Press release

Cellulose Ether Prices: Global Price and Market Insights for 2025

Cellulose Ether Prices in key regions for Q3 2025:USA: USD 3808.55/Ton

China: USD 4740.23/Ton

Germany: USD 3064.86/Ton

India: USD 2055.43/Ton

Brazil: USD 3922.91/Ton

What is Cellulose Ether?

Cellulose ether is a group of water-soluble or water-dispersible polymers derived from natural cellulose through chemical modification. Common types include methyl cellulose (MC), hydroxyethyl cellulose (HEC), hydroxypropyl methylcellulose (HPMC), and carboxymethyl cellulose (CMC). These materials are widely used as thickeners, binders, stabilizers, and water-retention agents.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/cellulose-ether-pricing-report/requestsample

Regional Prices Movement:

During Q3 2025, Cellulose Ether Prices in the USA averaged USD 3,808.55/ton. Prices remained relatively firm, supported by steady demand from construction, pharmaceuticals, and personal care sectors. Balanced domestic supply and stable import flows helped prevent sharp volatility, while moderate raw material and logistics costs maintained overall market stability.

In China, cellulose ether prices reached USD 4,740.23/ton in Q3 2025. Elevated prices were driven by consistent demand from construction additives and industrial applications. Environmental compliance costs and controlled production rates tightened supply, while export demand remained stable, supporting higher price levels despite cautious domestic purchasing sentiment.

During Q3 2025, Germany's cellulose ether prices stood at USD 3,064.86/ton. The market experienced subdued demand from the construction sector amid slower project activity. Adequate supply availability and competitive imports kept prices under pressure, while energy and processing costs showed limited upward influence during the quarter.

In India, cellulose ether prices averaged USD 2,055.43/ton in Q3 2025. Softer demand from infrastructure and real estate projects weighed on pricing sentiment. Ample domestic production and sufficient imports ensured comfortable supply levels, while stable raw material costs limited any significant price escalation.

During Q3 2025, cellulose ether prices in Brazil reached USD 3,922.91/ton. Prices were supported by steady demand from construction and industrial applications. Supply remained balanced, though higher logistics and import-related costs added upward pressure, keeping prices relatively firm throughout the quarter.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22422&flag=C

Factors Affecting Cellulose Ether Prices

Raw Material Costs: Prices of refined cellulose pulp, cotton linters, and chemical reagents strongly influence production costs.

Construction Sector Demand: Usage in cement, mortar, tile adhesives, and gypsum products significantly impacts demand.

Energy and Processing Costs: Energy-intensive processing and compliance with environmental standards affect pricing.

Production Capacity: Plant operating rates, maintenance shutdowns, and regional capacity expansions shape supply balance.

Logistics and Trade: Freight costs, export demand, and regional trade policies influence delivered prices.

Supply and Prices Overview

Cellulose ether supply is generally stable, supported by established production hubs in Asia, Europe, and North America. Prices fluctuate based on demand from construction, pharmaceuticals, food, and personal care industries. Periods of infrastructure slowdown or strong export demand can create short-term price volatility.

Cellulose Ether Price Index and Market Trend (Q3 2025)

In Q3 2025, the cellulose ether price index showed mixed regional trends. Prices remained firm in markets with steady construction and industrial activity, while regions experiencing slower building activity saw softer pricing. Overall, the market reflected balanced supply with cautious purchasing behavior.

Latest News and Market Developments

Stable construction chemical demand in Asia and the Americas

Continued focus on environmentally compliant manufacturing processes

Gradual recovery in infrastructure spending across select regions

Outlook

The outlook for cellulose ether remains moderately positive. Growth in construction additives, pharmaceuticals, and personal care products is expected to support long-term demand. However, pricing will continue to depend on raw material availability, energy costs, and regional construction activity.

Current Demand and Uses

Major applications of cellulose ether include:

Cement and mortar additives for improved workability and water retention

Pharmaceutical formulations as binders and controlled-release agents

Food and beverage thickeners and stabilizers

Personal care and cosmetic products

Paints, coatings, and industrial formulations

Overall, cellulose ether remains a critical functional additive across multiple industries, driven by versatility and sustainable raw material origins

How IMARC Pricing Database Can Help

The latest IMARC Group study, "Cellulose Ether Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of Cellulose Ether price trend, offering key insights into global Cellulose Ether market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Cellulose Ether demand, illustrating how consumer behaviour and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales [@] imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cellulose Ether Prices: Global Price and Market Insights for 2025 here

