Press release

Brazil Freight and Logistics Market Size, Share Analysis, Growth, Insight, Report 2026-2034

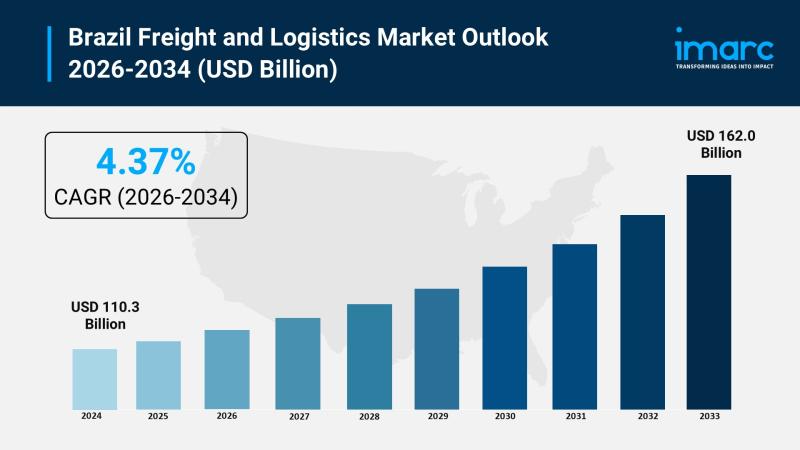

Market OverviewThe Brazil freight and logistics market reached a size of USD 110.3 Billion in 2025 and is projected to grow to USD 162.0 Billion by 2034. It is expected to grow at a CAGR of 4.37% during the forecast period from 2026 to 2034. Driving factors include increased demand for faster, more transparent deliveries, growth in domestic and international trade, and adoption of eco-friendly transportation systems such as electric and hybrid vehicles. shows strong growth prospects supported by infrastructural enhancements and digital integration.

Study Assumption Years

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

Brazil Freight and Logistics Market Key Takeaways

● The Brazil freight and logistics market size was USD 110.3 Billion in 2025.

● The market CAGR is 4.37% for the forecast period of 2026-2034.

● The market is forecasted to reach USD 162.0 Billion by 2034.

● Increased adoption of freight and logistics reduces compliance risks and penalties.

● Growth is bolstered by rising domestic and international trade activities.

● Expansion of the e-commerce sector is fostering greater demand for logistics services.

● Adoption of eco-friendly transportation like electric and hybrid vehicles offers growth opportunities.

● Integration of IoT and blockchain enhances transparency and operational efficiency.

Sample Request Link: https://www.imarcgroup.com/brazil-freight-logistics-market/requestsample

Market Growth Factors

Enhancing Trade Activity Enhancing the Brazil Freight and Logistics Market

The Brazil freight and logistics market is witnessing gradual growth with increasing trade activities both in the country and globally. With industries relying on optimized logistics chains for facilitating the transportation of raw materials, finished products, and other goods, companies are focused on streamlining supply chain operations to deliver faster, more transparent, and reliable delivery solutions.

The demand for courier, express, and parcel delivery solutions is increasing with the growth of ecommerce, which is leading to an increase in delivery requirements. Freight transport and forwarding solutions are critical in facilitating industrial production, distributing goods in the country, and participating in exports. With companies focusing on inventory management and demand-driven logistics solutions, warehouse and storage operations in Brazil are becoming more efficient.

The Brazil freight and logistics market is facilitated by investment in developing trade infrastructure to improve road connectivity, port operations, and other transport solutions. With companies engaging in activity to achieve speed and reliable delivery solutions, logistics companies are building stronger operations to eliminate time-consuming delays and improve deliverability.

Adoption of Technology: Sustainable Practices to Improve Market Efficiency

The Brazilian freight and logistics industry is moving forward because technology adoption and sustainability projects are transforming operational methods. Logistics companies are incorporating digital technology solutions to facilitate real-time tracking, automated paperwork, and analytical-driven operations. Big data analytics is also being used for demand analysis and capacity management in a better manner. Automation is increasingly being used in storage facilities to improve handling accuracy and quick turnaround times.

