Press release

Servo Motors and Drives Market | Europe Competes for Global Precision Edge: Siemens, Yaskawa & Mitsubishi Electrify Smart Factories While Low-Cost Drives Undercut Performance, Uptime & ROI

Servo Motors and Drives Market | Europe Competes for Global Precision Edge: Siemens, Yaskawa & Mitsubishi Electrify Smart Factorie

That era is over.

As Europe doubles down on smart factories, robotics, EV platforms, and high-precision packaging, the Servo Motors and Drives Market has shifted from commodity hardware to strategic automation infrastructure.

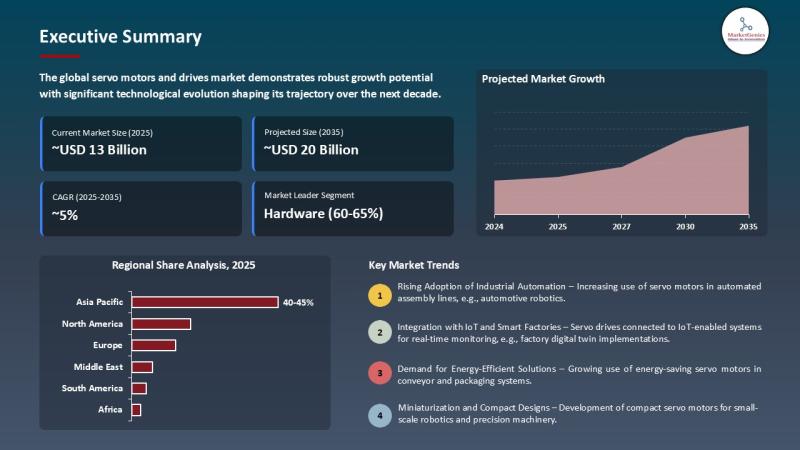

Globally, the Servo Motors and Drives Market is valued at USD 12.7 billion in 2025 and is projected to reach USD 20.3 billion by 2035, growing at a 4.8% CAGR and creating roughly USD 8 billion in cumulative opportunity over the period.

Get the Detailed Industry Analysis (including the Table of Contents, List of Figures, and List of Tables) - from the Servo Motors and Drives Market Research Report: https://marketgenics.co/download-report-sample/servo-motors-and-drives-market-62703

Hardware dominates with ~62% share, reflecting the central role of motors, drives and controllers in precision motion architectures.

The question in Europe is no longer:

"Do we need servo systems?"

It's: "How fast can we deploy high-precision servo architectures before low-cost alternatives lock in our disadvantages?"

Why Europe is leaning hard into precision motion

(Drivers in the Servo Motors and Drives Market)

Every millimeter of positioning accuracy matters in modern production.

Every millisecond of response time matters in high-speed packaging.

Every coordinated axis matters in robotics and semiconductor systems.

The Servo Motors and Drives Market is being driven by three structural realities:

High-precision automation pressure

Automotive, electronics, packaging, food & beverage, and medical devices all need tight motion control - not just "good enough" torque.

Industry 4.0 and smart manufacturing strategies

European factories are wiring servo motors and drives into IoT platforms, real-time monitoring systems, and edge analytics to reduce downtime and optimize throughput.

Demand for speed + flexibility, not just speed

Shorter product lifecycles, SKU proliferation and customization demand servo systems that combine high speed with reconfigurability.

Low-end motors can move things.

Servo motors and drives let European manufacturers compete.

To know more about the Servo Motors and Drives Market - Download our Sample Report: https://marketgenics.co/download-report-sample/servo-motors-and-drives-market-62703

Europe's high-stakes precision battlegrounds

(Where the Servo Motors and Drives Market bites hardest)

In Europe, the Servo Motors and Drives Market is deeply embedded in a few critical application arenas:

Automotive and EV manufacturing

Assembly line automation, robotic welding, paint systems, high-precision CNC machining - where motion quality directly impacts vehicle quality.

Electronics & semiconductor

Wafer handling, wire bonding, pick-and-place, PCB assembly and test equipment - a few microns off can mean a failed device.

High-speed packaging & consumer goods

Form-fill-seal, cartoning, bottling, labeling, and high-velocity sortation - servo response and repeatability determine line throughput and waste rates.

