Press release

India Fintech UPI Payments Market to Hit $12.52 Trillion by 2032, Driven by Digital Payment Revolution & Financial Inclusion | Leading companies - PhonePe, Google Pay, Paytm, CRED

Leander, Texas and Tokyo, Japan - Dec.10.2025As per DataM intelligence research report" The India fintech & UPI Payments market reached US$ 2.50 Trillion in 2024 and is expected to reach US$ 12.52 Trillion by 2032, growing at a CAGR of 22.3% during the forecast period 2025-2032." Digital-first consumers and instant payment infrastructure are fueling rapid growth in India's UPI-driven fintech ecosystem.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/india-fintech-and-upi-payments-market?Prasad

India: Recent Industry Developments

✅ In November 2025, The National Payments Corporation of India (NPCI) launched "UPI Circle" for delegated payments The feature allows primary users to authorize transactions for family members without their own bank accounts It significantly expands digital payment access to minors and elderly dependents in India

✅ In October 2025, PhonePe introduced a credit line on UPI feature in partnership with major Indian banks The service allows users to spend from a pre-approved credit limit via QR codes It democratizes access to short-term credit for millions of Indian consumers

✅ In September 2025, Paytm (One97 Communications) pivoted to a "TPAP-only" model for stability The strategic shift focuses on distribution partnerships with multiple banks to reduce regulatory risk It ensures the continuity of India's third-largest UPI app

✅ In August 2025, The Reserve Bank of India (RBI) raised the transaction limit for UPI Lite The increase facilitates larger offline wallet transactions for transit and retail It aims to reduce the load on core banking systems during peak hours

Japan: Recent Industry Developments

✅ In December 2025, PayPay announced a strategic integration with India's UPI for cross-border payments The integration allows Indian tourists in Japan to pay using their home apps at PayPay merchants It boosts tourism spending and strengthens Japan-India fintech ties

✅ In November 2025, Rakuten Pay tested a UPI-style "interoperable QR" system with other Japanese wallets The pilot aims to unify the fragmented Japanese QR payment landscape It mimics the success of India's unified interface to improve user convenience

✅ In October 2025, SBI Holdings partnered with an Indian fintech unicorn to launch a neo-banking app in Japan The venture utilizes the Indian partner's tech stack to offer low-cost digital banking It introduces India's frugal innovation to the Japanese financial sector

✅ In September 2025, The Bank of Japan released a study on India's "India Stack" as a model for digital ID The report recommends adopting similar open APIs to accelerate Japan's digital transformation It highlights the global influence of India's fintech infrastructure

India Fintech & UPI Payments Market: Drivers

The Indian fintech and UPI payments ecosystem is growing rapidly, fueled by digital adoption, smartphone penetration, and supportive government initiatives promoting financial inclusion. Unified Payments Interface (UPI) enables seamless, real-time transactions across banks, merchants, and peer-to-peer channels, enhancing convenience for consumers and businesses alike. Innovative fintech apps leverage UPI for instant payments, lending, and digital banking, while partnerships with traditional banks drive broader adoption. Regulatory frameworks and data security standards maintain trust and mitigate fraud risks.

Expansion of digital infrastructure, including QR-based payments and UPI-enabled e-commerce, is increasing transaction volumes across urban and rural markets. Growth is supported by incentives for merchants, fintech collaborations, and consumer education campaigns promoting cashless transactions. Emerging technologies, such as AI-driven credit scoring and real-time transaction analytics, enhance user experience and operational efficiency. With continued government support and rising digital literacy, India's fintech and UPI payments landscape is set for sustained growth.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/india-fintech-and-upi-payments-market?Prasad

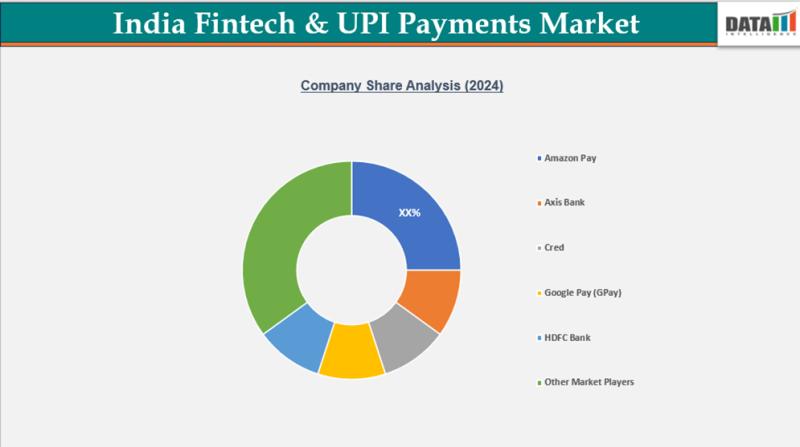

India Fintech & UPI Payments Market: Major Players

PhonePe, Google Pay, Paytm, CRED, and NPCI-backed platforms, along with traditional banks expanding digital apps and fintech startups innovating with lending, wealth, and super-app ecosystems.

