate clear performance advantages will be well positioned to capture long-term opportunities. End-use industries focused on sustainability - especially foodservice packaging and functional textiles - will continue to drive adoption of fluorine-free oil and grease repellent polymers across the UK and beyond.

Browse Full Report: https://www.factmr.com/report/fluorine-free-oil-grease-repellent-polymers-market

Purchase Full Report for Detailed Insights

For access to full forecasts, regional break-outs, product- and application-level analysis, company share details, and emerging trend assessments, you can purchase the complete report: https://www.factmr.com/checkout/12695

Have specific requirements or need assistance on report pricing or have a limited budget? Please contact sales@factmr.com

Related Reports:

Argan Oil Industry Analysis in the UK: https://www.factmr.com/report/argan-oil-industry-analysis-in-the-uk

White Oil Market: https://www.factmr.com/report/white-oil-market

Plant Oil Based Printing Inks Market: https://www.factmr.com/report/plant-oil-based-printing-inks-market

Edible Oil Adulteration Testing Chemicals Market: https://www.factmr.com/report/2024/edible-oil-adulteration-testing-chemicals-market

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

The demand for fluorine-free oil and grease repellent polymers is rising sharply as industries shift toward environmentally sustainable and health-conscious material solutions. Fluorine-containing repellents have historically dominated the market due to excellent performance; however, increasing regulatory restrictions and consumer preference for eco-friendly products are accelerating adoption of fluorine-free alternatives. These polymers provide effective oil and grease repellency across textiles, food packaging, paper products, and specialty industrial applications while avoiding long-lasting fluorinated chemistries.

In the United Kingdom and globally, manufacturers are embracing fluorine-free repellents to meet stringent environmental standards, improve product sustainability credentials, and cater to a growing market segment that prioritizes green chemistry and reduced ecological impact.

Market Overview

Fluorine-free oil and grease repellent polymers include a range of material chemistries such as silicone-based, hydrocarbon-based, and other engineered polymer systems designed to impart repellency without per- and polyfluoroalkyl substances (PFAS). These polymers work by creating low surface energy surfaces that resist wetting by oils and greasy substances. Applications span textile finishes (e.g., clothing and upholstery), grease-resistant food packaging, protective coatings, and specialty functional papers.

The global momentum toward fluorine removal from consumer and industrial products - driven by regulatory restrictions and corporate sustainability commitments - underpins expanding market adoption.

Quick Market Snapshot (2025-2035)

Market Growth Trend: Strong sustainable growth

Key Drivers: Regulatory bans on fluorochemicals, sustainability demand, food safety standards

Primary Product Types: Silicone-based, hydrocarbon-based, and other fluorine-free polymers

Major Applications: Textile finishes, grease-resistant packaging, industrial coatings

End Users: Apparel & textiles, food service packaging, industrial manufacturers

Key Demand Drivers

1. Regulatory Pressure on Fluorinated Polymers

Governments and regulatory bodies are restricting PFAS use.

Bans and phase-outs of long-chain fluorochemistries

Requirements for safer alternatives in consumer products

Global alignment on persistent chemical reduction

This forces manufacturers to adopt fluorine-free polymer solutions.

2. Rising Consumer Environmental Awareness

Consumers increasingly choose sustainable products.

Preference for PFAS-free labeling

Concerns about environmental persistence and health risks

Demand for "green" certified textiles and packaging

Brands are responding by switching to fluorine-free repellents.

3. Growth in Grease-Resistant Food Packaging

Food packaging sectors seek safer oil repellents.

Hot-food wraps and fast-food packaging materials

Bakery and microwaveable containers needing grease resistance

Recyclable and compostable substrate compatibility

Fluorine-free polymers provide necessary performance with sustainability.

4. Expansion of Technical and Functional Textiles

Specialty textiles require effective repellency.

Outdoor apparel and performance wear

Automotive interior fabrics

Home textiles with easy-clean properties

Fluorine-free finishes support multifunctional textile performance.