News-ID: 4318351 • Views: …

More Releases from IMARC Services Private Limited

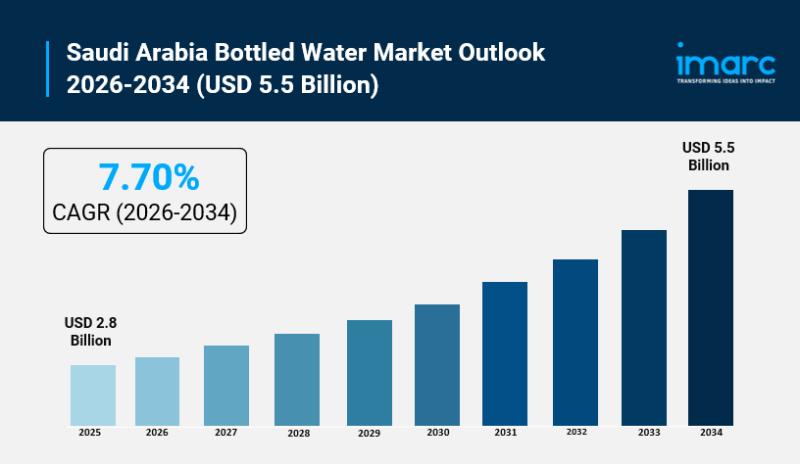

Saudi Arabia Bottled Water Market Set to Surge USD 5.5 Billion by 2034, Rising a …

Saudi Arabia Bottled Water Market Overview

Market Size in 2025: USD 2.8 Billion

Market Forecast in 2034: USD 5.5 Billion

Market Growth Rate 2026-2034: 7.70%

According to IMARC Group's latest research publication, "Saudi Arabia Bottled Water Market Size, Share, Trends and Forecast by Type, Distribution Channel, Packaging Size, and Region, 2026-2034", the Saudi Arabia bottled water market size was valued at USD 2.8 Billion in 2025. Looking forward, IMARC Group estimates the market to…

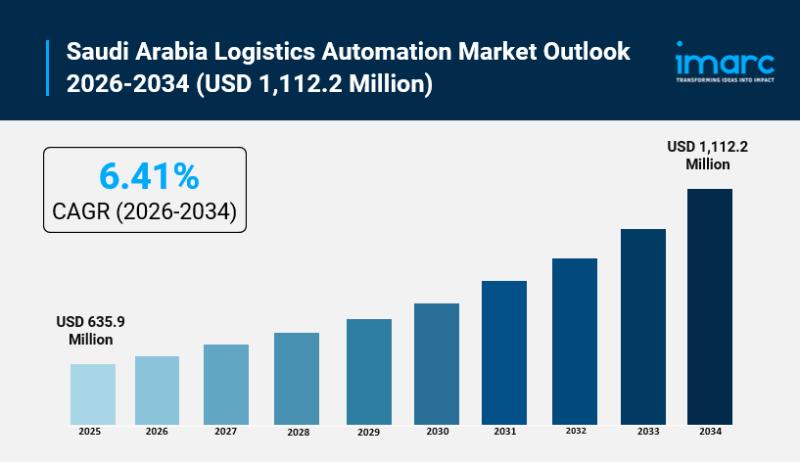

Saudi Arabia Logistics Automation Market Size to Worth USD 1,112.2 Million by 20 …

Saudi Arabia Logistics Automation Market Overview

Market Size in 2025: USD 635.9 Million

Market Forecast in 2034: USD 1,112.2 Million

Market Growth Rate 2026-2034: 6.41%

According to IMARC Group's latest research publication, "Saudi Arabia Logistics Automation Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the Saudi Arabia logistics automation market size reached USD 635.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,112.2 Million by 2034, exhibiting…

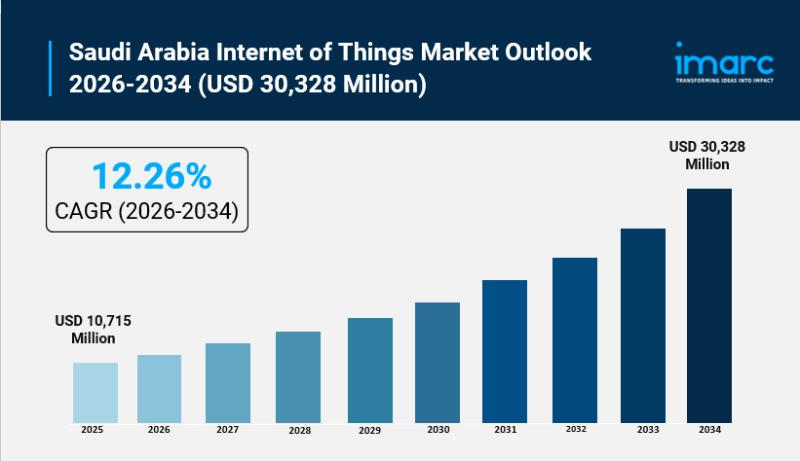

Saudi Arabia Internet of Things Market Set to Reach USD 30,328 Million by 2034 A …

