Press release

Top 30 Indonesian Public Companies Q3 2025 Revenue & Performance

1) Sector overview overall performance (Q3 2025 snapshot)Q3 2025 in Indonesias listed energy sector was dominated by coal-price weakness (Newcastle / ICI indexes down vs the prior year) and mixed operational results across miners and oil & gas firms. Several large coal miners and integrated groups recorded lower year-on-year net results in Q3 and for 9M25 as ASP (average selling prices) softened; however, some companies reported improved production volumes or operational efficiencies that partly offset price pressure. The IDX energy index showed modest positive movement in late October/November as traders rotated into names with resilient cash flows and dividend yields. The universe of listed energy companies remains broad (dozens of constituents from integrated miners to oil & gas services and power / shipping names).

2) Q3 2025 earnings Top 10 Indonesian public energy companies (summaries & actual numbers, converted to USD)

1. Bayan Resources (BYAN)

Q3 2025 net profit (reported): Rp 8.71 trillion (Q3 2025). That equates to ~USD 523 million (Rp 8,710,000,000,000 ÷ 16,637.55 = USD 523.6m).

9M25 sales and net income remained below 9M24 levels but Bayan continued to produce large volumes with a mix of fixed and floating contracts; the company still generated strong operating cash flows despite lower benchmark coal prices.

2. Alamtri Resources / Adaro group (ADRO / ADMR / related)

Q3 2025 net profit (reported): Rp 5.03 trillion for Q3 2025 (ADRO reported Q3/9M packs). Converted: ~USD 302.5 million.

ADROs Q3 result was down YoY from exceptionally strong prior year quarters; volumes stayed fairly stable but lower realized prices were the headwind. Company filings/9M25 financial statements provide the detail.

3. Golden Energy Mines (GEMS)

Q3 2025 net profit (reported): Rp 3.32 trillion (Q3 2025). Converted: ~USD 199.6 million.

Q3 showed QoQ moderation vs very strong prior-year quarters (lower coal indexes), but GEMS remained one of the larger miners by market cap and posted significant EBITDA.

4. Bumi Resources (BUMI)

Q3 2025 net profit (reported): Rp 490.5 billion (Q3 2025). Converted: ~USD 29.5 million.

BUMIs profit was down YoY from stronger previous periods; the firm continues to focus on cost control and deleveraging.

5. PT Bukit Asam (PTBA)

Q3 2025 net profit (reported): ~Rp 1.391.59 trillion (various releases show net profit c. Rp1.41.59 tn for Q3); I used the company 9M25 release showing Rp1.4 trillion net profit for Q3 (company IR PDF). Converted: ~USD 84.1 million (for Rp1.4 tn).

PTBA delivered modest revenue growth (volume up) but lower ASPs led to compressed margins; the company emphasized portfolio optimization and capex progress.

6. Medco Energi (MEDC)

Q3 / 9M 2025 highlights: Medco reported net profit (9M) and Q3 operational uplift from new oil & gas fields and renewable IPPs. Medcos Q3 reported profit for the quarter was Rp 1.43 trillion (company/IndoPremier note). Converted: ~USD 85.9 million.

Q3 production increased (oil & gas mboepd), and Medcos power segment grew with additional renewable capacity contributing to power sales. Company 9M25 press release and factsheet give production and sales detail.

7. Indika Energy (INDY)

Q3 2025 net profit (reported): Rp 8.0 billion in Q3 2025 (Indopremier / IPOT summary). Converted: ~USD 0.48 million.

INDYs Q3 and 9M25 were significantly reduced YoY losses or tiny profits in some segments reflecting weaker commodity prices and pressure in energy services & mining exposure. For 9M25 the company reported net profit that was only USD ~0.48m (9M) in some firm summaries signaling sharp YoY compression.

8. Adaro Andalan / AADI (and related Adaro group listings)

9M25 / Q3 commentary: Various Adaro-group entities (AADI / ADRO / affiliated) reported 9M / Q3 declines in net income vs 2024. One market note reports AADI 9M25 net ~USD 587.3m (a fall vs strong prior comparable period). Use the groups 9M filings for line-by-line detail.

9. Bumi Resources Minerals (BRMS) & other mid-caps (example BRMS)

BRMS Q3 2025 net profit (example): BRMS posted net profit for Q3 about USD 14.9m (Rp ≈ 247bn if converted at the same FX), and 9M25 cumulative net profit USD ~37.9m in research notes - showing gold / minerals players had pockets of strength.