Sustainability concerns are simultaneously impacting fleet renovation projects because of a growing emphasis on using electric and hybrid vehicles to lower emissions and fuel expenses. Organizations are increasingly synchronizing their logistics operations with sustainability strategies to respond to government requirements and corporate social responsibilities. Intelligent route optimization technology is being used to improve fuel efficiency and maximize delivery speed.

The adoption of digital freight management solutions is enhancing customer service and co-ordinated execution with all stakeholders. Logistics companies are increasingly focusing on employee skill-building support to enable them to work with new technology solutions. Such trends are bringing forth a more robust and efficient logistics network to cope with dynamic market requirements. Sustainability and innovations will increasingly gain significance, leading to an efficient logistics operating environment in Brazil.

Industry Demand and Regional Development For Long Term Growth The Brazil freight & logistics market is transforming in light of increased demand from other end-use industries. The agricultural, manufacturing, mining, construction, and wholesale trade industries are increasingly relying on efficient logistics solutions to support production continuity and optimized distribution.

The oil & gas industry is fueling demand for specialized transport & storage solutions with a focus on safety and regulatory requirements. Retail and consumer goods enterprises are shifting focus to last-mile optimized logistics solutions in order to support increasing consumer expectations of timely delivery. Developments in regions are impacting market demand, with regions of increased economic activity fueling demand for increased logistics support due to industry agglomeration and consumption activity in cities.

Infrastructure investments are increasing reach and facilitating basic logistics support in untapped regions. Partnerships among logistics companies and enterprises are increasing efficiency in service integration & expansion. As a consequence of increased complexities in supply chains, enterprises are increasingly adopting flexible logistics solutions facilitating scalability and cost-effectiveness.

Increased attention to logistics service innovation in terms of logistics operations transparency, reliability, and sustainability is increasingly impacting market requirements. As a consequence of continuous trade expansion and improved infrastructure, Brazil freight & logistics market is poised to grow in a sustained manner based on industry demand and regional development.

Market Segmentation

Logistics Function Insights:

● Courier, Express and Parcel

● Destination Type

● Domestic

● International

● Freight Forwarding

● Mode of Transport

● Air

● Sea and Inland Waterways

● Others

● Freight Transport

● Mode of Transport

● Air

● Pipelines

● Rail

● Road

● Sea and Inland Waterways

● Warehousing and Storage

● Temperature Control

● Non-Temperature Controlled

● Temperature Controlled

● Others

End Use Industry Insights:

● Agriculture, Fishing and Forestry

● Construction

● Manufacturing

● Oil and Gas, Mining and Quarrying

● Wholesale and Retail Trade

● Others

Regional Insights:

● Southeast

● South

● Northeast

● North

● Central-West

Regional Insights

The report covers the major regions in Brazil including Southeast, South, Northeast, North, and Central-West. Although specific market shares or CAGRs by region were not detailed, these regions represent the key markets analyzed for freight and logistics growth in the country.

In summary, regional distribution analysis helps understand market concentration and growth potential across Brazil's diverse territories.

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request Customization:- https://www.imarcgroup.com/request?type=report&id=13740&flag=E

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Brazil Freight and Logistics Market Size, Share Analysis, Growth, Insight, Report 2026-2034 here

