Press release

Bitcoin Payments Ecosystem Market Key Players - Share Consolidation Trends & Capital Growth Signals

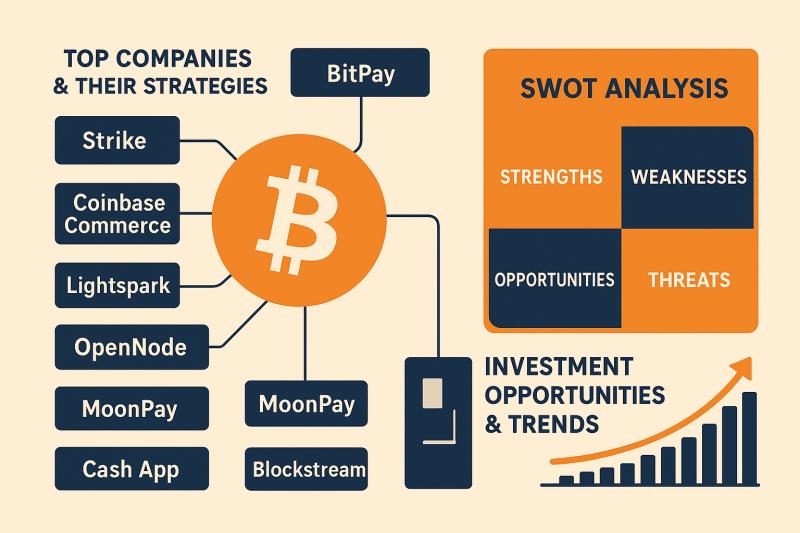

The Bitcoin payments ecosystem market is entering a pivotal phase, shaped by institutional adoption, regulatory clarity, rapid innovation in Layer-2 scaling, and the expansion of global merchant acceptance. As Bitcoin transitions from a speculative asset to a viable medium of exchange, leading companies are building infrastructure that supports fast, low-cost, borderless transactions. This strategic article examines the top companies shaping the market, provides a detailed SWOT analysis, and highlights key investment opportunities emerging across the Bitcoin payments ecosystem.➤ Request Free Sample PDF Report @https://www.researchnester.com/sample-request-8171

Top Companies & Their Strategies

1. BitPay

BitPay remains one of the most recognizable players in the Bitcoin payments ecosystem, offering merchant processing services, settlement tools, and crypto debit card products. Its strength lies in its well-established merchant network, advanced fraud detection capabilities, and long-standing regulatory compliance frameworks. BitPay continues to expand globally through integrations with ecommerce platforms such as Shopify and WooCommerce, strengthening its leadership position.

2. Strike

Strike, built on the Lightning Network, has gained prominence due to its ultra-low-cost payment rails and focus on remittances. The company differentiates itself through instant cross-border Bitcoin transactions, seamless fiat conversion, and strategic alliances with countries in Latin America. Strike's competitive advantage lies in leveraging Bitcoin's Lightning Network to undercut traditional payment processors and money transfer services.

3. Coinbase Commerce

Coinbase Commerce enables merchants worldwide to accept Bitcoin directly into their wallets without intermediaries. Its integration within Coinbase's broader ecosystem makes it highly attractive for businesses and enables easy conversion between crypto and fiat. Coinbase Commerce continues to scale by partnering with global brands and expanding support for Bitcoin-native payment features.

4. Lightspark

Lightspark is an emerging leader focused on enterprise-grade Lightning Network infrastructure. Founded by former Meta executives, Lightspark aims to create a new standard for Bitcoin-powered payments by offering APIs, liquidity management tools, and fraud mitigation technologies. Its strategy focuses on infrastructure-as-a-service, making it easier for financial institutions to adopt Lightning-powered payments.

➤ Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Bitcoin Payments Ecosystem Market report here → https://www.researchnester.com/sample-request-8171

5. OpenNode

OpenNode is a growing payments processor specializing in Bitcoin-only merchant solutions, customizable APIs, and payout systems. The company prioritizes an easy-to-integrate platform for businesses of all sizes, making it a preferred choice for enterprise-level commerce. Its operational footprint in the U.S., Europe, and Middle East enables broad international reach.

6. MoonPay

MoonPay supports Bitcoin buying, selling, and payment processing across 160+ countries. Although known primarily for its on-ramp services, MoonPay is increasingly moving into merchant acceptance and crypto-to-fiat settlement tools. Its major strength is its global network of partnerships with fintech platforms, mobile apps, and cryptocurrency wallets.

7. Cash App

Cash App has evolved from a simple peer-to-peer payment tool into one of the most influential Bitcoin-centric platforms. Through its Bitcoin Lightning integrations and user-friendly design, Cash App has played a major role in mainstreaming Bitcoin payments. Its access to millions of users provides significant scale for onboarding consumers into the Bitcoin payments ecosystem.

