Press release

Global Reinsurance Market is projected to reach the value of $1144.23 Billion by 2030.

In 2024, the Global Reinsurance Market was valued at $685.2 Billion, and is projected to reach a market size of $1144.23 Billion by 2030. Over the forecast period of 2025-2030, market is projected to grow at a CAGR of 10.8%.Request Sample @ https://virtuemarketresearch.com/report/reinsurance-market/request-sample

The global reinsurance market has experienced significant growth and transformation in recent years, driven by various factors. One long-term market driver is the increasing frequency and severity of natural disasters and catastrophic events. These events, such as hurricanes, earthquakes, and wildfires, have led to substantial losses for insurance companies, highlighting the importance of reinsurance in spreading risk and ensuring financial stability. However, the COVID-19 pandemic has had a mixed impact on the market. While the pandemic has increased awareness of the need for insurance coverage and risk management, it has also resulted in higher claims payouts for reinsurers due to business interruptions and economic uncertainty.

In the short term, a key market driver is the hardening of reinsurance rates. Insurers are facing higher claims costs and lower investment returns, leading to pressure on their profitability. As a result, reinsurers are tightening their underwriting standards and increasing premiums, particularly in high-risk areas or lines of business. This trend presents an opportunity for reinsurers to improve their profitability and strengthen their balance sheets. Additionally, technological advancements such as big data analytics and artificial intelligence are transforming the reinsurance industry. Reinsurers are leveraging these technologies to enhance risk assessment, pricing, and underwriting processes, improving efficiency and competitiveness in the market.

One trend observed in the industry is the growing demand for alternative capital sources. Traditionally, reinsurance has been dominated by traditional reinsurers with substantial capital reserves. However, in recent years, there has been a rise in alternative capital providers such as insurance-linked securities (ILS), catastrophe bonds, and collateralized reinsurance. These alternative capital sources offer diversification benefits and access to new markets, attracting both investors and insurers looking for innovative risk transfer solutions. Additionally, environmental, social, and governance (ESG) considerations are becoming increasingly important in the reinsurance industry. Reinsurers are incorporating ESG criteria into their underwriting processes and investment decisions, reflecting a broader shift towards sustainable and responsible business practices.

Segmentation Analysis:

The global Reinsurance Market segmentation includes:

By Distribution Channel: Direct Writing, Broker.

The broker distribution channel is estimated to contribute the most reinsurance income between 2022 and 2030, with a CAGR of around 4.6%. Reinsurance brokers play a crucial role in connecting the insurance needs of the reinsured and the reinsurer, negotiating mutually agreeable reinsurance terms, and assisting in the planning and development of reinsurance programs.

The broker distribution channel is also expected to witness the fastest growth. Brokers anticipate greater demand for cyber reinsurance, reflecting increased awareness and demand for cyber insurance protection.

Enquire Before Buying @ https://virtuemarketresearch.com/report/reinsurance-market/enquire

By End User: Life & Health Reinsurance, Non-Life/Property & Casualty Reinsurance.

The non-life/property & casualty reinsurance segment is anticipated to see the greatest CAGR of around 4.3% between 2022 and 2030 in terms of reinsurance revenue growth. Major catastrophes and natural disasters have put pressure on insurance firms, increasing demand for property and casualty reinsurance.

The non-life/property & casualty reinsurance segment is also expected to witness the fastest growth. Technological developments, alternative finance, and the integration of value-added services with reinsurance are shaping the future of this segment.

Regional Analysis:

By the end of 2030, the United States is predicted to have the largest market share, at US$ 186.6 billion, or almost 40% of the global share. The United States reinsurance market has been impacted by the COVID-19 outbreak, with an increased need for life reinsurance services.

The Asia Pacific region is expected to be the most profitable region with the fastest predicted growth. Demographic development and digital transformation dynamics are expected to fuel business growth for reinsurance companies in this region. Singapore and Hong Kong have become major international centers for reinsurance due to their established regulatory frameworks and robust financial infrastructure.

Latest Industry Developments:

1. Focus on Technological Innovation: Companies in the reinsurance market are increasingly focusing on technological innovation to enhance their market share. Recent developments include the use of big data analytics, artificial intelligence, and machine learning to improve risk assessment, underwriting processes, and customer service. Additionally, companies are exploring blockchain technology to streamline transactions and enhance data security. These technological advancements help companies stay competitive in the rapidly evolving reinsurance market.

2. Collaborations and Partnerships: Reinsurance companies are entering into collaborations and partnerships to enhance their market share and expand their reach. These collaborations include partnerships with insurtech companies to leverage their technology and expertise, as well as collaborations with other insurers to offer bundled reinsurance solutions. Additionally, companies are partnering with government agencies and non-profit organizations to develop innovative risk mitigation strategies and enhance their social responsibility efforts.

3. Diversification of Products and Services: Companies are diversifying their product and service offerings to cater to a broader range of clients and risks. This includes offering specialized reinsurance products for emerging risks such as cyber risks, climate change, and pandemics. Additionally, companies are expanding into new markets and regions to capitalize on growth opportunities and reduce dependency on specific markets. Diversification helps companies mitigate risks and enhance their competitive position in the market.

Buy Now @ https://virtuemarketresearch.com/checkout/reinsurance-market

About Us:

Virtue Market Research is a strategic management firm helping companies to tackle most of their strategic issues and make informed decisions for their future growth. We offer syndicated reports and consulting services. Our reports are designed to provide insights on the constant flux in the global demand-supply gap of markets.