Food & beverage and pharma packaging

Hygienic, repeatable filling and dosing, blister packs, and inspection systems where accuracy and consistency are regulatory issues, not just cost.

Intralogistics, warehousing & material handling

Automated guided vehicles (AGVs), gantries, lifts, sorters and robotic palletizing - all driven by servo-based, tightly controlled axes.

Wherever motion precision, speed, and synchronization define profit - the Servo Motors and Drives Market is the quiet backbone.

Hardware leads - but the real edge is now intelligent servo ecosystems

(Innovation and technology in the Servo Motors and Drives Market)

The hardware segment holds around 62% of the global Servo Motors and Drives Market, reflecting the central role of:

Servo motors (AC, DC, linear)

Servo drives (digital, high-performance)

Controllers, feedback encoders, and motion amplifiers

But Europe's next advantage won't come from motors alone - it will come from how those motors are integrated, digitized and orchestrated.

Buy Now: https://marketgenics.co/buy/servo-motors-and-drives-market-62703

From the report:

Yaskawa's Sigma-X and Sigma-7 platforms deliver high-precision, multi-axis control for semiconductor and electronics manufacturing - from wafer handling to PCB assembly - while suppressing vibration, optimizing torque and enabling predictive maintenance.

Mitsubishi Electric's MELSERVO-JET, launched in Europe, targets manufacturers seeking cost-effective but high-precision automation, packing fast performance into compact drives from 0.1 kW to 7 kW - ideal for European lines where cabinet space is constrained.

Siemens' SINAMICS S200 servo system demonstrates how compact, powerful servo drives plus high-resolution motors and fast current control can deliver the flexibility and responsiveness required by CNC, packaging, and robotics.

Partnerships such as ABB + Samotics ESA integration show how smart sensor fusion and condition monitoring transform drives from "power providers" into early-warning systems for motors, pumps and conveyors.

Meanwhile, new integrated, IoT-connected servo drives (like decentralized units with built-in logic, positioning and safety functions) exemplify the wider shift in the Servo Motors and Drives Market:

From: "motor + drive as a component purchase"

To: "intelligent motion node in a data-driven factory network."

The invisible competitor: low-cost motion that looks "good enough"

(Real friction in the Servo Motors and Drives Market)

The Servo Motors and Drives Market faces a persistent drag:

cheap generic motors and low-end drives.

On spreadsheets, these alternatives often win:

Lower upfront procurement costs

Basic motion capability "sufficient" for non-critical tasks

Easy to justify in cost-sensitive industries or SME environments

But they come with long-tail penalties:

Inferior precision and dynamic response

Shorter life and higher maintenance overhead

Poor integration with Industry 4.0 and real-time monitoring stacks

Limited support for advanced multi-axis orchestration

Higher shred, more rework, more downtime over time

The net effect:

Factories optimizing only for CAPEX sacrifice OEE, quality, and scalability.

European leaders in the Servo Motors and Drives Market are quietly making the opposite bet:

Pay more upfront for high-performance servo systems

Gain speed, quality, flexibility and predictive visibility over the lifecycle

Justify investments with measurable ROI - increased throughput, lower waste, faster changeovers

Cheap motion is not truly cheap.

It just hides the bill in operations.

What leaders are doing differently in servo strategy

(Behavior gap the market is exposing)

In the Servo Motors and Drives Market, high-performing European manufacturers and integrators are:

Standardizing on servo platforms from global players (Yaskawa, Mitsubishi Electric, Siemens, ABB, Schneider, Rockwell, Fanuc, etc.) that offer strong roadmaps, ecosystem stability and advanced control.

Choosing architectures that support:

Multi-axis synchronization

Industrial communication standards (EtherCAT, PROFINET, Ethernet/IP, etc.)

IoT-driven analytics, remote diagnostics and predictive maintenance

Leveraging compact, decentralized and integrated servo solutions to:

Reduce cabinet size

Simplify wiring

Lower commissioning time

Improve machine modularity

Treating servo system selection as a strategic automation decision, not a last-minute procurement line.

Laggards, by contrast:

Mix heterogeneous low-end drives with minimal networking

Limit themselves to basic positioning, no deep data

Face integration headaches when they later try to connect to MES, SCADA or cloud platforms

Struggle to respond when customers demand higher precision, faster delivery or new product formats

The Servo Motors and Drives Market is not just moving products - it is silently sorting manufacturers into future-ready and future-fragile.

