Press release

U.S. Charging as a Service Market to Hit US$ 14,570.9 Million by 2032 as Key Players Like ChargePoint, EVgo, and Electrify America Lead Infrastructure Expansion

The U.S. Charging as a Service Market is entering a defining phase as the nation accelerates toward large-scale electric vehicle (EV) adoption. According to Persistence Market Research, the market is projected to grow from US$ 2,309.6 Mn in 2025 to US$ 14,570.9 Mn by 2032, expanding at a powerful CAGR of 30.1% between 2025 and 2032. This remarkable expansion highlights the rising demand for flexible, scalable, and cost-efficient charging infrastructure solutions for both public and private stakeholders.The U.S. Charging as a Service (CaaS) market is evolving rapidly as businesses, municipalities, fleet operators, and real estate developers increasingly seek subscription-based or usage-based charging solutions rather than owning infrastructure outright. Over the next decade, the transition from combustion engines to electric mobility is expected to intensify, creating a continuous requirement for reliable EV charging access. With the market set to surge to US$ 14,570.9 Mn by 2032, the U.S. is emerging as one of the world's largest adopters of service-based charging ecosystems. Growing EV penetration, combined with government incentives, has established a strong foundation for CaaS providers to innovate and expand their footprints.

Market growth is also driven by the rising need for operational efficiency and reduced capital expenditure among businesses adopting electric fleets. Fleet electrification-particularly in logistics, last-mile delivery, and ride-sharing-is anticipated to be one of the biggest demand drivers. Public charging infrastructure remains the leading segment, supported by urban mobility initiatives and increasing consumer demand for accessible fast-charging points. The West Coast-especially California-continues to dominate due to supportive policies, early EV adoption, and a mature charging network. This establishes the region as a long-term hotspot for Charging as a Service innovations and deployments.

Get Your FREE Sample Report Instantly Click Now: https://www.persistencemarketresearch.com/samples/35445

The key players studied in the report include:

Key players operating in the U.S. Charging as a Service market include:

• WattLogic

• EV Safe Charge

• Lightning eMotors Inc.

• Blink Charging Co.

• ChargePoint Holdings Inc.

• Electrify America LLC

• SemaConnect Inc.

• EVgo Services LLC

• Others

Key Highlights from the Report

➤ The U.S. charging as a service market is projected to grow from US$ 2,309.6 Mn in 2025 to US$ 14,570.9 Mn by 2032.

➤ The market will observe a strong CAGR of 30.1% during the forecast period (2025-2032).

➤ Rising EV adoption and fleet electrification are primary catalysts fueling market expansion.

➤ Public charging infrastructure emerges as the leading service segment due to high visibility and utilization.

➤ California and the West Coast remain the dominant regional markets due to policy support and consumer adoption.

➤ Businesses are increasingly opting for subscription-based charging models to reduce infrastructure costs and operational complexities.

Market Segmentation

By Service

• Subscription

• Hosted

• Financed

By Charging Infrastructure

• Public Charging

• Private Charging

By Charging Station

• AC Charging

• DC Charging

By Application

• Commercial

o Hospitality

o Parking Garage

o Office Buildings

o Multi-family Units

o Others

• Residential

By Zone

• West U.S.

• Midwest U.S.

• Southwest U.S.

• Southeast U.S.

• Northeast U.S.

Customize This Report for Your Exact Requirements: https://www.persistencemarketresearch.com/request-customization/35445

Regional Insights

Regionally, the West Coast-driven by California's aggressive emissions reduction policies and robust clean energy investments-leads the U.S. Charging as a Service market. The region benefits from early EV adoption, well-developed charging corridors, and consistent policy support encouraging both public and private operators to expand infrastructure. This makes it the most mature and fastest-growing regional market within the U.S. charging ecosystem.

The Northeast and Mid-Atlantic regions follow closely, fueled by climate action mandates, dense urban populations, and the growing need for fleet electrification in delivery and public transportation sectors. Meanwhile, the Southern and Midwestern regions are witnessing steady expansion driven by rising EV sales and increased interest from utilities and commercial developers. As EV adoption spreads nationwide, regional disparities are expected to diminish, creating broader opportunities for service-based charging solutions.

