Press release

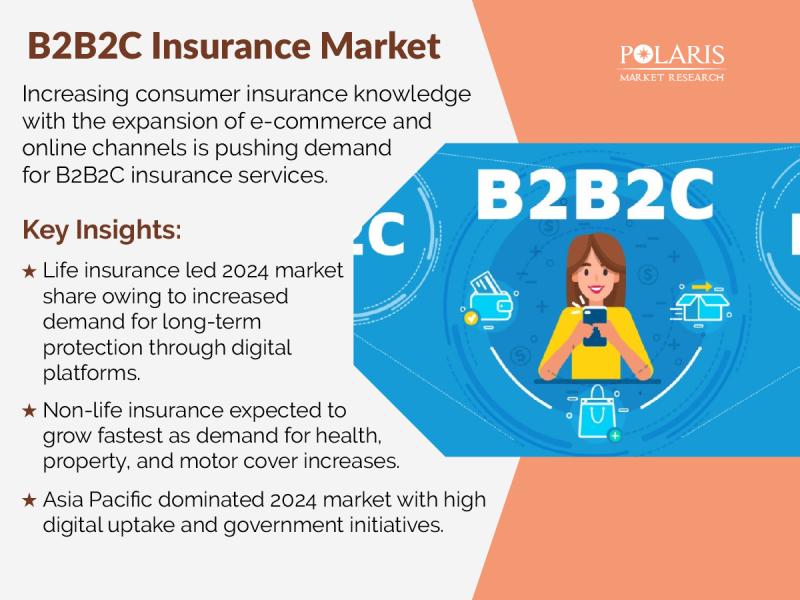

B2B2C Insurance Market on Track for USD 7.05 billion By 2034, Growing at a 6.3% CAGR

Market Size and Share:Global B2B2C Insurance Market is currently valued at USD 3.83 billion in 2024 and is anticipated to generate an estimated revenue of USD 7.05 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 6.3% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034

Polaris Market Research has introduced the latest market research report titled B2B2C Insurance Market that highlights the major revenue stream for the forecast period. The report contains clear, reliable, and thorough market data and information that will undoubtedly help businesses to develop and boost return on investment (ROI). The report focuses on B2B2C Insurance market size, share, growth status, future trends, volume, and key market dynamics. The report identifies essential customer attributes in order to identify various demands throughout the industry. Then, the market competition is determined along with various activities performed by key companies in the market.

Request Your Sample Today For An Exclusive Look At The Latest Trends And Upcoming Advancements @

https://www.polarismarketresearch.com/industry-analysis/b2b2c-insurance-market/request-for-sample#utm_source=openpr&utm_medium=paid&utm_campaign=openpr&utm_id=01

The report demonstrates a statistical overview of the current market condition, future prospects, latest technological advancements, and opportunities-challenges of top key players. Further, the region that is expected to produce the greatest potential in the market is mentioned in the analysis report. As per B2B2C Insurance market segmentation by type, application, and region, this report provides accurate calculations and forecasts for consumption value in terms of volume and value. Market dynamics (mainly covering drivers, restraints, and opportunities) give crucial information for understanding the market.

📊 Study Explore:

▪️ Historical and recent key insights

▪️ Market size by company, key regions/countries

▪️ Driving forces and roadblocks

▪️ Value chain analysis with price analysis and forecast

▪️ New prospects and targeted marketing methodologies

▪️ R&D and the demand for new product launches and applications.

▪️ New Project Investment Feasibility Analysis

Competitive Landscape Analysis

The report enfolds top competitors' analysis where B2B2C Insurance key players are covered along with competitor's strategy, sales, cost of production, standing position on the market organization size, share, growth, product line in the market, the financial status of competitors, and future expectation data throughout the forecast period. The study notes the reactions of competitors and enables business players to stay innovative and reduce business risks. Through this, players will be able to avoid repetitive mistakes in the business.

✍🏻 Some Of The Key Players In The Market Include:

Allianz SE

American International Group (AIG)

AXA S.A.

