Press release

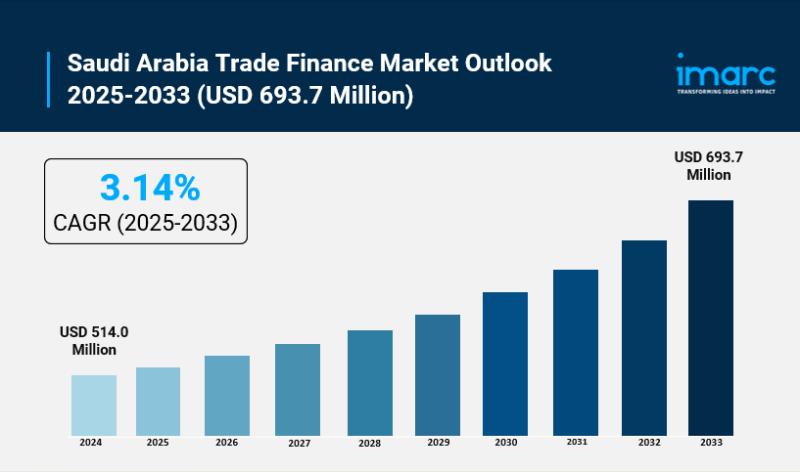

Saudi Arabia Trade Finance Market Size Projected to Reach USD 693.7 Million by 2033 | CAGR of 3.14%

Saudi Arabia Trade Finance Market OverviewMarket Size in 2024: USD 514.0 Million

Market Forecast in 2033: USD 693.7 Million

Market Growth Rate 2025-2033: 3.14%

According to IMARC Group's latest research publication, "Saudi Arabia Trade Finance Market Report by Finance Type (Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance), Offering (Letters of Credit, Bill of Lading, Export Factoring, Insurance, and Others), Service Provider (Banks, Trade Finance Houses), End User (Small and Medium-sized Enterprises, Large Enterprises), and Region 2025-2033", the Saudi Arabia trade finance market size reached USD 514.0 Million in 2024. The market is projected to reach USD 693.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.14% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-trade-finance-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Trade Finance Market

● AI platforms speed up trade finance approvals in Saudi Arabia, slashing processing times by 60% for smoother cash flow and business ops.

● Al Rajhi Bank's AI fraud tools cut trade finance incidents by over 35%, keeping deals safe and trustworthy for everyone involved.

● Vision 2030 backs AI digitization, enabling real-time compliance checks and seamless cross-border trade transactions effortlessly.

● AI risk tools predict defaults with 85% accuracy, helping lenders cut exposure and smartly allocate credit in busy markets.

● Automated AI document processing drops paperwork hassles by 50%, fueling Saudi's push to be a top digital trade hub.

How Vision 2030 is Transforming Saudi Arabia Trade Finance Industry?

Vision 2030 is transforming Saudi Arabia's trade finance market by accelerating digitalization, strengthening regulatory frameworks, and supporting diversification into non-oil sectors. Government initiatives promoting export growth, fintech adoption, and enhanced SME participation are boosting demand for innovative trade finance solutions. Platforms using blockchain, e-invoicing, and automated compliance are improving transparency and reducing processing times. Additionally, large-scale industrial and logistics projects are expanding cross-border trade activity, creating new opportunities for banks, fintech players, and alternative financing providers.

Saudi Arabia Trade Finance Market Trends & Drivers:

Saudi Arabia's trade finance market is booming thanks to Vision 2030, which pushes hard for economic diversification away from oil. Non-oil exports jumped 24.6% year-on-year to SR28.36 billion (about USD 7.56 billion) in April 2025, showing how businesses are diving into global trade with sectors like manufacturing and logistics leading the charge. This surge creates huge demand for tools like letters of credit and export financing to handle risks in cross-border deals. Government investments in mega-projects like Neom and industrial cities are pulling in foreign suppliers, while the trade surplus hit SR26.85 billion in July 2025, proving the Kingdom's rising role as a trade hub connecting Asia, Europe, and Africa. Banks are stepping up with tailored solutions to fuel this non-oil momentum.

Digital tech is revolutionizing trade finance in Saudi Arabia, making everything faster and more transparent for businesses. Major banks rolled out a collaborative AI and blockchain platform in June 2025 that cuts letters of credit processing time by 60%, giving SMEs real-time tracking and fewer errors in supply chains. The Saudi Arabian Monetary Authority (SAMA) launched digital trade finance regulations in July 2025, licensing fintechs for blockchain solutions and AI-driven processing to boost security and compliance. Al Rajhi Bank and others are automating approvals, slashing times by over half and opening doors for smaller players who couldn't compete before. This tech wave aligns perfectly with the National Transformation Program, turning complex paperwork into seamless digital flows.

