Press release

Vietnam Tax Management Software Market Outlook: Trends, Growth, and Future Opportunities 2026-2034

The Vietnam tax management software market was valued at USD 80.99 Million in 2025 and is forecasted to reach USD 211.70 Million by 2034, growing at a CAGR of 11.27% during 2026-2034. This growth is driven by government digitalization efforts, mandatory e-invoicing legislation, and increasing business awareness for compliance automation. The market also benefits from the rising demand among SMEs for affordable tax solutions and the shift toward cloud-based tax software integrated with accounting and ERP systems.Sample Request Link: https://www.imarcgroup.com/vietnam-tax-management-software-market/requestsample

Study Assumption Years

Base Year: 2025

Historical Year/Period: 2020-2025

Forecast Year/Period: 2026-2034

Vietnam Tax Management Software Market Key Takeaways

The market size of Vietnam tax management software reached USD 80.99 Million in 2025.

The market exhibits a CAGR of 11.27% during the forecast period 2026-2034.

The forecasted market size is USD 211.70 Million by 2034.

Growth is propelled by increasing government focus on digitalization and e-invoicing mandates.

Rising SME adoption due to cloud infrastructure improvements and SaaS tax software availability.

The need for software integration with ERP, payroll, and e-commerce platforms enhances market growth.

Regional dynamics vary with northern Vietnam seeing faster adoption of advanced solutions compared to central and southern regions.

Request Customization: https://www.imarcgroup.com/request?type=report&id=43925&flag=E

Market Growth Factors

The Vietnam tax management software market is primarily fueled by strong local government regulatory initiatives pushing electronic invoicing, real-time tax reporting, and enhanced compliance standards. The government is raising documentation and audit trail requirements, especially for foreign contractor taxes and cross-border services. This drives adoption of compliant, adaptable, and upgradeable software aligned with changing laws. Local tax authorities embedding digital invoice and payment verification demand solutions supporting Vietnamese language, governmental tax portal formats, and accounting conventions, intensifying the need for cloud-based, modular technologies with localized integration capabilities.

Another key driver is the increasing adoption of tax management solutions by small and medium-sized enterprises (SMEs) in Vietnam. Historically, large companies led adoption with in-house accounting and on-premise software. However, greater cloud infrastructure availability, enhanced internet penetration in cities like Ho Chi Minh City and Hanoi, and government digitalization initiatives have made SaaS tax software viable for smaller firms. SMEs seek user-friendly, low upfront cost software that simplifies tax filing, invoicing, deadline reminders, and basic analytics without large accounting teams. Local vendors are segmenting offerings by cost, workflow, language, and training support, helping expand the market.

Integration with enterprise-wide systems and analytical tools is another significant growth factor. Businesses increasingly require tax solutions integrated with ERP systems, payroll, e-commerce, and financial reporting software to reduce manual data entry and improve audit readiness. Analytics features like dashboards showing tax liabilities, cash flow impacts, regulatory scenario projections, and non-compliance risk are gaining popularity. Geographically, northern Vietnam leads in adopting advanced software due to industrial clusters, while southern Vietnam hosts many SMEs and export zones needing export-related VAT and cross-border tax support. Central Vietnam is less developed but improving through connectivity and digital literacy initiatives. Overall, local and global vendors are intensifying competition by customizing features for these regional needs.

Market Segmentation

Component Insights:

Software: Core solutions facilitating tax management and compliance.

Services: Include specialized training and consulting/implementation to support tax software deployment and operations.

Deployment Mode Insights:

Cloud-based: Tax management software hosted on cloud infrastructure offering scalability and ease of access.

On-premises: Locally installed software managed within client IT environments.

Organization Size Insights:

Small and Medium-sized Enterprises: Targeting businesses seeking affordable, straightforward tax compliance solutions.

Large Enterprises: Catering to bigger organizations with comprehensive tax management requirements.

Industry Vertical Insights:

Retail: Tax management solutions tailored to retail sector needs.

BFSI: Banking, Financial Services, and Insurance sector adopting tax automation software.

Healthcare: Industry-specific compliance and tax management.

Energy and Utilities: Focused solutions for these critical sectors.

Manufacturing: Addressing tax complexities in manufacturing operations.

Others: Includes all other industry verticals adopting tax management software.