Berkshire Hathaway

China Life Insurance Group

Munich Re

Ping An Insurance

Prudential Financial

Tokio Marine Holdings

UnitedHealth Group

Swiss Re

Zurich Insurance Group

Interested in personalized insights? Ask Us For Customization:

https://www.polarismarketresearch.com/industry-analysis/b2b2c-insurance-market/request-for-customization#utm_source=openpr&utm_medium=paid&utm_campaign=openpr&utm_id=01

B2B2C Insurance Market Report Highlights

✔️ Based on insurance type, life insurance dominated in 2024, driven by long-term protection and widespread digital and partner-based adoption.

✔️ In terms of distribution channel, online distribution is expected to grow fastest due to seamless policy management and increasing e-commerce and fintech partnerships.

✔️ Asia Pacific dominated in 2024, fueled by digital adoption, government financial inclusion initiatives, and rising insurance awareness.

✔️ North America is projected to record the highest CAGR, supported by advanced technology adoption, strong regulatory frameworks, and increasing online policy usage.

Market Analysis and Insights

The influential contents covered by the report include B2B2C Insurance market share information, analysis of smaller companies, merger and acquisition, investment plans, demand-supply, gross margin, and import-export. The next chapter of the study introduces the industrial chain analysis, as well as raw materials (suppliers, supply & demand, market concentration rate, cost) and downstream buyers. Next, the regional segmentation overview goes into in-depth detail about the geographical factors of the market. The regional and country-level analysis incorporates the demand and supply forces that are influencing market growth.

On the basis of regions, the report has segmented the market into the following key regions:

▸ North America (United States, Canada, and Mexico)

▸ Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

▸ Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

▸ South America (Brazil, Argentina, Colombia, and the rest of South America)

▸ The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

When talking about research procedure, information involving percentage share splits and breakdowns is obtained from secondary sources and verified with primary sources. Our thorough research methodology will help you to provide the most accurate B2B2C Insurance market forecasts and estimates with minimal flaws. The key influencing factors and entry barriers in this industry are scrutinized using various tools such as Porter's Five Forces analysis and SWOT analysis.

Finally, the market prospects are enfolded, covering the sales and revenue forecast and regional forecast. The report then foresees the B2B2C Insurance industry with respect to type and application. A perspective on sales, revenue, price, market share, and the growth rate by-product is given in this report. In addition, the report analysts have assessed each application's usage and growth rate. According to the estimates, the survey report helps business participants in making their business gainful and obtaining the best investment options.

Click here to Access the Full Report:

https://www.polarismarketresearch.com/industry-analysis/b2b2c-insurance-market#utm_source=openpr&utm_medium=paid&utm_campaign=openpr&utm_id=01

Highlights of The Research Report:

➢ The report estimates the market share, value, and future development plans of the major industry manufacturers.

➢ It provides a better knowledge of the market's prospects and prognosis for the time period.

➢ A comprehensive analysis of factors that drive and restrain the growth of the industry is provided.

➢ The report provides a comprehensive analysis of the market with respect to dynamics, competitive analysis, and upcoming B2B2C Insurance market trends.

➢ The projections in this report are made by analyzing the current trends and future market potential in terms of value.

✅ The Report Provides You Answer to Below Mentioned Question:

1. What are the B2B2C insurance market statistics?

➜ The global B2B2C insurance market was valued at USD 3.83 billion in 2024 and is projected to reach USD 7.05 billion by 2034.

2. What is the growth rate of the B2B2C insurance market value?

➜ The market is expected to record a CAGR of 6.3% during the forecast period.

3. Which region dominated the global B2B2C insurance market share in 2024?

➜ Asia Pacific led the market in 2024, driven by rapid digital adoption and increasing consumer awareness of insurance products.

4. Who are the key players in the B2B2C insurance market?

➜ Key players include UnitedHealth Group, Allianz SE, Berkshire Hathaway, AXA S.A., Ping An Insurance, China Life Insurance Group, Zurich Insurance Group, Prudential Financial, Munich Re, Swiss Re, American International Group (AIG), and Tokio Marine Holdings.

5. Which segment, by insurance type, dominated the B2B2C insurance market revenue share in 2024?

➜ Life insurance dominated the market in 2024 due to strong demand for long-term protection and savings products offered through digital and partner-based channels.

6. Which segment, by distribution channel, is expected to witness the fastest growth during the forecast period?

➜ The online distribution segment is projected to witness the fastest growth during the forecast period, fueled by rising digital adoption and expanding partnerships with fintech and e-commerce platforms.