Market Drivers

Growing EV adoption stands as the most influential driver of the U.S. Charging as a Service market. As automakers pivot toward electrification and federal policymakers promote clean transportation, demand for charging availability has accelerated across public and private spaces. Many businesses prefer CaaS models to avoid high upfront installation costs, instead opting for predictable service fees and scalable charging capacity. Additionally, the surge in e-commerce and last-mile delivery has created strong incentives for fleet electrification, pushing logistics providers to invest in reliable charging networks to maintain operational efficiency.

Government incentives also contribute significantly to market momentum. Federal and state tax credits, grants, and infrastructure funding support the rapid installation of charging networks. Utilities across the U.S. are deploying managed charging and demand-response solutions that integrate seamlessly with the CaaS model. These policies not only accelerate infrastructure rollout but also reduce financial risks for operators and customers. The convergence of sustainability commitments, favorable policy frameworks, and shifting consumer behavior has created an optimal landscape for Charging as a Service adoption.

Market Restraints

Despite strong growth prospects, the U.S. Charging as a Service market faces several challenges that limit the pace of expansion. High installation and grid-upgrade costs remain a major barrier, particularly in regions with older distribution networks. CaaS models help mitigate upfront expenses, but service providers still face capital-intensive requirements to build reliable charging infrastructure. Additionally, permitting delays and regulatory inconsistencies across states and municipalities can slow project execution, affecting operational timelines and profitability.

Another key restraint involves interoperability issues between charging networks, EV models, and software platforms. As multiple providers operate independently, fragmentation can lead to inconsistent user experiences, reliability concerns, and higher maintenance costs. Energy supply variability, especially during peak demand periods, can also create operational challenges for service-based charging networks. These constraints highlight the need for industry standardization, improved grid resilience, and cross-sector collaboration to ensure long-term market stability.

Market Opportunities

The U.S. Charging as a Service market is positioned for significant opportunities as electrification spreads across transportation, real estate, and commercial sectors. Fleet electrification offers one of the biggest prospects, as companies increasingly require tailored charging solutions for buses, trucks, and last-mile vans. CaaS providers can benefit from long-term contracts and high utilization rates, making fleet charging a stable revenue stream. Similarly, commercial and residential developers are integrating EV charging to increase property value and attract sustainability-focused tenants, creating new business avenues.

Technological advancements-such as smart charging, vehicle-to-grid (V2G) services, and AI-driven energy management-are opening doors for premium service offerings. As the grid shifts toward renewable energy sources, demand for intelligent load-balancing and energy-efficient charging solutions will rise. Partnerships among utilities, automakers, real estate firms, and charging specialists are expected to accelerate innovation. With the right strategic investments, service providers can capture growing opportunities in urban mobility systems, workplace charging, and managed energy services.

Ready to Dive Deep? Buy Full Report Today: https://www.persistencemarketresearch.com/checkout/35445

Recent Developments

• May 2024: A leading charging service provider expanded subscription-based charging solutions targeting commercial fleet operators across major U.S. cities.

• February 2024: A major EV charging company introduced a new energy-management platform designed to optimize charging loads for multi-site commercial customers.

Frequently Asked Questions

➤ What are the main factors influencing the U.S. Charging as a Service Market during 2025-2032?

➤ Which companies are the major sources in the U.S. Charging as a Service Market?

➤ What are the market's opportunities, risks, and general structure within the U.S. Charging as a Service Market?

➤ Which of the top U.S. Charging as a Service Market companies compare in terms of sales, revenue, and pricing?

➤ How are market types and applications evaluated in terms of deals, revenue, and value in the U.S. Charging as a Service Market?

Future Opportunities and Growth Prospects

The future of the U.S. Charging as a Service market looks exceptionally promising as sustainability goals, electric mobility policies, and consumer preferences align toward zero-emission transportation. As the market scales toward US$ 14,570.9 Mn by 2032, service providers will benefit from expanding demand across fleet, commercial, residential, and public charging landscapes. The integration of smart technologies, renewable energy solutions, and enhanced interoperability will shape the next generation of CaaS platforms, creating new business models and revenue opportunities. With strong government backing, rising EV adoption, and a shift toward service-driven infrastructure, the market is set to enter a period of sustained innovation and long-term growth.