8. Blockstream

Blockstream focuses on Bitcoin infrastructure, including the Liquid sidechain and Lightning development tools. While not a merchant processor, its technologies support faster and more secure Bitcoin transactions for enterprises. Its strategy revolves around building the technical backbone that enables secure, scalable Bitcoin payments across global financial networks.

➤ View our Bitcoin Payments Ecosystem Market Report Overview: https://www.researchnester.com/reports/bitcoin-payment-ecosystem-market/8171

SWOT Analysis

Strengths

Leading companies in the Bitcoin payments ecosystem market benefit from advanced blockchain infrastructure, strong developer communities, and increasing merchant acceptance. Many firms leverage the Lightning Network, enabling high-speed, low-cost transactions that outperform traditional payment rails. Their global reach allows them to operate across regions underserved by banks, and their brands have built significant trust with both consumers and businesses.

Weaknesses

A major challenge for many Bitcoin payments providers is regulatory uncertainty, particularly in regions where digital assets face ambiguous classifications. Some companies struggle to balance innovation with compliance, slowing product deployments and limiting adoption. Merchant onboarding remains uneven across industries, and user education continues to be a barrier in emerging markets. Volatility also affects companies that rely on direct Bitcoin acceptance rather than instant fiat conversion.

Opportunities

Growth opportunities are expanding across remittances, cross-border commerce, microtransactions, and enterprise-grade settlement systems. Companies can capitalize on increasing regulatory acceptance in key regions such as Europe, Singapore, and parts of Latin America. Adoption of Bitcoin's Lightning Network presents massive potential for scaling payments, especially for fintechs and ecommerce platforms. Additionally, partnerships with banks, payment processors, and mobile wallet providers present new channels for expansion.

Threats

Bitcoin payment companies face ongoing threats from regulatory restrictions, traditional financial incumbents entering the crypto sector, and competitive pressure from stablecoin payment solutions. Emerging blockchain networks offering faster or cheaper alternatives may divert merchant attention away from Bitcoin. Cybersecurity risks remain a constant threat, particularly as transaction volumes scale. Market sentiment volatility could weaken consumer interest, impacting transaction-based revenue models.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-8171

Investment Opportunities & Trends

Increasing M&A Activity

The Bitcoin payments ecosystem is witnessing rising merger and acquisition interest as larger financial institutions seek to integrate blockchain-based payment capabilities. Companies specializing in Lightning infrastructure, fraud detection, and AI-driven compliance tools are becoming attractive acquisition targets. Over the past year, several crypto payment startups have been acquired by global fintech leaders to accelerate their entry into the blockchain space.

Venture Funding in Infrastructure & Cross-Border Payments

Venture capital continues flowing into companies developing Lightning Network infrastructure, merchant APIs, and cross-border settlement platforms. Startups focusing on remittances in Latin America, Africa, and Southeast Asia are receiving significant investment due to Bitcoin's efficiency in bypassing high-fee traditional remittance routes. Infrastructure providers such as Lightspark and OpenNode also attract capital due to their scalability and enterprise-focused product lines.

Technology Integration & Enterprise Adoption

Enterprise adoption of Bitcoin payments is becoming more common as companies recognize its operational advantages-real-time settlement, lower processing costs, and chargeback elimination. Major global brands are integrating Bitcoin processing tools through APIs from Coinbase Commerce, BitPay, and OpenNode. Lightning Network integrations are accelerating, allowing real-time micropayments for digital goods, gaming, content monetization, SaaS billing, and cross-border payroll.

Regions Attracting the Most Capital

• Latin America: High remittance volumes and favorable crypto regulations are driving investment in companies building Bitcoin remittance and merchant networks.

• Europe: Clear regulatory frameworks under MiCA are fueling enterprise adoption and infrastructure development.

• Southeast Asia: Mobile-first commerce and fragmented banking systems create strong demand for Bitcoin-based settlement networks.

• U.S. tech hubs: Venture-backed Bitcoin payments startups remain concentrated in New York, Miami, Austin, and Silicon Valley.

Notable Innovations in the Last 12 Months

• Expansion of Lightning Network enterprise-grade infrastructure by multiple companies.

• Launch of Bitcoin-powered remittance corridors across Latin America and Africa.

• Integration of Bitcoin payments into ecommerce platforms such as Shopify and WooCommerce.

• Policy developments in Europe and Asia that provide clearer regulatory pathways for Bitcoin payment providers.

• New APIs enabling faster merchant onboarding and instant crypto-to-fiat settlement.