The Kafalah program is a game-changer for SMEs in Saudi trade finance, easing access to funding so they can grab international opportunities. In Q3 2025 alone, it issued 5,447 guarantees worth SR10.6 billion, up 4% from last year, unlocking SR14 billion in financing-an 8% rise-for 4,384 businesses. Since starting, Kafalah has backed over 26,500 SMEs with SR125.3 billion in total loans, focusing on viable firms short on collateral. Tied to Vision 2030's SME push, it partners with banks like Saudi Investment Bank to offer guarantees from SR2.5 million to SR15 million, sparking job growth and exports in non-oil areas. This public-private teamwork is building a stronger, more inclusive trade ecosystem.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=20769&method=1315

Saudi Arabia Trade Finance Industry Segmentation:

The report has segmented the market into the following categories:

Finance Type Insights:

● Structured Trade Finance

● Supply Chain Finance

● Traditional Trade Finance

Offering Insights:

● Letters of Credit

● Bill of Lading

● Export Factoring

● Insurance

● Others

Service Provider Insights:

● Banks

● Trade Finance Houses

End User Insights:

● Small and Medium-sized Enterprises

● Large Enterprises

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Trade Finance Market

● November 2025: Saudi Awwal Bank wins best trade finance provider award, boosting efficiency with digital platforms amid Vision 2030 push.

● September 2025: SAMA launches new e-commerce payments interface, streamlining digital trade transactions for faster cross-border deals.

● August 2025: Alkhabeer Capital partners with AWRAAQ Digital on blockchain for block trade negotiations, cutting settlement times sharply.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Trade Finance Market Size Projected to Reach USD 693.7 Million by 2033 | CAGR of 3.14% here

News-ID: 4306584 • Views: …

More Releases from IMARC Group

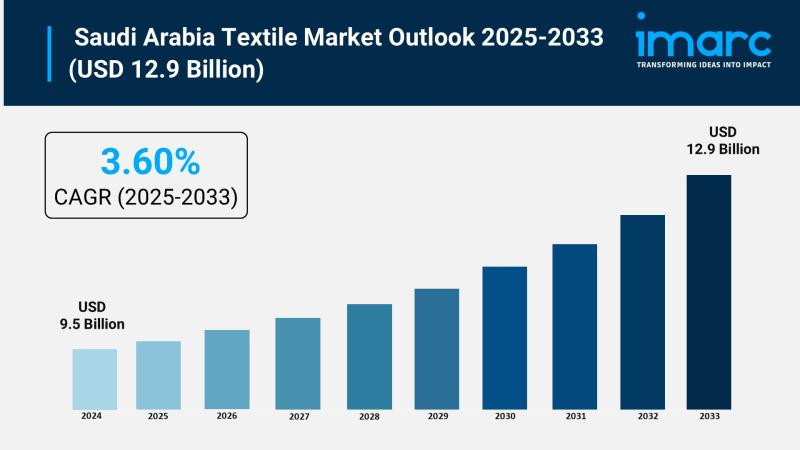

Saudi Arabia Textile Market Is Expected to Reach USD 12.9 Billion by 2033, Grow …

Saudi Arabia Textile Market Overview

Market Size in 2024: USD 9.5 Billion

Market Size in 2033: USD 12.9 Billion

Market Growth Rate 2025-2033: 3.60%

According to IMARC Group's latest research publication, "Saudi Arabia Textile Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia textile market size was valued at USD 9.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.9 Billion by 2033, exhibiting a…