Segment Covered in the India Fintech & UPI Payments Market:

By Transaction Type

The market is segmented into peer-to-peer (P2P) 55% and peer-to-merchant (P2M) 45%, with P2P dominating due to high adoption for instant money transfers between individuals. P2M transactions are growing with expanding digital retail, e-commerce, and service payments. Government initiatives and increasing smartphone penetration drive adoption. Convenience, speed, and safety of UPI payments support consistent market growth.

By Use Case

Use cases include retail & e-commerce payments 30%, money transfer & remittances 25%, bill payments & utilities 15%, travel & hospitality 10%, financial services 10%, donations & subsidies 5%, and others 5%, with retail & e-commerce and P2P remittances dominating. Bill payments, travel, and financial services show strong growth. Expanding digital economy and financial inclusion programs drive usage. Growing trust and awareness among consumers support market adoption.

By Deployment Mode

Deployment modes include QR code-based payments 40%, in-app/online payment gateways 35%, and point-of-sale (POS) terminals 25%, with QR code-based payments dominating due to ease of use, low cost, and universal adoption across merchants. In-app gateways are growing with smartphone penetration. POS terminals are expanding in organized retail and service sectors. Secure and seamless digital payment infrastructure supports market expansion.

By End-User

End-users include individual consumers 60%, small & medium enterprises 20%, large enterprises 10%, and financial institutions 10%, with individual consumers dominating due to widespread adoption of UPI for personal transactions. SMEs are increasingly using UPI for merchant payments. Large enterprises and financial institutions adopt for payment settlements and bulk transactions. Convenience, efficiency, and cost-effectiveness drive end-user adoption.

Regional Analysis

North India - 25% Share

North India leads with 25% share due to high smartphone penetration, urbanization, and rapid adoption of UPI payments in Delhi, Haryana, and Punjab. P2P transactions dominate. Retail & e-commerce payments and QR code-based modes are widely used. Individual consumers are the primary end-users. Government initiatives and fintech partnerships support growth.

West India - 20% Share

West India holds 20% share driven by adoption in Maharashtra, Gujarat, and Rajasthan. P2P and P2M transactions are both growing. Retail, bill payments, and financial services lead use cases. QR code and in-app payments dominate. Individual consumers and SMEs are primary end-users. Urban digital adoption drives market growth.

South India - 20% Share

South India accounts for 20% share due to tech-savvy population and fintech adoption in Karnataka, Tamil Nadu, and Telangana. P2P transactions dominate. Retail & e-commerce, remittances, and utility payments are key use cases. QR code-based payments lead. Individual consumers and SMEs drive market adoption.

East India - 15% Share

East India holds 15% share with growing UPI adoption in West Bengal, Odisha, and Bihar. P2P transactions dominate. Retail payments and remittances are primary use cases. QR code and in-app payments are widely used. Individual consumers lead end-users. Government digital payment campaigns support growth.

Central India - 10% Share

Central India records 10% share driven by adoption in Madhya Pradesh and Chhattisgarh. P2P dominates transaction types. Retail & e-commerce and bill payments are key use cases. QR code-based payments lead deployment. Individual consumers are primary end-users. Increasing smartphone penetration and financial inclusion programs drive adoption.

Purchase this report before year-end and unlock an exclusive 30% discount:

https://www.datamintelligence.com/buy-now-page?report=india-fintech-and-upi-payments-market

(Purchase 2 or more Repots and get 50% Discount)

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?Prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Fintech UPI Payments Market to Hit $12.52 Trillion by 2032, Driven by Digital Payment Revolution & Financial Inclusion | Leading companies - PhonePe, Google Pay, Paytm, CRED here

News-ID: 4310111 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

Clinical Trial Management System Market Set for Strong Growth to USD 4.2 Billion …

The Global Clinical Trial Management System Market reached USD 1.5 billion in 2022 and is projected to witness lucrative growth by reaching up to USD 4.2 billion by 2031. The global clinical trial management system market is expected to exhibit a CAGR of 14.6% during the forecast period (2024-2031).