These innovations signal accelerating adoption and position the Bitcoin payments ecosystem for continued maturation.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8171

➤ Related News -

https://www.linkedin.com/pulse/what-factors-driving-global-growth-beta-testing-tools-xqxyf

https://www.linkedin.com/pulse/what-future-digital-transformation-consulting-services-ehsyf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bitcoin Payments Ecosystem Market Key Players - Share Consolidation Trends & Capital Growth Signals here

News-ID: 4285109 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

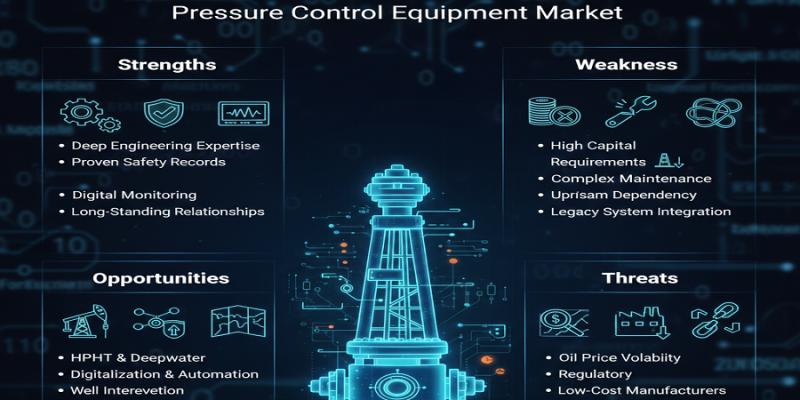

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

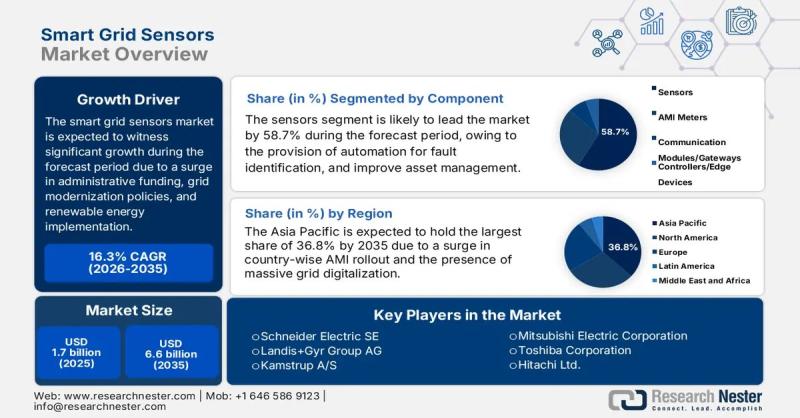

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Bitcoin

Bitcoin Mining and Bitcoin CloudMining Evolve with AI-Optimized Technology

Toronto, Canada - October 2025

With the world shifting towards increased use of digital resources, Hashj establishes the new trend in the sector once again, introducing an improved cloudmining platform with bitcoin. This new system has been revolutionary because anyone can engage in bitcoin mining without technical skills or costly software and hardware. Better still, users can begin to mine immediately without any registration to be given a $118 giveaway…

Loans against Bitcoin for more Bitcoin

Go VIP Worldwide, wholly owned by Matthew Barnes, drew a $100,000 loan from an FDIC Bank against Go VIP Worldwide's Bitcoin holdings on July 29, 2025 and immediately used the entire loan to buy more Bitcoin.

This is significant as Go VIP Worldwide is not a publicly traded company begging Wall Street to beg the public to buy Bitcoin for their publicly traded company, as it appears all the leveraged…

1502.app, LLC Launches 1502, The Bitcoin Messenger, Bitcoin meets mainstream fea …

1502.app, LLC is excited to announce the official launch of 1502, The Bitcoin Messenger, after a successful year of open beta testing. 1502 integrates non-custodial wallets into a private messenger environment and offers additional features for a global audience of freelancers, digital nomads, overseas workers, and small shop owners.

1502 aims to merge daily-life utility with Bitcoin, allowing direct Bitcoin transactions between two parties without any intermediary involvement.

This innovative approach is…

BITCOIN UP REVIEW 2022:IS BITCOIN UP A SAFE INVESTMENT?

Bitcoin Up Review:Despite the fact that it is a complex world, the introduction of trading robots made it easier for newcomers to understand the world of cryptocurrencies. They can open the doors for passionate investors wanting to reap the rewards of these technologies capable of forecasting price movements and making judgments without any human assistance by democratizing the use of these sorts of assets with automated algorithms and artificial intelligence.

Cryptocurrency…

What is Bitcoin? Understanding Bitcoin & Blockchain in 10 Minutes.

Bitcoin's open-source code (software), launched in 2009 by an anonymous developer, or group of developers, that are known only by the pseudonym Satoshi Nakamoto. This ingenious codebase enabled a completely trust-less network between strangers. And both sender and receiver can remain anonymous, if they so desire.

Bitcoin is not printed by a government or issued by a central bank or authority. Bitcoin is created by ingenious open-source code (software) installed on…

Bitcoin Association launches online education platform Bitcoin SV Academy

Bitcoin Association, the Switzerland-based global industry organisation that works to advance business with the Bitcoin SV blockchain, today announces the official launch of Bitcoin SV Academy – a dedicated online education platform for Bitcoin, offering academia-quality, university-style courses and learning materials.

Developed by Bitcoin Association, Bitcoin SV Academy has been created to make learning about Bitcoin – the way creator Satoshi Nakamoto designed it - accessible, accurate and understandable. Courses are…