Press release

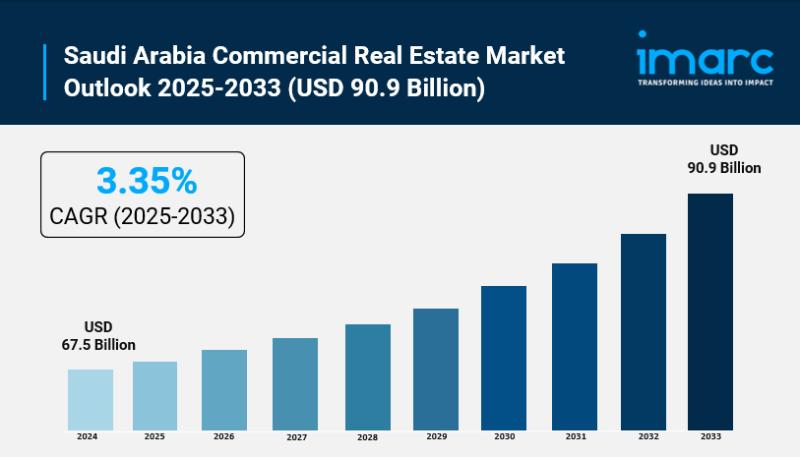

Saudi Arabia Commercial Real Estate Market Size To Exceed USD 90.9 Billion By 2033 | CAGR of 3.35%

Saudi Arabia Commercial Real Estate Market OverviewMarket Size in 2024: USD 67.5 Billion

Market Size in 2033: USD 90.9 Billion

Market Growth Rate 2025-2033: 3.35%

According to IMARC Group's latest research publication, "Saudi Arabia Commercial Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia commercial real estate market size reached USD 67.5 Billion in 2024. Looking forward, the market is expected to reach USD 90.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.35% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Commercial Real Estate Market

● Revolutionizing Property Management and Operations: AI-powered building management systems and IoT integration are transforming commercial property operations through predictive maintenance, smart energy optimization, and automated facility management, reducing operational costs by 25-30% while improving tenant satisfaction and sustainability performance across office buildings, retail centers, and mixed-use developments.

● Enhancing Property Valuation and Investment Decisions: Machine learning algorithms and big data analytics are revolutionizing property valuation models and investment strategies, analyzing market trends, demographic patterns, and economic indicators to improve investment decision accuracy by 35-40% while identifying high-potential commercial real estate opportunities aligned with Vision 2030 developments.

● Streamlining Transaction Processes with Blockchain: AI-integrated blockchain technology is transforming property transactions, lease agreements, and title deed management through secure, transparent, and tamper-proof digital ledgers, reducing transaction processing time by 50-60% while minimizing fraud risks and enhancing regulatory compliance across Saudi Arabia's commercial real estate sector.

● Optimizing Space Utilization and Tenant Experience: Advanced AI analytics and sensor technologies are enabling smart space management and personalized tenant experiences in commercial properties, improving space utilization efficiency by 30-35% while providing data-driven insights for workplace design, retail layout optimization, and hospitality service enhancement.

● Accelerating Property Marketing Through Virtual Technologies: AI-powered virtual property tours, 3D visualization, and augmented reality platforms are transforming commercial real estate marketing and leasing processes, reducing time-to-lease by 40-45% while enabling international investors and corporate tenants to explore properties remotely, supporting Saudi Arabia's ambition to attract global businesses.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-commercial-real-estate-market/requestsample

Saudi Arabia Commercial Real Estate Market Trends & Drivers:

Saudi Arabia's commercial real estate market is experiencing robust growth driven by the Kingdom's Vision 2030 economic diversification strategy, with the non-oil sector projected to grow by 5.8% in 2025, rising from 4.5% in 2024. The government's massive investments in infrastructure development, special economic zones, and business-friendly regulatory frameworks are attracting substantial foreign direct investments (FDIs) and encouraging multinational companies to establish regional headquarters in strategic cities including Riyadh, Jeddah, and NEOM, creating unprecedented demand for premium office spaces and mixed-use developments.

The rapid expansion of tourism and hospitality sectors is significantly driving commercial real estate development, with mega-projects like NEOM, The Red Sea Project, Diriyah Gate, and Qiddiya requiring massive hospitality infrastructure including hotels, resorts, shopping centers, and entertainment venues. Religious tourism to Mecca and Medina continues to expand with government initiatives to upgrade facilities for growing numbers of pilgrims, while programs such as e-visa issuance and international entertainment events are attracting foreign visitors and driving demand for diverse commercial spaces across the Kingdom.

