Press release

The Global Metaverse in Finance Market is projected to reach a market size of USD 14.28 billion by the end of 2030.

According to the report published by Virtue Market Research The Global Metaverse in Finance Market was valued at USD 9.95 billion and is projected to reach a market size of USD 14.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 7.5%.Request Sample Copy of this Report @ https://virtuemarketresearch.com/report/metaverse-in-finance-market/request-sample

The rise of the Metaverse in finance has created a new chapter in how people interact with money, investment, and digital assets. It is shaping the future of financial ecosystems by merging blockchain, augmented reality, and artificial intelligence into a unified space where digital identities and transactions exist side by side. The long-term driver pushing this evolution forward is the global shift toward decentralized finance and digital ownership. As financial institutions seek transparency, speed, and borderless operations, the Metaverse becomes an ideal environment for growth. Virtual financial hubs, tokenized assets, and immersive banking experiences are reshaping how individuals and companies engage with capital markets. Over time, this convergence of technology and finance is expected to redefine how trust and value are established in the digital world.

The COVID-19 pandemic acted as a powerful accelerator for this transformation. During the lockdown years, physical interactions were limited, and digital platforms became the default space for both personal and professional engagement. Financial institutions that had previously been slow to embrace digital transformation were suddenly forced to adapt. Virtual reality-based meetings, digital asset management, and blockchain-secured transactions grew rapidly in popularity. Consumers began trusting digital solutions for investing and trading, paving the way for the Metaverse to emerge as a credible financial frontier. The pandemic essentially compressed years of innovation into a short span, creating the groundwork for financial ecosystems to flourish within virtual worlds. It demonstrated that remote interaction and digital assets could be not only efficient but also secure and profitable, making the Metaverse a long-term structural shift rather than a passing experiment.

In the near term, one of the strongest drivers for the Metaverse in finance market is the rising adoption of blockchain-based payments. Businesses and consumers alike are drawn to the transparency, reduced transaction fees, and near-instant cross-border transfers offered by blockchain systems. As financial companies begin to integrate virtual wallets, NFTs, and tokenized investment instruments, a new digital economy is emerging inside the Metaverse. This momentum is strengthened by the growing comfort of consumers with digital currencies and the increasing use of smart contracts in automating complex financial agreements. The result is a short-term surge in demand for infrastructure and platforms capable of supporting secure, immersive, and decentralized financial activities.

An important opportunity lies in expanding financial inclusion through the Metaverse. Traditional banking systems often exclude individuals in regions with limited access to formal financial institutions. However, in the Metaverse, anyone with an internet connection and a digital identity can participate in global financial ecosystems. Tokenized assets can represent ownership of anything from real estate to art, creating avenues for micro-investment that were previously inaccessible. Financial institutions have the chance to build inclusive ecosystems that empower individuals, small businesses, and startups, bridging the global financial gap. This opportunity is particularly valuable for emerging economies where digital banking adoption is already on the rise.

A notable trend shaping the Metaverse in finance market is the creation of virtual financial districts. These immersive environments are becoming digital replicas of traditional financial centers, where users can attend virtual meetings, trade cryptocurrencies, and interact with AI-driven financial advisors in real time. Banks and fintech companies are experimenting with virtual branches that offer personalized services and enhanced customer engagement. This trend is not just about creating a visual experience-it represents a structural evolution in customer service and financial interaction. The blending of social, financial, and digital layers within these environments encourages both participation and innovation, building stronger connections between users and institutions.

Segmentation Analysis:

By Component: Hardware, Software, Services

The MetaVerse in Finance Market by component reflects how different technological layers build the foundation for virtual financial ecosystems. Hardware stands as the largest segment due to the rising use of advanced headsets, sensors, and computing systems that create immersive digital environments for banking and financial operations. These devices enable real-time interactions, realistic simulations, and secure financial experiences within the Metaverse. Meanwhile, software is the fastest-growing segment during the forecast period, supported by continuous development in blockchain integration, 3D modeling tools, and AI-based virtual platforms.

Financial institutions are increasingly investing in interoperable software frameworks that link decentralized finance systems with traditional banking networks. Services, though smaller in scale, play an essential supportive role by providing customized development, maintenance, and system integration for Metaverse applications in finance. This layered approach enhances accessibility, performance, and digital trust, forming the base for the long-term adoption of virtual financial ecosystems across global markets.

By Application: Digital Identity, Digital Assets, Smart Contracts, Payments and Settlements, Others

The MetaVerse in Finance Market by application showcases how various digital functions are transforming conventional finance. The largest segment in this category is digital assets, driven by the widespread adoption of cryptocurrencies, NFTs, and tokenized financial instruments that enable ownership and trade in decentralized spaces. Users are increasingly engaging in secure, transparent transactions using blockchain technology, giving digital assets a dominant role in Metaverse-driven finance. On the other hand, smart contracts are the fastest-growing segment during the forecast period, fueled by their ability to automate complex financial processes without intermediaries.

