Press release

Automotive Insurance Broking and Risk Management Market Innovations Feature AI Enabled Claims Management Policy Administration and Risk Assessment Services

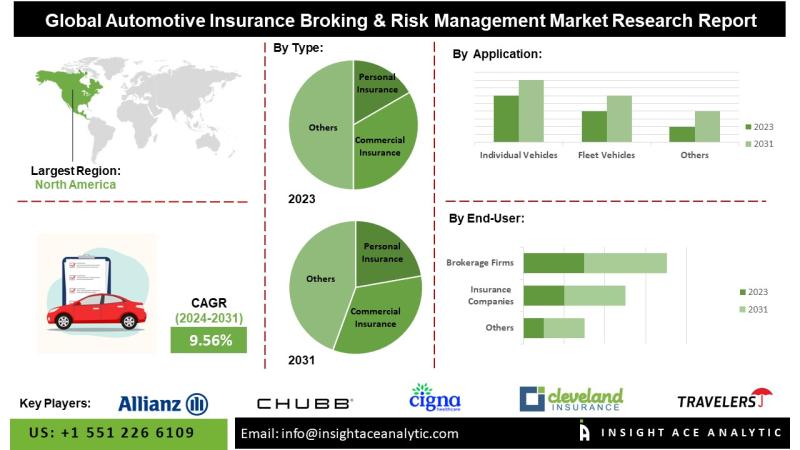

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Insurance Broking & Risk Management Market - (By Type (Personal Insurance, Commercial Insurance), By Application (Individual Vehicles, Fleet Vehicles), By End-User (Insurance Companies, Brokerage Firms), By Distribution Channel (Direct Sales, Online Platforms, Brokers), By Service Type (Risk Assessment, Claims Management, Policy Administration)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."According to the latest research by InsightAce Analytic, the Global Automotive Insurance Broking & Risk Management Market is predicted to grow with a CAGR of 9.56% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2726

Automotive insurance brokerage functions as an intermediary between insurers and vehicle owners, facilitating the acquisition of suitable insurance coverage. Central to automobile insurance is the effective management of risk, which involves identifying, assessing, and mitigating potential exposures associated with vehicle ownership and operation.

Brokers play a pivotal role by analyzing clients' insurance requirements, comparing available policy options, and recommending customized solutions that provide optimal protection. They also negotiate favorable terms and competitive pricing, ensuring clients are comprehensively covered while navigating the complexities of insurance contracts.

The growth of the automotive insurance brokerage market is driven by an increasing number of vehicle owners and rapid technological advancements. Insurers are leveraging telematics, sensors, and advanced data analytics to offer personalized insurance solutions, thereby enhancing customer engagement and retention. Additionally, evolving regulatory standards and heightened awareness of risk management are motivating both individuals and businesses to adopt comprehensive coverage strategies. Together, these factors are driving market expansion and creating avenues for innovation within the sector.

List of Prominent Players in the Automotive Insurance Broking & Risk Management Market:

• Allianz SE

• AXA S.A.

• Berkshire Hathaway Inc.

• Chubb Limited

• Cigna Corporation

• Cleveland Insurance Group

• Travelers Companies, Inc.

• Zurich Insurance Group AG

• MetLife, Inc.

• The Hartford Financial Services Group, Inc.

• Munich Reinsurance Company (Munich Re)

• American International Group, Inc. (AIG)

• Prudential Financial, Inc.

• Liberty Mutual Insurance

• Assicurazioni Generali S.p.A.

• Aviva plc

• State Farm Mutual Automobile Insurance Company

• Nationwide Mutual Insurance Company

• Hiscox Ltd

• Marsh & McLennan Companies, Inc.

• Aon plc

• Willis Towers Watson Public Limited Company

• CNA Financial Corporation

• Sompo International Holdings Ltd.

• Admiral Group plc

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics

Drivers:

The automotive insurance brokerage and risk management sector is experiencing sustained growth, driven by rising adoption of insurance solutions among individual and corporate clients. As the market evolves, there is an increasing demand for expert advisory services to guide clients in selecting appropriate insurance products.

Technological innovations, particularly in artificial intelligence (AI) and machine learning (ML), are reshaping the industry by enabling digital platforms and online brokers to offer automated support throughout the insurance application and management processes. Brokerage firms are increasingly focused on providing comprehensive risk coverage, addressing exposures such as health, accidents, and other potential liabilities, thereby enhancing overall customer protection.