Saudi Arabia Internet of Things Market Overview

Market Size in 2025: USD 10,715 Million

Market Forecast in 2034: USD 30,328 Million

Market Growth Rate 2026-2034: 12.26%

According to IMARC Group's latest research publication, "Saudi Arabia Internet of Things Market Size, Share, Trends and Forecast by Component, Application, Vertical, and Region, 2026-2034", The Saudi Arabia internet of things market size was valued at USD 10,715 Million in 2025 and is projected to reach USD 30,328…

Saudi Arabia Duty-Free and Travel Retail Market Projected to Reach USD 726.1 Mil …

Saudi Arabia Duty-Free and Travel Retail Market Overview

Market Size in 2025: USD 417.7 Million

Market Forecast in 2034: USD 726.1 Million

Market Growth Rate 2026-2034: 6.34%

According to IMARC Group's latest research publication, "Saudi Arabia Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034", the Saudi Arabia duty-free and travel retail market size reached USD 417.7 Million in 2025. Looking forward, IMARC Group expects…

More Releases for Price

Bitcoin Price, XRP Price, and Dogecoin Price Analysis: Turn Volatility into Prof …

London, UK, 4th October 2025, ZEX PR WIRE, The price movements in the cryptocurrency market can be crazy. Bitcoin price (BTC price), XRP price, and Dogecoin price vary from day to day, which can make it complicated for traders. Some investors win, but many more lose, amid unpredictable volatility. But there's a more intelligent way and that is Hashf . Instead of contemplating charts, Hashf provides an opportunity for investors…

HOTEL PRICE KILLER - BEAT YOUR BEST PRICE!

Noble Travels Launches 'Hotel Price Killer' to Beat OTA Hotel Prices

New Delhi, India & Atlanta, USA - August 11, 2025 - Noble Travels, a trusted name in the travel industry for over 30 years, has launched a bold new service called Hotel Price Killer, promising to beat the best hotel prices offered by major online travel agencies (OTAs) and websites.

With offices in India and USA, Noble Travels proudly serves an…

Toluene Price Chart, Index, Price Trend and Forecast

Toluene TDI Grade Price Trend Analysis - EX-Kandla (India)

The pricing trend for Toluene Diisocyanate (TDI) grade at EX-Kandla in India reveals notable fluctuations over the past year, influenced by global supply-demand dynamics and domestic economic conditions. From October to December 2023, the average price of TDI declined from ₹93/KG in October to ₹80/KG in December. This downward trend continued into 2024, with October witnessing a significant drop to ₹73/KG, a…

Glutaraldehyde Price Trend, Price Chart 2025 and Forecast

North America Glutaraldehyde Prices Movement Q1:

Glutaraldehyde Prices in USA:

Glutaraldehyde prices in the USA dropped to 1826 USD/MT in March 2025, driven by oversupply and weak demand across manufacturing and healthcare. The price trend remained negative as inventories rose and procurement slowed sharply in February. The price index captured this decline, while the price chart reflected persistent downward pressure throughout the quarter.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/glutaraldehyde-pricing-report/requestsample

Note: The analysis can…

Butane Price Trend 2025, Update Price Index and Real Time Price Analysis

MEA Butane Prices Movement Q1 2025:

Butane Prices in Saudi Arabia:

In the first quarter of 2025, butane prices in Saudi Arabia reached 655 USD/MT in March. The pricing remained stable due to consistent domestic production and strong export activities. The country's refining capacity and access to natural gas feedstock supported price control, even as global energy markets saw fluctuations driven by seasonal demand and geopolitical developments impacting the Middle East.

Get the…

Tungsten Price Trend, Chart, Price Fluctuations and Forecast

North America Tungsten Prices Movement:

Tungsten Prices in USA:

In the last quarter, tungsten prices in the United States reached 86,200 USD/MT in December. The price increase was influenced by high demand from the aerospace and electronics industries. Factors such as production costs and raw material availability, alongside market fluctuations, also contributed to the pricing trend.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/tungsten-pricing-report/requestsample

Note: The analysis can be tailored to align with the customer's specific…