This automation improves transaction speed, reduces operational costs, and enhances trust. Digital identity solutions, payments and settlements, and other emerging tools support the ecosystem by improving security, verification, and cross-border transaction efficiency. Together, these applications are redefining how individuals and institutions exchange, validate, and store financial value within interconnected virtual economies.

By End Use: Banking, Insurance, Securities and Investment Services, Others

The MetaVerse in Finance Market by end use illustrates how different financial sectors are embedding immersive digital tools into their operations. Banking is the largest segment, as financial institutions are rapidly adopting Metaverse-based platforms to provide virtual customer service, digital asset management, and blockchain-enabled transactions. Banks are establishing virtual branches that allow real-time consultations and cross-border financial activities in immersive environments.

Meanwhile, securities and investment services are the fastest-growing segment during the forecast period, with investors using digital twins, predictive AI tools, and tokenized assets for trading and portfolio management. The insurance sector is also evolving, using the Metaverse to simulate risk models and offer interactive policy experiences. The "others" category, including fintech startups and decentralized organizations, contributes to diversification and innovation within the financial ecosystem. This collective integration demonstrates how the Metaverse is shaping each financial sub-sector into a digitally connected, interactive environment that blends engagement with efficiency.

Read More @https://virtuemarketresearch.com/report/metaverse-in-finance-market

Regional Analysis:

The MetaVerse in Finance Market by region highlights how adoption patterns vary across global financial ecosystems. North America is the largest regional segment, supported by advanced digital infrastructure, early blockchain integration, and strong investments by major financial and technology firms. The region's established fintech ecosystem and progressive regulations around virtual assets make it a central hub for Metaverse finance innovation. Asia-Pacific, however, is the fastest-growing region during the forecast period, driven by expanding digital banking networks, high smartphone penetration, and the rapid rise of virtual economy initiatives in countries like China, Japan, and South Korea. Europe follows with strong regulatory frameworks and collaborations between banks and virtual technology providers.

South America and the Middle East & Africa are gradually adopting decentralized finance solutions and blockchain applications to enhance transparency and inclusion. Each region contributes uniquely, but the overall growth trajectory shows the global financial landscape is shifting toward immersive, technology-driven transformation through the expanding Metaverse in finance market.

Latest Industry Developments:

• Accelerating tokenization and fiat-linked digital assets to expand tradable liquidity: Market participants increasingly prioritize wide-scale tokenization of real-world assets and the integration of fiat-pegged digital instruments to capture tradable liquidity inside virtual economies. This trend pushes firms to convert bonds, money-market instruments, and real estate into programmable tokens that can be fractionally owned, while concurrently exploring bank-backed stablecoins that simplify on-ramps and settlements. By doing so, organizations create new secondary markets, shorten settlement cycles, and attract institutional capital that prefers regulated, auditable representations of value. The approach also enables creative product wrappers-like tokenized funds and collateralized NFT lending-expanding market depth and transaction velocity within metaverse finance ecosystems.

• Forming strategic alliances and cross-industry consortiums to scale user reach: A clear industry trend is the proliferation of strategic alliances between banks, fintechs, game studios, and infrastructure providers to build interoperable metaverse financial services. These partnerships aim to combine regulatory knowledge, custodial capabilities, immersive experiences, and distributed-ledger infrastructure so that offerings launch faster and reach larger user bases. Consortium-led pilots and joint initiatives reduce single-entity risk and create shared standards for wallets, identity, and liquidity routing. The alliance model speeds enterprise adoption by providing plug-and-play modules for virtual branches, while enabling legacy firms to experiment without fully committing capital, thereby broadening market share across traditional and digital-native audiences.

• Prioritizing security, regulatory compliance, and interoperability as competitive differentiators: Companies increasingly treat robust security, clear compliance frameworks, and cross-chain interoperability as core marketable features rather than back-office functions. This trend sees firms embedding biometric and AI-driven fraud detection, engaging with regulators to create compliant token frameworks, and investing in middleware that links permissioned and public ledgers. Emphasizing proven custody solutions, auditable smart-contract templates, and standardized identity layers helps firms reduce liability and win trust from institutional clients. By advertising demonstrable controls and regulatory alignment, providers differentiate themselves in a crowded market and convert cautious enterprises into active participants in metaverse finance.

customize the Full Report Based on Your Requirements @https://virtuemarketresearch.com/report/metaverse-in-finance-market/customization

CONTACT US :

Virtue Market Research

Kumar Plaza, #103, SRPF Rd, Ramtekadi, Pune, Maharashtra 411013, India

E-mail: megha@virtuemarketresearch.com

Phone: +1-917 436 1025

ABOUT US :

"Virtue Market Research stands at the forefront of strategic analysis, empowering businesses to navigate complex market landscapes with precision and confidence. Specializing in both syndicated and bespoke consulting services, we offer in-depth insights into the ever-evolving interplay between global demand and supply dynamics. Leveraging our expertise, businesses can identify emerging opportunities, discern critical trends, and make decisions that pave the way for future success."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The Global Metaverse in Finance Market is projected to reach a market size of USD 14.28 billion by the end of 2030. here

News-ID: 4296017 • Views: …

More Releases from Virtue Market Research

Global Bioethanol for Automotive Market is projected to reach the value of USD 4 …

The Global Bioethanol for Automotive Market was valued at USD 25.28 Billion in 2024 and is projected to reach a market size of USD 45.03 Billion by 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.1%.