Challenges:

The sector faces competitive pressure from alternative distribution channels, including digital platforms, insurance aggregators, and third-party websites, which often provide policies with minimal fees. These platforms meet consumer demand for faster processing, personalized coverage, and innovative insurance solutions, thereby challenging traditional brokerage models and compelling brokers to differentiate through enhanced service offerings.

Regional Trends:

North America is projected to capture a significant share of the automotive insurance brokerage and risk management market, underpinned by technological innovation, increasing financial independence, and investments in research and development, particularly in areas such as autonomous vehicles and enhanced security solutions.

Europe also represents a key market, supported by industrial growth, rising automobile sales, and an expanding middle-class population with greater disposable income. The increasing demand for automotive insurance in both regions reinforces the positive growth trajectory of the global market.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2726

Recent Developments:

• In June 2024, Aon and Zurich Insurance Group (Zurich) introduced a ground-breaking environmentally friendly insurance program that offers full protection for green and blue-coloured energy endeavours with investment costs of up to USD 250 million worldwide. The goal of the endeavour is to expedite the creation of renewable hydrogen infrastructure. Aon is the authorized dealer, and Zurich is the primary insurer. Additionally, it is a part of Zurich's promise to help the transition to zero by involving customers and developing fresh offerings and innovative products.

Segmentation of Automotive Insurance Broking & Risk Management Market-

By Type-

• Personal Insurance

• Commercial Insurance

By Application-

• Individual Vehicles

• Fleet Vehicles

By End-User-

• Insurance Companies

• Brokerage Firms

By Distribution Channel-

• Direct Sales

• Online Platforms

• Brokers

By Service Type-

• Risk Assessment

• Claims Management

• Policy Administration

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/automotive-insurance-broking--risk-management-market/2726

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Insurance Broking and Risk Management Market Innovations Feature AI Enabled Claims Management Policy Administration and Risk Assessment Services here

News-ID: 4193561 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

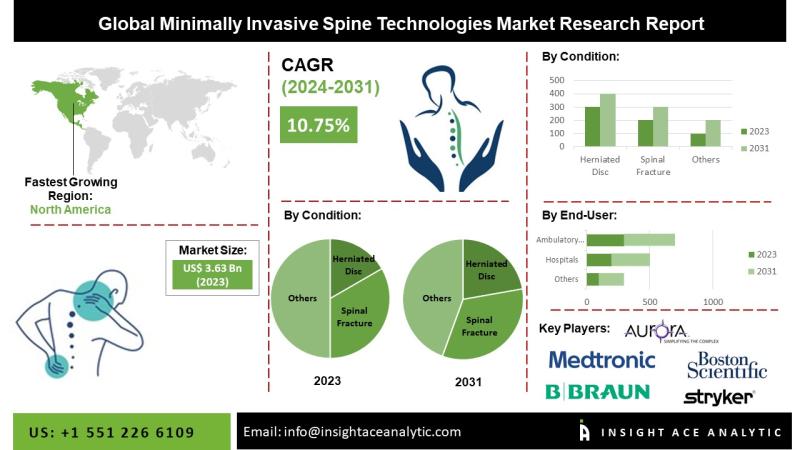

Minimally Invasive Spine Technologies Market Future Trends and Scope Analysis Re …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Minimally Invasive Spine Technologies Market Size, Share & Trends Analysis Report By condition (Herniated Disc, Spinal Stenosis, Degenerative Disc Disease, Spinal Deformity, Spinal Fracture, Spinal Infection, and Spinal Tumor) and end user (Hospitals, Ambulatory Surgery Centers, and Orthopedic Clinics)- Market Outlook And Industry Analysis 2031"

