Press release

The Future of Food Packaging: Why Base Paper Is Quietly Becoming a USD 15,211 Million Powerhouse

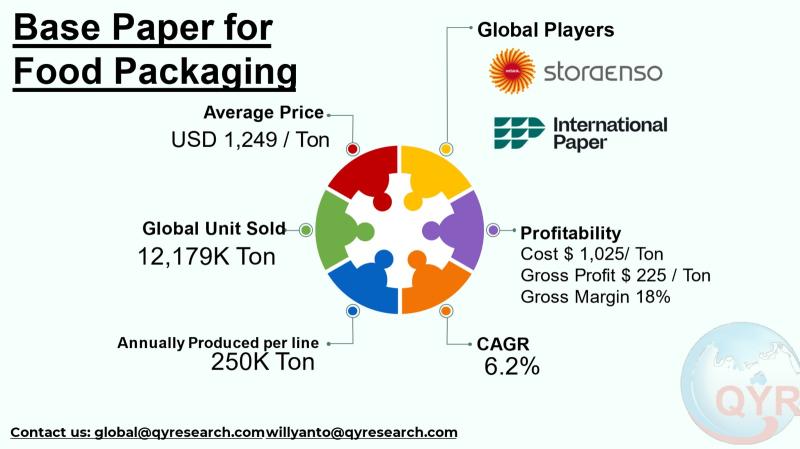

The global base paper for food packaging sector sits at the intersection of traditional pulp-and-paper manufacturing and fast-moving consumer goods packaging needs, supplying the primary fibrous substrates that are later coated, printed, laminated or formed into food wraps, cups, bags and flexible formats. Demand is driven by foodservice growth, retail-packaged foods, and a rapid shift by brand owners toward fiber-based, recyclable alternatives to single-use plastics. Sustainability policy, recyclability mandates and consumer preference for lower-plastic-content packaging are reshaping investments across the value chain from pulp suppliers and papermakers to converters and converters coating partners.In 2024 the base paper for food packaging market size amounted to USD 15,211 million and a compound annual growth rate of 6.2% through 2031, reaching market size USD 23,156 million by 2031. With an average selling price at USD 1,249 per ton, total global unit demand in 2024 is approximately 12.179K tons. A 18% factory gross margin on a USD 1,249 price implies an average factory gross profit of about USD 225 per ton and a cost of goods sold of about USD 1,024 per ton. The COGS breakdown is pulp/raw fiber), energy, labor, coating & chemical additives, maintenance and consumables. A single line full machine capacity production is around 250K ton per line per year. Downstream demand for base paper for food packaging is concentrated in flexible paper (pouches & bags) and coated cup/cupstock and board (for hot and cold cups and trays), with a plausible illustrative split being flexible packaging and pouches, cupstock & hot-fill papers, paper bags & wraps and lamination/labels.

Latest Trends and Technological Developments

Barrier and PFAS-free technologies, water-based and bio-wax coatings, and inline flexographic application processes have been the most visible technology themes in recent months. Major suppliers and coatings specialists have highlighted new water-based barrier formulations and flexography-integrated coating lines that let converters apply high-performance barriers inline while improving recyclability; announcements and demonstrations at global packaging shows in 2025 have emphasized these advances (for example, collaborative demonstrations of inline barrier coating processes announced around FACHPACK and recent industry releases in 2025-2025). The broader industry has also accelerated development of PFAS-free greaseproof papers and polysaccharide and biowax solutions that improve oil and water resistance while avoiding persistent chemistries. (Selected public industry items and announcements: barrier coating technology and launch coverage; barrier-coating market updates).

Mondi Group (buyer) entered into a supply agreement with International Paper (supplier) for the procurement of 500 metric tons of coated recycled base paper, specifically designed for sustainable food-grade packaging. The material, which meets FDA and EU regulatory standards for direct food contact, was purchased at a contracted price of USD 1,250 per metric ton, with delivery scheduled to Mondi's production facility in Środa Śląska, Poland, by Q1 2025. This high-barrier base paper will be further processed into grease-resistant wrappers for fast-food packaging.

McDonalds Corporation implemented the newly developed packaging material sourced from Mondi Group across 800 of its European outlets. The paper, used for wrapping premium burgers and breakfast items, replaced a prior non-recyclable laminated alternative. The total contract value for the annual supply amounted to USD 3.2 million, covering approximately 2,550 metric tons of the specialized base paper. This shift supported McDonalds 2025 sustainability goals by ensuring that the packaging is fully recyclable in standard paper streams, while maintaining durability and food-safety integrity.