Why investors and boards should care about servo decisions

(Financialization of the Servo Motors and Drives Market)

Servo systems shape industrial P&Ls more than they appear to:

Affects cycle time → revenue throughput per line

Affects quality rates → shred, rework, and warranty risk

Affects flexibility → ability to run more SKUs or customized batches

Affects downtime → reliability of production commitments

For investors looking at European industrial assets, the right question is:

"What is the servo and drives architecture behind this factory's 'efficiency' claim?"

"Are they locked into low-precision legacy systems or equipped with scalable servo platforms?"

"Do their servo investments integrate with predictive maintenance and IoT analytics?"

In a USD 20.3 billion global Servo Motors and Drives Market, factories that upgrade intelligently will:

Generate better margins from the same floor space

Defend against labor shortages via automation

Adapt faster when markets demand new variants, formats, or products

That's not just motion engineering.

That's competitive strategy in mechanical form.

The hidden motion backbone of Europe's smart factory future

(Strategic role of the Servo Motors and Drives Market)

Servo motors and drives are not just components inside machines.

They are the movement layer of Europe's industrial future:

Robotics cells that weld, pick, place, assemble, and inspect

Packaging lines that run at staggering speeds without spilling quality

Semiconductor tools that align wafers and devices within microns

EV and battery lines that demand torque control, not guesswork

Warehouses where AGVs and robots choreograph synchronized movements

Europe's transition to high-productivity, high-complexity, low-waste manufacturing depends on one very practical thing:

Not just moving...

but moving precisely, repeatably, and intelligently.

That is exactly where the Servo Motors and Drives Market sits - quietly, but decisively - under every "smart factory" headline.

About Us

MarketGenics is a global market research and management consulting company empowering decision makers across healthcare, technology, and policy domains. Our mission is to deliver granular market intelligence combined with strategic foresight to accelerate sustainable growth.

We support clients across strategy development, product innovation, healthcare infrastructure, and digital transformation.

Contact:

Mr. Debashish Roy

MarketGenics Research

800 N King Street, Suite 304 #4208, Wilmington, DE 19801, United States

USA: +1 (302) 303-2617

Email: sales@marketgenics.co

Website: https://marketgenics.co

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Servo Motors and Drives Market | Europe Competes for Global Precision Edge: Siemens, Yaskawa & Mitsubishi Electrify Smart Factories While Low-Cost Drives Undercut Performance, Uptime & ROI here

News-ID: 4302005 • Views: …

More Releases from MarketGenics Research

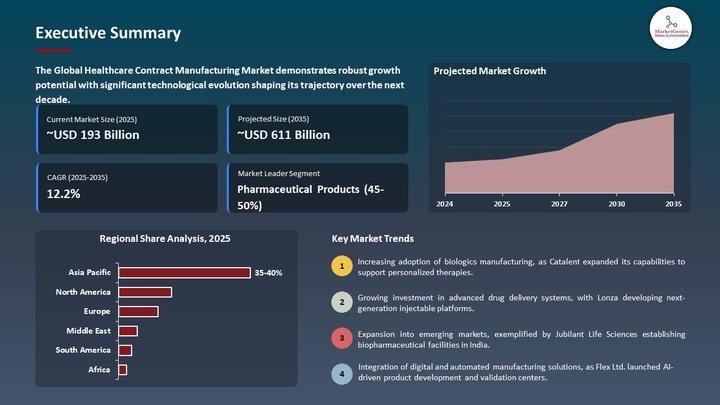

Healthcare Contract Manufacturing Market | Europe's Race for Quality-Centric Man …

Healthcare Contract Manufacturing Market | Europe's High-Precision Manufacturing Pivot Is Reshaping the Future of Therapeutics

The Healthcare Contract Manufacturing Market used to live in the operational shadows - a technical appendix to pharma strategy, an afterthought to medical device roadmaps.

That era is gone.

Europe's push for biologics scale-up, GMP modernization, sterile manufacturing compliance, and resilient supply chains has moved the Healthcare Contract Manufacturing Market from the backroom of operations into the center…

"Aerosol Cans Market in Europe: Sustainability, Aluminum Demand, and Regional Gr …

The world is moving fast on sustainability-biodegradable materials, reusable packaging, and recyclable metals are capturing headlines. Aerosol cans, often overlooked as simple packaging, have quietly evolved into a high-performance, environmentally-conscious solution across personal care, household, healthcare, and industrial sectors.

