Press release

Saudi Arabia Online Grocery Market Size Projected to Reach USD 5,925.7 Million by 2033, CAGR is 15.87%

Saudi Arabia Online Grocery Market OverviewMarket Size in 2024: USD 1,543.7 Million

Market Forecast in 2033: USD 5,925.7 Million

Market Growth Rate 2025-2033: 15.87%

According to IMARC Group's latest research publication, "Saudi Arabia Online Grocery Market Size, Share, Trends, and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2025-2033", The Saudi Arabia online grocery market size reached USD 1,543.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,925.7 Million by 2033, exhibiting a growth rate (CAGR) of 15.87% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-online-grocery-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Online Grocery Market

● AI powers super-fast deliveries for apps like Nana and Rabbit, hitting over 80% of orders in two hours thanks to smart route optimization, while Amazon's recent tie-up with Al-Othaim uses AI inventory to ensure fresh groceries arrive same-day in Riyadh and Jeddah.

● Vision 2030 backs AI in retail with digital transformation goals, helping online grocery platforms cut waste through predictive stocking amid 99% internet access and high smartphone use across Saudi households.

● Platforms leverage AI for personalized picks by scanning shopping habits, boosting loyalty as e-commerce hits billions with over 850,000 daily food orders fueling grocery demand in urban spots.

● Nana's AI-driven demand forecasting and route tweaks keep shelves stocked perfectly, supporting local farmers while handling hundreds of thousands of daily orders in a market valued at $1.5 billion plus.

● Amazon's temperature-controlled fleets paired with AI analytics maintain cold chains for perishables, aligning with government pushes for efficient logistics that reshape how Saudis grab everyday essentials online.

How Vision 2030 is Transforming Saudi Arabia Online Grocery Industry?

Vision 2030 is reshaping the Saudi Arabia online grocery market by accelerating digital adoption, enhancing logistics capabilities, and promoting consumer convenience. Government-backed initiatives to strengthen e-commerce infrastructure, electronic payments, and last-mile delivery networks are boosting platform efficiencies and service quality. Rising urbanization, busy lifestyles, and demand for fresh, fast, and reliable delivery are expanding online grocery usage. Additionally, investment in cloud kitchens, fulfillment centers, and AI-driven inventory systems is supporting seamless operations, making digital grocery shopping a mainstream and rapidly growing preference across the Kingdom.

Saudi Arabia Online Grocery Market Trends & Drivers:

One of the biggest factors boosting Saudi Arabia's online grocery market right now is the surge in mobile and internet penetration. With nearly the entire population now accessing high-speed internet and over 32 million active smartphone users, digital habits are fueling a new wave of grocery shopping convenience. Shoppers are embracing user-friendly apps and instant delivery platforms because they save time and eliminate hassle. Brands like Jahez and Nana are seeing record online orders thanks to omnichannel strategies and slick mobile experiences. This digital shift is also being fast-tracked by changing lifestyles and urban populations demanding seamless, quick shopping from their smartphones, making online groceries a part of daily life for millions.

Aggressive expansion and innovation by local and international grocery players are reshaping the market. Mid-size and large supermarket chains, such as Panda and Carrefour, are rolling out express delivery, voice-assisted shopping, and cashless transactions to win consumer loyalty. Companies are investing in dark stores-mini warehouses built for online orders-which have dramatically cut fulfillment times in major Saudi cities, sometimes down to just under an hour per delivery. These tech-driven changes have encouraged more customers to try online groceries, especially in Riyadh and Jeddah, where recent company reports point to double-digit monthly growth in delivery volumes and a rising share of repeat shopper transactions across leading platforms.

Government initiatives are also powering the market's momentum by creating a highly supportive environment for e-commerce and logistics. Saudi Vision 2030's push for digital transformation includes funding for smart logistics, streamlined import procedures, and major upgrades in cold chain infrastructure. Investment in "last mile delivery" solutions-from smart lockers to electric vehicle fleets-means groceries arrive fresher and faster, directly benefitting end consumers. The Ministry of Commerce's regulatory reforms and local start-up grants have also lowered barriers for new grocery delivery ventures. These moves have kickstarted record levels of entrepreneurial activity and innovation, pushing the whole industry closer to global best practices and ensuring it keeps evolving in line with consumer demand.

Buy the Latest 2026 Edition: https://www.imarcgroup.com/checkout?id=20887&method=1315

Saudi Arabia Online Grocery Industry Segmentation:

The report has segmented the market into the following categories:

Analysis by Product Type:

● Vegetables and Fruits

● Dairy Products

● Staples and Cooking Essentials

● Snacks

● Meat and Seafood

● Others

Analysis by Business Model:

● Pure Marketplace

● Hybrid Marketplace

● Others

Analysis by Platform:

● Web-Based

● App-Based

Analysis by Purchase Type:

● One-Time

● Subscription

Regional Analysis:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Online Grocery Market

● November 2025: Amazon partners with Al-Othaim Markets for same-day grocery delivery in Riyadh and Jeddah, adding over 10,000 products via smart inventory systems.

● November 2025: Domestic platforms like Nana and Ninja expand rapidly, capturing market share through AI-optimized routes amid 13% rise in digital registrations.