PropTech adoption and smart city development are transforming the commercial real estate landscape, with projects like King Abdullah Financial District (KAFD), New Murabba, and Qiddiya incorporating cutting-edge technologies, green features, and digital infrastructure. Developers are prioritizing walkable, multi-functional environments integrating offices, retail areas, recreation spaces, and parks, while regulatory reforms including the Real Estate General Authority (REGA), digital title deed systems, and Real Estate Investment Trusts (REITs) are enhancing market transparency, reducing transactional risks, and improving accessibility for domestic and international investors seeking opportunities in Saudi Arabia's evolving commercial property sector.

Saudi Arabia Commercial Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Offices

● Retail

● Industrial

● Logistics

● Multi-family

● Hospitality

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players, including major international and regional real estate developers, investors, and property management companies operating across Saudi Arabia's commercial real estate sector.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=16881&flag=E

Recent News and Developments in Saudi Arabia Commercial Real Estate Market

● May 2025: The 2nd Roads, Bridges & Tunnels KSA 2025 Conference is scheduled from April 30 to May 1, 2025, in Jeddah, serving as an essential forum for industry leaders, government representatives, and innovators to collaborate on urban infrastructure projects enhancing connectivity and land values in prime commercial locations.

● January 2025: New Murabba, a planned commercial downtown in northwest Riyadh spanning almost 12 square miles, continues development with residential, retail, hotel, community, and office spaces, representing one of the Kingdom's most ambitious mixed-use development projects aligned with Vision 2030 objectives.

● April 2024: King Abdullah Financial District (KAFD) progressed significantly with nearly 60 skyscrapers under development in Riyadh, positioning the city as a global financial hub with state-of-the-art office buildings, luxury hotels, retail spaces, and residential properties attracting major multinational corporations and financial institutions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Commercial Real Estate Market Size To Exceed USD 90.9 Billion By 2033 | CAGR of 3.35% here

News-ID: 4220442 • Views: …

More Releases from IMARC Group

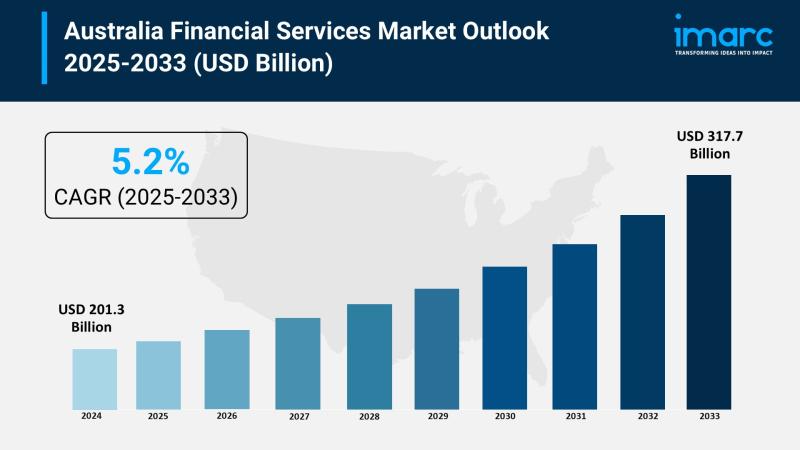

Australia Financial Services Market 2025 | Worth USD 317.7 Billion to 2025-2033

Market Overview

The Australia financial services market size reached USD 201.3 Billion in 2024 and is projected to grow to USD 317.7 Billion by 2033. The market is expected to expand steadily with a compound annual growth rate of 5.2% during the forecast period from 2025 to 2033. Key factors driving this growth include the rising demand for digital banking, regulatory advancements, strong economic performance, increasing fintech investments, and enhanced consumer…

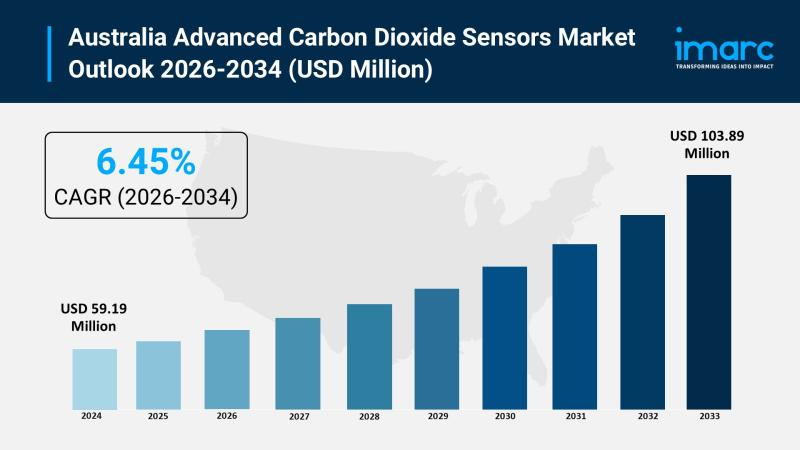

Australia Advanced Carbon Dioxide Sensors Market | Worth USD 103.89 Million 2026 …