More Trending Reports by Polaris Market Research:

B2B2C Insurance Market:

https://www.polarismarketresearch.com/press-releases/b2b2c-insurance-market

Digital Identity Verification Blockchain Solutions Market:

https://www.polarismarketresearch.com/industry-analysis/digital-identity-verification-blockchain-solutions-market

Future of Robotics Market:

https://www.polarismarketresearch.com/industry-analysis/future-of-robotics-market

Analyzing the Top 20 Companies Driving Growth in the Fantasy Sports Market in 2025:

https://www.polarismarketresearch.com/blog/top-20-fantasy-sports-companies-dynamics-2025

Robo Taxi Market:

https://san.com/cc/dallas-is-the-next-front-in-the-robotaxi-revolution/

Contact:

Likhil G

8 The Green Ste 19824,

Dover, DE 19901,

United States

Phone: +1-929 297-9727

Email: sales@polarismarketresearch.com

Web: https://www.polarismarketresearch.com

Follow Us: LinkedIn | Twitter

About Polaris Market Research & Consulting, Inc:

Polaris Market Research is a global market research and consulting company. The company specializes in providing exceptional market intelligence and in-depth business research services for PMR's clientele spread across different enterprises. We at Polaris are obliged to serve PMR's diverse customer base present across the industries of healthcare, technology, semiconductors, and chemicals among various other industries present around the world. We strive to provide PMR's customers with updated information on innovative technologies, high-growth markets, emerging business environments, and the latest business-centric applications, thereby helping them always to make informed decisions and leverage new opportunities. Adept with a highly competent, experienced, and extremely qualified team of experts comprising SMEs, analysts, and consultants, we at Polaris endeavor to deliver value-added business solutions to PMR's customers.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B2C Insurance Market on Track for USD 7.05 billion By 2034, Growing at a 6.3% CAGR here

News-ID: 4268515 • Views: …

More Releases from Polaris Market Research & Consulting

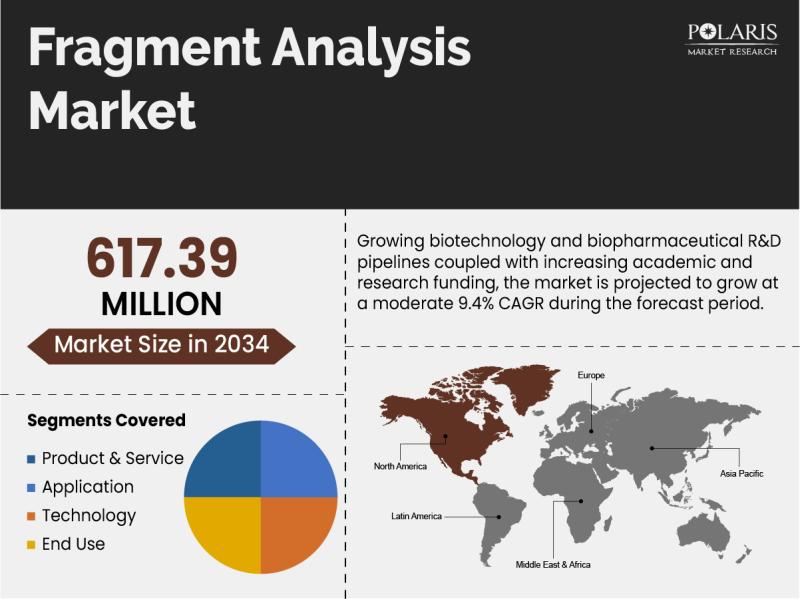

Fragment Analysis Market Size Projected to Reach USD 617.39 Million by 2034, Gro …

Global Fragment Analysis Market is currently valued at USD 275.72 Million in 2025 and is anticipated to generate an estimated revenue of USD 617.39 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 9.4% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034.

Polaris Market Research recently introduced the latest update on Fragment Analysis Market…

Metal Binder Jetting Market Growth Projected at 10.6% CAGR, Reaching USD 402.46 …

Global Metal Binder Jetting Market is currently valued at USD 147.51 Million in 2024 and is anticipated to generate an estimated revenue of USD 402.46 Million by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 10.6% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2025 - 2034.

