Press release

Global Carbon-Smart Municipal Bond Market Landscape Through 2034: Forces Driving the Next Phase of Expansion

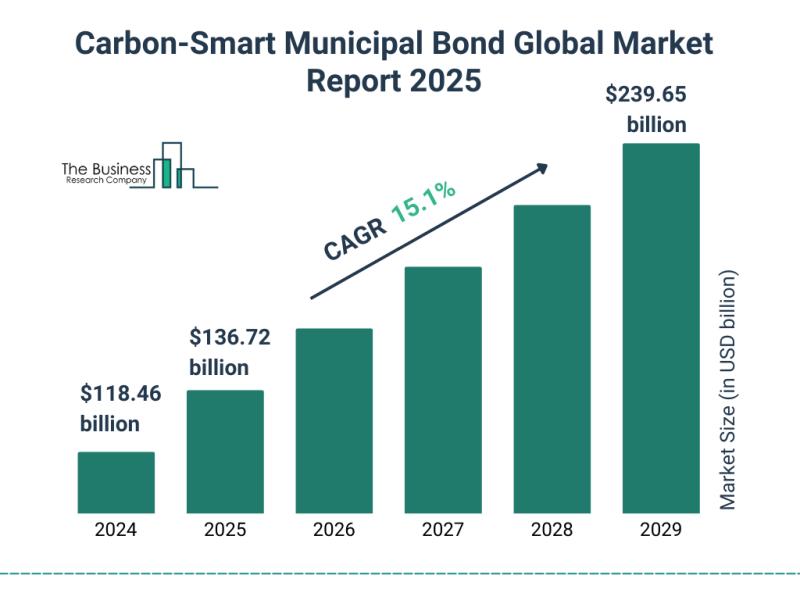

Market growth outlook for the Carbon Smart Municipal Bond MarketThe carbon-smart municipal bond sector has expanded significantly in recent years, with its market size expected to rise from $118.46 billion in 2024 to $136.72 billion in 2025, marking a 15.4% CAGR. This historical growth stems from several influential dynamics: increased corporate engagement in local sustainability projects, broader availability of carbon offset mechanisms, deeper integration of climate risk into municipal budget planning, a rising investor preference for climate-aligned long-term financial instruments, and strengthened transparency requirements surrounding carbon-smart initiatives.

Forecast valuation for the Carbon Smart Municipal Bond Market by 2029

Looking ahead, the market is forecast to accelerate further, reaching $239.65 billion by 2029 at a 15.1% CAGR. Several factors drive this outlook, including expanding investment in clean energy development, greater governmental incentives supporting low-carbon infrastructure, rising public awareness of climate change impacts, growing institutional appetite for environmentally responsible assets, and increased issuance of green and carbon-smart bonds from municipal entities. Anticipated advances include improvements in renewable energy technologies, wider adoption of smart grid systems, progress in carbon capture and storage methods, enhanced materials for energy-efficient building, and next-generation innovations in electric and low-emission public transit.

Access the full Carbon-Smart Municipal Bond Market report here:

https://www.thebusinessresearchcompany.com/report/carbon-smart-municipal-bond-global-market-report

Drivers supporting the Carbon Smart Municipal Bond Market's future expansion

One of the most influential drivers behind market growth is the rising demand for renewable energy. Investment in clean power projects-spanning solar, wind, biomass, and hydro-continues to increase as governments and corporations pursue decarbonization commitments and shift toward low-emission energy systems. Carbon-smart municipal bonds help make these transitions possible by directing capital toward sustainable infrastructure, such as renewable energy installations and grid upgrades, enabling communities to cut greenhouse gas emissions, reinforce long-term energy resilience, and generate measurable economic and environmental value. Eurostat data published in December 2024 underscores this trend: renewable energy represented 24.5% of EU consumption in 2023, up from 23.0% in 2022.

Climate awareness driving momentum in the Carbon Smart Municipal Bond Market

Growing global understanding of climate change is also expected to accelerate market expansion. Increased public awareness of environmental risks-along with a clearer recognition of climate solutions-continues to shape attitudes, influence policy, and guide investment behavior toward sustainability. Carbon-smart municipal bonds play a pivotal role by financing climate adaptation and mitigation initiatives, such as energy efficiency upgrades and resilient infrastructure projects. As noted by Gov.UK in July 2024, the UK's national goal of reaching net-zero greenhouse gas emissions by 2050 has gained substantial public visibility, with awareness levels ranging from 93-95% among adults aged 45+ and 87-89% among younger adults. This heightened climate literacy further stimulates demand for funding mechanisms that support environmentally responsible development.

Download your free Carbon-Smart Municipal Bond Market sample now:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29333&type=smp

Trends guiding innovation in the Carbon Smart Municipal Bond Market

Key organizations in the carbon-smart municipal bond sector are advancing transparency and investor confidence through frameworks like the Climate Bonds Standard, a certification system that verifies whether bond proceeds finance projects achieving meaningful climate benefits. This standard ensures that issuances meet robust environmental criteria, supporting investments in low-carbon infrastructure and climate resilience.

Certification-driven momentum in the Carbon Smart Municipal Bond Market

A practical example of this trend came in March 2024, when the Vadodara Municipal Corporation in India issued Asia's first certified green municipal bond. The bond finances sustainable urban development, particularly water infrastructure designed to reduce pollution and protect natural water systems. By achieving Climate Bonds Standard certification, the issuance appealed strongly to environmentally focused investors, secured capital at competitive rates, and provided transparent reporting-demonstrating how structured certification systems can strengthen municipal climate financing while supporting long-term resilience and public well-being.