Market Overview

The Australia advanced carbon dioxide sensors market size was USD 59.19 Million in 2025 and is expected to grow to USD 103.89 Million by 2034. The market growth is driven by strong government-led emissions reduction policies, enhanced building standards for CO2 monitoring, and the integration of IoT-enabled sensor technologies in smart buildings. These trends are supported by increased focus on indoor air quality and workplace health, fueling innovation in…

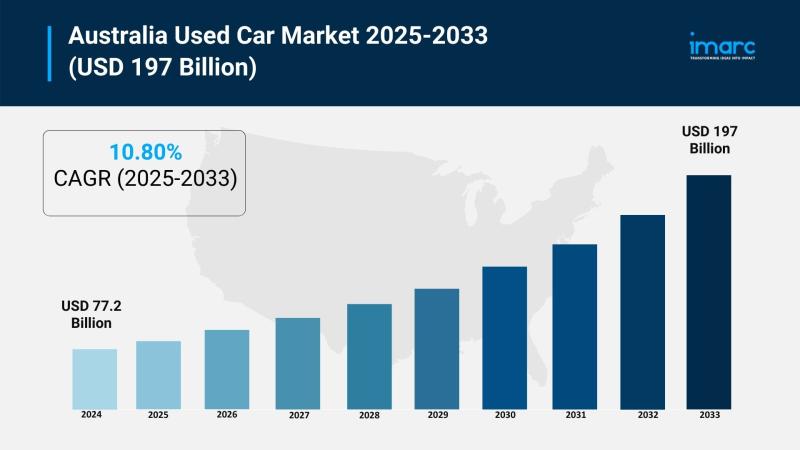

Australia Used Car Market Projected to Reach USD 197 Billion by 2033

Market Overview

The Australia used car market was valued at USD 77.2 Billion in 2024 and is projected to reach USD 197 Billion by 2033. The market is experiencing strong growth driven by affordability concerns, rising demand for reliable pre-owned vehicles, and the increasing role of digital platforms that simplify transactions. Economic pressures and the shift toward cost-effective vehicle options are further accelerating expansion, making the used car market a vital…

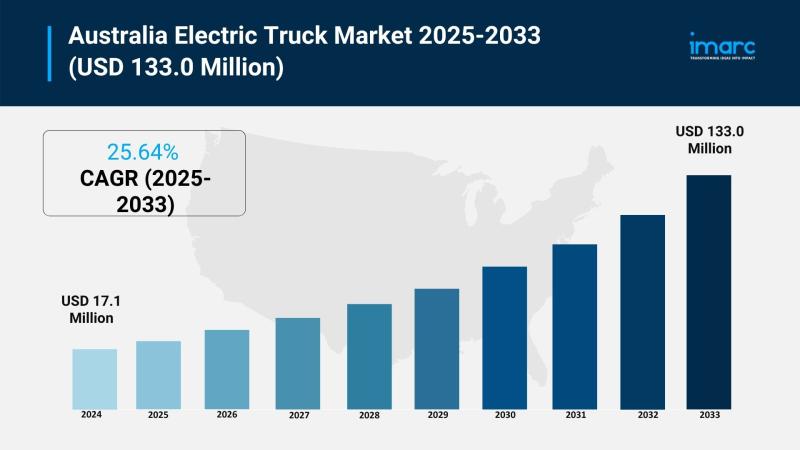

Australia Electric Truck Market Projected to Reach USD 133.0 Million by 2033

Market Overview

The Australia electric truck market reached USD 17.1 Million in 2024 and is projected to expand to USD 133.0 Million by 2033. With a forecast period spanning 2025 to 2033, the market is growing significantly due to stringent government emissions regulations, rising fuel costs, and advancements in battery and charging infrastructure technologies. Investments in fleet electrification and sustainable transport solutions are further driving market share growth. For further details,…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…