In 2025, the global Aerosol Cans Market reached USD 14.4 billion, and it is projected to expand to USD 24.0 billion by 2035, growing at a CAGR of 4.7%. For a sector…

Clinical Trial Supplies Market | Europe's New Era of Trial Logistics - Big Pharm …

Clinical Trial Supplies Market | Europe's Supply-Chain Transformation Reshaping the Future of Drug Development

The Clinical Trial Supplies Market used to live in the back rooms of pharma operations - cartons, kits, comparators, storage rooms and shipping labels.

That era is gone.

Europe's pivot toward precision medicine, biologics, decentralized studies, and multi-country regulatory complexity has pushed the Clinical Trial Supplies Market from a logistics afterthought into a strategic pillar of clinical success.

This shift…

Clinical Trial Supplies Market | Europe's Supply-Chain Reinvention - Cold-Chain …

The Clinical Trial Supplies Market used to be a logistics afterthought: labelled vials, dry ice shipments, and predictable pallet runs. That era is gone.

Europe's regulatory complexity, the explosion of biologics and cell & gene therapies, and the rise of decentralized clinical trials (DCTs) have moved the Clinical Trial Supplies Market from a vendor line-item into a strategic capability that determines trial speed, quality and cost. From cryogenic storage in Frankfurt…

More Releases for Servo

Kpower servo : A Leading Chinese linear servo Manufacturer

Company Overview

Kpower is a linear servo https://blog.kpower.com/index.php?c=show&id=2086 manufacturer with a 20-year history, boasting an office area of 47,000 square meters and extensive experience in R&D and customization of linear servos. Its products are now sold globally, with applications across diverse fields including UAVs, cleaning robots, lawn-mowing robots, and smart home devices. Though less known in the retail market due to its long-standing focus on enterprise-level customization services, Kpower holds a…

Top 5 Servo Stabilizers to Buy - Guide From Servo Stabilizer India

Voltage fluctuations in India cause damage to lakhs of industrial machinery every year. Voltage stability and a constant power supply are important for the safety and performance of household and industrial devices. Servo stabilizers are the equipment that offer safety from voltage fluctuation to machines. Therefore, Servo Stabilizer India has compiled a list of the top five servo stabilizers for Indian consumers in 2025.

Servo Stabilizer India is assisting businesses and…

Servo Motor Drivers Market

Servo Motor Drivers Market Overview

The Servo Motor is a commonly used motor for high technology devices in various industries like automation. This motor is a self-controlled electrical device, that switch part of a machine with high productivity and great accuracy. The o/p shaft of this motor can be stimulated to a specific angle. These motors are mainly used in different applications like home electronics, cars, toys, airplanes, etc. This article…

Global Servo-Drives and Servo-Amplifiers Market Size Analysis 2025-2031

On 2025-2-12 Global Info Research released【Global Servo-Drives and Servo-Amplifiers Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031】. This report includes an overview of the development of the Servo-Drives and Servo-Amplifiers industry chain, the market status of Consumer Electronics (Nickel-Zinc Ferrite Core, Mn-Zn Ferrite Core), Household Appliances (Nickel-Zinc Ferrite Core, Mn-Zn Ferrite Core), and key enterprises in developed and developing market, and analysed the cutting-edge technology, patent, hot…

Integrated Step Servo Motors

Global Integrated Step Servo Motors Market Overview:

The Integrated Step Servo Motors market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Integrated Step Servo Motors market has experienced significant growth, driven by factors such as increasing consumer demand, technological advancements, and…

Servo-Drives and Servo-Amplifiers Market Growth Factors, Opportunities, Ong …

A servo drive is a special electronic amplifier used to power electric servomechanisms.

A servo drive can also be referred to as an amplifier, because it takes the control signal from the controller and amplifies it to deliver a specific amount of voltage and current to the motor.

LPI (LP Information)' newest research report, the "Servo-Drives and Servo-Amplifiers Industry Forecast" looks at past sales and reviews total world Servo-Drives and Servo-Amplifiers sales…