Press release

How New Financial Literacy Programs Aim to Strengthen Entrepreneur Cash Flow Skills

For many new business owners, understanding how money moves through their company can feel overwhelming. While passion and skill often drive people to start a business, practical financial knowledge doesn't always follow automatically. As a result, many early-stage entrepreneurs discover, sometimes too late, that cash flow, not creativity, is what determines whether their business can survive.Image: https://www.globalnewslines.com/uploads/2025/12/5605423ca2963cb373adc3b2b285a166.jpg

Instead of opening with the idea that many practitioners are already addressing the issue, the focus shifts to the entrepreneurs themselves, specifically, to how foundational financial skills can help reduce preventable business failures tied to poor cash flow management. Among them is ProfessorEMoney [https://www.professoremoney.com/], a Los Angeles-based financial education provider developing a new series of programs designed to help entrepreneurs build stronger, more organized money systems. Rather than presenting a corporate announcement, the initiative reflects a broader trend: more founders are seeking accessible ways to improve their financial literacy long before crises arise.

Recent concerns about small business sustainability underscore why these efforts matter. Research from SCORE, a national network supporting small businesses, has frequently pointed to cash flow challenges as a leading factor behind early business closure. While the circumstances vary, the root issue is often the same, entrepreneurs are making decisions without clear insight into their financial realities.

ProfessorEMoney's upcoming programs, set to roll out in early 2026, focus on building those fundamentals. The curriculum explores practical topics such as early-stage business planning, bookkeeping basics, and everyday financial tracking for a small business. Instead of offering predictions or promising outcomes, the approach centers on understanding the numbers business owners encounter every day.

For many new founders, the challenge isn't that they lack intelligence or ambition, it's that they lack access to straightforward, step-by-step guidance. Financial terminology can feel intimidating, and most entrepreneurs didn't start their business to spend hours navigating spreadsheets or software systems. By breaking down those concepts into digestible lessons, programs like this aim to make financial clarity more attainable.

Entrepreneurs who have previously struggled with budgeting, reconciliation, or distinguishing profit from cash flow may find these types of resources especially useful. While the education itself cannot guarantee business success, learning the mechanics behind cash movement can help to empower business owners to make more informed decisions.

The initiative also reflects a wider movement toward strengthening entrepreneurial adaptability in uncertain economic conditions. With more individuals turning to self-employment and microbusiness models, financial literacy is increasingly seen as an essential skill rather than an optional one.

Readers interested in learning more or connecting directly can visit https://www.professoremoney.com/ for additional resources, updates, and contact information. This direct link provides entrepreneurs with a centralized place to access financial education tools tailored to early-stage founders.

As conversations about entrepreneurship evolve, so too does the recognition that sustainable business operations require both vision and practical financial structure. Educational programs that focus on clarity, skill-building, and early-stage support may play a growing role in helping founders navigate the realities behind their numbers.

Media Contact

Company Name: ProfessorEMoney

Contact Person: Erin Steinberger

Email: Send Email [http://www.universalpressrelease.com/?pr=how-new-financial-literacy-programs-aim-to-strengthen-entrepreneur-cash-flow-skills]

Country: United States

Website: https://www.professoremoney.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. GetNews makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How New Financial Literacy Programs Aim to Strengthen Entrepreneur Cash Flow Skills here

News-ID: 4313746 • Views: …

More Releases from Getnews

MaryPat Spikes Koos Releases Emotionally Charged Novel Age of the Earth

Image: https://www.globalnewslines.com/uploads/2026/01/1767824068.jpg

Image: https://www.aionewswire.com/storage/images/ckeditor//515qJi1biPL._SL1499__1767823318.jpg

Author MaryPat Spikes Koos presents a powerful story of love, struggle, and spiritual discovery in her new novel, Age of the Earth [https://www.amazon.com/Age-Earth-MaryPat-Spikes-Koos/dp/B0FX233DZR/ref=tmm_pap_swatch_0?_encoding=UTF8&dib_tag=se&dib=eyJ2IjoiMSJ9.j9pfgs7WVuJXxDme5ZIjbl7GaBgt-6ehxPXjNX1b5GCTzwrAJSO0bfw9bjV8c8_20R4fWr9a0Dtq8OrhpNPIw6wxHLCQHsX7g2atrVj34qnVzIV0VUBlYkyhhrXFoZHDfv0N2pZua0qv0WSAji3ok9RWOpe2KQUnxWau0WdV1ecpB-j1wmjjfTqqeLkyigQ182ol5iMuPNt7OrRL5GH3rSM-F0ajIo-2BpicmcUdqOE.6IcCyXKeT6qaykahfjdNIRYeeHi18HTPaZPFu7s1JFo&qid=1761529696&sr=1-8]. Inspired by her father's life in oil exploration, the book weaves faith, science, trauma, and resilience into a deeply personal narrative.

The novel follows Mary Margaret, a Baptist from Dallas, and Eugene, an atheist orphan turned oil man. Their worlds collide when their son is born…

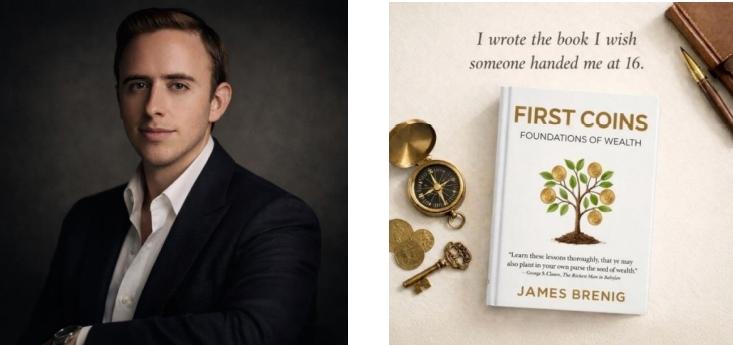

Entrepreneur James Brenig Launches New Money Book for Teens, Adapting Wealth Cla …

Gibraltar-based entrepreneur James Brenig has debuted his first book, titled First Coins: Foundations of Wealth. Written specifically for teens and young adults, the book is a modern adaptation of the classic The Richest Man in Babylon, turning timeless financial principles into a relatable story that helps the next generation understand the basics of saving and investing.

The project began at home when James was looking for resources to teach his own…

Game-Changing Startups to Watch at CES 2026: The Future of AI and Consumer Tech

Las Vegas, NV - As CES 2026 approaches, the technology world is entering an exciting new phase. Startups are introducing tools and products that aim to make AI and digital services more useful in everyday life. These companies are not just showing off futuristic concepts, but fixing actual frustrations like repetitive administrative workloads and the struggle to manage complex financial data.

It is worth noting that several companies on this list…

Market Tram Shares Insights into South Australia's High Demand For Used Toyota V …

Image: https://www.globalnewslines.com/uploads/2026/01/1767805248.jpg

Toyota models across South Australia continue to attract strong attention in the used car market, with steady demand reflecting buyer confidence, limited supply, and long-standing trust in the brand.

Sydney, NSW - January 7, 2026 - Market Tram, an online marketplace that connects buyers and sellers of used vehicles across Australia, has released new insights into the strong demand for used Toyota vehicles in South Australia. Recent data shows Toyota…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…