10. Other large names (examples with Q3 data available):

ITMG (Indo Tambangraya), PGAS (Perusahaan Gas Negara), Petrosea, Elnusa, TBS Energi Utama, Transcoal many of these published 3Q/9M packs on their investor IR pages and/or were summarized by local research portals; results varied by sub-sector (coal miners were volume-resilient but price-pressured; oil & gas firms fared better where production rose or hedges protected margins).

3) Key trends & insights from Q3 2025

Price vs volume split: Q3 showed a classic split several coal producers recorded higher volume/sales growth but still posted lower net income because benchmark coal prices (Newcastle / ICI variants) retreated YoY. The miners ability to offset price declines with cost and volume improvements was uneven.

Divergence across subsectors: Large, well-contracted miners and diversified groups (Bayan, Adaro group) generated big operating cash flows despite price weakness; service companies and some oil & gas contractors saw weaker margins due to demand timing.

Renewables & power growth in oil & gas players: Companies with power or renewables exposure (e.g., Medco Power within MEDC) reported positive Q3 contributions, aligning with corporate strategies to diversify beyond thermal coal and conventional oil & gas.

FX & interest environment: Rupiah moved in a range near IDR 16.6k16.7k per USD in late Oct/Nov; companies with USD revenues benefited from FX when translating export proceeds, while those with USD debt felt financing cost pressures.

Capex / portfolio optimization: Several majors signalled capex discipline and focus on portfolio optimization (sales mix, downstream/offtake contracts) heading into Q4. PTBA and some miners highlighted capex realization and production guidance adjustments in their IR packs.

4) Outlook Q4 2025 and beyond

Near term (Q4 2025): Expect continued volatility tied to thermal coal indices and macro liquidity. If coal prices stabilise or recover modestly, miners Q4 will benefit; otherwise, further margin compression is possible. Oil & gas names with growing production (or with favorable hedges) may continue to outperform mining peers.

Medium term (2026): Structural drivers Indonesias energy transition plans, renewable IPP growth, and government downstream push will redirect some capex into power/renewables and downstream projects. Companies accelerating diversification (power, renewables, copper/critical minerals) are likely to re-rate over a multi-year horizon if execution is consistent.

Risks: commodity price shocks, policy changes on coal exports or domestic prioritization, FX/interest rate moves, and project delays are the main downside risks. On the upside, stronger-than-expected global coal demand or higher gas prices would boost earnings quickly for producers.

5) Conclusion

Q3-2025 was a mixed quarter for Indonesias listed energy companies: production and volume gains in many mining names were offset by lower commodity prices, while diversified oil & gas players and companies with power/renewables exposure posted more constructive operational stories. The top 30 public energy universe remains broad and varied the immediate Q4 outlook depends heavily on coal/energy price movements and execution on portfolio diversification (notably renewables and downstream projects). For investors or analysts, the actionable approach is to differentiate between (a) cash-generative miners with resilient balance sheets and (b) names whose earnings hinge on one-off project timelines or commodity-sensitive services.

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Top 30 Indonesian Public Companies Q3 2025 Revenue & Performance here

News-ID: 4295318 • Views: …

More Releases from QY Research

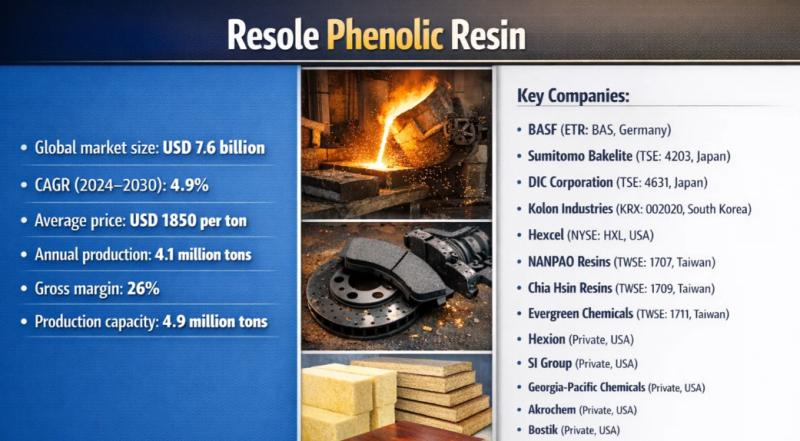

From Slow Cure to High Performance: Weyerhaeuser's Shift to Resole Phenolic Resi …

Problem

Weyerhaeuser Company using conventional thermoplastic binders or novolac-type phenolic systems faced limited heat resistance, slower curing, and additional curing-agent requirements. In applications such as wood panels, insulation, abrasives, refractories, and molded components, these limitations led to longer press cycles, insufficient thermal stability, and inconsistent mechanical performance under high-temperature or fire-exposed conditions.