● October 2025: Quick commerce surges in online grocery with 30-minute deliveries for essentials, driven by urban demand in Riyadh and Jeddah using dark stores.

Note: If you require specific details, data, or insights that are not currently included in the scope of these reports, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the reports are updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Online Grocery Market Size Projected to Reach USD 5,925.7 Million by 2033, CAGR is 15.87% here

News-ID: 4298091 • Views: …

More Releases from IMARC Group

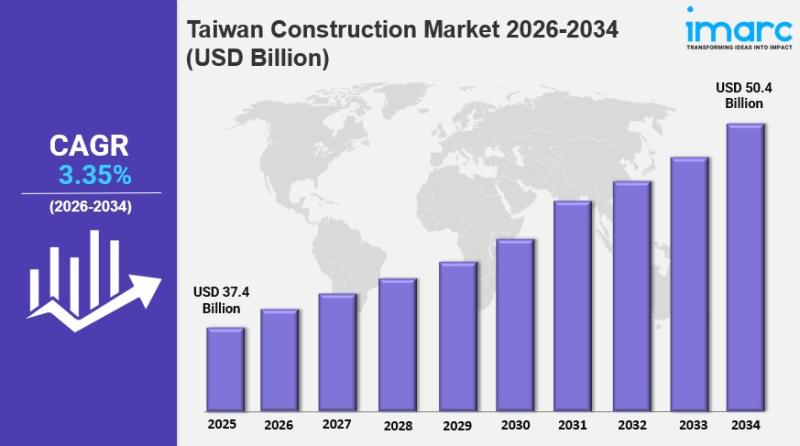

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

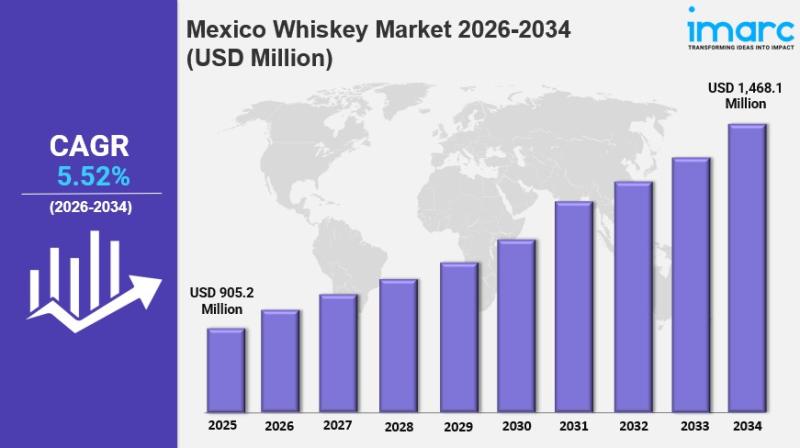

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

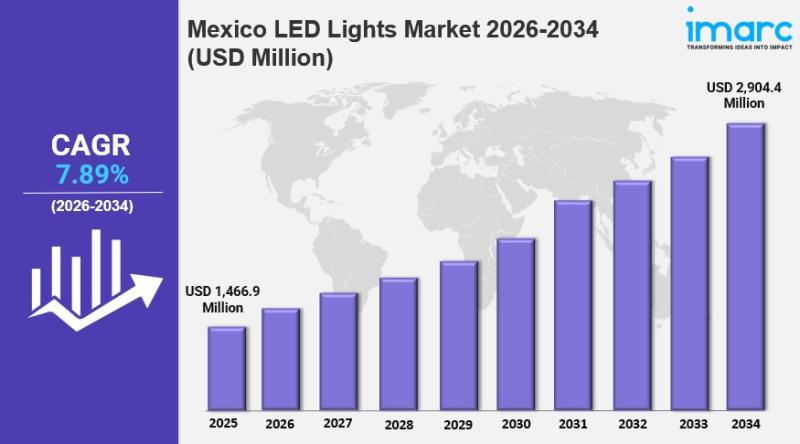

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

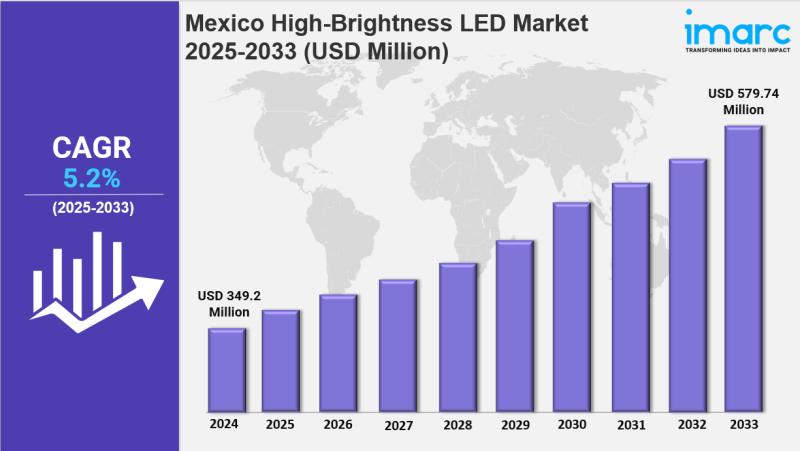

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…