Market Segmentation Analysis

By Polymer Type

Silicone-Based Polymers:

Provide durable oil and water repellency with good environmental profile.

Hydrocarbon-Based Polymers:

Cost-effective and compatible with many substrates.

Other Bio-Based or Specialty Polymers:

Emerging chemistries tuned for specific applications.

Silicone and hydrocarbon chemistries account for the largest share, with new bio-based polymers gaining traction.

By Application

Textile Finishes:

Apparel, technical fabrics, upholstery and automotive textiles.

Food Packaging:

Grease-resistant wraps, paperboard, disposable containers.

Industrial Coatings:

Protective coatings for machinery and components exposed to oil/grease.

Specialty Papers:

Oil-resistant printing and label materials.

Textile finishes and packaging segments are primary demand drivers.

By End-Use Industry

Apparel & Footwear

Foodservice & Packaging

Industrial Manufacturing

Automotive & Transportation

Home & Consumer Goods

Foodservice and textile sectors collectively contribute a major portion of demand.

Regional Demand Trends - UK Focus

England:

High demand due to concentration of textile manufacturers and packaging producers prioritizing sustainability.

Scotland & Wales:

Steady adoption driven by eco-friendly product initiatives and regional industry clusters.

Northern Ireland:

Growing interest among SMEs transitioning to sustainable finishes and packaging.

Across the UK, sustainability goals and consumer advocacy groups support adoption of fluorine-free polymer technologies.

Challenges and Market Restraints

1. Performance Gaps Compared to Traditional Fluorochemicals

Fluorine-free alternatives may initially lag in extreme repellency.

Ongoing R&D to close performance differential

Trade-off between repellency, durability, and cost

2. Cost Considerations

Advanced fluorine-free polymers can carry premium pricing.

Higher material costs versus legacy PFAS chemistries

Budget sensitivity among value-oriented manufacturers

3. Integration into Existing Manufacturing Processes

Need for process re-optimization and testing

Training and equipment modifications for new chemistries

Emerging Trends and Opportunities

1. Development of High-Performance Bio-Based Polymers

Polymers derived from renewable feedstocks

Enhanced biodegradability and sustainability credentials

2. Strategic Partnerships for Innovation

Brand-supplier collaborations on custom formulations

Co-development of application-specific solutions

3. Certification and Sustainability Labeling

Third-party endorsements for PFAS-free products

Branding opportunities tied to green performance

4. Expansion of Recycling and Circular Economy Initiatives

Compatibility with paper and textile recycling streams

Closed-loop product design

Competitive Landscape Overview

Market participants are focusing on:

R&D to enhance performance of fluorine-free repellents

Broadening product portfolios to serve diverse substrates

Technical support for application transitions and optimization

Collaboration with apparel brands and packaging converters

Innovation, sustainability credentials, and application expertise are key competitive differentiators.

Future Outlook

The demand for fluorine-free oil and grease repellent polymers is expected to grow steadily through 2035, supported by regulatory momentum, sustainability commitments, and ongoing advances in material science. While challenges remain in matching the highest-level performance of legacy fluorochemistries, continuous innovation and formulation improvements are narrowing the gap.

Manufacturers that align product development with eco-friendly standards, offer strong technical support, and demonstrate clear performance advantages will be well positioned to capture long-term opportunities. End-use industries focused on sustainability - especially foodservice packaging and functional textiles - will continue to drive adoption of fluorine-free oil and grease repellent polymers across the UK and beyond.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fluorine-Free Oil & Grease Repellent Polymers Market Landscape 2036: Strategic Benchmarking, Pricing Trends & Regional Hotspots here

