Press release

Travel Insurance Market to Reach USD 64.06 Billion by 2035, Growing at a 9.5% CAGR | Rising Global Tourism, Traveler Safety Awareness, and Digital Insurance Platforms Drive Growth

The Travel Insurance Market Size was estimated at USD 23.6 Billion in 2024. The industry is projected to grow from USD 25.84 Billion in 2025 to USD 64.06 Billion by 2035, exhibiting a steady CAGR of 9.5% during the forecast period 2025-2035.Growth is driven by the resurgence of international travel, increasing awareness of travel-related risks, and widespread adoption of digital insurance services.

Key Market Drivers

• Rising Global Tourism and Business Travel

Increasing cross-border travel for leisure and corporate purposes continues to fuel demand for travel insurance solutions.

• Higher Awareness of Health & Travel Risks

Travelers are more conscious of medical emergencies, trip cancellations, and unforeseen disruptions.

• Growth of Online Travel Agencies (OTAs) and Aggregators

Seamless integration of insurance add-ons at checkout boosts policy uptake.

• Wide Availability of Customizable Coverage

Insurers offer flexible coverage options for medical emergencies, lost luggage, trip delays, and adventure travel.

• Digital Insurance Platforms and Mobile Apps

Instant policy issuance, automated claims processing, and AI-based support enhance customer experience.

Get a Free PDF Sample> https://www.marketresearchfuture.com/sample_request/11161

Market Segmentation Highlights

1. By Insurance Type:

• Single-Trip Travel Insurance (Dominant Segment)

Popular among tourists, short-term business travelers, and occasional flyers.

• Annual Multi-Trip Insurance

Favored by frequent travelers, corporate clients, and long-term travelers.

• Long-Stay Travel Insurance

Designed for students, expatriates, and extended work assignments.

2. By Coverage:

• Medical Coverage

Covers illnesses, injuries, and hospitalization abroad.

• Trip Cancellation & Interruption

Protects against financial losses from delays or cancellations.

• Baggage & Personal Belongings

Reimbursement for lost, delayed, or damaged baggage.

• Travel Assistance

24/7 help services including emergency evacuation, translations, and concierge support.

3. By Distribution Channel:

• Insurance Companies

Direct policies sold via company websites and apps.

• Banks

Bancassurance models offering bundled travel insurance.

• Online Travel Agencies & Aggregators (Fastest Growing)

Integrated policy offerings during ticket or hotel bookings.

• Brokers & Agents

Traditional channel serving specialized or corporate clients.

Buy Premium Research Report> https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=11161

Regional Analysis

Europe - Market Leader

• Strong travel culture and high penetration of travel insurance

• Presence of major multinational insurers

• Mandatory insurance requirements in certain countries

North America

• High travel frequency and greater awareness of medical coverage

• Digital-first insurance platforms growing rapidly

Asia-Pacific - Fastest Growing Region

• Rising disposable incomes and outbound tourism

• Growing partnerships between insurers and travel agencies

Latin America & Middle East/Africa

• Increasing travel activity and growing insurance literacy

• Expansion of international flight routes and tourism markets

Key Market Opportunities

• AI-Based Claims Processing & Fraud Detection

Automation improves turnaround times and customer satisfaction.

• Adventure & Niche Travel Insurance

Coverage tailored to extreme sports, cruises, and solo travel.

• Embedded Insurance Solutions

Automatic inclusion of coverage within airlines, OTAs, fintech apps, and booking platforms.

• Global Health Coverage Integration

Long-term cross-border medical protection for expatriates, students, and digital nomads.

Browse Complete Research Report> https://www.marketresearchfuture.com/reports/travel-insurance-market-11161

Competitive Landscape

The travel insurance market is moderately competitive, with key players focusing on digitalization, product customization, and worldwide assistance networks. Major companies include:

• Allianz Partners

• AXA

• Zurich Insurance Group

• Generali Global Assistance

• Tokio Marine

• AIG Travel

• Berkshire Hathaway Travel Protection

• InsureMyTrip

• Travelex Insurance Services

• Seven Corners

These insurers are enhancing global reach, offering flexible coverage plans, and leveraging technology-driven platforms to improve customer experience.