Solution

Hexion adopted Resole Phenolic Resin, a thermosetting phenolic resin synthesized under alkaline conditions with a formaldehyde-to-phenol ratio greater than 1.…

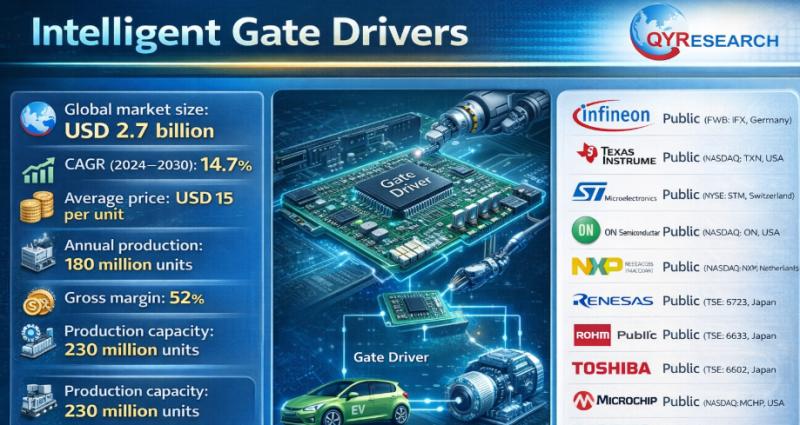

Global and U.S. Intelligent Gate Drivers Market Report, Published by QY Research …

QY Research has released a comprehensive new market report on Intelligent Gate Drivers, advanced semiconductor control components that integrate gate-driving, protection, sensing, and communication functions to manage power transistors such as IGBTs, MOSFETs, SiC MOSFETs, and GaN HEMTs. Unlike conventional gate drivers, intelligent gate drivers embed real-time monitoring, fault protection, and adaptive control, enabling higher efficiency, reliability, and safety in modern power electronic systems. As electrification accelerates across EVs, renewable…

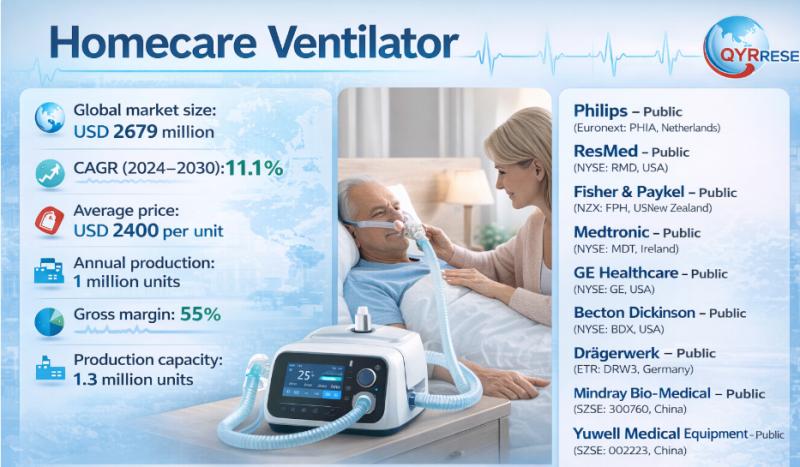

Global and U.S. Homecare Ventilator Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Homecare Ventilator, a medical device that assists or takes over a person's breathing outside of a hospital setting. Designed for long‐term respiratory support, these ventilators are used by people with chronic respiratory conditions such as COPD, neuromuscular disease, spinal injuries, or sleep‐related breathing disorders. Homecare ventilators are typically portable, quieter, and easier to operate than ICU ventilators.

Core Market Data

Global market…

Top 30 Indonesian Battery Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aneka Tambang Tbk (ANTM) diversified metals (nickel & battery feedstock)

Bayan Resources Tbk (BYAN) large mining & metal revenue

AlamTri Resources / Adaro Energy Tbk (ADRO) diversified mining & metals

Indo Tambangraya Megah Tbk (ITMG) mining including metals exposure

PT Bukit Asam Tbk (PTBA) minerals/coal & metals linkage

Vale Indonesia Tbk (INCO) nickel & concentrates

PT Timah…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…