News-ID: 4314547 • Views: …

More Releases from IMARC Group

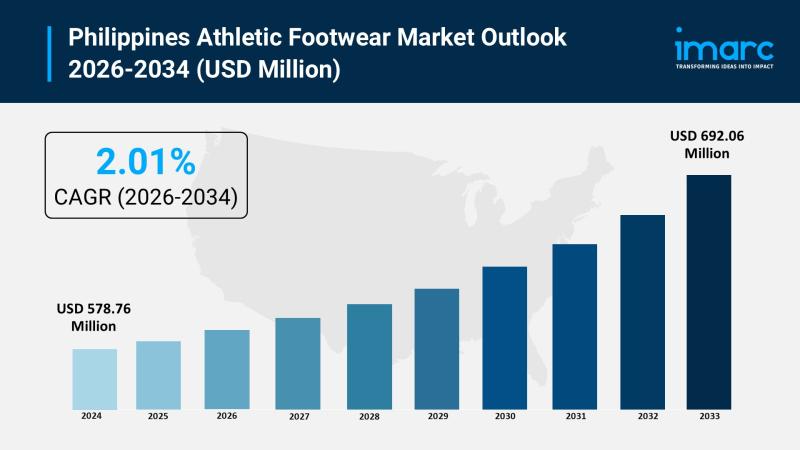

Philippines Athletic Footwear Market 2026 to Reach USD 692.06 Million by 2034 Am …

Market Overview

The Philippines athletic footwear market size was valued at USD 578.76 Million in 2025 and is projected to reach USD 692.06 Million by 2034, growing at a compound annual growth rate of 2.01% from 2026-2034. The market is expanding rapidly, driven by increasing health consciousness, fitness trends, and demand for stylish yet functional shoes. With a growing middle class and a focus on performance and comfort, the Philippines athletic…

IMARC Group: Philippines Lingerie Market 2026 | Poised for Rapid Growth at 6.70% …

Market Overview

The Philippines lingerie market size was valued at USD 433.27 Million in 2025 and is projected to reach USD 776.72 Million by 2034, growing at a compound annual growth rate (CAGR) of 6.70% during 2026-2034. The market is experiencing robust expansion driven by evolving consumer preferences, rising disposable incomes, and increasing emphasis on comfort and personal expression in intimate apparel. Urbanization and expanding retail infrastructure are reshaping purchasing patterns…

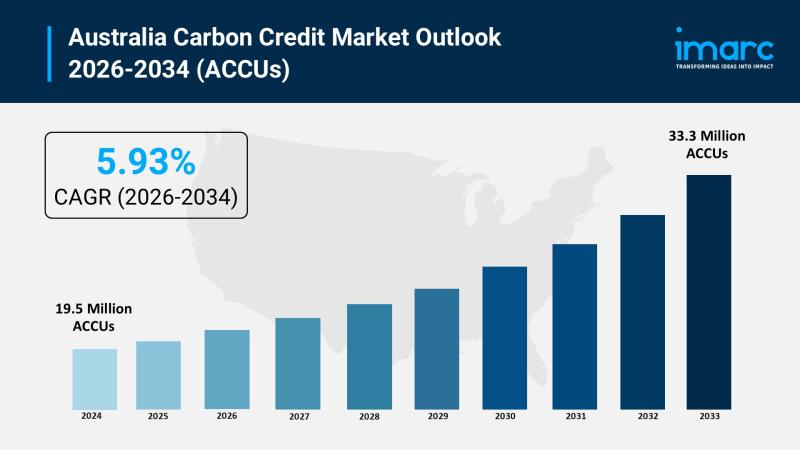

Australia Carbon Credit Market 2026 | Worth 33.3 Million ACCUs by 2034

Market Overview

The Australia carbon credit market size reached 19.5 Million ACCUs in 2025 and is projected to reach 33.3 Million ACCUs by 2034, exhibiting a CAGR of 5.93% during the forecast period 2026-2034. The industry is expanding significantly due to favorable government policies and regulations, increased dedication to corporate social responsibility, expanded international trade prospects, and significant expansion in renewable energy projects.