Read More Articles -

Web3 Payments Market https://www.marketresearchfuture.com/reports/web3-payments-market-12242

NLP in Finance Market https://www.marketresearchfuture.com/reports/nlp-in-finance-market-11795

Internet of Things (IoT) Insurance Market https://www.marketresearchfuture.com/reports/internet-of-things-iot-insurance-market-2700

Health Insurance Market https://www.marketresearchfuture.com/reports/health-insurance-market-8227

Insurance Protection Product Market https://www.marketresearchfuture.com/reports/insurance-protection-product-market-9984

Pet Insurance Market https://www.marketresearchfuture.com/reports/pet-insurance-market-12399

Debt Collection Software Market https://www.marketresearchfuture.com/reports/debt-collection-software-market-22776

Debt Security Market https://www.marketresearchfuture.com/reports/debt-security-market-22786

Digital Transformation Consulting Market https://www.marketresearchfuture.com/reports/digital-transformation-consulting-market-22794

Financial Risk Management Software Market https://www.marketresearchfuture.com/reports/financial-risk-management-software-market-22806

About US

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis regarding diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact:

Market Research Future

99 Hudson Street,5Th Floor

New York, New York 10013

United States of America

Sales: +1 628 258 0071(US)

+44 2035 002 764(UK

Email: sales@marketresearchfuture.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Travel Insurance Market to Reach USD 64.06 Billion by 2035, Growing at a 9.5% CAGR | Rising Global Tourism, Traveler Safety Awareness, and Digital Insurance Platforms Drive Growth here

News-ID: 4308239 • Views: …

More Releases from Market Research Future (MRFR),

Digital Payment Market to Reach USD 524.28 Billion by 2035, Growing at a 15.08% …

The Digital Payment Market Size was estimated at USD 111.81 Billion in 2024. The industry is projected to grow from USD 128.67 Billion in 2025 to USD 524.28 Billion by 2035, exhibiting a strong CAGR of 15.08% during the forecast period 2025-2035.

The market's growth is propelled by rising global demand for secure, fast, and convenient payment solutions, expanding e-commerce, and widespread adoption of mobile wallets, QR payments, and contactless technologies.

Key…

Europe Digital Payment Market to Reach USD 160.13 Billion by 2035, Growing at a …

The Europe Digital Payment Market Size was estimated at USD 34.46 Billion in 2024. The market is projected to grow from USD 39.63 Billion in 2025 to USD 160.13 Billion by 2035, registering a strong CAGR of 14.99% during the forecast period 2025-2035.

The rapid shift toward cashless transactions, growth of fintech platforms, and strong regulatory frameworks such as PSD2 and open banking are accelerating digital payment adoption across Europe.

Key Market…

Microgreens Market to Reach USD 3.0 Billion by 2035 at 10.58% CAGR Driven by Hea …

The global Microgreens Market Is poised for remarkable growth over the next decade, fueled by increasing health awareness among consumers and the rise of urban farming practices. According to the latest analysis from Market Research Future, the microgreens market, valued at approximately USD 0.9 billion in 2023, is expected to expand significantly and reach USD 3.0 billion by 2035. This growth corresponds to a robust compound annual growth rate (CAGR)…

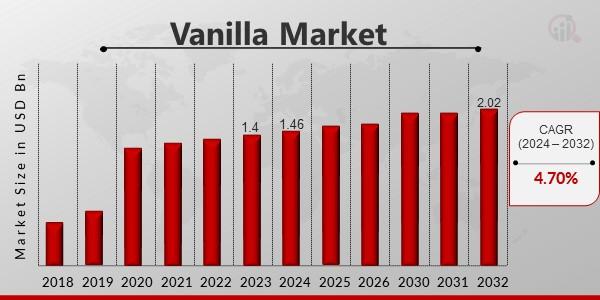

Vanilla Market Insights: The Growing Demand and Innovations Shaping the Future

Vanilla Market Overview

According to Market Research Future, the global vanilla market was valued at USD 1.4 billion in 2023 and is expected to expand from USD 1.46 billion in 2024 to USD 2.02 billion by 2032, registering a CAGR of 4.70% over the forecast period.

The global vanilla market is experiencing significant growth, driven by a combination of increased demand, evolving consumer preferences, and ongoing innovations. As one of the most…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…