Polaris Market Research recently introduced the latest update on Metal Binder…

Rigid Food Packaging Market to Reach USD 354.25 Billion by 2034, Growing at a CA …

The quantitative market research report published by Polaris Market Research on Rigid Food Packaging Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Rigid Food Packaging Market size, financial data, and projected future growth. All the…

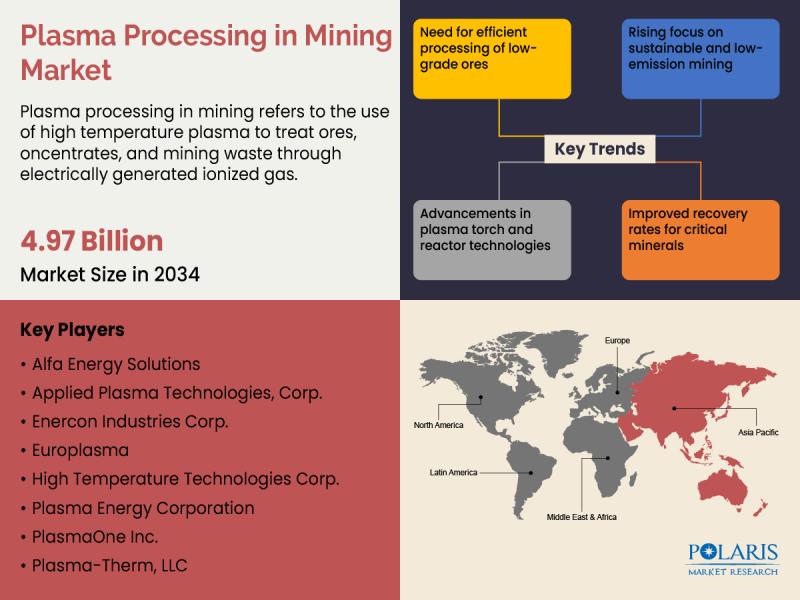

Global Plasma Processing in Mining Market to Reach USD 4.97 Billion by 2034, Reg …

Market Size and Share:

The global plasma processing in mining market is estimated to reach approximately USD 2.62 billion in 2025 and is expected to experience steady growth from 2026 to 2034, expanding at a projected CAGR of 7.4% during the forecast period.

Polaris Market Research has introduced the latest market research report titled Plasma Processing in Mining Market that highlights the major revenue stream for the forecast period. The report contains…

More Releases for B2B2C

Expanding Automobile Industry Propels Growth In B2B2C Insurance Market: The Driv …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

B2B2C Insurance Market Size Growth Forecast: What to Expect by 2025?

The B2B2C insurance market has experienced substantial growth in the past few years. The market which was valued at $4.27 billion in 2024 is set to increase to $4.61 billion come 2025, with a compound annual growth rate…

Italy's B2B2C Insurance Market to Hit $150.68 Billion by 2026

According to a recent report published by Allied Market Research, titled, "Italy B2B2C Insurance Market by Insurance Type, Application, and Industry Vertical: Opportunity Analysis and Industry Forecast, 2022-2026," the Italy B2B2C insurance market size was valued at $86.56 billion in 2017, and is projected to reach $150.68 billion by 2026, growing at a CAGR of 8.8% from 2022 to 2026.

➡️Request Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A31484

The inclusion of insurance…

B2B2C Insurance Market Insights: Growth Drivers, Challenges, and Regional Trends …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market Growth and Restrain Factors Analysis Report

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size (Large Enterprise, Small & medium Enterprise), By Nature of business (Brick & Mortar, E-Commerce, Multi-channel, Non-Commercial, Service Company), By End Use Industry (Banks…

B2B2C Insurance Market, depending on the specific focus you want: Convenience Ta …

B2B2C Insurance Market worth $1.77 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global B2B2C Insurance Market- (By Product (Life, Non-life (Health Insurance, Home Insurance, Vehicle Insurance, Personal Insurance, Accident Insurance, Others (Transport, Credit Insurance, etc.)), By Geographical scope (National, Multi-Country, Regional, Global), By Company size

(Large Enterprise, Small & medium Enterprise), By Nature…