Regional Insights

Northern Vietnam leads in the adoption of advanced tax management software due to its concentration of large industrial corporations and exporters. The region experiences quicker uptake of sophisticated tools integrated with enterprise systems and analytical capabilities. Southern Vietnam, with numerous SMEs and export processing zones, demands tax software addressing export-related VAT and cross-border tax challenges. Central Vietnam trails but sees gradual improvement via government initiatives enhancing digital literacy and infrastructure connectivity. This regional variation shapes competitive dynamics as vendors localize features to meet diverse market needs.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Vietnam Tax Management Software Market Outlook: Trends, Growth, and Future Opportunities 2026-2034 here

News-ID: 4317288 • Views: …

More Releases from IMARC Group

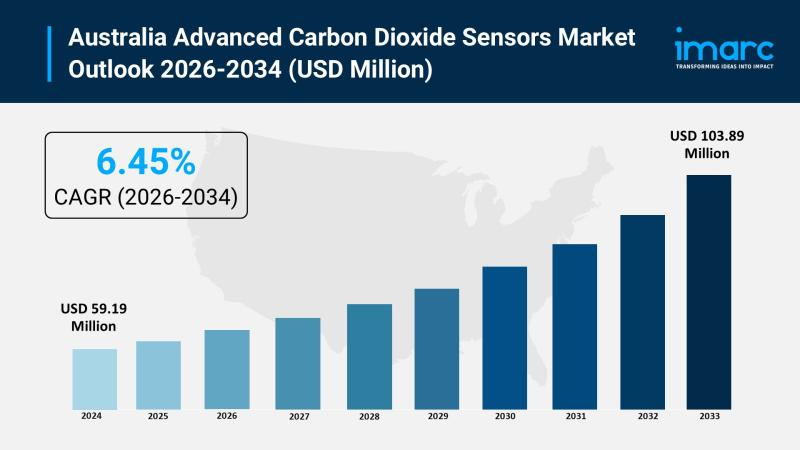

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

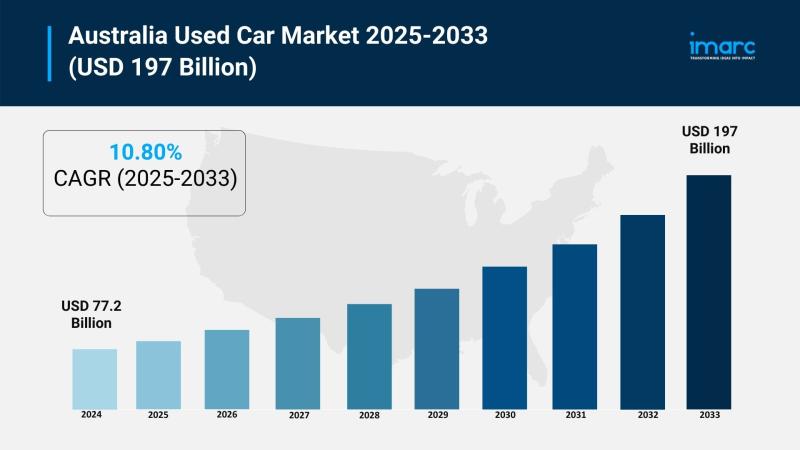

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

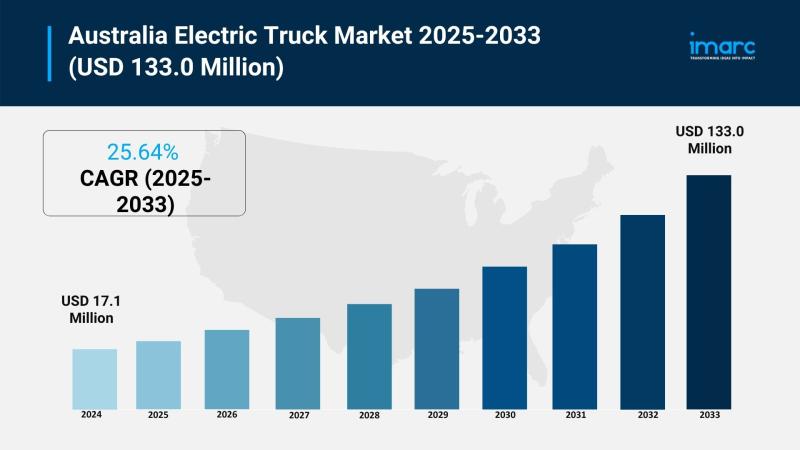

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

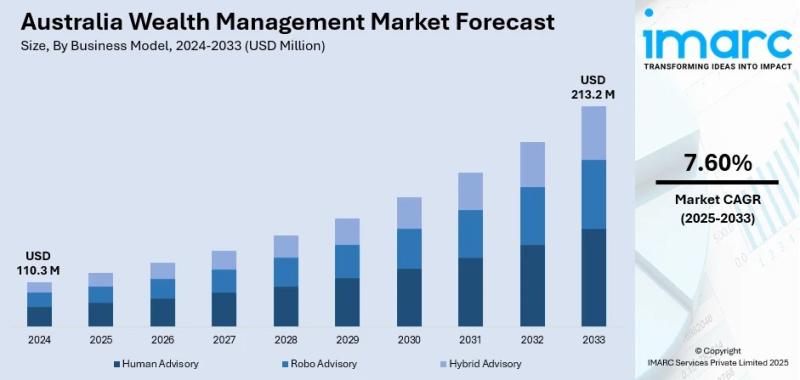

Australia Wealth Management Market Projected to Reach USD 213.2 Million by 2033

Market Overview

The Australia Wealth Management Market reached a size of USD 110.3 Million in 2024 and is projected to grow to USD 213.2 Million by 2033. The market is expected to expand during its forecast period with a CAGR of 7.60% from 2025 to 2033. Key growth factors include rising high-net-worth individuals, digital financial transformation, regulatory reforms like FOFA, and a robust superannuation system. For more details, visit the Australia…

More Releases for Vietnam

Vietnam Marvel Travel: Redefining Premium Travel Experiences Across Vietnam

Vietnam Marvel Travel, a leading premium travel agency in Vietnam, is redefining how international and domestic travelers explore the country through high-quality tours, luxury cruises, and tailor-made travel experiences. With a strong focus on service excellence, comfort, and authenticity, the company helps travelers discover Vietnam's most iconic landscapes and cultural destinations with ease and confidence.

Vietnam, 29th Dec 2025 - Vietnam Marvel Travel's vision is to become a trusted premium travel…

