Press release

Surging Application Across End Users Powers the Expansion of the Legacy System Modernization for Banks Market in 2025

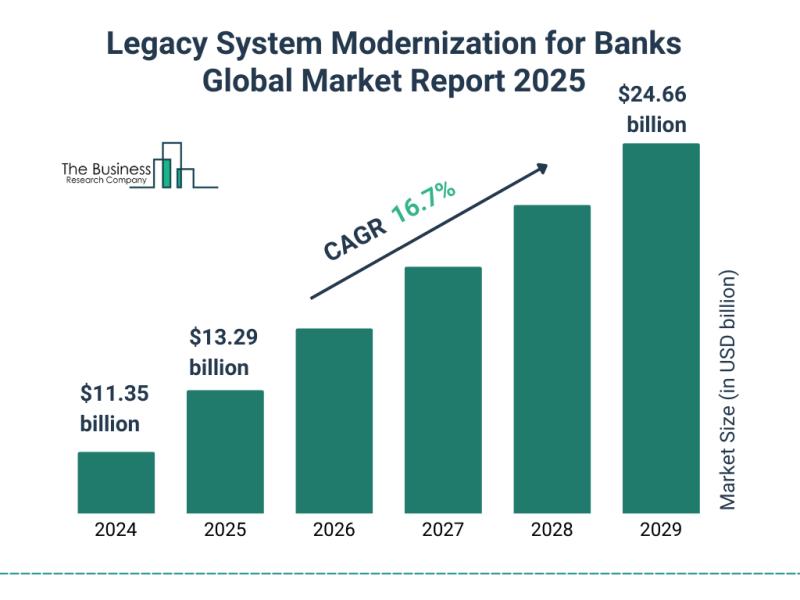

What Is the Projected Size of the Legacy System Modernization for Banks Market by 2025?The overall valuation for the modernization of antiquated banking systems has experienced swift expansion lately, projected to escalate from eleven point thirty-five billion US dollars in the year 2024 to thirteen point twenty-nine billion US dollars by 2025, reflecting a compound annual growth rate of seventeen point one percent. This upward trajectory observed throughout the past period stems from several key factors, including the heightened integration of Internet of Things gadgets, escalating requirements for smart urban development projects, broader utilization of geographically referenced services, the broadening scope of interconnected physical structures, and a greater emphasis placed upon optimizing energy utilization.

What Is the Predicted Size of the Legacy System Modernization for Banks Market by 2029?

Projections indicate that the global market focused on modernizing legacy systems within the banking sector is slated for substantial augmentation in the years ahead, reaching a valuation of $24.66 billion by 2029, reflecting a compound annual growth rate (CAGR) of 16.7%. This forward trajectory in the anticipated timeframe is fueled by several key factors, such as the increasing incorporation of machine learning capabilities, the wider rollout of 5G network infrastructure, the proliferation of smart home environments, escalating requirements for immediate data analysis, and a heightened organizational focus on tailoring user interactions. During this forecast span, prominent developments will encompass technological leaps within sensor networks, ongoing inventive progress in AI-powered ambient systems, swift evolution of edge computing architectures, active exploratory work in context-aware technologies, and the broader acceptance of sophisticated data handling methodologies.

Access the full Legacy System Modernization for Banks Market report here:

https://www.thebusinessresearchcompany.com/report/legacy-system-modernization-for-banks-global-market-report

Which Major Drivers Are Fueling the Expansion of the Legacy System Modernization for Banks Market?

Heightened attention to both cybersecurity efforts and adherence to governing regulations is anticipated to fuel the expansion of the market dedicated to updating outdated banking infrastructure in the future. This emphasis on security measures and fulfilling compliance mandates involves protecting data and systems while simultaneously satisfying the necessary reporting, auditing, and control stipulations established by financial overseers. Such a strong push towards improved security and regulatory alignment stems from the documented increase in cybercriminal activities and the substantial financial setbacks authorities have recorded. Upgrading older core systems and customer-facing platforms allows financial institutions to implement superior security mechanisms such as identification verification, logging, and encryption, alongside quicker deployment of security fixes and automated documentation for audits, thereby assisting banks in satisfying their security mandates and auditing duties. Illustratively, concrete figures from the US primary federal law enforcement branch, the FBI, reported 880,418 victim complaints in 2023, marking an almost ten percent increase compared to 2022, with reported financial damages surpassing the $12.5 billion threshold (a twenty-two percent year-over-year jump), clearly demonstrating the intensifying threat landscape that necessitates greater expenditure on security and compliance initiatives. Consequently, the elevated priority placed on fortifying cybersecurity and meeting regulatory standards is acting as a primary impetus for growth within the sector focused on modernizing banks' legacy systems.

Download your free Legacy System Modernization for Banks Market sample now:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29828&type=smp

Which Emerging Trends Are Shaping the Future of the Legacy System Modernization for Banks Market?