Explore the Latest Trending Research Reports:

https://www.persistencemarketresearch.com/market-research/europe-compact-wheel-loader-market.asp

https://www.persistencemarketresearch.com/market-research/offshore-support-vessel-market.asp

https://www.persistencemarketresearch.com/market-research/aircraft-seats-market.asp

https://www.persistencemarketresearch.com/market-research/automotive-timing-cover-market.asp

https://www.persistencemarketresearch.com/market-research/ev-lubricants-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street, London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Charging as a Service Market to Hit US$ 14,570.9 Million by 2032 as Key Players Like ChargePoint, EVgo, and Electrify America Lead Infrastructure Expansion here

News-ID: 4313442 • Views: …

More Releases from Persistence Market Research

India Aluminum Beverage Can Market Size to Reach US$ 0.8 Bn by 2032 - Persistenc …

The India aluminum beverage can market is undergoing a significant transformation, driven by changing consumer lifestyles, rising urbanization, and a noticeable shift toward sustainable and convenient packaging formats. Aluminum beverage cans are increasingly preferred across carbonated soft drinks, energy drinks, sports beverages, alcoholic drinks, and ready-to-drink juices due to their lightweight structure, portability, fast chilling properties, and superior recyclability. In India, where on-the-go consumption is accelerating rapidly, aluminum cans are…

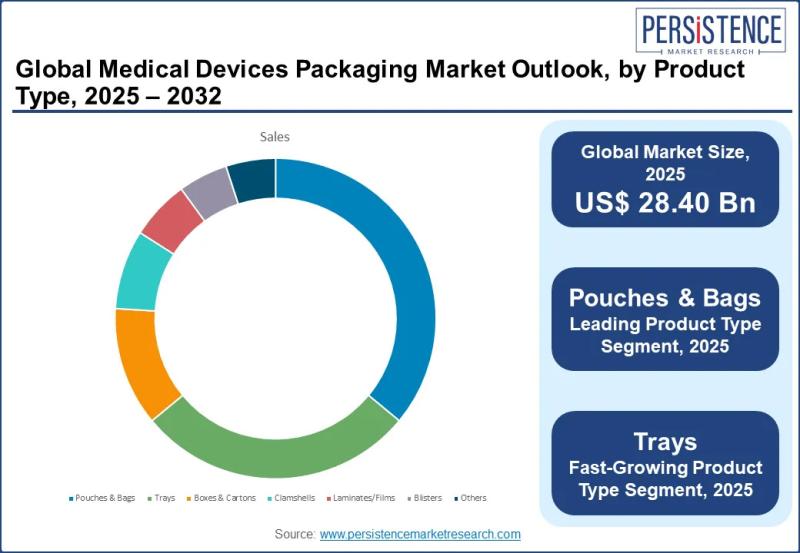

Medical Devices Packaging Market Size to Reach US$ 41.57 Billion by 2032 - Persi …

The medical devices packaging market plays a vital role within the global healthcare ecosystem, acting as a protective and regulatory bridge between manufacturers and end users. Medical device packaging refers to specialized materials and formats designed to safeguard medical instruments, implants, diagnostic tools, and consumables throughout storage, transportation, and clinical use. These packaging solutions are engineered to maintain sterility, prevent contamination, ensure ease of handling, and comply with strict regulatory…

