Press release

Credit Card Processing Fee Study Finds 59% of Businesses Absorb the Cost

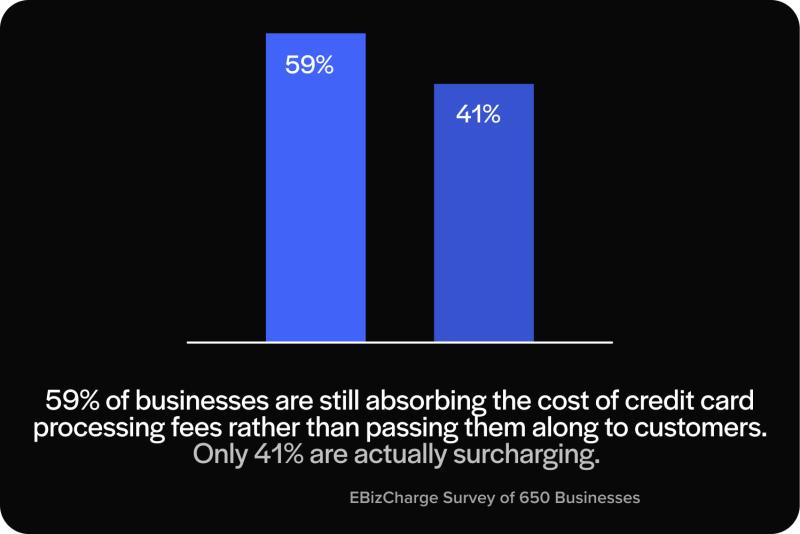

EBizCharge survey finds 59% of businesses absorb credit card processing fees instead of passing them on to customers.

Key Takeaways:

- 59% of businesses absorb credit card processing fees rather than passing them to customers

- Only 41% of companies add surcharges or convenience fees - Businesses spend an average of 3.65% of total revenue on payment processing

- 31.54% of businesses lose 5% or more of their revenue to processing fees

- 62% of companies that do surcharge see customers switch to lower-cost payment methods

- 55% of payment decision-makers personally avoid credit cards when surcharges apply"

Many business owners already understand how processing fees add up. What starts as a small percentage on each transaction can turn into thousands of dollars in lost revenue every year. For most companies, absorbing these fees feels easier than passing them to customers - a way to avoid friction at checkout and maintain loyalty.

That decision, while understandable, comes at a real cost. Every dollar spent on processing fees is one less dollar that can go toward growth, payroll, or reinvestment. The survey shows that while many business owners recognize this, few have found a clear strategy to manage it.

"This is something we hear from business owners all the time - it's hard to balance customer expectations with rising costs," said Branden Korf, of EBizCharge.

Among companies that do surcharge, 62% said customers shifted to lower-cost payment methods like debit https://ebizcharge.com/blog/debit-card-surcharging-is-it-legal/ or ACH - a sign that transparency can influence payment behavior in positive ways.

The full survey and analysis are available at

https://ebizcharge.com/blog/the-true-cost-of-processing-fees-what-650-decision-makers-revealed/

----------------------------------------------------------------------------------------

Company Name:

EBizCharge

Full Postal Address:

20 Pacifica #14

Irvine, CA 92618

United States

Contact Information:

Phone: +1 (949) 996 5032

Email: branden.k@gmail.com

Website: www.ebizcharge.com

Press Contact:

Branden K.

Public Relations

Email: branden.k@ebizcharge.com

https://ebizcharge.com/ EBizCharge is a payment processing platform built to help businesses accept payments faster, more securely, and with less effort. The solution works directly inside more than 100 business systems, including accounting, ERP, and eCommerce platforms, to simplify how companies handle transactions and manage cash flow.

The EBizCharge payment gateway streamlines payment workflows by reducing manual entry, minimizing errors, and automating accounts receivable tasks. It supports credit card, debit card, and ACH/eCheck payments, along with advanced features for subscription billing, automated invoicing, and payment reminders - all designed to save time and improve accuracy.

From small businesses to large B2B enterprises, companies use EBizCharge to connect payment processing directly into the tools they already rely on, such as NetSuite, Sage, Microsoft Dynamics, and major online shopping carts. Its secure gateway and flexible API options make it easy to integrate payments without disrupting existing systems.

By focusing on transparency, security, and efficiency, EBizCharge helps businesses lower processing costs, speed up collections, and give customers a smoother way to pay - whether online, in person, or on the go.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Processing Fee Study Finds 59% of Businesses Absorb the Cost here

News-ID: 4245763 • Views: …

More Releases for EBizCharge

Medical Accounting Software Market to See Huge Growth | NetSuite, EBizCharge, Or …

The Global Medical Accounting Software Market study describes how the technology industry is evolving and how major and emerging players in the industry are responding to long term opportunities and short-term challenges they face. One major attraction about Medical Accounting Software Industry is its growth rate. Many major technology players - including NetSuite (United States), Intuit Inc. (United States), Sage Software Inc. (Canada), Cougar Mountain Software (United States), Microsoft Corporation…

Payment Management Software Market Players Gaining Attractive Investments| NetSu …

Advance Market Analytics published a new research publication on "Payment Management Software Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Payment Management Software market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample…

Billing & Invoicing Software Market is Booming Worldwide with Freshbooks, Tipalt …

Global Billing & Invoicing Software Market Size, Status and Forecast 2019-2025 is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Billing & Invoicing Software Market. Some of the key players profiled in the study are…

Payment Software Market Next Big Thing | Major Giants PaySimple Pro, PDCflow, EB …

The Global Payment Software Market to witnessed good recovery in growth post first half of 2020 and is projected coverup market sizing during the forecast period (2021-2026). The assessment provides a 360° view and insights - outlining the key outcomes of the Payment Software market, current scenario analysis that highlights slowdown aims to provide unique strategies and solutions following and benchmarking key players strategies. In addition, the study helps with…

Online Payment Software Market is Booming Worldwide | PaySimple Pro, EBizCharge, …

Advance Market Analytics released a comprehensive study of 200+ pages on 'Online Payment Software' market with detailed insights on growth factors and strategies. The study segments key regions that includes North America, Europe, Asia-Pacific with country level break-up and provide volume* and value related cross segmented information by each country. Some of the important players from a wide list of coverage used under bottom-up approach are Bill.com (United States),PaySimple Pro…

Online Payment Software Market Is Booming Worldwide | Bill.com, PaySimple Pro, P …

HTF MI recently introduced Global Online Payment Software Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Bill.com, PaySimple Pro, PDCflow, EBizCharge, Tipalti, Worldpay, Recurly, Cayan, MoonClerk…