Key players within the Legacy System Modernization for Banks sector are heavily prioritizing innovation, specifically by employing advanced, cloud-native core banking and payments infrastructures that facilitate quicker introductions of customer-focused products and bring banking functions up to modern standards. Offerings such as those from DXC and Thought Machine exemplify this trend, utilizing cloud-native core banking along with managed support services to overhaul older systems. This modernization effort allows for swift product releases, operations powered by automation, and configuration without needing code, all while guaranteeing stability and adherence to regulations, thereby speeding up the digital evolution for financial institutions and boosting how effectively they run. Taking June 2025 as an example, DXC Technology, a major US-based firm specializing in global IT and advisory services, unveiled a collaborative offering designed to hasten modernization specifically for smaller and medium-sized banks, merging DXC's deep sector knowledge and managed expertise with Thought Machine's Vault Core cloud-native platform and Vault Payments system for updating outdated infrastructure. This combined package empowers banks to roll out novel offerings, including different types of savings plans, home loans, and credit facilities, in mere hours rather than what previously took weeks, all while maintaining high standards for operational effectiveness, regulatory adherence, and scalable performance driven by automation. Delivering this as a comprehensive managed service streamlines the entire modernization journey, cuts down the duration until a product reaches the market, and encourages a quicker embrace of novel, consumer-focused financial services.

How Is the Legacy System Modernization for Banks Market Structured Across Different Segments?

The legacy system modernization for banks market covered in this report is segmented -

1) By Component: Software, Services

2) By Bank Type: Retail Banks, Commercial Banks, Investment Banks

3) By Deployment Mode: On-Premises, Cloud-Based, Hybrid

4) By Enterprise Size: Small And Medium Enterprises, Large Enterprises

5) By Application: Banking, Financial Services And Insurance (BFSI), Healthcare, Retail And E-Commerce, Manufacturing, Information Technology (IT) And Telecommunications, Government, Other Applications

Sub Segment:

1) By Software: Core Banking Platforms, Payment Processing Software, Middleware And Integration Software, Data Management And Analytics Tools, Application Programming Interface Management Platforms

2) By Services: Consulting And Assessment Services, Application Modernization Services, Cloud Migration Services, Code Refactoring Services, Replatforming Services

Which Companies Are Leading Technological Advancements in the Legacy System Modernization for Banks Market?

Major companies operating in the legacy system modernization for banks market are Microsoft Corporation; Deloitte Touche Tohmatsu Limited; accenture* plc; International Business Machines Corporation; PricewaterhouseCoopers International Limited; Tata Consultancy Services Limited; Fujitsu Limited; NTT DATA Corporation; Capgemini SE; Cognizant Technology Solutions Corporation; Infosys Limited; DXC Technology Company; HCL Technologies Limited; Atos SE; Wipro Limited; Tech Mahindra Limited; EPAM Systems Inc.; Mphasis Limited; Persistent Systems Limited; Temenos AG

Which Regions Present the Most Attractive Opportunities for the Legacy System Modernization for Banks Market?

North America was the largest region in the legacy system modernization for banks market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the legacy system modernization for banks market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

Purchase your detailed Legacy System Modernization for Banks Market report now:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29828

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Reach out to us:

The Business Research Company: https://www.thebusinessresearchcompany.com/,

Americas +1 310-496-7795,

Europe +44 7882 955267,

Asia & Others +44 7882 955267 & +91 8897263534,

Email us at info@tbrc.info.

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

With over 17500+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Armed with 1,500,000 datasets, the optimistic contribution of in-depth secondary research, and unique insights from industry leaders, you can get the information you need to stay ahead.Our flagship product, the Global Market Model (GMM), is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Surging Application Across End Users Powers the Expansion of the Legacy System Modernization for Banks Market in 2025 here

News-ID: 4301866 • Views: …

More Releases from The Business Research Company

Leading Companies Fueling Growth and Innovation in the Sun Care Products Market

The sun care products market is on track for substantial expansion as consumer awareness about skin protection intensifies worldwide. With evolving preferences and technological advancements shaping product offerings, this sector is set to witness robust growth in the coming years. Let's explore the market's size projections, key players, emerging trends, and major segments driving its development through 2030.

Projected Size and Growth Trajectory of the Sun Care Products Market

The…

Future Perspectives: Key Trends Shaping the Styrene Butadiene Rubber (SBR) Based …

The styrene butadiene rubber (SBR) based adhesive market is on track for notable growth as we approach 2030. Driven by a variety of factors including expanding infrastructure projects and rising demand across multiple industries, this sector is poised for steady expansion. Let's explore the market's size projections, key players, emerging trends, and the main segments shaping its future.

Projected Growth and Market Size of Styrene Butadiene Rubber Based Adhesives

The…

Emerging Sub-Segments Transforming the Stearic Acid Market Landscape

The stearic acid market is poised for significant expansion in the coming years, driven by evolving demand across various industries. This report explores the projected market size, leading companies, key trends, and segment analysis shaping the future of this vital chemical.

Stearic Acid Market Size and Growth Outlook

The stearic acid market is set to grow robustly, reaching a valuation of $54.63 billion by 2030. This represents a compound annual…

Market Trend Insights: The Impact of Recent Innovations on the Specialty Pestici …

The specialty pesticides sector is on the verge of significant expansion as global agricultural practices continue to evolve. Driven by increasing demand for crop protection and sustainable farming techniques, this market is set to experience robust growth in the coming years. Let's explore the market's anticipated value, leading companies, emerging trends, and detailed segmentation to gain a comprehensive understanding of this dynamic industry.

Projected Market Size and Growth Expectations for Specialty…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…