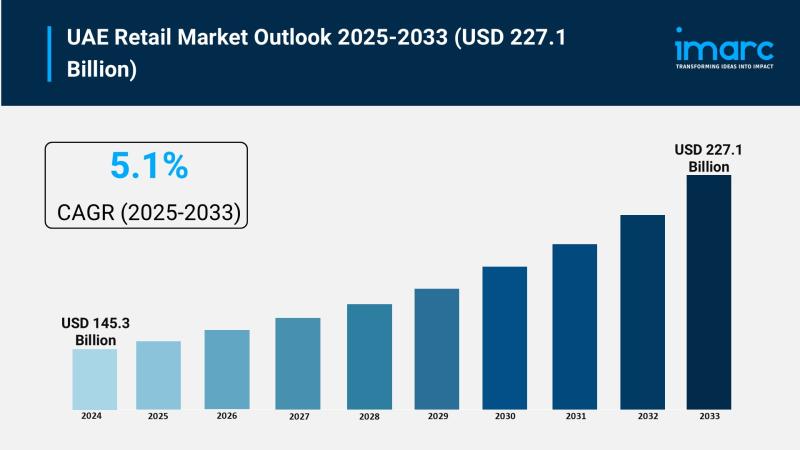

UAE Retail Market Size is Expected to Reach USD 227.1 Billion By 2033 | CAGR: 5. …

UAE Retail Market Overview

Market Size in 2024: USD 145.3 Billion

Market Size in 2033: USD 227.1 Billion

Market Growth Rate 2025-2033: 5.1%

According to IMARC Group's latest research publication, "UAE Retail Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE retail market size reached USD 145.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 227.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.1%…

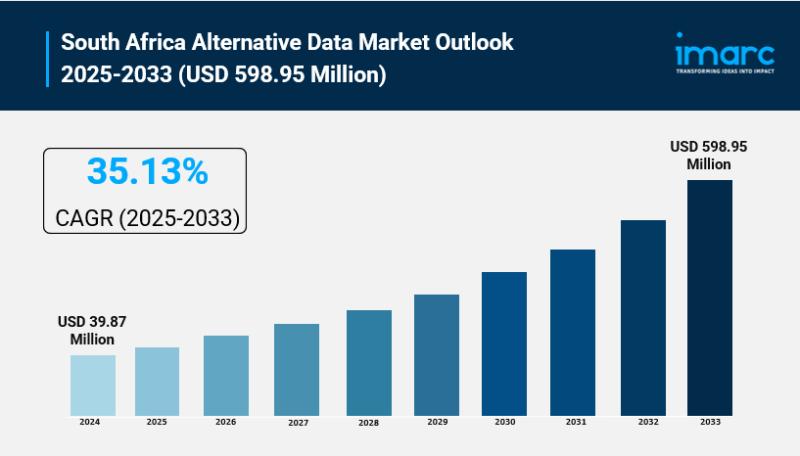

South Africa Alternative Data Market Size to Reach USD 598.95 Million by 2033 | …

South Africa Alternative Data Market Overview

Market Size in 2024: USD 39.87 Million

Market Size in 2033: USD 598.95 Million

Market Growth Rate 2025-2033: 35.13%

According to IMARC Group's latest research publication, "South Africa Alternative Data Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The South Africa alternative data market size reached USD 39.87 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 598.95 Million by 2033, exhibiting…

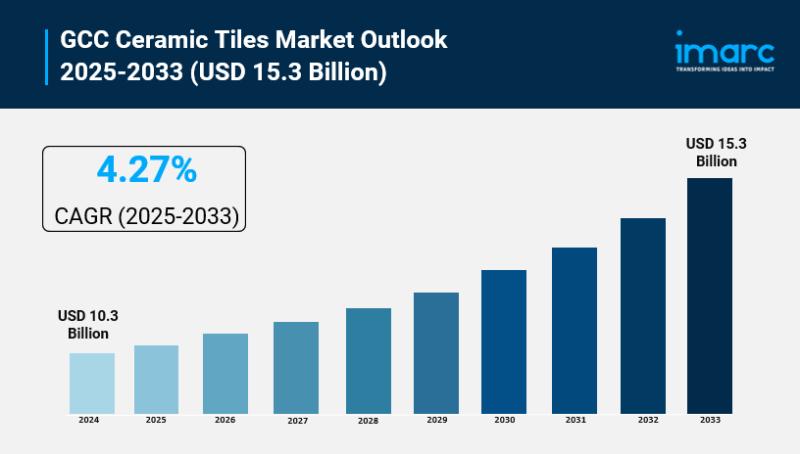

GCC Ceramic Tiles Market Size to Hit USD 15.3 Billion by 2033 | With a 4.27% CAG …

GCC Ceramic Tiles Market Overview

Market Size in 2024: USD 10.3 Billion

Market Size in 2033: USD 15.3 Billion

Market Growth Rate 2025-2033: 4.27%

According to IMARC Group's latest research publication, "GCC Ceramic Tiles Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The GCC ceramic tiles market size reached USD 10.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.3 Billion by 2033, exhibiting a growth rate…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…