Request a Sample Report: https://www.imarcgroup.com/australia-carbon-credit-market/requestsample

How AI is Reshaping the…

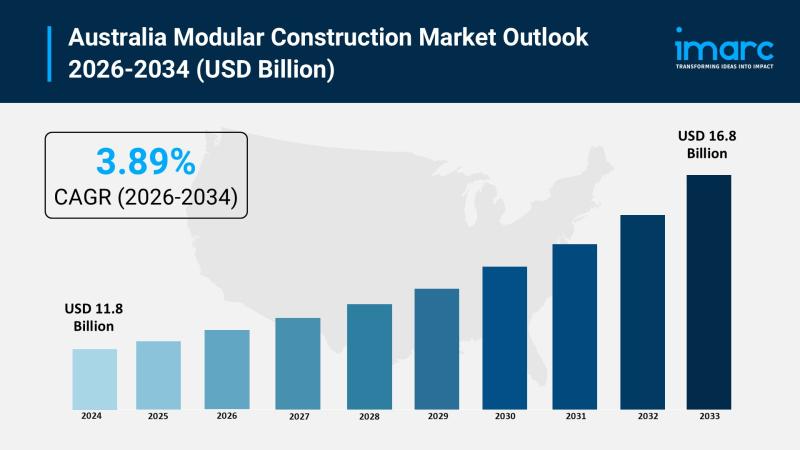

Australia Modular Construction Market 2026 | USD 16.8 Billion by 2034

Market Overview

The Australia modular construction market size reached USD 11.8 Billion in 2025 and is projected to reach USD 16.8 Billion by 2034, exhibiting a CAGR of 3.89% during the forecast period 2026-2034. The market is primarily driven by government infrastructure support, increasing housing demand, environmental considerations, and technological advances addressing the rising demand for efficient, adaptable housing solutions in urban and remote areas across the country.

Request a Sample Report:…

More Releases for Brazil

Brazil Clinical Trials Market ANVISA Brazil Guidelines Brazil Clinical Trials Re …

Brazil Cancer Drugs Clinical Trials Insight 2024 Report Offering:

• Brazil Clinical Trials Market Opportunity 2024 and 2030 (In US$ Billion)

• Clinical Trials Regulatory Framework In Brazil

• Total Number of Cancer Drugs In Clinical Trials In Brazil

• Total Number Of Cancer Drugs Approved In Brazil

• 400 Pages Clinical Trials Insight On All Cancer Drugs In Clinical Trials By Company, Indication and Phase

• 80 Pages Clinical Insight On All Cancer Drugs Approved in Market By Company and Indication

• Insight…

South East Brazil growing with major share in the Brazil Professional Hair Care …

In the Report “Brazil Professional Hair Care Market: By Categories (Coloring, Perming & Straightening, Shampoo & Conditioning & Styling); Sales Channel (Back Bar and Take Home) & By Company - (2018-2023)“ published by IndustryARC, the market is driven by the growing awareness of special functionalities of products, boosting the sales of treatment and hair conditioning market.

South East Brazil growing with major share in the Brazil Professional Hair Care Market

The Northern…

ATM Machine Market is Booming (18% CAGR)| NCR Brazil, Diebold Brazil, Wincor Nix …

HTF MI recently introduced ATM Machine Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Itautec S/A, NCR Brazil, Diebold Brazil, Wincor Nixdorf Brazil,…

Brazil: Country Intelligence Report 2018 By Claro, Sky Brazil, Oi, Vivo, TIM Bra …

"Brazil: Country Intelligence Report", by GlobalData provides an executive-level overview of the telecommunications market in Brazil today, with detailed forecasts of key indicators up to 2021. Published annually, the report provides detailed analysis of the near-term opportunities, competitive dynamics and evolution of demand by service type and technology/platform across the fixed telephony, broadband, and mobile, as well as a review of key regulatory trends. …

Agrochemicals Market in Brazil

ReportsWorldwide has announced the addition of a new report title Brazil: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Brazil: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

ATM Machine Market in Brazil 2015-2019: Competitive analysis of key vendors, inc …

Albany, NY, Feb 23, 2017: This report segments the ATM machine market in Brazil by revenue generated and the unit shipment. It also includes the competitive analysis of key vendors, including Itautec S/A, NCR Brazil, Diebold Brazil and Wincor Nixdorf Brazil.

Market scope of the ATM machine market in Brazil

Technavios market research analyst predict that the ATM machine market in Brazil will continue to grow at CAGR of 18.72%. The key…