Asia is the single largest regional driver of incremental tonnage for base paper used in food packaging because of its large and expanding foodservice sector, rapid retail and e-commerce growth, and major paper-industry investments across China, India, Southeast Asia and Japan. The Asia-Pacific paper packaging market has been reported as a major and growing share of global packaging paper demand, with multiple market studies showing robust growth in the region driven by urbanization and brand shifts toward fiber-based formats. China continues to lead capacity additions and technological upgrades, while Japan, South Korea and India are important centers for specialty coating development and high-value grades. Mill investments in the region are notable for both large integrated pulp/paper complexes and new smaller high-value specialty lines focused on sustainable barrier solutions. Regional market estimates and forecasts for Asia Pacific paper packaging corroborate a materially higher demand profile compared with other regions.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5515722

Base Paper for Food Packaging by Type:

Container Packaging Paper

Non Container Packaging Paper

Base Paper for Food Packaging by Product Category:

Bleached Wood Pulp

Unbleached Wood Pulp

Base Paper for Food Packaging by Market Segment:

Liquid Packaging Base Paper

Food Bag Base Paper

Tableware Base Paper

Baking Base Paper

Others

Base Paper for Food Packaging by Features:

Oil and Grease Resistance

Moisture Resistance

Heat Sealable Barrier Coating

Microwave or Oven Safe

Others

Base Paper for Food Packaging by Shape:

Flat Sheets

Pre Cut Wraps

Rollstock

Multilayer Laminated Paper

Others

Base Paper for Food Packaging by Application:

Baked Goods

Paper Cutlery

Beverage/Dairy

Instant foods

Others

Global Top 15 Key Companies in the Base Paper for Food Packaging Market

Billerud

Stora Enso

Ahlstrom-Munksjö

UPM

Oji F-Tex

Yibin Paper

Wuzhou Special Paper Group

Shandong Sun Holdings Group

DS Smith

International paper

Westrock

Xianhe

Twin River Paper

Detmold Group

Zhejiang KAN Special Materials

Regional Insights

Within Southeast Asia, ASEAN demand growth is concentrated in Indonesia, Vietnam, Thailand and Malaysia. Indonesia stands out because of its large population, expanding retail and foodservice markets, and several domestic mills and converters integrating more packaging-grade paper capacity and specialty coating partnerships. Indonesian market studies and regional reports from 20242025 show the domestic paper-packaging sector growing at mid-single digits to low double digits depending on sub-segments, with e-commerce and quick-service-restaurant (QSR) packaging being important end markets. Local players are also responding to government and buyer pressure to reduce plastic content in packaging, which supports incremental demand for barrier-treated base papers and coated cupstock. Supply dynamics in ASEAN are influenced by feedstock availability (recovered fiber vs. virgin pulp), energy costs, and regional trade flows to larger markets in East Asia and Australia.

The sector faces several persistent challenges. First, raw material and pulp price volatility materially affect COGS since pulp is the dominant input cost; mills with less efficient fiber sourcing face margin compression when pulp prices spike. Second, energy intensity and electricity/steam costs remain important cost levers and competitive differentiators for mills in different geographies. Third, recyclability tradeoffs created by barrier chemistries can limit downstream recycling streams and provoke regulatory or buyer pushback, which in turn increases R&D cost and conversion complexity. Fourth, pricing pressure exists from competing plastic and multi-material formats that can be cheaper for certain uses; converters must prove total-system sustainability and often accept thin margins while investing in new coating lines and certification. Finally, talent skilled in specialty papermaking and inline coating operations is relatively scarce in some growth markets, delaying ramp-up. Industry reporting and company earnings through 2024 and 2025 have repeatedly pointed to these input-cost and demand-mix headwinds for paper packaging players.