Market growth is driven by the rising complexity of clinical trials, increasing R&D investments by pharmaceutical and biotech companies, and the need…

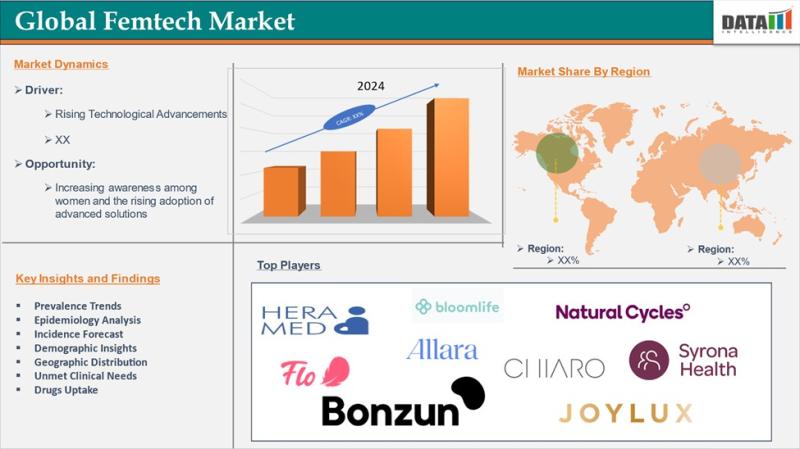

Femtech Market US$ 112.30 Billion by 2033 with 12.6% CAGR North America Leads wi …

The Global Femtech Market reached US$ 38.90 billion in 2024 and is projected to grow significantly to US$ 112.30 billion by 2033, registering a CAGR of 12.6% during the forecast period 2025-2033. This strong growth reflects increasing awareness of women's health issues, rising digital health adoption, and greater investments in technology-driven healthcare solutions tailored specifically for women.

Femtech focuses on addressing both female-specific and women-prevalent health conditions through products such as…

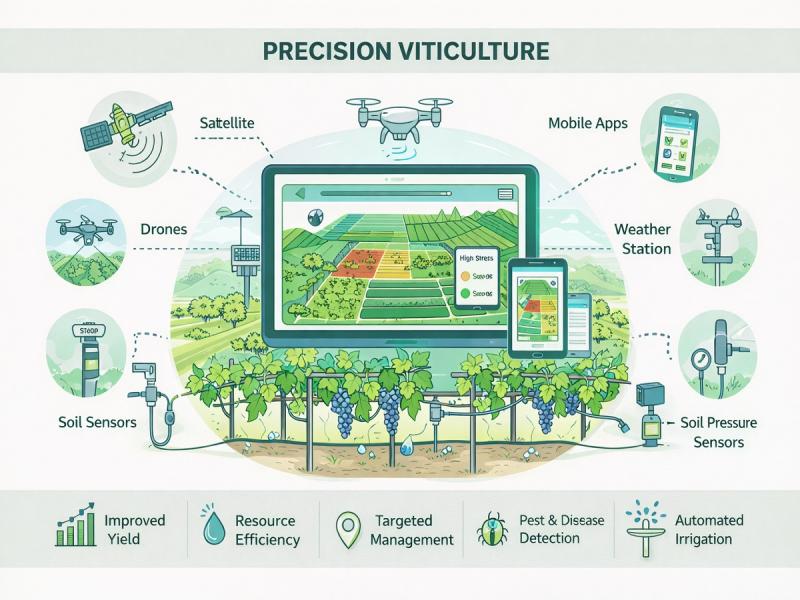

Precision Viticulture Market | US$ 9.51 Billion by 2032 | 14.40% CAGR | Europe L …

The Global Precision Viticulture Market reached US$ 3.24 billion in 2024 and is expected to reach US$ 9.51 billion by 2032, growing at a CAGR of 14.40% during the forecast period 2025-2032. Market growth is driven by the increasing adoption of advanced agricultural technologies to improve vineyard productivity, optimize resource utilization, and enhance grape quality amid rising climate variability.

Precision viticulture integrates technologies such as GPS, remote sensing, drones, IoT sensors,…

United States Public Safety and Security Market sees strong growth at a CAGR of …

The public safety and security market is projected to grow from USD 564.05 billion in 2025 to USD 979.84 billion by 2030 at a compound annual growth rate (CAGR) of 11.4% during the forecast period. The growing trend of IoT in public safety is driving the market as connected devices enable real-time monitoring, faster responses, and better management of emergencies. It helps authorities gather accurate data and improve decision-making. The…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…