Vietnam beverages Market : Key Findings for Market Analysis and Business Plannin …

Vietnam beverages Market Analysis and Forecast, 2019-2028

The Vietnam beverages market was over US$ 2.5 billion in 2019 and is expected to grow at a CAGR of around 14.2% over the forecast period of 2022-2028.

Market Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market for the historical period of 2019-2021 and the forecast…

Vietnam beverages Market | Outlook and Opportunities: A Forecast of Growth, Inve …

Vietnam beverages Market Analysis and Forecast, 2022-2028

The Vietnam beverages market was US$ 480 Bn in 2021 and is expected to grow at a CAGR of around 12.5% over the forecast period of 2022-2028.

Download PDF Sample of beverages Market report @ https://www.themarketinsights.com/request-sample/280160

Market Scope & Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market…

Vietnam beverages market Key Information By Top Key Player | Sabeco, Heineken Vi …

The Vietnam beverages market was over US$ 2.5 billion in 2019 and is expected to grow at a CAGR of around 14.2% over the forecast period of 2022-2028.

Market Scope & Overview

The Vietnam beverages market study by RationalStat comprises comprehensive market analysis and insights across the key market segments and geography. The market report analyzes the Vietnam market for the historical period of 2019-2021 and the forecast period of 2022-2028 based…

Vietnam Agriculture Market, Vietnam Agriculture Industry, Vietnam Agriculture Li …

Agriculture has always been of pronounced importance for Vietnam, as feeding the realm’s largest population is not a relaxed task. The Vietnam government has been associate the agriculture industry with a number of policies, demanding to alleviate the output and seeking methods to ensure the sector is developing healthily and sustainably. The Vietnam federal government has been decidedly supportive of agriculture for decades, and there is extensive political consensus as…

The Baby Food Sector in Vietnam, 2018 Key Trends and Opportunities By Vietnam Da …

"The Baby Food Sector in Vietnam, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Vietnamese market.

Vietnamese mothers have prepared fresh food for their babies but, as the economy has developed and more women have been drawn into the urban workplace, these mothers have increasingly found they have less time to spend preparing food and to spend with their…