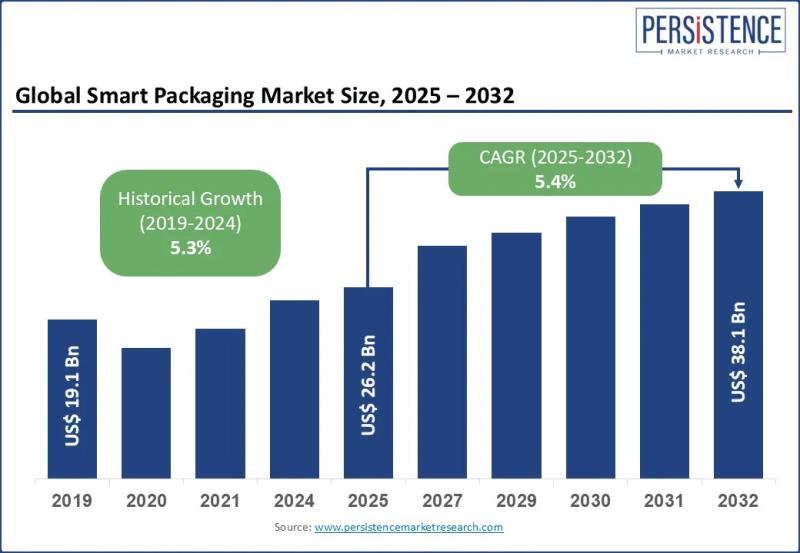

Smart Packaging Market Size Valued at US$ 26.2 Bn in 2025, Projected to Reach US …

The smart packaging market is rapidly transforming the global packaging landscape by integrating advanced technologies with traditional packaging materials to deliver enhanced functionality, traceability, and consumer engagement. Smart packaging refers to packaging systems embedded with features such as sensors indicators QR codes RFID tags and data tracking mechanisms that monitor product condition authenticity and movement across the supply chain. These solutions are increasingly adopted as businesses shift from passive containment…

Football Equipment Market Set for Strong Global Growth Through 2032

The global football equipment market continues to display resilient growth driven by rising participation in football across all age groups, expanding commercial opportunities, and technological advancements in sports gear. The industry is expected to grow from an estimated US$ 18.7 billion in 2025 to approximately US$ 24.1 billion by 2032, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

➤ Download Your Free Sample & Explore Key…

More Releases for Charging

Is it better to choose AC charging piles or DC charging piles for home charging …

Choosing between AC and DC charging piles for home charging piles requires comprehensive consideration of charging needs, installation conditions, cost budgets and usage scenarios and other factors. Here's a breakdown:

Image: https://www.beihaipower.com/uploads/4c61b8bc1.jpg

1. Charging speed

* AC charging piles: The power is usually between 3.5kW and 22kW, and the charging speed is relatively slow, suitable for long-term parking and charging, such as night charging.

* DC charging piles: The power is usually…

800V system challenge: charging pile for charging system

800V Charging pile "Charging Basics"

This article mainly talks about some preliminary requirements for 800V charging piles [https://www.beihaipower.com/products/], first let's take a look at the principle of charging: When the charging tip is connected to the vehicle end, the charging pile will provide (1) low-voltage auxiliary DC power to the vehicle end to activate the built-in BMS (battery management system) of the electric vehicle After activation, (2) connect the car end…

What is dynamic mode of EV Charging? Dynamic EV Charging vs Traditional EV Charg …

A dynamic charging system is a technology that allows electric vehicles to charge while in motion. This system typically involves embedding charging infrastructure into the road surface, which enables the vehicle to charge its battery as it travels along the road. This can potentially extend the range and operational capabilities of electric vehicles, as they can receive continuous power while on the move. Dynamic charging systems have the potential to…

Electric Bus Charging Infrastructure Market Forecast to 2028 - COVID-19 Impact a …

In every region, electrification appears as a clear alternative to increase urban growth and to care for the city environment simultaneously, using electric buses. With the right charging technology, the advantages of electric buses can be used, such as the use of renewable energy, less energy consumption, less noise, lower particle emissions, reliable service, and others. The severe emission standards across the globe are expected to drive more electric bus…

Global Automotive Electric Recharging Point Market Size, by Type (Home Charging …

Global Automotive Electric Recharging Point Market research report provides complete intelligence about the global Automotive Electric Recharging Point industry, including market growth factors and prominent competitors in the market. The report also enfolds insightful analysis of competition intensity, segments, environment, trade regulations, and product innovations to render deep comprehension of the complete Automotive Electric Recharging Point market structure. Recent developments, technology diffusion, and important events of the market are also…

Electric Vehicle Charging Equipment Market Report 2018: Segmentation by Type (AC …

Global Electric Vehicle Charging Equipment market research report provides company profile for Fortum, Fuji Electric, Leviton, Shell, Qualcomm, Bosch, Schneider Electric, Siemens, ABB, AeroVironment, Chargemaster, ClipperCreek, DBT-CEV, Engie and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018…