The Global Minimally Invasive Spine Technologies Market is estimated to reach…

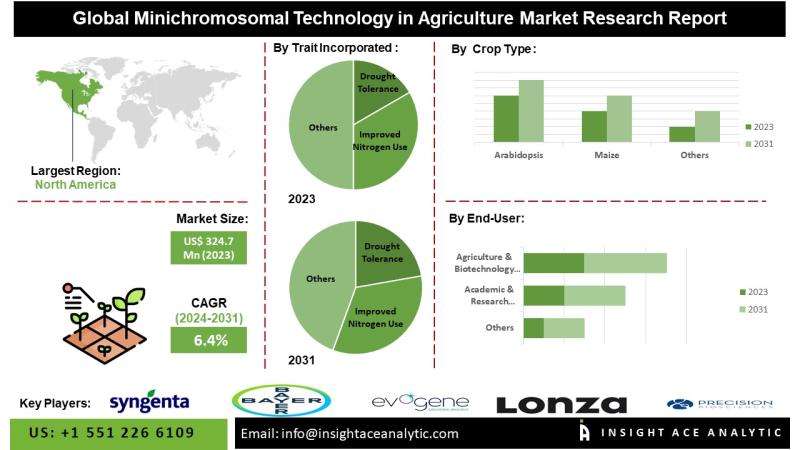

Minichromosomal Technology in Agriculture Market Report on the Untapped Growth O …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Minichromosomal Technology in Agriculture Market- (By Trait Incorporated (Drought Tolerance, Improved Nitrogen Use, Herbicide Tolerance, Pest Resistance, Others), By Crop Type (Arabidopsis, Maize, Others), By End-user (Agriculture & Biotechnology Companies, Academic & Research Institutes, Others)) Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Minichromosomal Technology…

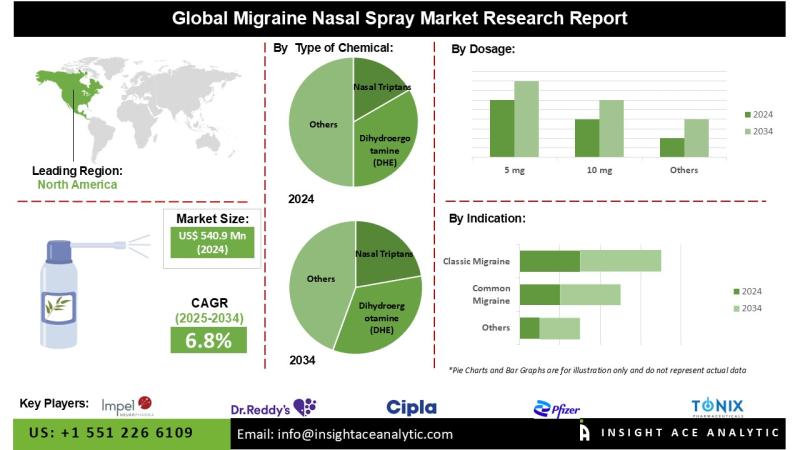

Migraine Nasal Spray Market Know the Scope and Trends

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Migraine Nasal Spray Market- (By Type of Chemical (Nasal Triptans, Dihydroergotamine (DHE), Non-steroidal anti-inflammatory drugs (NSAIDs)), By Dosage (5 mg, 10 mg, 20 mg, 40 mg), By Indication (Common Migraine, Classic Migraine, Cluster Migraine, Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."

According to the…

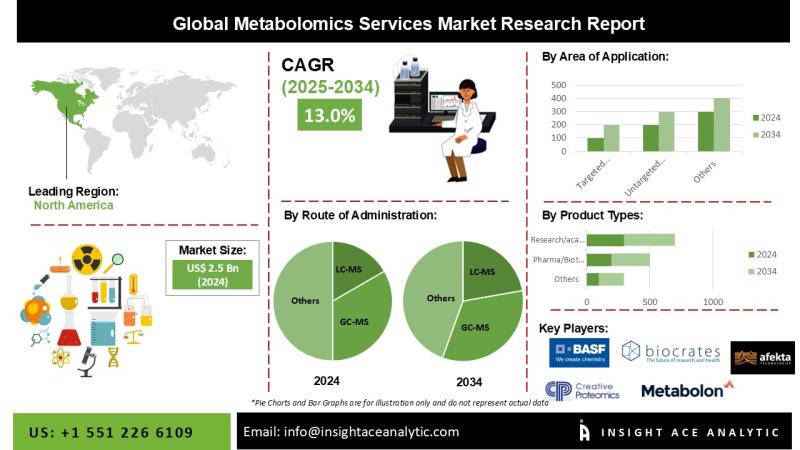

Metabolomics Services Market Exclusive Trends Analysis with Forecast to 2034

"Metabolomics Services Market" in terms of revenue was estimated to be worth $ 2.5 Bn in 2024 and is poised to reach $ 8.6 Bn by 2034, growing at a CAGR of 13.0% from 2025 to 2034 according to a new report by InsightAce Analytic.

Request For Free Sample Pages:

https://www.insightaceanalytic.com/request-sample/1766

Latest Drivers Restraint and Opportunities Market Snapshot:

Key factors influencing the metabolomics services market are:

• Increasing chronic disease

• Growing aging population

• Innovations in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…