News-ID: 4319483 • Views: …

More Releases from Fact.MR

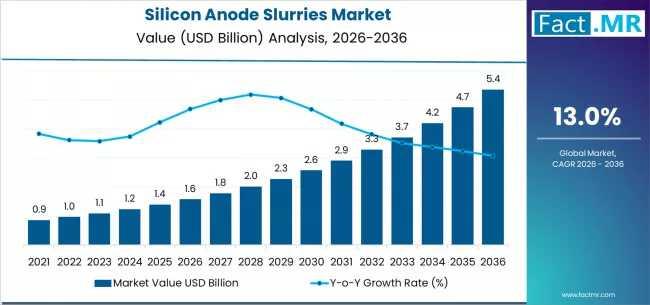

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

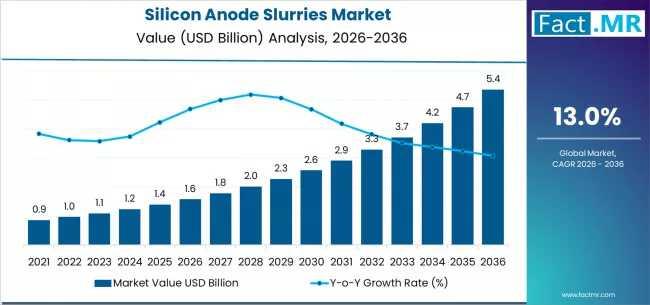

Silicon Anode Slurries Market Forecast 2026-2036: Market Size, Share, Competitiv …

The global silicon anode slurries market is set for significant expansion between 2026 and 2036, fueled by the rising adoption of high-energy-density lithium-ion batteries across electric vehicles (EVs), consumer electronics, and grid-scale energy storage. As battery manufacturers increasingly transition from graphite to silicon-enhanced anodes, the demand for high-performance, scalable silicon anode slurries is projected to grow sharply.

To access the complete data tables and in-depth insights, request a Discount On The…

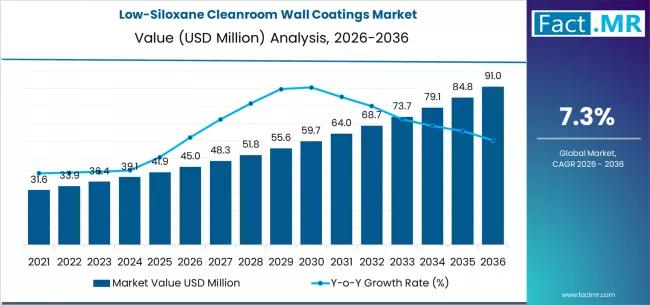

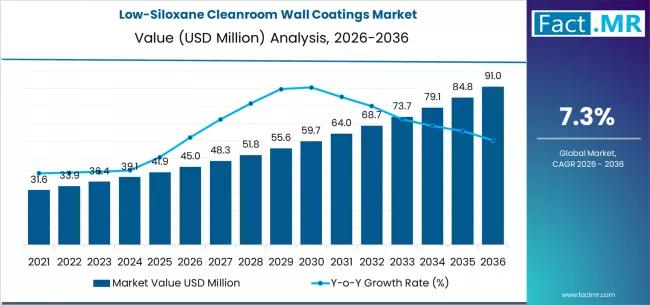

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

Low-Siloxane Cleanroom Wall Coatings Market Deep-Dive 2026-2036: Strategic Forec …

The low-siloxane cleanroom wall coatings market is poised for steady growth over the next decade, driven by rising contamination-control requirements across semiconductor, pharmaceutical, biotechnology, and precision manufacturing industries. These coatings are specifically engineered to minimize siloxane outgassing and volatile organic compound emissions, helping maintain ultra-clean environments where even trace contamination can disrupt production quality.

By 2036, the market for low-siloxane cleanroom wall coatings is expected to grow to USD 91.04 million.…

More Releases for Polymer

MDR Certificate For Single Polymer Clip Applier And Multiple Polymer Clip Applie …

EU Quality Management System Certificate

Regulation (EU)2017/745, Annex Ix Chapter I and III

MDR 804963 R000

Manufacturer: Hangzhou Sunstone Technology Co., Ltd

Address:

2nd Floor of Building 1,

#460 Fucheng Rd, Qiantang Area

Hangzhou

Zhejiang

310018

China

Single Registration Number: CN-MF-000040501

EU Authorised Representative: MedPath GmbH

Address:

Mies-van-der-Rohe-Strasse 8

80807

Munich

Germany

Scope: See attached Device Schedule

On the basis of our examination of the quality system in accordance with Regulation (EU) 2017/745, Annex IX

Chapter I and lll, the quality system meets the requirements of the Regulation. For the…

Acrylic Polymer Market

𝐓𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐚𝐜𝐫𝐲𝐥𝐢𝐜 𝐩𝐨𝐥𝐲𝐦𝐞𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐰𝐚𝐬 𝐯𝐚𝐥𝐮𝐞𝐝 𝐚𝐭 𝐚𝐩𝐩𝐫𝐨𝐱𝐢𝐦𝐚𝐭𝐞𝐥𝐲 𝐔𝐒𝐃 𝟐𝟎 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟐 𝐚𝐧𝐝 𝐢𝐬 𝐩𝐫𝐨𝐣𝐞𝐜𝐭𝐞𝐝 𝐭𝐨 𝐫𝐞𝐚𝐜𝐡 𝐔𝐒𝐃 𝟑𝟔.𝟗 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐛𝐲 𝟐𝟎𝟑𝟐, 𝐠𝐫𝐨𝐰𝐢𝐧𝐠 𝐚𝐭 𝐚 𝐜𝐨𝐦𝐩𝐨𝐮𝐧𝐝 𝐚𝐧𝐧𝐮𝐚𝐥 𝐠𝐫𝐨𝐰𝐭𝐡 𝐫𝐚𝐭𝐞 (𝐂𝐀𝐆𝐑) 𝐨𝐟 𝟔.𝟒% 𝐟𝐫𝐨𝐦 𝟐𝟎𝟐𝟑 𝐭𝐨 𝟐𝟎𝟑𝟐.

𝐀𝐜𝐫𝐲𝐥𝐢𝐜 𝐏𝐨𝐥𝐲𝐦𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

The acrylic polymer market has experienced significant growth due to its versatile applications across various industries, including paints and coatings, adhesives, textiles, and construction. Acrylic polymers are favored for…

Polymer Processing Aids: Enhancing Efficiency and Quality in Polymer Manufacturi …

Introduction

Polymer Processing Aids (PPAs) are indispensable additives used to improve the efficiency, quality, and cost-effectiveness of polymer manufacturing. These aids, often added in small quantities, significantly enhance polymer production by reducing surface defects, improving flow properties, and reducing wear on manufacturing equipment. Their role is critical in enabling smooth, uninterrupted processing, leading to higher-quality end products and improved manufacturing productivity. With the ever-growing demand for polymers across industries like automotive,…

What Are Lithium Polymer? Information About Lithium Polymer Batteries Guide

Did people know that Lithium Polymer power over 80% of the drones used in recreational and commercial applications today? Lithium Polymer (LiPo) batteries have become a staple in modern electronics. From powering smartphones and laptops to energizing drones and electric vehicles, these batteries offer a blend of high energy density and flexibility that makes them ideal for a wide range of applications. In this article, we'll dive deep into what…

Custom Polymer Synthesis Market 2023 Will Record Massive Growth, Trend Analysis …

The Custom Polymer Synthesis Market Trends Overview 2023-2030:

A new Report by Stratagem Market Insights, titled "Custom Polymer Synthesis Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2030," offers a comprehensive analysis of the industry, which comprises insights on the Custom Polymer Synthesis market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures, tables, and charts,…

Silyl Modified Polymer (MS Polymer) Market Forecast Research Reports Offers Key …

Silyl Modified Polymer (MS Polymer) Market: Introduction

MS polymers, also known as silyl modified polymers or silyl terminated polymers, are polymers with a silane group. A silyl modified polymer (MS polymer) usually refers to a hybrid polymer backbone, usually polyurethane or polyether and a silane end group. Formulators can change the backbone polymer in sealants and adhesives utilizing MS polymers to match the specified application, achieving silicone-like performance while avoiding the…