103 Kumar Plaza,SRPF Road,

Ramtekadi,Pune,

Maharashtra - 411013

Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Reinsurance Market is projected to reach the value of $1144.23 Billion by 2030. here

News-ID: 4303572 • Views: …

More Releases from Virtue Market Research

The Global Vodka Seltzer Market is projected to reach a market size of USD 16.22 …

The Vodka Seltzer Market was valued at USD 9.4 billion in 2024 and is projected to reach a market size of USD 16.21 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.1%.

Request Sample @ https://virtuemarketresearch.com/report/vodka-seltzer-market/request-sample

The vodka seltzer market has grown from a niche beverage choice into a mainstream favorite, supported by shifting consumer lifestyles and evolving…

The Global Telehealth Services Market and is projected to reach a market size of …

The Global Telehealth Services Market was valued at USD 126.1 billion and is projected to reach a market size of USD 302.49 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.7%.

Request Sample @ https://virtuemarketresearch.com/report/telehealth-services-market/request-sample

The perennial shift towards patient-centric healthcare has been a pivotal long-term market driver for telehealth services. Over the years, the industry has witnessed…

The Subscription Box/Subscription E-Commerce Market is projected to reach a mark …

The Subscription Box/Subscription E-Commerce Market is valued at USD 47.19 billion in 2024 and is projected to reach a market size of USD 97.73 billion by the end of 2030. Over the outlook period of 2025-2030, the market is anticipated to grow at a CAGR of 12.9%.

Request Sample @ https://virtuemarketresearch.com/report/subscription-e-commerce-market/request-sample

The subscription e-commerce market has grown into one of the most dynamic parts of the digital economy. It began as a…

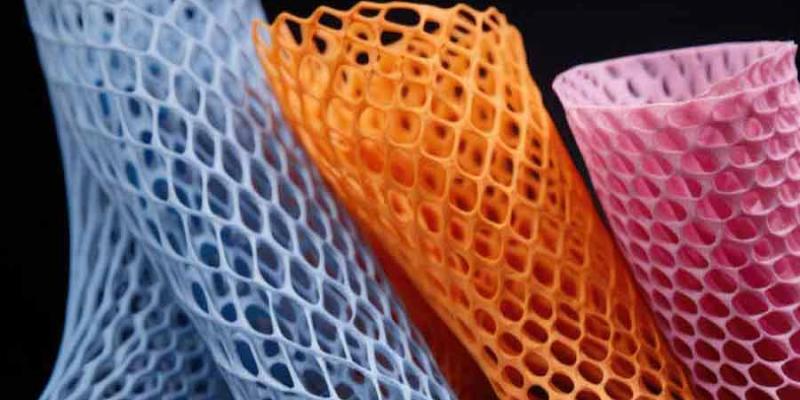

The Global Aramid Fibre Reinforced Polymer Composites Market is projected to rea …

According to the report published by Virtue Market Research in Aramid Fibre Reinforced Polymer Composites Market was valued at USD 5.55 billion and is projected to reach a market size of USD 8.57 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.

Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/aramid-fibre-reinforced-polymer-composites-market/request-sample

The Aramid Fibre Reinforced Polymer Composites…

More Releases for Reinsurance

Reinsurance Services Market SWOT Analysis by Key Players Hannover Re, Korean Rei …

The Latest research coverage on Reinsurance Services Market provides a detailed overview and accurate market size. The study is designed considering current and historical trends, market development and business strategies taken up by leaders and new industry players entering the market. Furthermore, study includes an in-depth analysis of global and regional markets along with country level market size breakdown to identify potential gaps and opportunities to better investigate market status,…

Crop Reinsurance Market Is Booming So Rapidly | Munich Reinsurance, Swiss Reinsu …

The Crop Reinsurance Market study with 65+ market data Tables, Pie charts & Figures is now released by HTF MI. The research assessment of the Market is designed to analyze futuristic trends, growth factors, industry opinions, and industry-validated market facts to forecast till 2029. The market Study is segmented by key a region that is accelerating the marketization. This section also provides the scope of different segments and applications that…

Agriculture Reinsurance Market Is Booming Worldwide : Agroinsurance, Swiss Reins …

The Latest Released Agriculture Reinsurance market study has evaluated the future growth potential of Agriculture Reinsurance market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, emerging trends along with essential drivers, challenges,…

Recent Reinsurance Market Investment Activity From Established Companies Are to …

The latest release from WMR titled Reinsurance Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Reinsurance including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Reinsurance Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment…

Life Reinsurance Market is Going to Boom | Swiss Re, Munich Reinsurance, Korean …

Advance Market Analytics published a new research publication on “Life Reinsurance Market Insights, to 2026″ with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Life Reinsurance market was mainly driven by the increasing R&D spending across the world.

Some of the key players profiled in…

Reinsurance Market To See Stunning Growth | Munich, Korean Reinsurance, Swiss

Latest Market Research on “Reinsurance Market” is now released to provide hidden gems performance analysis in recent years and years to come. The study explains a detailed overview of market dynamics, segmentation, product portfolio, business plans, and the latest development in the industry. Staying on top of market trends & drivers is always remain crucial for decision-makers and marketers to hold emerging opportunity.

Get the inside scoop with Sample report https://www.htfmarketreport.com/sample-report/3185812-global-reinsurance-market-26

Know…