Press release

Blockchain Finance Market Size: Poised for Accelerated Growth Driven by Next-Gen Technologies by 2035

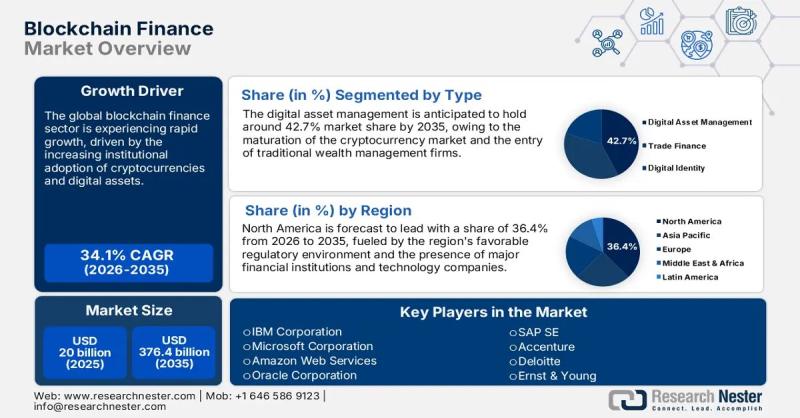

Market Outlook and ForecastThe Blockchain Finance Market is rapidly emerging as a cornerstone of global financial innovation, reshaping how institutions manage transactions, assets, and trust. In 2025, the market is valued at USD 20 billion and is projected to reach USD 376.4 billion by 2035, expanding at an impressive 34.1% CAGR from 2026 to 2035. This exponential growth reflects a shift toward decentralized, transparent, and secure financial systems driven by blockchain adoption across banking, insurance, payments, and investment management.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8082

Regional Performance Highlights

North America is set to remain the largest regional contributor, accounting for approximately 36.4% of the Blockchain Finance Market by 2035. The region's dominance stems from the early adoption of blockchain technologies in banking, coupled with favorable regulatory frameworks and significant venture capital investments in blockchain startups. The United States in particular has witnessed rapid enterprise adoption, with major financial institutions integrating blockchain for cross-border transactions, compliance automation, and digital asset management.

Europe is expected to experience sustained expansion from 2026 through 2035, driven by the European Union's regulatory clarity around digital assets and the rollout of the Markets in Crypto-Assets (MiCA) regulation. These frameworks are fostering institutional participation while ensuring consumer protection. The region's strong emphasis on data privacy and decentralized identity management also supports blockchain innovation across banking and insurance sectors.

Meanwhile, the Asia Pacific Blockchain Finance Market is poised to grow at over 25% CAGR between 2026 and 2035, fueled by the rise of fintech ecosystems in China, India, Singapore, and Japan. These nations are embracing blockchain for remittance solutions, trade finance, and smart contract applications, addressing inefficiencies in traditional banking systems. Governments across the region are increasingly supporting blockchain adoption through digital currency pilots and distributed ledger infrastructure initiatives.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Blockchain Finance Report Overview here: https://www.researchnester.com/reports/blockchain-finance-market/8082

Market Segmentation

Within the Blockchain Finance ecosystem, the Peer-to-Peer (P2P) Transfers segment is projected to account for 59.4% of the market share by 2035. P2P transactions leverage blockchain to eliminate intermediaries, reducing transaction fees and enhancing real-time settlement. This segment's growth reflects the rising demand for decentralized payment solutions and cross-border remittance efficiency, especially among unbanked populations.

The Bitcoin segment dominates the market with an anticipated 66.3% share by 2035, as it continues to serve as a foundational use case for blockchain in finance. Institutional investors are increasingly treating Bitcoin as a store of value, while major payment providers have integrated it into mainstream financial systems. Beyond Bitcoin, stablecoins and central bank digital currencies are gaining traction, offering a bridge between decentralized finance (DeFi) and traditional banking frameworks.

➤ Discover how the Blockchain Finance Market is evolving globally - access your free sample report → https://www.researchnester.com/sample-request-8082

Top Market Trends

1. Institutional Adoption and Tokenized Assets

A defining trend in the Blockchain Finance Market is the rapid institutional adoption of blockchain for asset tokenization and capital market applications. Financial institutions are leveraging blockchain to tokenize bonds, equities, and real estate, enabling fractional ownership and improved liquidity. Platforms like J.P. Morgan's Onyx and Goldman Sachs' digital asset platform are leading this evolution, demonstrating blockchain's potential to modernize settlement systems and reduce operational costs.

This trend underscores the convergence of traditional finance and decentralized infrastructure, where blockchain ensures transparency and immutability in asset management.

2. Integration of Central Bank Digital Currencies

The proliferation of Central Bank Digital Currencies initiatives is another major force shaping blockchain finance. Over 130 countries are exploring or piloting Central Bank Digital Currencies, aimed at creating efficient, traceable, and inclusive payment ecosystems. For instance, China's e-CNY, the European Central Bank's Digital Euro project, and India's Digital Rupee pilot signify how nations are integrating blockchain-backed digital currencies into their monetary systems.

These initiatives are expected to redefine monetary policy frameworks, enhance cross-border payment efficiency, and reduce dependence on traditional correspondent banking systems.