For manufacturers and investors, the highest-value strategies are (1) securing advantaged pulp or recovered-fiber supply contracts to stabilize COGS, (2) vertically integrating or forming JV partnerships with barrier coating suppliers to offer certified recyclable fiber-plus-barrier systems, (3) targeting mid-to-high-end foodservice and flexible pouch segments where brand owners pay premiums for recyclable/clean-label packaging, (4) investing in energy efficiency and process automation to protect factory margins, and (5) leveraging regional export hubs (e.g., Southeast Asian mills exporting to East Asia/Australia) to capture arbitrage opportunities. Companies also benefit from product differentiation (e.g., PFAS-free greaseproof, compostable coatings) and from certifications (recycled content chain of custody, food-contact approvals), which reduce buyer friction and command higher realized prices.

Product Models

Base paper for food packaging refers to specially manufactured paper materials used as the foundational layer for producing food-safe packaging products. These papers may undergo additional coating, lamination, or conversion processes to achieve desired properties such as grease resistance, wet strength, printability, and heat sealing.

Container packaging paper is paper types designed to form structural or semi-rigid food packaging, such as cups, trays, cartons, and boxes. Notable products include:

Cupstock PE-Coated Board International Paper: Paperboard engineered for hot and cold beverage cups with strong rigidity and moisture resistance.

Foodservice Kraft Board WestRock: Durable kraft board used for takeaway food containers with high printability.

Paper Tray Base Board Stora Enso: Base paper designed for molded fiber or pressed food trays.

FBB (Folding Box Board) Natura Metsä Board: Lightweight, stiff board for folding food boxes and bakery cartons.

Food Container Linerboard Smurfit Kappa: Liner used for corrugated food containers requiring high strength.

Non container packaging paper is paper types used for flexible or non-structural food packaging, such as wraps, bags, liners, and pouches. Notable products include:

Greaseproof Paper Base Ahlstrom: Specialty paper for bakery wraps and fast-food liners with natural grease resistance.

Wax-Base Wrapping Paper Nippon Paper: Base sheet designed for wax-coated deli and confectionery wraps.

MG Kraft Paper Mondi Group: Machine-glazed kraft with smoothness ideal for food bags and sachets.

Glassine Paper Felix Schoeller: Ultra-smooth, transparent-appearance paper for high-grease foods and candies.

Parchment Baking Base Paper Nordic Paper: Heat-resistant paper for bakery release and oven applications.

Base paper for food packaging is a growth segment within the broader paper-based packaging market, supported by regulatory pressure on plastics, rising brand sustainability commitments and accelerating technology that closes the performance gap between fiber and plastics. While input-cost volatility and recyclability tradeoffs represent real commercial risks, converters and mills that secure supply advantages, invest in sustainable barrier technologies and align with fast-growing regional markets (notably Asia and ASEAN/Indonesia) are best positioned to capture higher-margin growth through 2031.

Investor Analysis

What investors should watch: (1) unit demand growth in Asia and ASEAN (tonnage trends and local consumption data), (2) pulp and recovered-fiber price trends (as the primary COGS driver), (3) announcements and commercialization of PFAS-free and water-based barrier coatings, and (4) capex and capacity additions (new lines and retrofit projects that can re-rate margins). Investors can use the unit-demand and margin benchmarks in this document to build scenario models for mill free cash flow under different pulp-price and utilization settings, to stress-test acquisition targets (where tangible capacity and product mix determine upside) and to prioritize North-South Asia assets where demand growth and freight economics favor local production.Base paper is a volume and margin lever for many packaging value chains small changes in raw material costs or in realized price per ton cascade to meaningful EBITDA effects at scale. Companies that can combine low-cost, secure fiber supply, efficient machines and differentiated barrier solutions are most likely to sustain margins above the mid-teens and capture market share from plastic alternatives.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5515722

5 Reasons to Buy This Report

Consolidated, region-focused view of base paper demand with Asia and ASEAN emphasis that highlights where incremental tonnage will come from.

Unit-level economics and practical factory benchmarks (price per ton, gross profit per ton, COGS composition and representative single-line capacities).

Coverage of the latest technology and barrier-coating developments (PFAS-free solutions, inline coating processes) with dated references.

Strategic playbook for manufacturers and investors (supply security, integration, product differentiation and regional arbitrage).

Curated list of top global players and a clear investor checklist tying operational KPIs to investment outcomes.

5 Key Questions Answered

How large was the global base paper for food packaging market in 2024 and in unit terms?

What is a defensible per-ton economics snapshot (price, COGS per ton, gross profit per ton and typical COGS breakdown)?

Which regions (Asia and ASEAN) are the fastest growth opportunities and why?