Request Sample @ https://virtuemarketresearch.com/report/bioethanol-for-automotive-market/request-sample

In the short term, the market growth is driven by the growing demand for environment-friendly fuel alternatives to reduce carbon emissions and dependence…

The Global Bio Glutamic Acid Market is projected to reach a market size of USD 3 …

The Global Bio Glutamic Acid Market was valued at USD 2.93 million in 2024 and is projected to reach a market size of USD 3.83 million by 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 4.56%.

Request Sample @ https://virtuemarketresearch.com/report/bio-glutamic-acid-market/request-sample

The global bio glutamic acid market has witnessed steady transformation in recent years, driven by the rising demand for sustainable biochemical ingredients across…

The Global Alfalfa Honey Market is expected to reach USD 1.49 billion by 2030.

The Global Alfalfa Honey Market was valued at USD 1.1 billion in 2024 and will grow at a CAGR of 5.2% from 2025 to 2030. The market is expected to reach USD 1.49 billion by 2030.

Request Sample @ https://virtuemarketresearch.com/report/alfalfa-honey-market/request-sample

The Alfalfa Honey Market has been gaining attention for its unique flavor, rich nutritional profile, and growing demand among health-conscious consumers. One of the long-term drivers fueling this market is the rising…

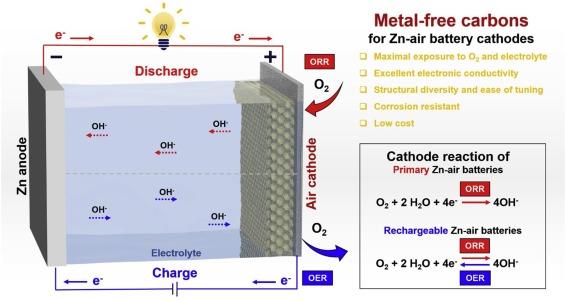

The Global Air Electrode Battery Market is projected to reach a market size of U …

The Global Air Electrode Battery Market was valued at USD 1.5 Billion and is projected to reach a market size of USD 3.19 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 9.9%.

Request Sample @ https://virtuemarketresearch.com/report/air-electrode-battery-market/request-sample

The air electrode battery market is steadily gaining attention as the world searches for energy solutions that are both efficient and sustainable.…

More Releases for Metaverse

Shaping the Metaverse In Automotive Market in 2025: Digitalization Drives Growth …

How Big Is the Metaverse In Automotive Market Expected to Be, and What Will Its Growth Rate Be?

In recent times, the metaverse in the automotive market's magnitude has experienced a substantial increase. This sector, which is projected to expand from $4.03 billion in 2024 to $5.43 billion in 2025, anticipates achieving a compound annual growth rate (CAGR) of 34.6%. Factors attributing to this vigorous growth during the past period include…

Metaverse In Healthcare Market Report 2024 - Metaverse In Healthcare Market Grow …

"The Business Research Company recently released a comprehensive report on the Global Metaverse In Healthcare Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

According to The Business Research Company's, The metaverse in healthcare…

Revolutionising L&D activities using a Metaverse and AI- Technologies Metaverse …

The concept of "Metaverse" rose to fame in 2021 and soon established itself as the next level of social networking and virtual interactions. The metaverse is a 3D virtual simulated environment which can be accessed by a user by their own avatar. Once within the environment, the user can not only interact with their surroundings using their avatar but also with the avatars of other users. This feature makes the…

Metaverse in Healthcare Market Training, Treatment, Transformation: The Expandin …

Metaverse in Healthcare Market Assessment worth $ 71.2 Billion by 2030 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Metaverse in Healthcare Market- by Component (Software and Hardware) Technology (Augmented Reality (AR), Virtual Reality(VR), Artificial Intelligence(AI), and Mixed Reality(MR)), Devices (VR Headsets, AR Devices, and Mixed Reality Platforms), End-Users (Medical Training & Education Modules, Diagnosis, Designing ORs, Treatment,…

Metaverse in Education Market to Witness Huge Growth by 2028 | Roblox, Microsoft …

Latest Study on Industrial Growth of Metaverse in Education Market 2023-2029. A detailed study accumulated to offer the Latest insights about acute features of the Metaverse in Education market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future…

First medical event in metaverse

On November 11, a landmark event took place - Eternity Life Forum. It was first event of its kind to be viewed in metaverse: ability to walk the halls, interact with other attendees and expertise benefits of an offline event.

EL Forum has become for both speakers and visitors an absolute quintessence of experience, background and research in anti-aging and life prolongation field.

Visitors and speakers from different states and parts of…