3. Rise of Decentralized Finance (DeFi) and Smart Contracts

Decentralized Finance (DeFi) has evolved from niche experimentation into a mainstream innovation reshaping global finance. DeFi platforms, powered by smart contracts, enable lending, borrowing, and trading without intermediaries. The increasing adoption of decentralized exchanges (DEXs), automated liquidity pools, and blockchain-based derivatives markets is accelerating financial inclusion and market efficiency.

Projects like Aave, Uniswap, and Compound highlight how DeFi is democratizing access to financial services while reducing systemic risks through transparency and decentralization.

➤ Stay ahead of the curve with the latest Blockchain Finance Market trends. Claim your sample report → https://www.researchnester.com/sample-request-8082

Recent Company Developments

The Blockchain Finance landscape is witnessing continuous innovation, with major companies and emerging players driving technological and strategic advancements. The following are key developments over the past 12 months that highlight the market's dynamic evolution:

1. IBM Corporation expanded its Blockchain Platform for Financial Services, partnering with multiple banks to streamline digital payments and settlement operations using Hyperledger Fabric.

2. Ripple Labs Inc. strengthened its position in cross-border remittances by collaborating with leading Asian banks to enhance real-time payment infrastructure.

3. Consensys launched MetaMask Institutional, providing secure DeFi access for asset managers and financial institutions through advanced custody integrations.

4. R3 continued to expand its Corda blockchain ecosystem, with new deployments in trade finance and insurance, supporting interoperable blockchain solutions across global banking networks.

5. Visa Inc. and Mastercard made strategic moves into blockchain finance, enabling crypto-linked card programs and supporting stablecoin settlements on their networks.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8082

Related Links:

https://www.linkedin.com/pulse/what-future-credit-management-software-market-consumers-radar-l8zzf

https://www.linkedin.com/pulse/what-future-education-technology-edtech-market-consumers-radar-tmmff

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain Finance Market Size: Poised for Accelerated Growth Driven by Next-Gen Technologies by 2035 here

News-ID: 4255336 • Views: …

More Releases from Research Nester Pvt Ltd

Urinalysis Market size to exceed $4.6Billion by 2035 | Roche Diagnostics, Siemen …

Market Outlook and Forecast

The global urinalysis market is showing steady expansion, supported by rising diagnostic testing volumes and continuous technological innovation across laboratory and point-of-care settings. The market was valued at USD 3.5 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% from 2026 to 2035. This growth is driven by increased testing frequency in hospitals and…

Respiratory Pathogen Testing Kits Market size to cross $ 7.8 Billion by 2035 | A …

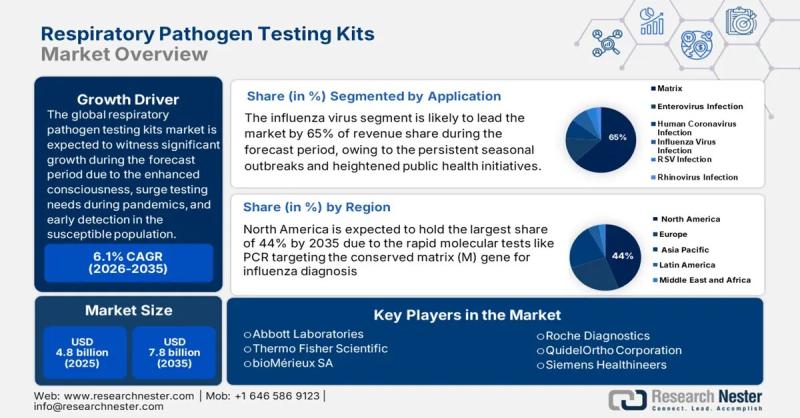

Market Outlook and Forecast

The Respiratory Pathogen Testing Kits Market is witnessing sustained expansion, driven by strong institutional demand and the broadening scope of clinical applications across healthcare settings. Valued at USD 4.8 billion in 2025, the market is projected to reach USD 7.8 billion by 2035, advancing at a compound annual growth rate (CAGR) of 6.1% from 2026 to 2035. This steady growth reflects long-term investments in infectious disease preparedness,…

Optic Nerve Disorders Treatment Market Dominance: Top Companies Strengthening Sh …

The Optic Nerve Disorders Treatment Market is evolving rapidly as neurological and ophthalmic research converge to address complex, vision-threatening conditions such as optic neuritis, ischemic optic neuropathy, hereditary optic neuropathies, and glaucoma-related nerve damage. Driven by advances in biologics, neuroprotection, gene therapy, and precision diagnostics, the market has become a focal point for large pharmaceutical players, specialized ophthalmology companies, and venture-backed biotech firms. This strategic article explores the competitive landscape,…

Top Companies in Surgical Sealants and Adhesives Market - Benchmarking Performan …

The surgical sealants and adhesives market has become a critical segment within advanced wound closure and surgical care, driven by the growing demand for minimally invasive procedures, reduced post-operative complications, and faster healing outcomes. Unlike traditional sutures and staples, surgical sealants and adhesives offer superior tissue bonding, hemostasis, and reduced infection risks across cardiovascular, orthopedic, general, and cosmetic surgeries.

As healthcare systems prioritize efficiency, patient safety, and value-based outcomes, leading medical…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…