What are the most important technology trends (barrier, PFAS alternatives, inline coating) and recent dated announcements?

Which companies are the leading players and what business model moves de-risk margin compression?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Global Base Paper for Food Packaging Market Research Report 2025

https://www.qyresearch.com/reports/3525392/base-paper-for-food-packaging

Global Base Paper for Food Packaging Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/4930205/base-paper-for-food-packaging

Global Base Paper for Food Packaging Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/4807220/base-paper-for-food-packaging

Base Paper for Food Packaging- Global Market Share and Ranking, Overall Sales and Demand Forecast 2026-2032

https://www.qyresearch.com/reports/5512015/base-paper-for-food-packaging

Global Base Paper for Disposable Food Packaging Market Research Report 2025

https://www.qyresearch.com/reports/3818308/base-paper-for-disposable-food-packaging

Global Water-based Coated Paper for Food Packaging Market Research Report 2025

https://www.qyresearch.com/reports/4800794/water-based-coated-paper-for-food-packaging

Global Paper Packaging Box for Food Market Research Report 2025

https://www.qyresearch.com/reports/4397910/paper-packaging-box-for-food

Global Aseptic Paper for Food Packaging Market Research Report 2025

https://www.qyresearch.com/reports/3559521/aseptic-paper-for-food-packaging

Global Packaging Paper for Food Contact Market Research Report 2025

https://www.qyresearch.com/reports/3490493/packaging-paper-for-food-contact

Global Transparent Papers for Food Packaging Market Research Report 2025

https://www.qyresearch.com/reports/3821907/transparent-papers-for-food-packaging

Contact Information:

Te: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

Related Report Recommendation

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Future of Food Packaging: Why Base Paper Is Quietly Becoming a USD 15,211 Million Powerhouse here

News-ID: 4303424 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Paper

Newsprint Paper Market | Alberta Newsprint, BO Paper Group, Daio Paper, Emami Pa …

Introduction:

The introduction to the report serves as a gateway into the comprehensive world of the newsprint paper market. As industries continue to evolve and adapt to changing consumer demands and technological advancements, understanding the market dynamics becomes paramount for industry stakeholders. The report takes on the responsibility of offering a profound and all-encompassing analysis of the newsprint paper market, catering to the needs of a diverse audience that includes manufacturers,…

Paraffin Paper Market to Witness Massive Growth by 2027 | Patty Paper, Dunn Pape …

A new research document released by HTF MI with title "Global Paraffin Paper Market SWOT analysis by Size, Status and Forecast 2022 to 2027" provides a complete assessment of Paraffin Paper Market. The study focuses on changing market dynamics, geopolitical and regulatory policies, key players Strategies to better analyse demand at risk across various product type. Some of the major and emerging players analysed in the study are Dunn Paper,…

Pulp and Paper Market Key Player Analysis By sappi, Lee & Man Paper, Nippon Pape …

Global Pulp and Paper Market Research Report 2018–2025 is a historical overview and in-depth study on the current & future market of the Pulp and Paper Industry. The report represents a basic overview of the market status, competitor segment with a basic introduction of key vendors, top regions, product types and end industries. This report gives a historical overview of the market trends, growth, revenue, capacity, cost structure, and…

Global Waste Paper Recycling Market Forecast 2019-2026 Miami Waste Paper, Dixie …

Market study on Global Waste Paper Recycling 2019 Research Report presents a professional and complete analysis of Global Waste Paper Recycling Market on the current market situation.

Report provides a general overview of the Waste Paper Recycling industry 2019 including definitions, classifications, Waste Paper Recycling market analysis, a wide range of applications and Waste Paper Recycling industry chain structure. The 2019's report on Waste Paper Recycling industry offers the global…

Book Paper Market Report 2018 Companies included Stora Enso, Oji Paper, Nippon P …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com *********

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides…

Global Pulp and Paper Market 2018 Key Players: sappi, Lee & Man Paper, Nippon Pa …

Pulp and Paper Market:

WiseGuyReports.com adds “Pulp and Paper Market 2018 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting 2025” reports tits database.

Executive Summary

Global Pulp and Paper Market valued approximately USD XX billion in 2017 is anticipated to grow with a healthy growth rate of more than XXX% over the forecast period 2017-2025. Pulp and paper producers produces and sells cellulose-based products, derived from wood. Packaging paper, graphic paper and…