Segment landscape of the Carbon Smart Municipal Bond Market

The carbon-smart municipal bond market covered in this report is segmented -

By Bond Type: General Obligation Bonds, Revenue Bonds, Green Bonds, Social Bonds, Other Bond Types

By Investor Type: Institutional Investors, Retail Investors, Other Investor Types

By Issuer: State Governments, Local Governments, Municipal Agencies, Other Issuers

By Application: Infrastructure Development, Renewable Energy Projects, Sustainable Transportation, Water And Waste Management, Other Applications

Subsegments include:

- General Obligation Bonds: Short-Term, Long-Term, Tax-Exempt

- Revenue Bonds: Utility Revenue Bonds, Transportation Revenue Bonds, Healthcare Revenue Bonds

- Green Bonds: Climate Adaptation Bonds, Renewable Energy Bonds, Energy Efficiency Bonds

- Social Bonds: Affordable Housing, Community Development, Healthcare And Education Bonds

- Other Bond Types: Hybrid Bonds, Catastrophe Bonds, Public-Private Partnership Bonds

Leading companies shaping the Carbon Smart Municipal Bond Market

Key organizations participating in this market include Bank of America Corporation; Fannie Mae; HSBC Holdings plc; Itaú Unibanco Holding S.A.; Deutsche Bank Aktiengesellschaft; Air Liquide S.A.; Southern Company; Constellation Energy Corporation; National Thermal Power Corporation (NTPC) Limited; Sempra Energy; Koninklijke KPN N.V.; Indian Railways Finance Corporation; Adani Green Energy Limited; African Development Bank Group; Hannon Armstrong Sustainable Infrastructure Capital Inc.; Pimpri Chinchwad Municipal Corporation; Etihad Rail; Surat Municipal Corporation; Avaada Energy Private Limited; Vadodara Municipal Corporation.

Regional outlook for the Carbon Smart Municipal Bond Market

North America was the leading region in the carbon-smart municipal bond market in 2024, while Asia-Pacific is expected to be the fastest-growing region through the forecast period. Covered regions include Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

Purchase your detailed Carbon-Smart Municipal Bond Market report now:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29333

This Report Supports:

Business Leaders & Investors - Identify growth opportunities, assess risks, and plan long-term strategies.

Manufacturers & Suppliers - Track sustainability-focused investment trends and market demand.

Policy Makers & Regulators - Inform policy decisions and monitor climate-focused development.

Consultants & Analysts - Guide market entry, expansion strategies, and environmental advisory services.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Carbon-Smart Municipal Bond Market Landscape Through 2034: Forces Driving the Next Phase of Expansion here

News-ID: 4303102 • Views: …

More Releases from The Business Research Company

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Bond

Multi-Parameter Bond Screener: Enhanced Bond Search by Cbonds

The constantly growing flow of information on the debt instruments available on the market compels businesses and private investors to search for effective ways to systematize and filter out only relevant data. Although many companies offer pools of information regarding the bonds issued on the specific local market or stock exchange, this data is often limited and fragmented. Moreover, awkward interface further delays the search process. Thus, finding a flexible…

Bond Market Set for Explosive Growth

The latest 115+ page survey report on Global Bond Market is released by HTF MI covering various players of the industry selected from global geographies like North America (Covered in Chapter 6 and 13), United States, Canada, Mexico, Europe (Covered in Chapter 7 and 13), Germany, UK, France, Italy, Spain, Russia, Others, Asia-Pacific (Covered in Chapter 8 and 13), China, Japan, South Korea, Australia, India, Southeast Asia, Others, Middle East…

Corporate Bond Market, Top key players are HDFC Corporate Bond Fund ,Aditya Birl …

Corporate Bond Market

The report begins with a brief introduction on the various segments of the bond market in Global followed by a further split of corporate bond segments. Evolution of the corporate bond market in Global entails a brief description of the major events that have taken place since its inception. The market overview section provides an overview of the global corporate bond market in terms of issuance of corporate…

Welsh Forestry Investment Bond Launched

Seattle, WA, September 03, 2011 -- An innovative Wales-based forestry investment firm has started up and has attracted support from Forestry Research Associates (FRA).

Woodland Bond is a concept launched by managing director John Tunnicliffe, who wanted to offer people the chance to invest in Welsh woodland, while helping to manage the woodland in the country sustainably.

FRA has spoken out in support of the idea, which is similar to the successful…

James Bond Test™ MK III Developed for Adhesion, Bond and Other Tensile Strengt …

James Instruments Inc. manufacturer of the world's most advanced Non Destructive Test Equipment for construction materials has developed the James Bond Test MK III for measuring the bond strength/tensile strength/adhesion strength of concrete, asphalt, tile, concrete repair, or other overlay material by the direct tension or pull off method. It uses disc attached to the material under test to,

1.

Measure the…

First Bond Sale: Greece by Barvetii

Greece has successfully sold government bonds in its first attempt since the huge EU-IMF loan bail-out was launched in early May.

Analysts at Barvetii International Wealth Consultants the international wealth consultants believe this first bond sale will test investors’ appetites after a recent downgrade by the credit rating agencies, which cut the country’s rating to "junk". The benchmark Greek 10-year bond yield trades at 10%, almost twice as much as Spain’s,…